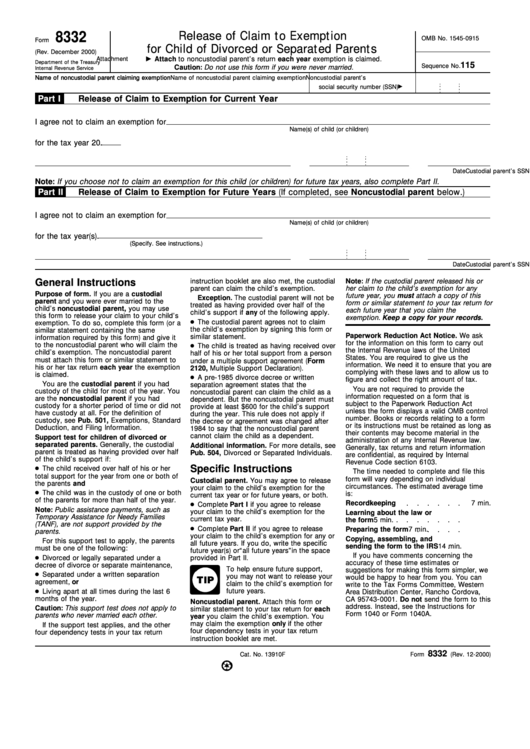

Tax Form 8332 Printable

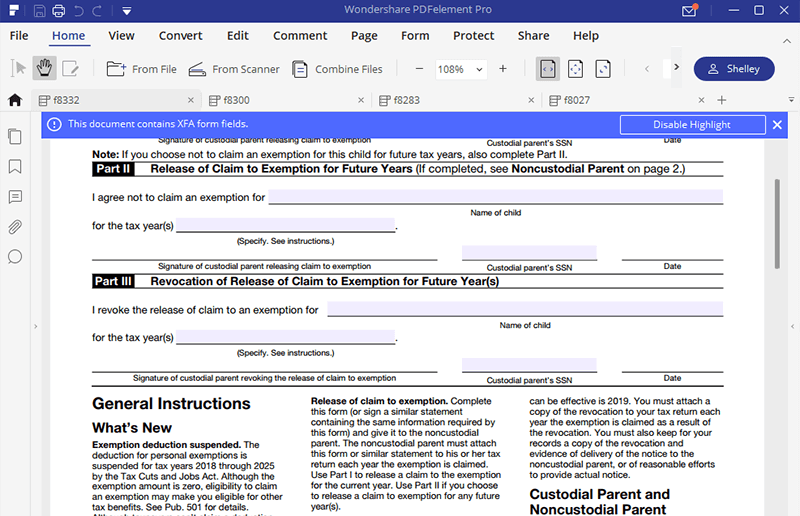

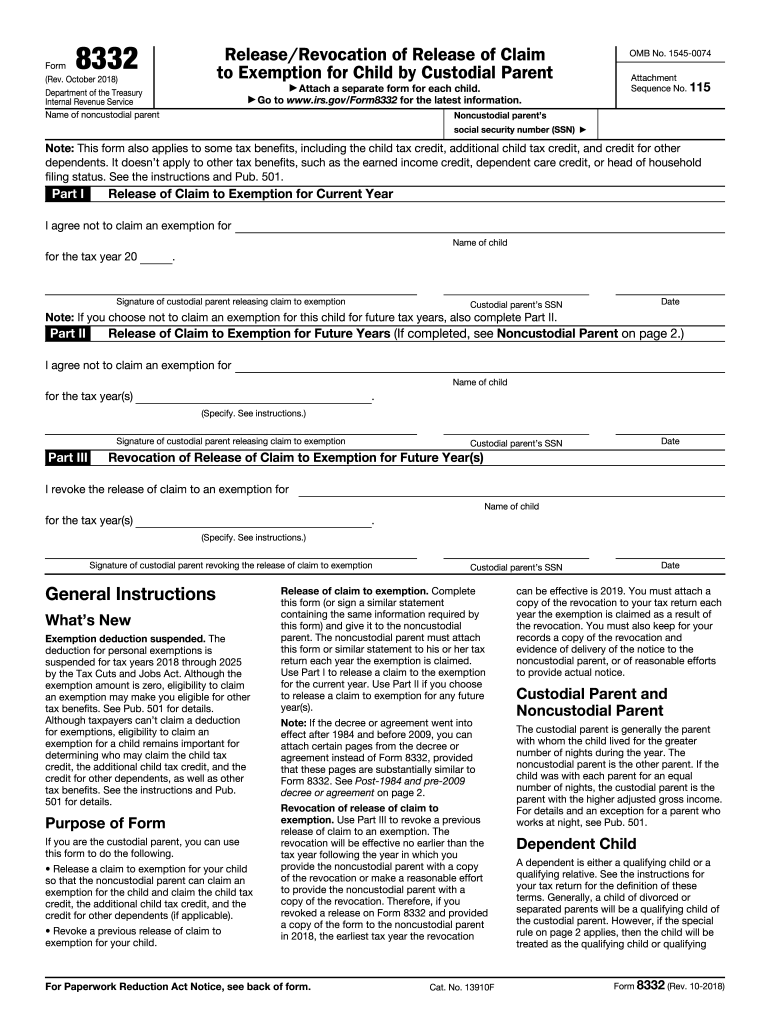

Tax Form 8332 Printable - Learn when and how to file this form, and what. Prepare the form 8332 on the custodial parent's return. A custodial parent can also use the form. You or the other party can transfer the right to claim a child as a dependent. To generate form 8332 in. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Web form 8332 is used to allow the noncustodial parent to claim the child tax credit for specific or future tax years. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. Delete the data entered in screen 70, release of. Generating form 8332 release of claim to exemption in proconnect tax. To generate form 8332 in. Web the form 8332 can be found here: Prepare the form 8332 on the custodial parent's return. Form 8332 is a tax form that allows custodial parents to release their right to claim a child as a dependent to the noncustodial parent. A custodial parent can also use the form. Web the form 8332 can be found here: New rules apply to allow the custodial parent to revoke a previous release of claim to exemption. Solved•by intuit•updated july 17, 2023. Generating form 8332 release of claim to exemption in proconnect tax. If you have custody of your child, but want to release the right to claim your child as a. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in january 2024, so this is the latest version of form 8332, fully. Web irs form 8332: New rules apply to allow the custodial parent to revoke a previous release of claim to exemption. Web when to use form 8332. Form 8332 is. New rules apply to allow the custodial parent to revoke a previous release of claim to exemption. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Prepare the form 8332 on the custodial parent's return. Generating form 8332 release of claim to exemption in proconnect tax. Delete the data. Web the form 8332 can be found here: Generating form 8332 release of claim to exemption in proconnect tax. Web when to use form 8332. Prepare the form 8332 on the custodial parent's return. You or the other party can transfer the right to claim a child as a dependent. Web make my parenting plan now. Delete the data entered in screen 70, release of. Web irs form 8332: When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Learn when and how to file this form, and what. Delete the data entered in screen 70, release of. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in january 2024, so this is the latest version of form 8332, fully. Release of claim to exemption for child: Web when to use form 8332. Web the form 8332 can be found here: Generating form 8332 release of claim to exemption in proconnect tax. Solved•by intuit•updated july 17, 2023. Web when to use form 8332. A custodial parent can also use the form. Release of claim to exemption for child by custodial parents. It can be used for curr… You or the other party can transfer the right to claim a child as a dependent. A custodial parent can also use the form. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. Web make my parenting plan. Web the form 8332 can be found here: It can be used for curr… New rules apply to allow the custodial parent to revoke a previous release of claim to exemption. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Solved•by intuit•updated july 17, 2023. Web when to use form 8332. Print, sign, and distribute to noncustodial parent. Prepare the form 8332 on the custodial parent's return. Learn when and how to file this form, and what. Delete the data entered in screen 70, release of. To generate form 8332 in. Generating form 8332 release of claim to exemption in proconnect tax. Revocation of release of claim to exemption on this. Solved•by intuit•updated july 17, 2023. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in january 2024, so this is the latest version of form 8332, fully. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. Web the form 8332 can be found here: You or the other party can transfer the right to claim a child as a dependent. Release of claim to exemption for child:

Tax Form 8332 Printable

Irs Form 8332 Printable 2023 Calendar Printable

Irs Form 8332 Printable

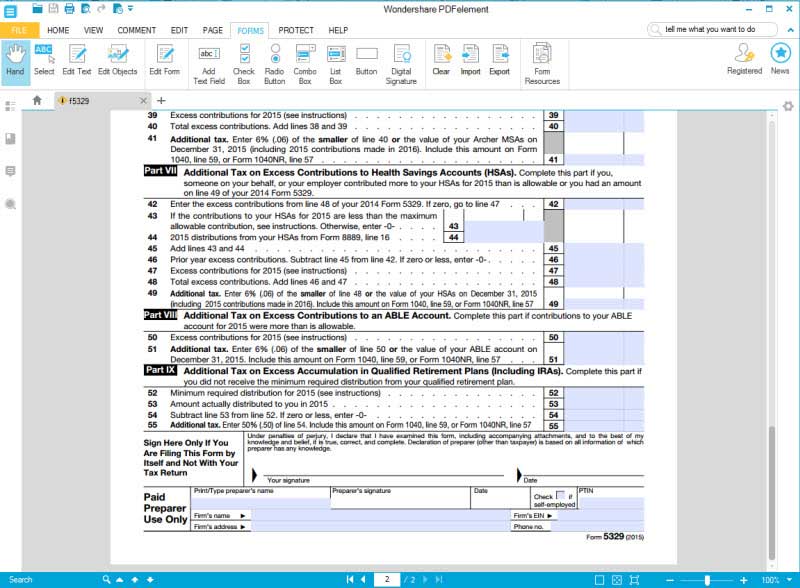

IRS Form 8332 Fill it with the Best PDF Form Filler

Bupa Tax Exemption Form Form 8332 Release/Revocation of Release of

8332 PDF 20182024 Form Fill Out and Sign Printable PDF Template

Irs Form 8332 Printable

IRS Form 8332 A Guide for Custodial Parents

Irs Form 8832 Download Fillable Pdf Or Fill Online Entity

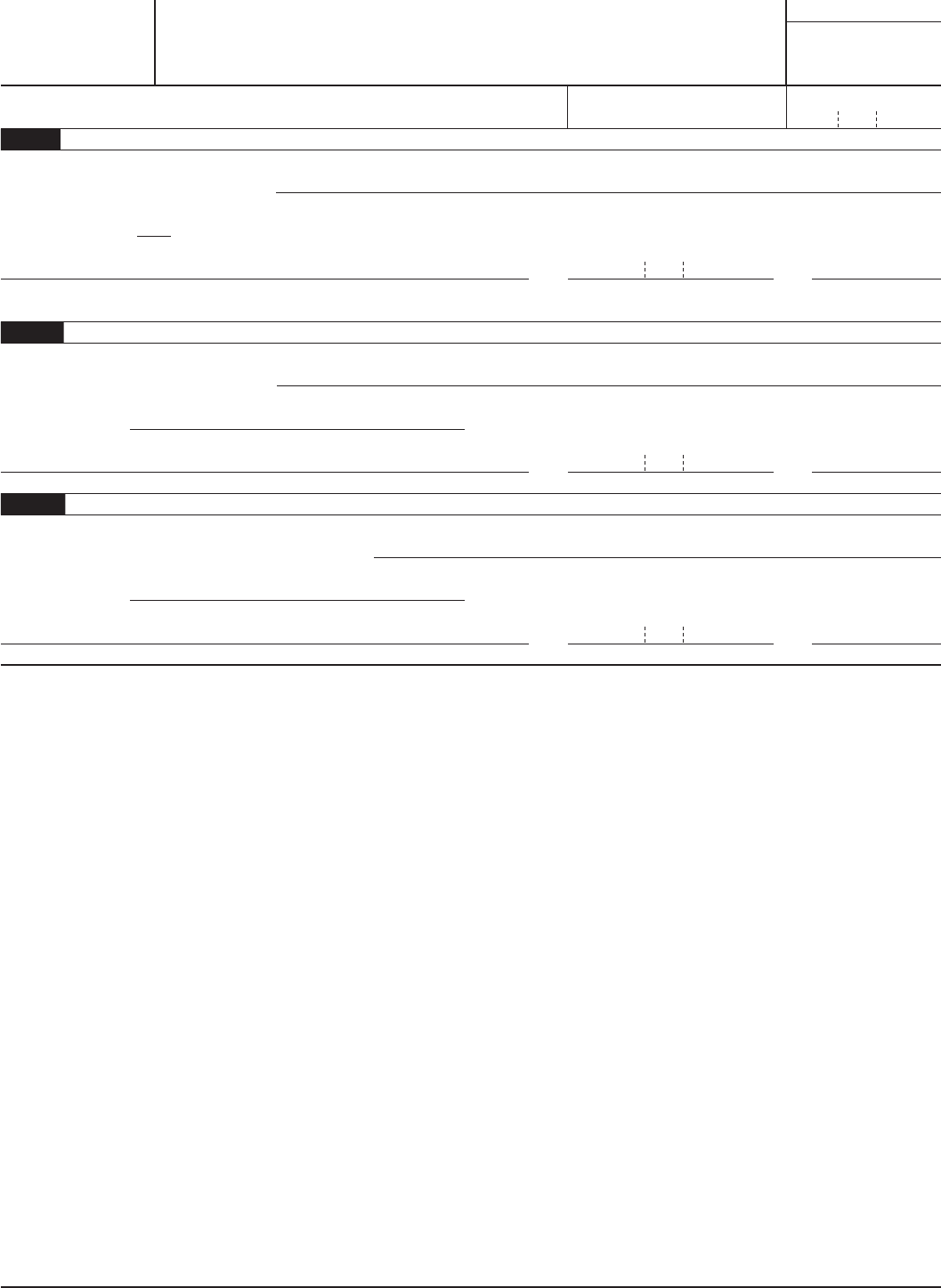

Form 8332 Edit, Fill, Sign Online Handypdf

New Rules Apply To Allow The Custodial Parent To Revoke A Previous Release Of Claim To Exemption.

It Can Be Used For Curr…

Web Form 8332 Is Used To Allow The Noncustodial Parent To Claim The Child Tax Credit For Specific Or Future Tax Years.

A Custodial Parent Can Also Use The Form.

Related Post: