Trid Fee Tolerance Chart

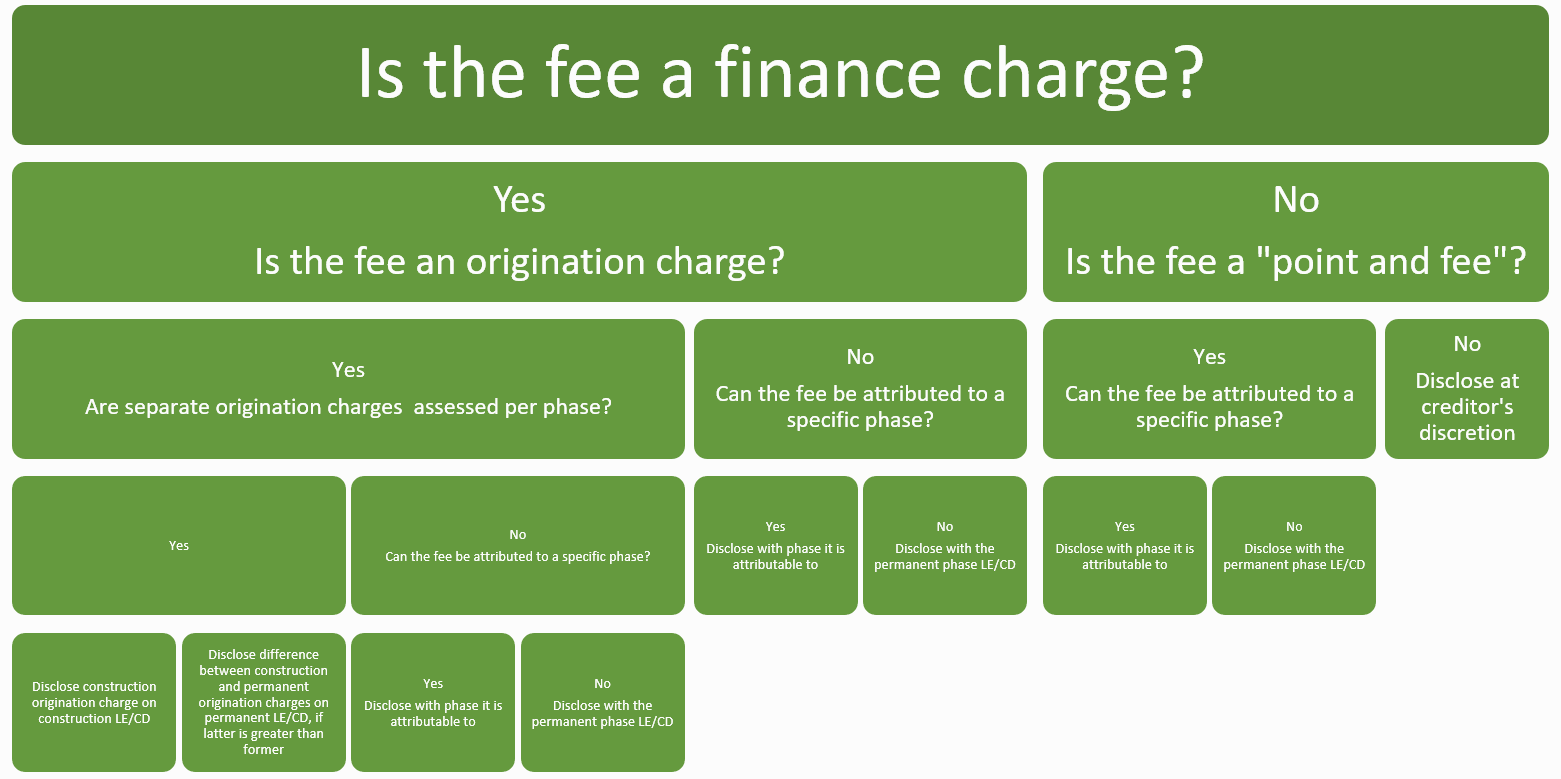

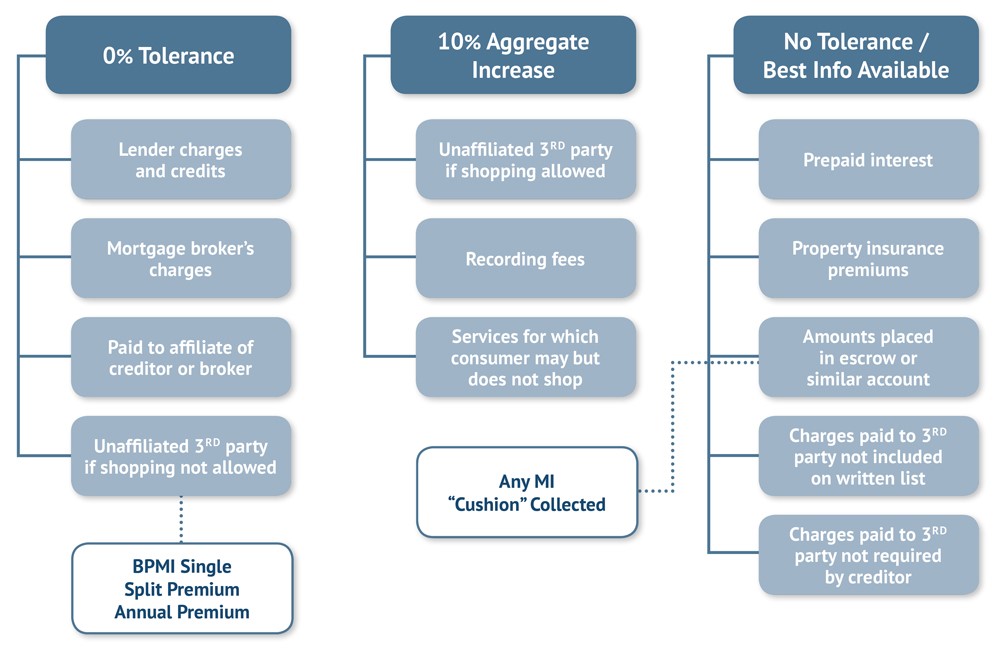

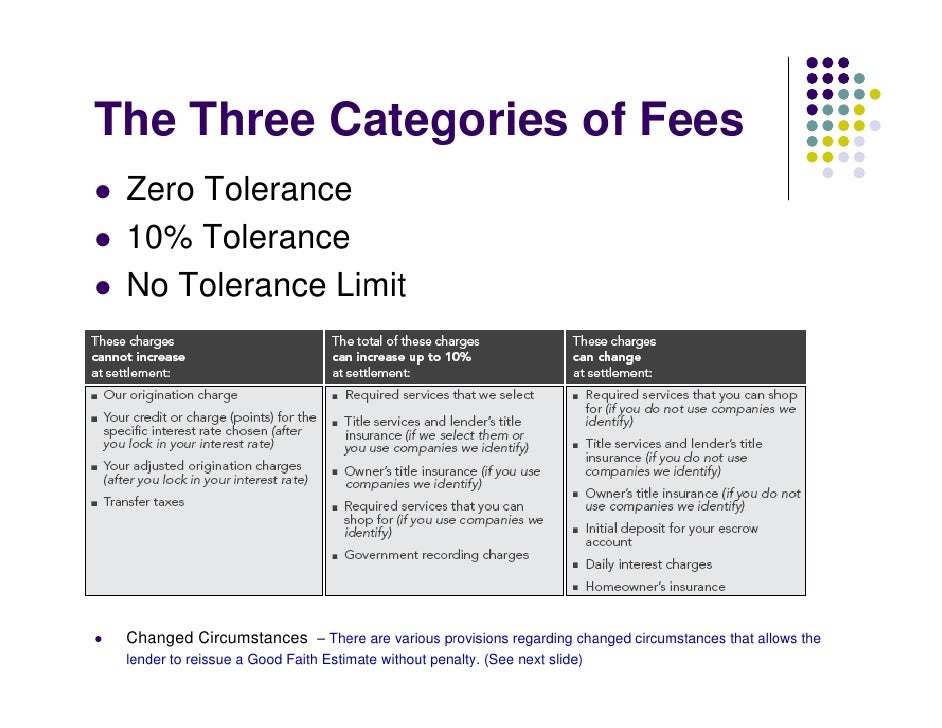

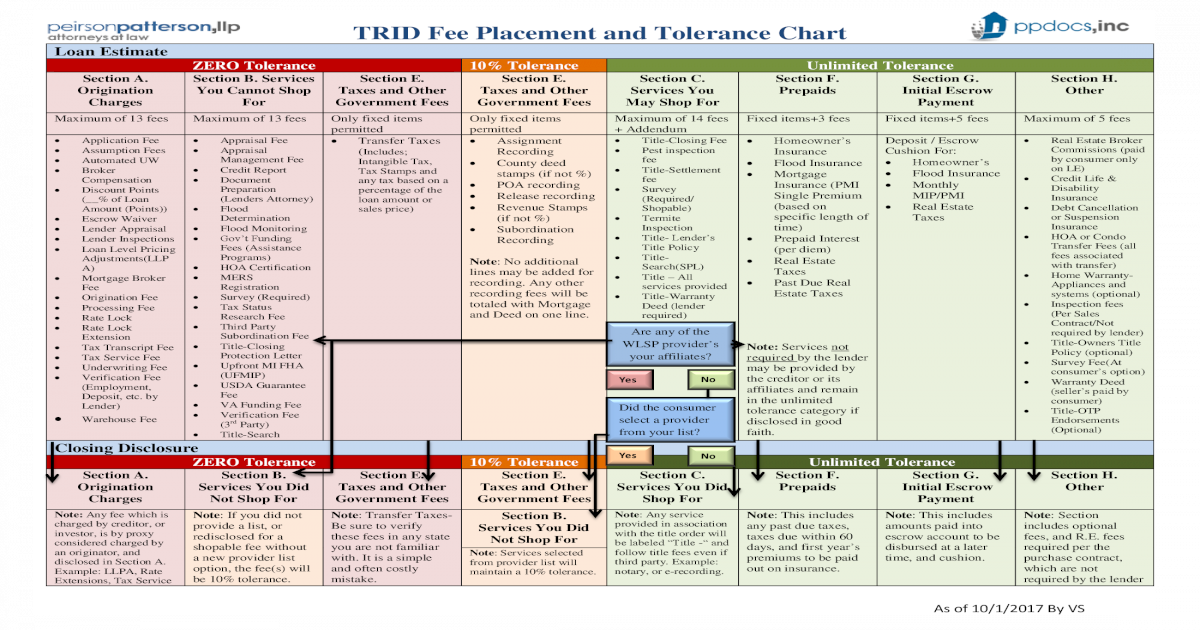

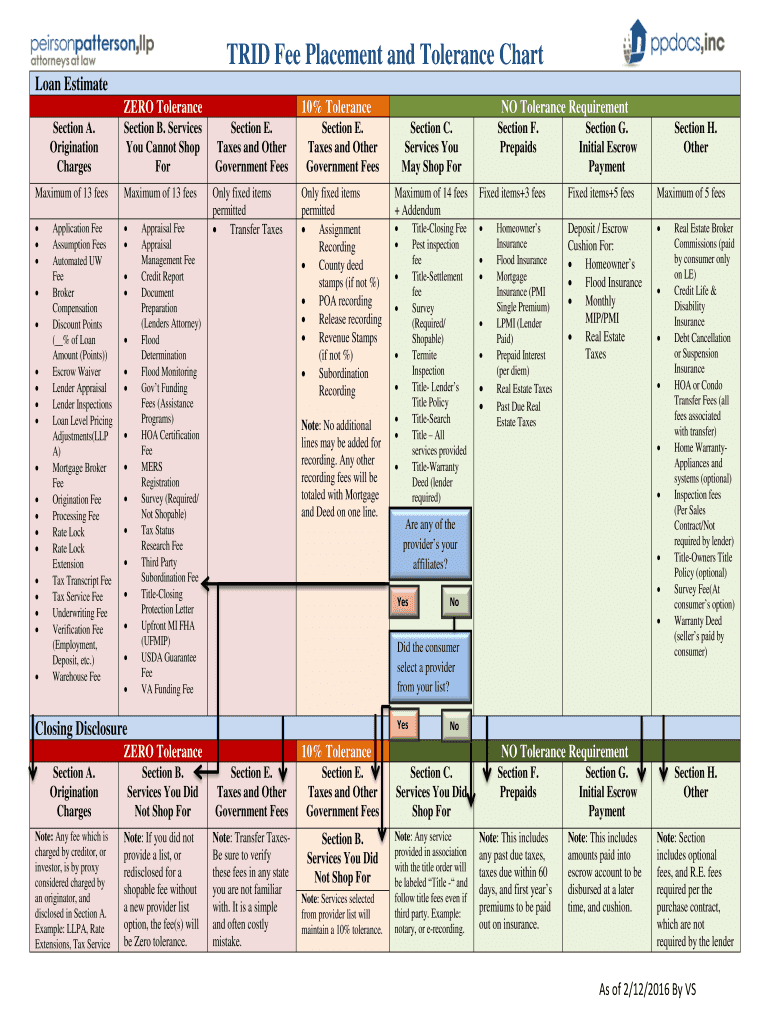

Trid Fee Tolerance Chart - Web although the owner’s title insurance policy rate quoted by the title insurance company is $2,568, the cost of owner’s title insurance is disclosed as $1,593 on the trid disclosures. Taxes and other government fees section e. If paid to a provider on the lender’s list there is a 10% tolerance. Information in regards to investors, all in one place. Taxes and other government fees. Web requirements and guidance on current requirements for tolerances in the good faith analysis (section 7) requirements and guidance for providing revised loan estimates (section 8) requirements for permitting a consumer to shop and providing the written list of service providers (sections 7.3, 7.5, 7.6, 7.7, 7.11, and 8.7) Origination charges charges for services performed by the creditor. Cumulative total by more than 10%. Web the following interactive trid process impact chart highlights a typical mortgage lending process from application through closing and beyond and identifies the various processes, disclosures, and timing requirements that will be impacted by trid. Otherwise there is no tolerance limit for section c fees. If fee is paid to an afiliate of the lender there is a zero tolerance. A a 0% services borrower cannot shop for required third party services that the borrower cannot shop for. Otherwise there is no tolerance limit for section c fees. Web the three tolerance buckets are zero tolerance, 10% tolerance and unlimited tolerance. Web among its many. If paid to a provider on the lender’s list there is a 10% tolerance. A a 0% services borrower cannot shop for required third party services that the borrower cannot shop for. Web in other words, a fee will be considered within tolerance if it does not change by an amount more than the amount allowed in the specific bucket. 1 paid monthly in arrears (arch mi ez monthly) but the borrower will not make any mi payments at consummation1 A a 0% services borrower cannot shop for required third party services that the borrower cannot shop for. Web trid tolerance chart c borrower may shop f prepaids g escrow deposit please note: Information in regards to investors, all in. § 1026.37, content of the loan estimate. Services you may shop for. Taxes and other government fees section c. A a 0% services borrower cannot shop for required third party services that the borrower cannot shop for. If paid to a provider on the lender’s list there is a 10% tolerance. If fee is paid to an afiliate of the lender there is a zero tolerance. Otherwise there is no tolerance limit for section c fees. Web among its many provisions, the trid rule outlines fee tolerance requirements and defines changes of circumstance that affect loan terms. Web trid fee placement and tolerance chart. Mortgage insurance type disclose on the trid. B b 0% service borrower can shop for and provided by creditor or affiliate chooses. Web among its many provisions, the trid rule outlines fee tolerance requirements and defines changes of circumstance that affect loan terms. Information in regards to investors, all in one place. Please consult regulatory guidance in order to determine w here to list a particular fee. Understanding these aspects is crucial for both lenders and borrowers to navigate mortgage transactions smoothly. Web trid tolerance chart c borrower may shop f prepaids g escrow deposit please note: Web trid fee allocation and tolerance chart. Web main trid provisions and official interpretations can be found in: Web trid fee placement and tolerance chart as of 2/12/2016 by vs. If paid to a provider on the lender’s list there is a 10% tolerance. Otherwise there is no tolerance limit for section c fees. Web trid fee placement and tolerance chart as of 2/12/2016 by vs loan estimate zero tolerance 10% tolerance no tolerance requirement section a. The corresponding loan estimate disclosure. Information in regards to investors, all in one. Origination charges charges for services performed by the creditor. Otherwise there is no tolerance limit for section c fees. If paid to a provider on the lender’s list there is a 10% tolerance. Mortgage insurance type disclose on the trid disclosures? A a 0% services borrower cannot shop for required third party services that the borrower cannot shop for. Taxes and other government fees. Web although the owner’s title insurance policy rate quoted by the title insurance company is $2,568, the cost of owner’s title insurance is disclosed as $1,593 on the trid disclosures. Web requirements and guidance on current requirements for tolerances in the good faith analysis (section 7) requirements and guidance for providing revised loan estimates (section. Web the three tolerance buckets are zero tolerance, 10% tolerance and unlimited tolerance. Zero tolerance, 10 percent cumulative tolerance and no or unlimited tolerance. Taxes and other government fees. Web trid fee placement and tolerance chart as of 2/12/2016 by vs loan estimate zero tolerance 10% tolerance no tolerance requirement section a. Services you may shop for. The corresponding loan estimate disclosure. Services you cannot shop for section e. Cumulative total by more than 10%. Web requirements and guidance on current requirements for tolerances in the good faith analysis (section 7) requirements and guidance for providing revised loan estimates (section 8) requirements for permitting a consumer to shop and providing the written list of service providers (sections 7.3, 7.5, 7.6, 7.7, 7.11, and 8.7) Taxes and other government fees. Taxes and other government fees section e. If paid to a provider on the lender’s list there is a 10% tolerance. Understanding these aspects is crucial for both lenders and borrowers to navigate mortgage transactions smoothly. Web trid fee allocation and tolerance chart. Web among its many provisions, the trid rule outlines fee tolerance requirements and defines changes of circumstance that affect loan terms. Taxes and other government fees.

Interactive Trid Calendar Calendar Template 2023

trid fee placement and tolerance chart Focus

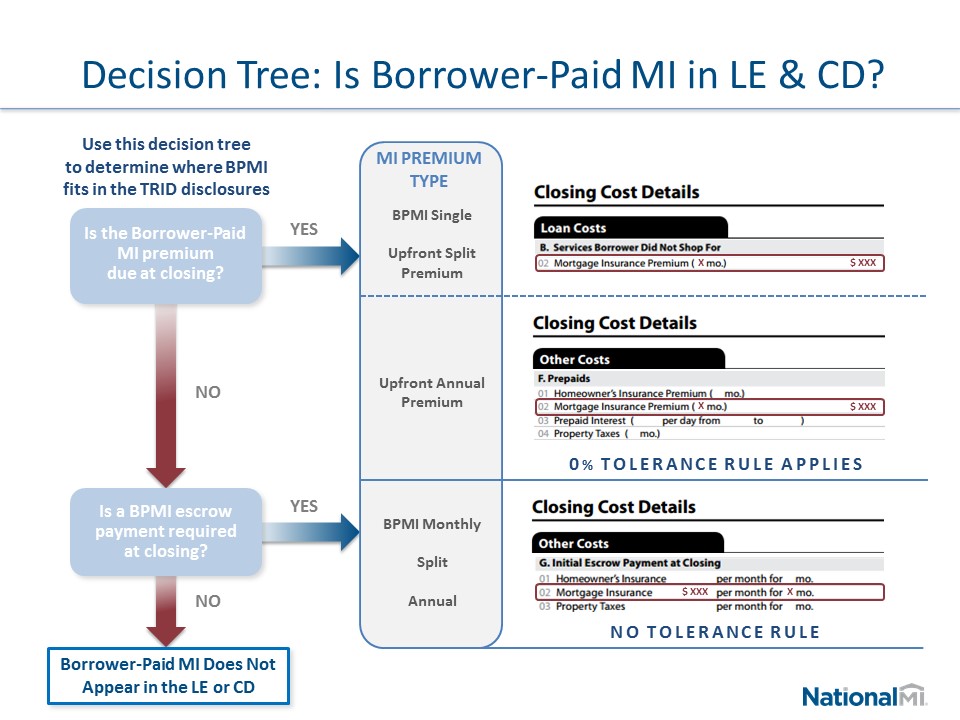

Mortgage Insurance in TRID FAQ National MI

Trid Tolerance Chart

trid fee placement and tolerance chart Focus

TRID Fee Placement and Tolerance Chart Fee Placement and Tolerance

Road Map to TRID Rule VariationsTolerance

Mortgage Insurance in TRID FAQ National MI

hmdatridchart

Trid Tolerance Chart 2023 Complete with ease airSlate SignNow

Texas Home Equity 2% Cheatsheet.

Supplement I To Part 1026 (Including Official Interpretations For The Above Provisions)

A A 0% Services Borrower Cannot Shop For Required Third Party Services That The Borrower Cannot Shop For.

Web As Is The Case Under Current Law, The Trid Rule Identifies Three Categories Of Tolerance Thresholds:

Related Post: