State Tax Addback Chart

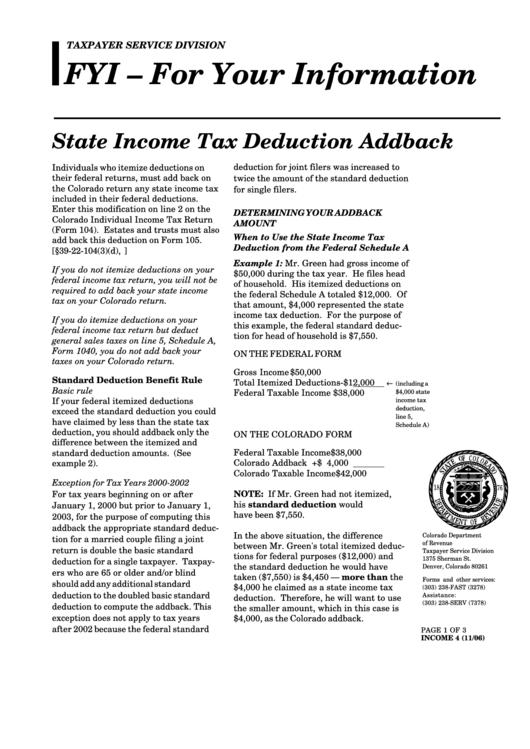

State Tax Addback Chart - Tom selby, director of public policy at aj bell, said the personal. Web explore the latest 2024 state income tax rates and brackets. Web state income tax addback. Information current as of 4/29/2013. Web as of april 16, 2024. Web this chart shows whether each state and the district of columbia allow a corporation income tax deduction for income taxes paid to states or localities. Web based on this favorable irs position, on april 19, 2021, as part of its 2021/22 budget bill, new york state joined the list of states that have enacted similar tax laws. Download the full list of state charts to easily compare how each state (plus washington, d.c., and new york. Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state. Which states don't have an income tax? Which states don't have an income tax? Web this chart shows whether the state requires an addition or subtraction modification for net capital gains in determining state taxable income. Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state. Web the state tax chart builders (bna) tool organizes selected chunks of information. How high are income taxes in my state? Web massachusetts conforms to the federal tax code as it existed in 2005, and california to the code as of 2015. For example, by selecting several tax topics and then selecting various. Map to find taxes imposed, tax rates, due. Web the charts below are quick reference guides listing each modification. Web this chart shows whether each state and the district of columbia allow a corporation income tax deduction for income taxes paid to states or localities. For example, by selecting several tax topics and then selecting various. Which states don't have an income tax? Business interest deduction (irc §163 (j)) determination. Conformity chart, which includes each state’s conformity status, key. Web massachusetts conforms to the federal tax code as it existed in 2005, and california to the code as of 2015. Web the state tax chart builders (bna) tool organizes selected chunks of information into charts. Which states don't have an income tax? Business interest deduction (irc §163 (j)) determination. Conformity chart, which includes each state’s conformity status, key differences. Web as of april 16, 2024. Income tax rates and alternative minimum taxes; Web compare 2022 state income tax rates and brackets with a tax data report. For example, by selecting several tax topics and then selecting various. Web explore the latest 2024 state income tax rates and brackets. Web browse the reference library for the latest guidance and tools to address your state and local tax needs including an interactive u.s. Web compare 2022 state income tax rates and brackets with a tax data report. Differences in federal and state law add complexity in determining how section 163 (j) applies at the state level. Conformity chart, which includes. Web browse the reference library for the latest guidance and tools to address your state and local tax needs including an interactive u.s. Web compare 2022 state income tax rates and brackets with a tax data report. Individuals who claim an itemized deduction on their federal income tax return for state income tax. For example, by selecting several tax topics. Download the full list of state charts to easily compare how each state (plus washington, d.c., and new york. Web state income tax addback. Differences in federal and state law add complexity in determining how section 163 (j) applies at the state level. Which states don't have an income tax? Applicable corporations subject to amt decision tool. Information current as of 4/29/2013. How high are income taxes in my state? Web more than 120 charts are provided, covering discrete state tax topics including: Web this chart shows whether the state requires an addition or subtraction modification for net capital gains in determining state taxable income. Web this chart shows whether each state and the district of columbia. Income tax rates and alternative minimum taxes; Web this chart shows whether the state requires an addition or subtraction modification for net capital gains in determining state taxable income. Web compare 2022 state income tax rates and brackets with a tax data report. Web based on this favorable irs position, on april 19, 2021, as part of its 2021/22 budget. For example, by selecting several tax topics and then selecting various. Web the state tax chart builders (bna) tool organizes selected chunks of information into charts. Tom selby, director of public policy at aj bell, said the personal. Differences in federal and state law add complexity in determining how section 163 (j) applies at the state level. Web this chart shows whether the state requires an addition or subtraction modification for net capital gains in determining state taxable income. Web based on this favorable irs position, on april 19, 2021, as part of its 2021/22 budget bill, new york state joined the list of states that have enacted similar tax laws. Download the full list of state charts to easily compare how each state (plus washington, d.c., and new york. Web download the full state i.r.c. Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state. How high are income taxes in my state? Web browse the reference library for the latest guidance and tools to address your state and local tax needs including an interactive u.s. Business interest deduction (irc §163 (j)) determination. Web explore the latest 2024 state income tax rates and brackets. State conformity with federal bonus depreciation rules. Income tax rates and alternative minimum taxes; Web state income tax addback.

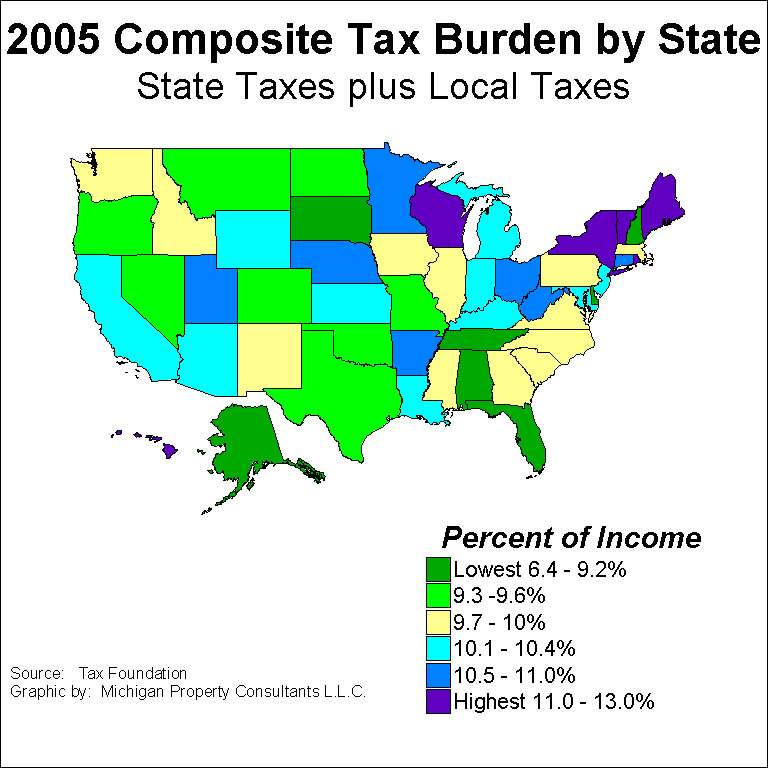

Which States Pay the Most Federal Taxes A Look At The Numbers

State Tax Deduction Addback Instruction Form 2006 printable

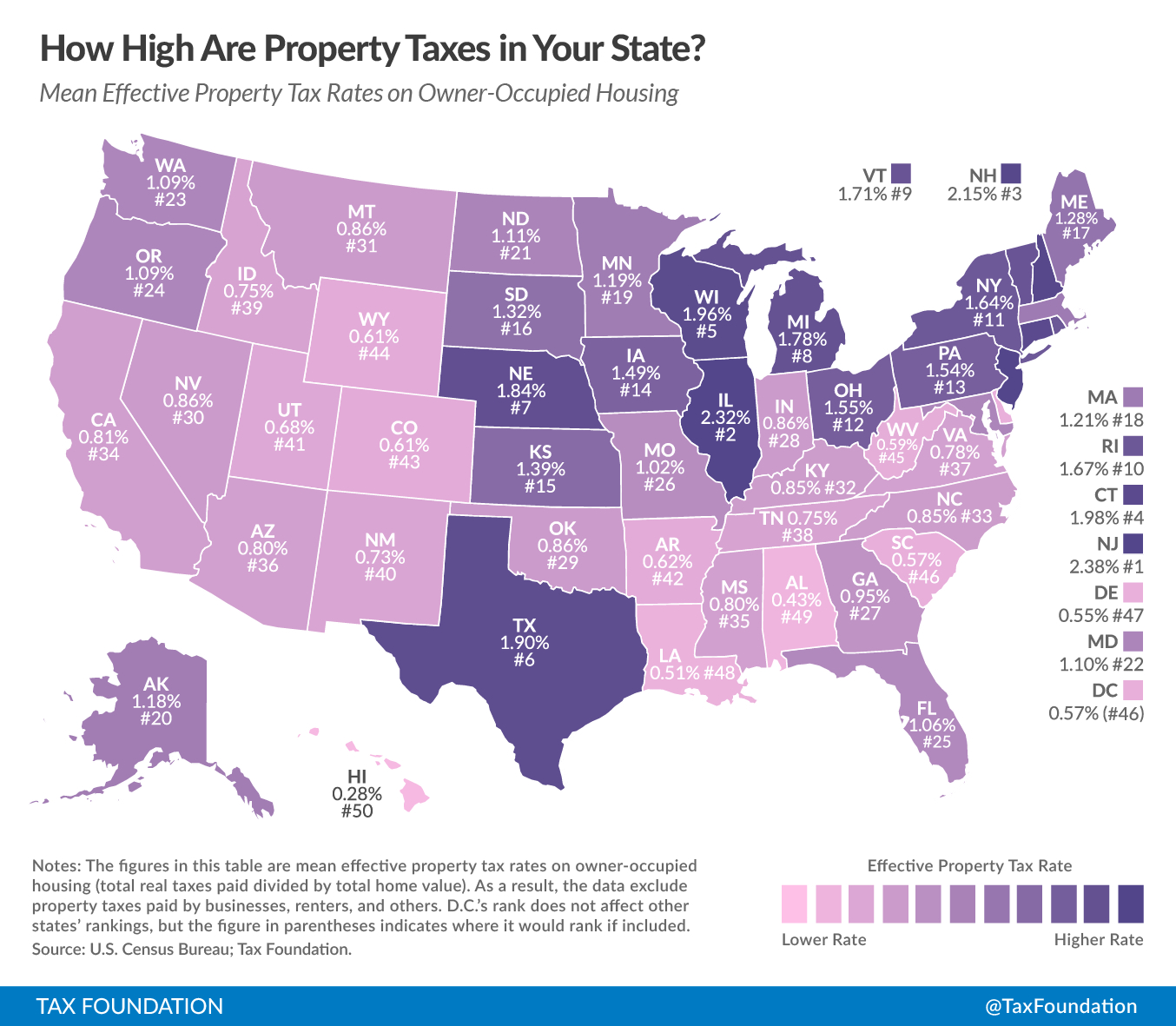

How High are Tax Rates in Your State?

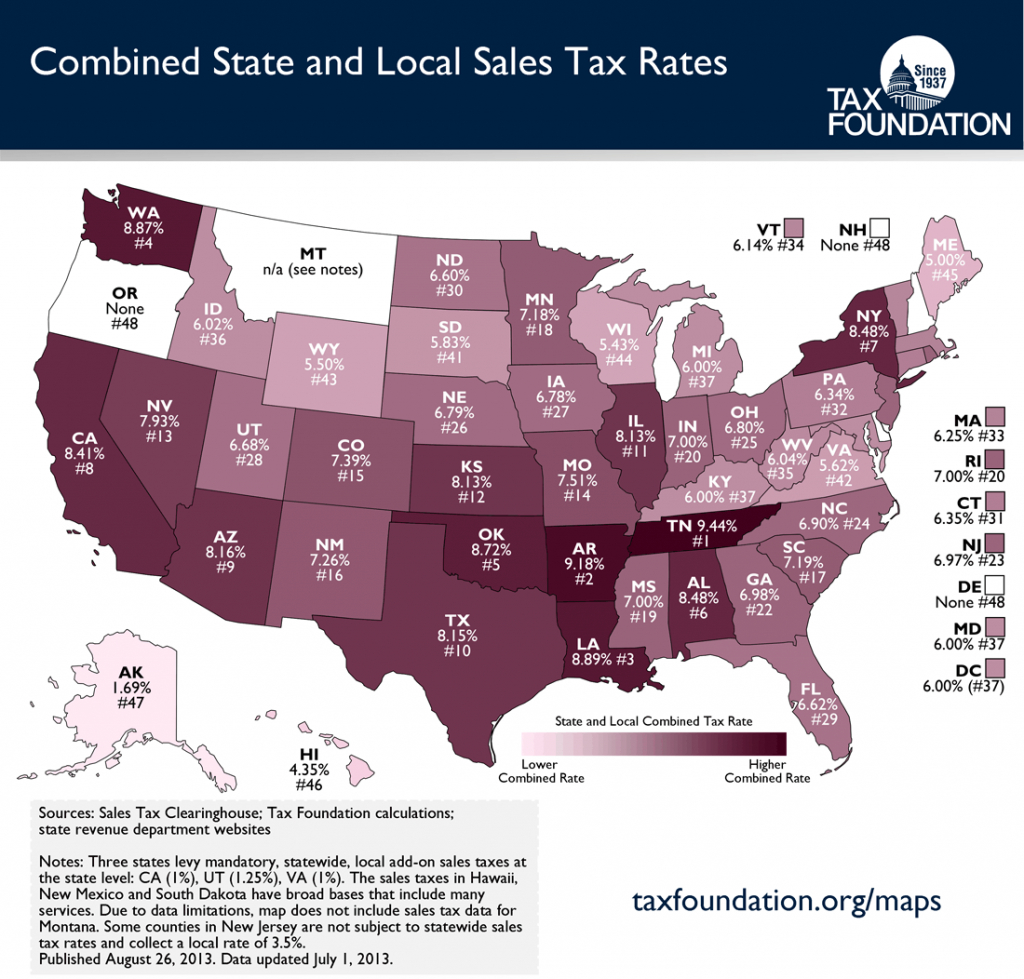

The Kiplinger Tax Map Guide To State Taxes, State Sales Texas

How High Are Spirits Taxes In Your State? Tax Foundation Texas

2019 State Individual Tax Rates and Brackets Tax Foundation

State Tax Conformity a Year After Federal Tax Reform

Top State Tax Rates for All 50 States Chris Banescu

State Taxes State Taxes Chart

Az State Tax Brackets 2024 Ania Meridel

Individuals Who Claim An Itemized Deduction On Their Federal Income Tax Return For State Income Tax.

Web Compare 2022 State Income Tax Rates And Brackets With A Tax Data Report.

Web This Chart Shows Whether Each State And The District Of Columbia Allow A Corporation Income Tax Deduction For Income Taxes Paid To States Or Localities.

Web The Chart Below Summarizes Some Of The State Income Tax Issues Raised By P.l.

Related Post: