Tulip Bubble Chart

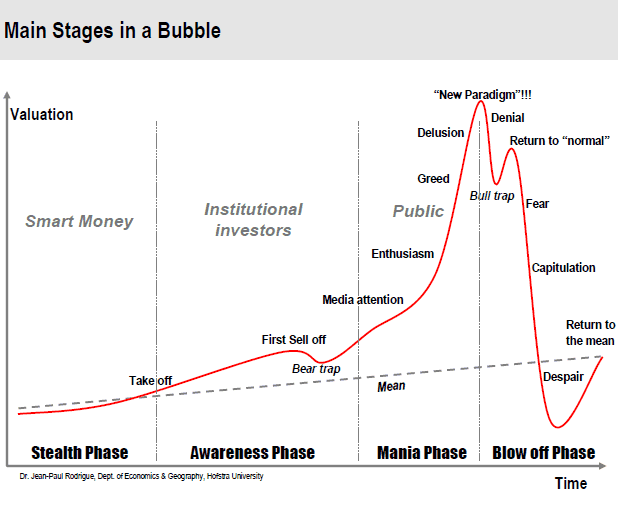

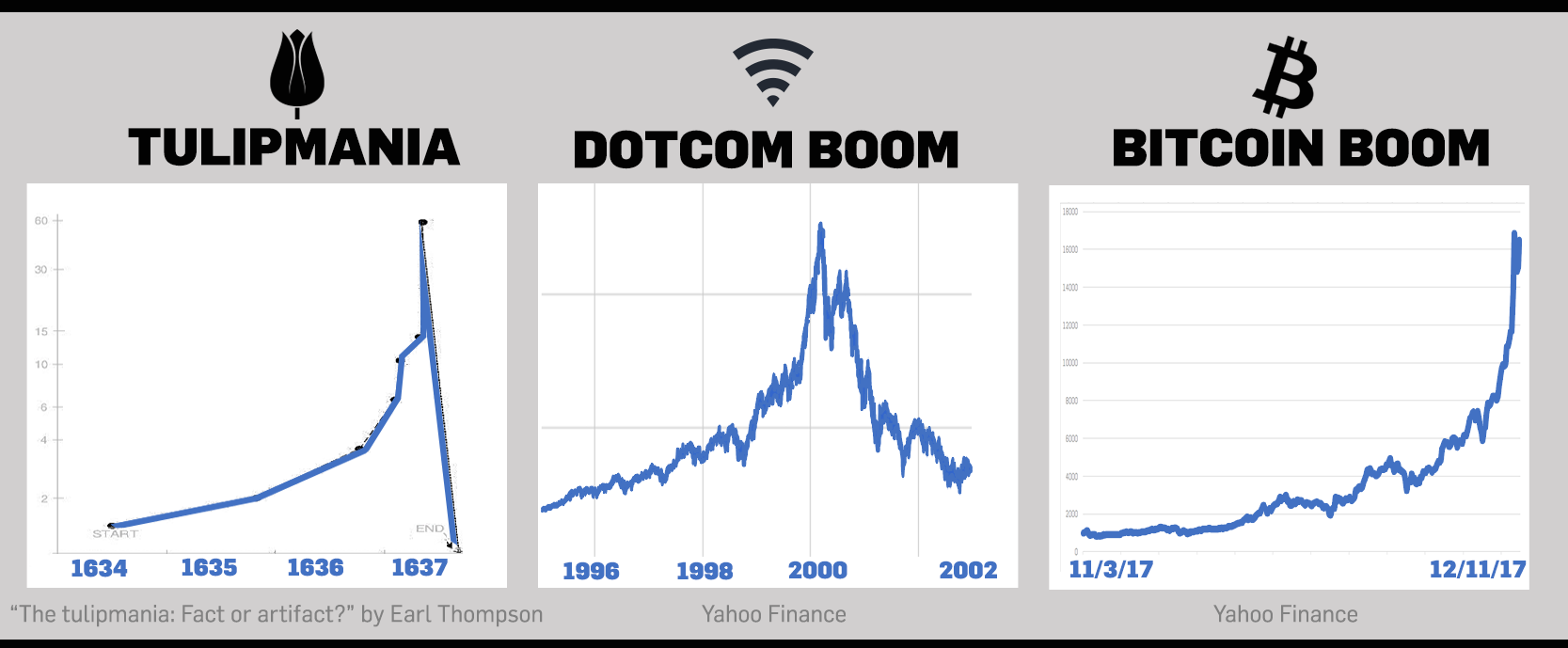

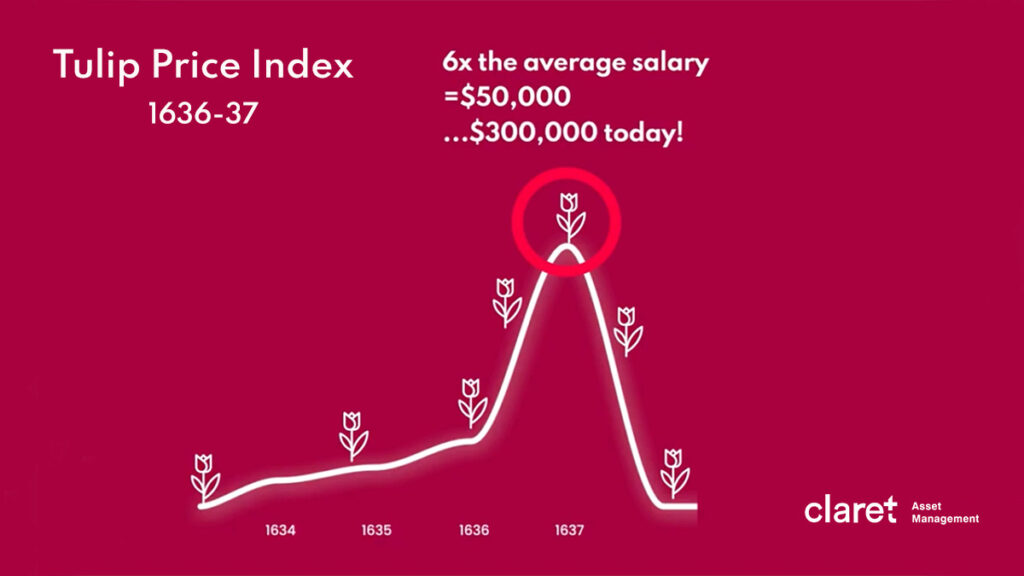

Tulip Bubble Chart - As the ascent of the chart began, the tulip, a simple flower, was transformed in the 17th century into a coveted luxury item and a status symbol. In the 17th century, history’s first speculative bubble popped. Web tulip mania ( dutch: It serves as a lesson in the dangers of unchecked greed and its impact on financial markets. Web people got wiped out. the flowers that cost more than houses. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting, which brueghel originated. Around the same time, tulip speculation even spread to paris and england, where tulips were traded on the london stock exchange. Web it is generally considered to have been the first recorded speculative bubble in history. The demand for rare tulip species in diverse hues quickly surpassed the supply, causing the price of individual bulbs to rise to unjustifiable heights across northern europe. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. Tulips became the talk of the fledgling dutch republic. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. Web updated march 22, 2020. Web the tulip bubble chart is a classic depiction of speculative mania and its eventual unravelling. Web tulip mania ( dutch: Web tulip mania, also known as the dutch tulip bulb market bubble, was a speculative frenzy in the netherlands during the 17th century, specifically from 1636 to 1637. Web tulip bulb speculation became so widespread by 1636 that they were traded on amsterdam’s stock exchange and in rotterdam, haarlem, leyden, alkmar, hoorn, and other towns. As the ascent of the. The purpose to understand this bubble is to highlight the risks of speculative investing and the potential consequences of irrational market behavior. It serves as a lesson in the dangers of unchecked greed and its impact on financial markets. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy.. Around the same time, tulip speculation even spread to paris and england, where tulips were traded on the london stock exchange. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting,. Web like many flowers, they can come in a variety of different colours: Web it is generally considered to have been the first recorded speculative bubble in history. It serves as a lesson in the dangers of unchecked greed and its impact on financial markets. This data visualization presents the phenomenon in modern financial terms. Around the same time, tulip. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting, which brueghel originated. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. The causes of tulip mania have perhaps been distorted over the centuries, with many assuming it. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting, which brueghel originated. In the 17th century, history’s first speculative bubble popped. And tulips figure prominently in many of the 22 ravishing. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative. The causes of tulip mania have perhaps been distorted over the centuries, with many assuming it was one of the first examples of a market bubble bursting. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy. Web tulip bulb speculation became so widespread by 1636 that they were. Web tulipmania took hold of the netherlands in the 1600s and is widely viewed as the first financial asset bubble. Web tulip mania ( dutch: The term tulip mania is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values. Web this small, free exhibition charts the course over two centuries of. As tulip prices shot up by 1,000 percent in the 1630s, dutch investors scrambled to buy up bulbs still in the ground. The purpose to understand this bubble is to highlight the risks of speculative investing and the potential consequences of irrational market behavior. But months later, the bubble burst. And if it bursts, the. Web tulip mania ( dutch: Web tulip mania, also known as the dutch tulip bulb market bubble, was a speculative frenzy in the netherlands during the 17th century, specifically from 1636 to 1637. Web tulip mania was a period during the 17th century where contract prices for tulip bulbs reached extremely high levels before crashing in 1637. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting, which brueghel originated. The major acceleration started in 1634 and then dramatically collapsed in february 1637. Web tulip mania ( dutch: Tulips became the talk of the fledgling dutch republic. The demand for rare tulip species in diverse hues quickly surpassed the supply, causing the price of individual bulbs to rise to unjustifiable heights across northern europe. Web like many flowers, they can come in a variety of different colours: The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy. As tulip prices shot up by 1,000 percent in the 1630s, dutch investors scrambled to buy up bulbs still in the ground. Web the amsterdam stock exchange opened in 1602 and the baltic grain trade, an informal futures market itself, had begun decades earlier. It serves as a lesson in the dangers of unchecked greed and its impact on financial markets. Web people got wiped out. the flowers that cost more than houses. The netherlands was therefore primed for a new trade, which was to become tulip mania. In both cities, traders strove to. The purpose to understand this bubble is to highlight the risks of speculative investing and the potential consequences of irrational market behavior.

Is TSLA A 1,000 Stock Or A Tulip Mania Bubble? Robert McCarty

The Index of Tulip Market during Tulip Bubble [10] Download

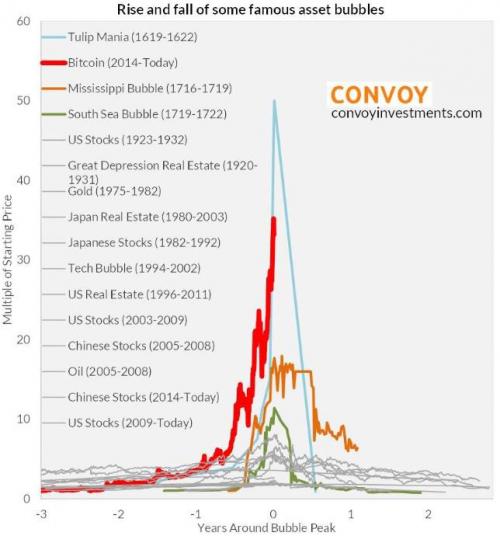

It’s Official Bitcoin Surpasses “Tulip Mania”, Is Now The Biggest

Look How Bitcoin's Rise Stacks up Against the Bubble and

5 Stages of a Financial Bubble, From Birth to Bust » Claret

tulipomania Burbuja, Tulipanes, Sociología

Bitcoin tulip bulb or another gold? Varchev Finance

the anatomy of a Bubble. the tulip Bubble in 163637. Download

Not PC This Time It's Different, Episode IX 'The Rise and fall of

Tulip Bubble Chart

But Months Later, The Bubble Burst.

This Data Visualization Presents The Phenomenon In Modern Financial Terms.

And Tulips Figure Prominently In Many Of The 22 Ravishing.

Web The Tulip Bubble Chart Is A Classic Depiction Of Speculative Mania And Its Eventual Unravelling.

Related Post: