Windfall Elimination Chart

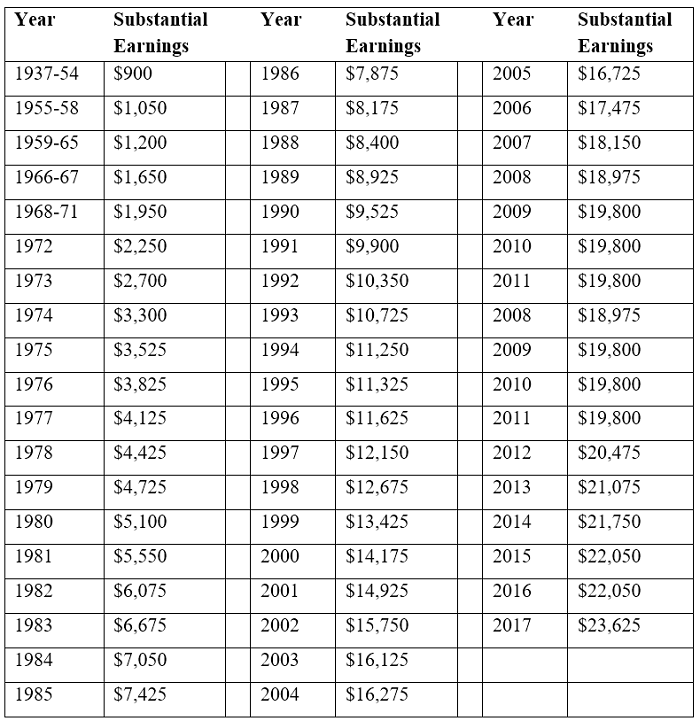

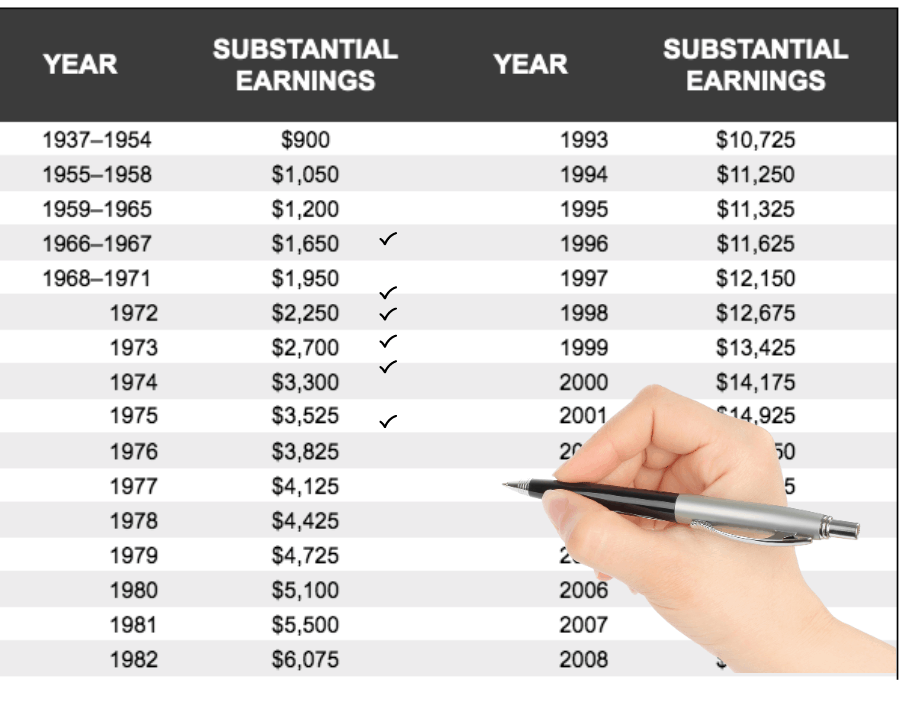

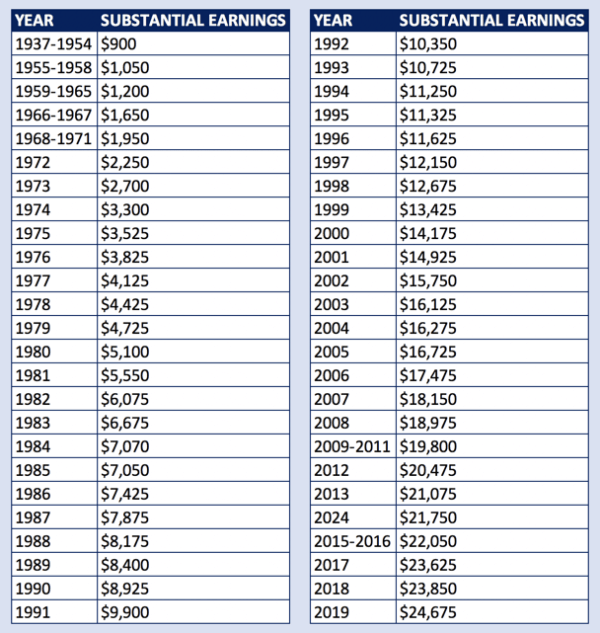

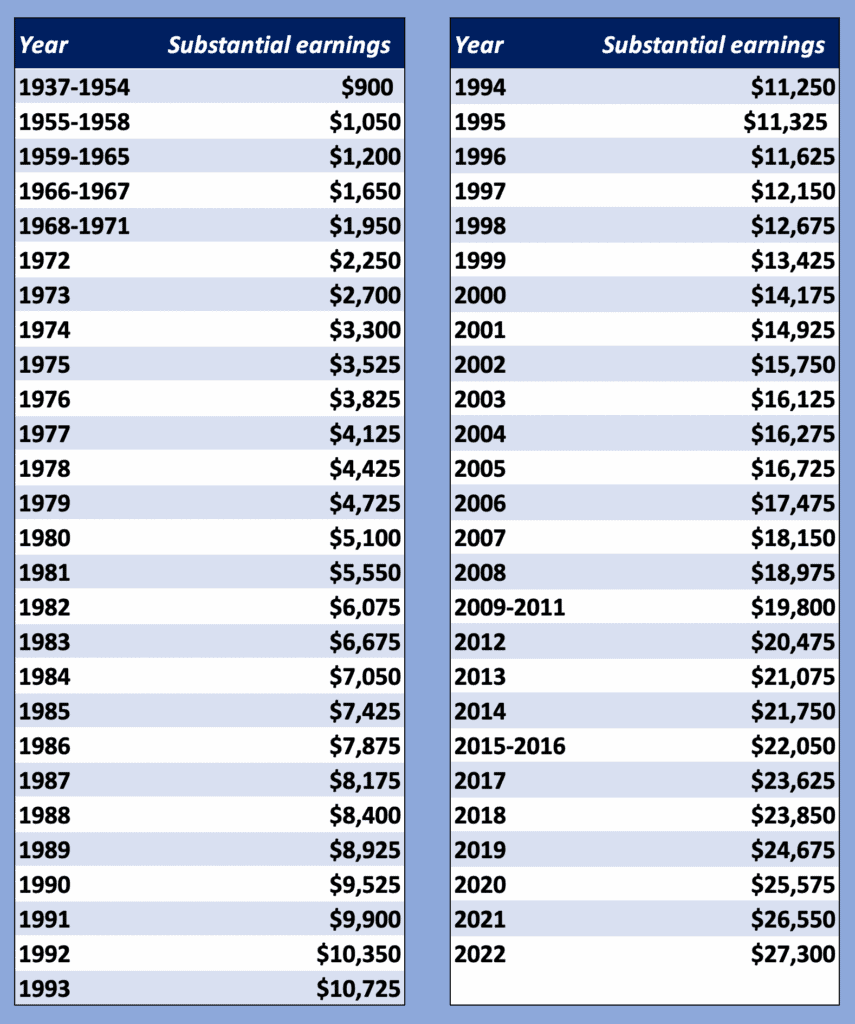

Windfall Elimination Chart - It most commonly affects government work or work in. How additional years of substantial earnings will affect the wep penalty. For people who reach 62 or developed a disability in 1990 or later, we reduce the 90% factor to. A worker becomes eligible for disability insurance benefits (dib) after 1985; The amount of social security benefit you can expect after the wep reduction (for comparison we also illustrate your benefit without considering the wep). Web the windfall elimination provision is designed to calculate her social security benefit as if she is a high earner at $125,000 all in the social security system. Web under the provision, we reduce the 90% factor in our formula and phase it in for workers who reached age 62 or developed a disability between 1986 and 1989. Web the windfall elimination provision (wep) and the government pension offset (gpo) are two separate provisions that reduce regular social security benefits for workers and their eligible family members if the worker receives (or is entitled to) a pension based on earnings from employment not covered by social security. The number of “substantial earnings” years you already have. Web count up the number of substantial earnings years and use the chart below to determine the amount that your payment will be reduced. How additional years of substantial earnings will affect the wep penalty. The windfall elimination provision reduces your eligibility year (ely) benefit amount before it is reduced or The normal social security calculation formula is substituted with a new calculation that results in a lower benefit amount. Our windfall elimination provision (wep) online calculator can tell you how your benefits may. The windfall elimination provision reduces your eligibility year (ely) benefit amount before it is reduced or Web look at our wep chart below to see how wep affects social security benefits. The normal social security calculation formula is substituted with a new calculation that results in a lower benefit amount. Federal, state, or local government employment) it may reduce the. Your social security statement provides an estimate of your payment without any considerations for the wep adjustment. It applies only to workers who did not pay social security taxes, and so did not earn credits toward social security income during their working years. How additional years of substantial earnings will affect the wep penalty. The amount of social security benefit. Web two social security provisions reduce or eliminate the benefits of certain individuals who receive pension income from employment not covered by social security. This reduction is called the “windfall elimination provision” (wep). Web the windfall elimination provision (wep) is a formula that effectively reduces social security and disability benefits for certain retirees who receive a pension during retirement, in. Web the windfall elimination provision (abbreviated wep [1]) is a statutory provision in united states law [2] which affects benefits paid by the social security administration under title ii of the social security act. Our windfall elimination provision (wep) online calculator can tell you how your benefits may be affected. You will need to enter all your earnings taxed by. The windfall elimination provision reduces your eligibility year (ely) benefit amount before it is reduced or Web this calculator will tell you: Web count up the number of substantial earnings years and use the chart below to determine the amount that your payment will be reduced. How additional years of substantial earnings will affect the wep penalty. The number of. Web the windfall elimination provision (wep) reduces the amount of social security benefits people can collect if they receive a government retirement plan in addition to social security. The amount of social security benefit you can expect after the wep reduction (for comparison we also illustrate your benefit without considering the wep). You will need to enter all your earnings. A worker becomes eligible for disability insurance benefits (dib) after 1985; For people who reach 62 or developed a disability in 1990 or later, we reduce the 90% factor to. Web the windfall elimination provision (wep) is a formula that can reduce the size of your social security retirement or disability benefit if you receive a pension from a job. Whether you think this is fair. You will need to enter all your earnings taxed by social security into the wep online calculator manually. Web your social security benefit might be reduced if you get a pension from an employer who wasn’t required to withhold social security taxes. For people who reach 62 or developed a disability in 1990 or. Web our windfall elimination provision (wep) online calculator can tell you how your benefits may be affected. Web your social security benefit might be reduced if you get a pension from an employer who wasn’t required to withhold social security taxes. The amount of social security benefit you can expect after the wep reduction (for comparison we also illustrate your. Web the windfall elimination provision (wep) is a formula that can reduce the size of your social security retirement or disability benefit if you receive a pension from a job in which you did not pay social security taxes. Web the windfall elimination provision (wep) is a modified benefit formula designed to remove the unintended advantage, or “windfall,” of the regular benefit formula for certain retired or disabled workers who spent less than full careers in covered employment and who are also entitled to Web if you are expecting to receive a pension based on work not covered by social security, (e.g. You will need to enter all your earnings taxed by social security into the wep online calculator manually. Federal, state, or local government employment) it may reduce the amount of social security benefits we can pay you. Web the windfall elimination provision is designed to calculate her social security benefit as if she is a high earner at $125,000 all in the social security system. It most commonly affects government work or work in. Use our wep online calculator or download our detailed calculator to get an estimate of your benefits. The windfall elimination provision reduces your eligibility year (ely) benefit amount before it is reduced or Web look at our wep chart below to see how wep affects social security benefits. Web two social security provisions reduce or eliminate the benefits of certain individuals who receive pension income from employment not covered by social security. This reduction is called the “windfall elimination provision” (wep). It applies only to workers who did not pay social security taxes, and so did not earn credits toward social security income during their working years. Whether you think this is fair. Web the windfall elimination provision (wep) and the government pension offset (gpo) are two separate provisions that reduce regular social security benefits for workers and their eligible family members if the worker receives (or is entitled to) a pension based on earnings from employment not covered by social security. Your social security statement provides an estimate of your payment without any considerations for the wep adjustment.Peabody Council on Aging Resource Library Social Security Windfall

Windfall Elimination Provision (How To Reduce It) YouTube

Social Security’s Windfall Elimination Provision Estate Plan

Windfall Elimination Program (WEP) 2018 Social Security Retirement Guide

Peabody Council on Aging Resource Library Social Security Windfall

How Do You Avoid The Windfall Elimination Provision

Navigating Social Security’s Windfall Elimination Provision (WEP) With

Ssa Threshold 2024 Letty Olympie

The Best Explanation of the Windfall Elimination Provision (2021 Update

The Best Explanation of the Windfall Elimination Provision (2022 Update

A Worker Becomes Eligible For Disability Insurance Benefits (Dib) After 1985;

For People Who Reach 62 Or Developed A Disability In 1990 Or Later, We Reduce The 90% Factor To.

Web Congress Enacted And President Reagan Signed Into Law On April 21, 1983, The Windfall Elimination Provision (Wep) To Mitigate This Potential Windfall.

Web The Windfall Elimination Provision (Wep) Reduces The Amount Of Social Security Benefits People Can Collect If They Receive A Government Retirement Plan In Addition To Social Security.

Related Post: