Paga Penalty Chart

Paga Penalty Chart - Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code violation, and $200 per employee per pay period for each subsequent violation. The three questions the court will address are as. Code section 2699(f) of $100 per employee per initial violation and $200 per employee per each subsequent violation applies. Everything you need to know about paga penalties and who is entitled to receive penalties. 5th __ (2021), which will impact employers facing paga lawsuits. And penalties for the other employment. First, departing from turrieta v.lyft, inc., 69 cal. Web posted in meal and rest breaks, new cases. Web when no civil penalty is specifically specified, the default paga penalty provided by cal. Web failure to pay overtime, failure to provide meal breaks and failure to provide rest breaks carry an initial paga penalty of $50.00, and a subsequent penalty of $100.00. Web on november 30, 2021, the court of appeal, first appellate district, issued an important opinion in moniz v.adecco usa, inc., __ cal. This insight will examine the three biggest questions employers have about paga as we head into the new year. For good measure, the supreme court noted that paga penalties are required to be split 75%/25% between the. Moniz clarified several critical issues employers routinely face in paga litigation. Web relying on raines, the trial court held that the proper measure of paga penalties for any violation of section 226 (a) is set forth in section 226.3, which provides, in relevant part: Web ―paga is concerned only with civil penalties, whereas section 226(e) provides for damages or statutory. 5th __ (2021), which will impact employers facing paga lawsuits. Web as we enter 2023, the supreme court of california is set to rule in three paga cases that may all have substantial implications for employers. Web failure to pay overtime, failure to provide meal breaks and failure to provide rest breaks carry an initial paga penalty of $50.00, and. Web relying on raines, the trial court held that the proper measure of paga penalties for any violation of section 226 (a) is set forth in section 226.3, which provides, in relevant part: 12, 2019), the california supreme court held that plaintiffs cannot recover the unpaid wages described in labor code section 558 in a private attorneys general act. Web. Web the employer’s first labor violation is punishable by a civil penalty of $100 per employee, per pay period. Web usa january 20 2022. 12, 2019), the california supreme court held that plaintiffs cannot recover the unpaid wages described in labor code section 558 in a private attorneys general act. Moniz clarified several critical issues employers routinely face in paga. Penalties for wage statement violations are $250 for the first violation and $1,000 for each subsequent violation, cal. Web the following chart identifies labor code violations giving rise to a claim under the private attorneys general act of 2004 (paga). Web in a successful paga action, the california labor and workforce development agency is entitled to 75% of the recovered. The three questions the court will address are as. Penalties for wage statement violations are $250 for the first violation and $1,000 for each subsequent violation, cal. Any subsequent violations are punishable by $200 per employee, per pay period. Web accordingly, such wages could not be recovered as a penalty under paga, because paga only allows for the recovery of. Bucking the trend of unrelentingly bad news for employers in the state, the california court of appeal has held that the default (lower) penalties found in the labor code private attorneys general act (“paga”) and not the heightened penalties set forth in labor code section 226.3. For good measure, the supreme court noted that paga penalties are required to be. Web accordingly, such wages could not be recovered as a penalty under paga, because paga only allows for the recovery of penalties. Code section 2699(f) of $100 per employee per initial violation and $200 per employee per each subsequent violation applies. When a provision of the labor code provides for a specific penalty, that penalty applies. Web on november 30,. First, departing from turrieta v.lyft, inc., 69 cal. And penalties for the other employment. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. When a provision of the labor code provides for a specific penalty, that penalty applies. Coastal pacific food distributors, inc. Code section 2699(f) of $100 per employee per initial violation and $200 per employee per each subsequent violation applies. Web as we enter 2023, the supreme court of california is set to rule in three paga cases that may all have substantial implications for employers. Coastal pacific food distributors, inc. Web ―paga is concerned only with civil penalties, whereas section 226(e) provides for damages or statutory penalties raines v. Penalties for wage statement violations are $250 for the first violation and $1,000 for each subsequent violation, cal. Web in a successful paga action, the california labor and workforce development agency is entitled to 75% of the recovered penalties, and the remaining 25% goes to the “aggrieved employees.” the split in the california courts of appeal. Web attempts to curb abuse of the statute, through legislation, have been generally unsuccessful. Web posted in meal and rest breaks, new cases. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. Everything you need to know about paga penalties and who is entitled to receive penalties. Web relying on raines, the trial court held that the proper measure of paga penalties for any violation of section 226 (a) is set forth in section 226.3, which provides, in relevant part: Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code violation, and $200 per employee per pay period for each subsequent violation. Web paga’s plain language indicates that an employer will be assessed a lower, “initial” penalty for each initial pay period in which a violation occurs, and a higher, “subsequent” penalty for each subsequent pay period in which a violation occurs. Web failure to pay overtime, failure to provide meal breaks and failure to provide rest breaks carry an initial paga penalty of $50.00, and a subsequent penalty of $100.00. Web the following chart identifies labor code violations giving rise to a claim under the private attorneys general act of 2004 (paga). Web christmas came early this year for california employers.

The Fight to Replace PAGA California New Car Dealers Association

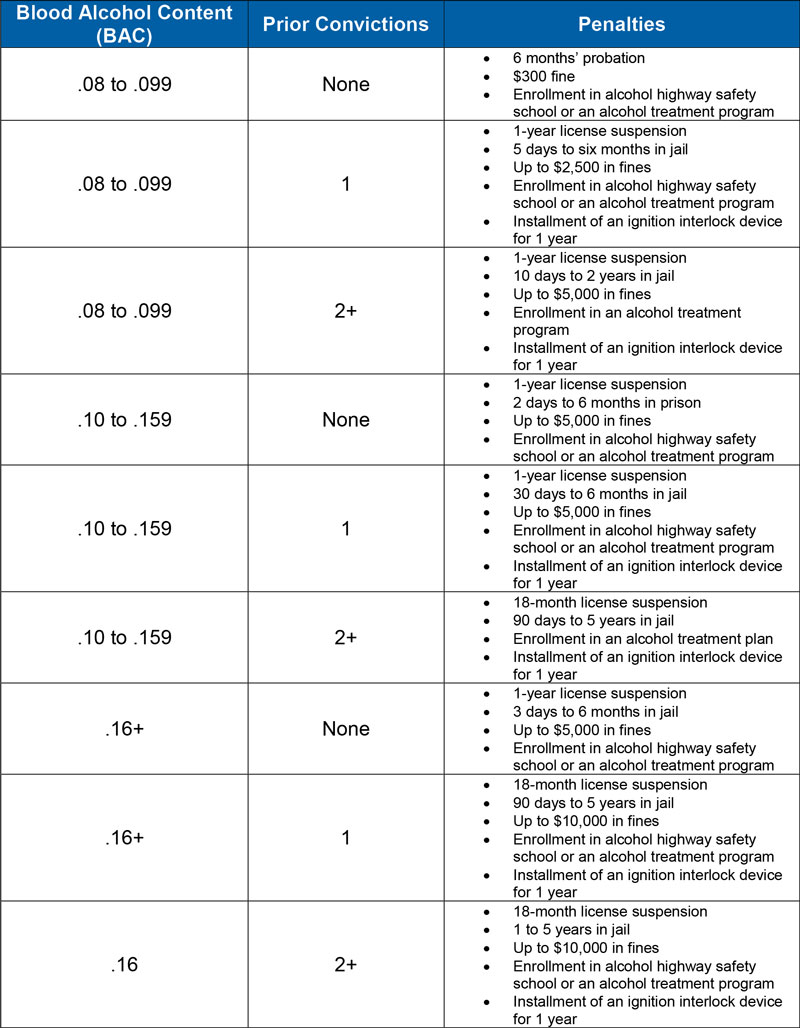

DUI Penalties Chart The GoTo Guy for DUI The Hudson Law Office

Employers Beware! Wage & Hour Violations Can Lead to Steep Penalties

Penalty Chart Section Penalty to Penalty levied in case of Fraud Loans

Paga penalties chart Fill out & sign online DocHub

Emmanuel Paga back in the team after apologising for penalty miss in

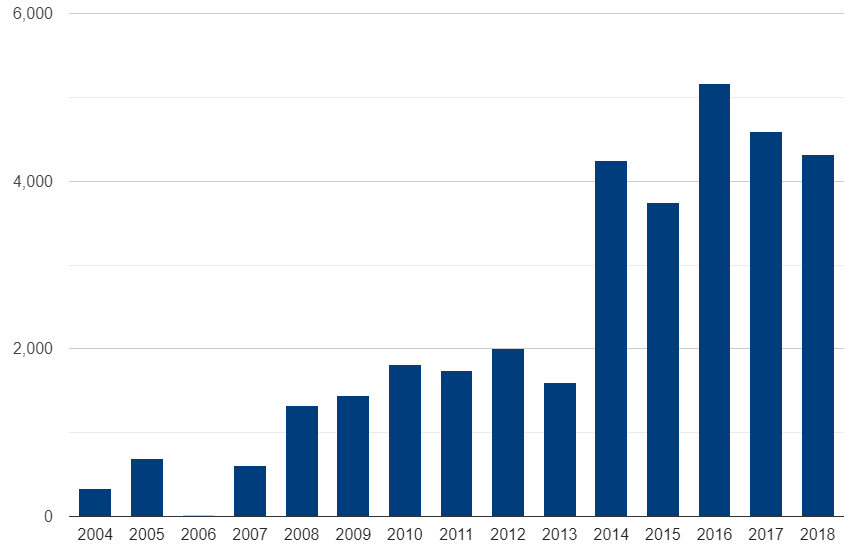

Pa Dui Penalty Chart

APP DE RENDA EXTRA Penalty Shootout PAGA MESMO? APP QUE ESTA PAGANDO

A Chart For Predicting PenaltyShootout Odds in Real Time FiveThirtyEight

Penalty chart under Tax Act, 1961

Web What Is Paga?

Moniz Clarified Several Critical Issues Employers Routinely Face In Paga Litigation.

Web On November 30, 2021, The Court Of Appeal, First Appellate District, Issued An Important Opinion In Moniz V.adecco Usa, Inc., __ Cal.

5Th __ (2021), Which Will Impact Employers Facing Paga Lawsuits.

Related Post: