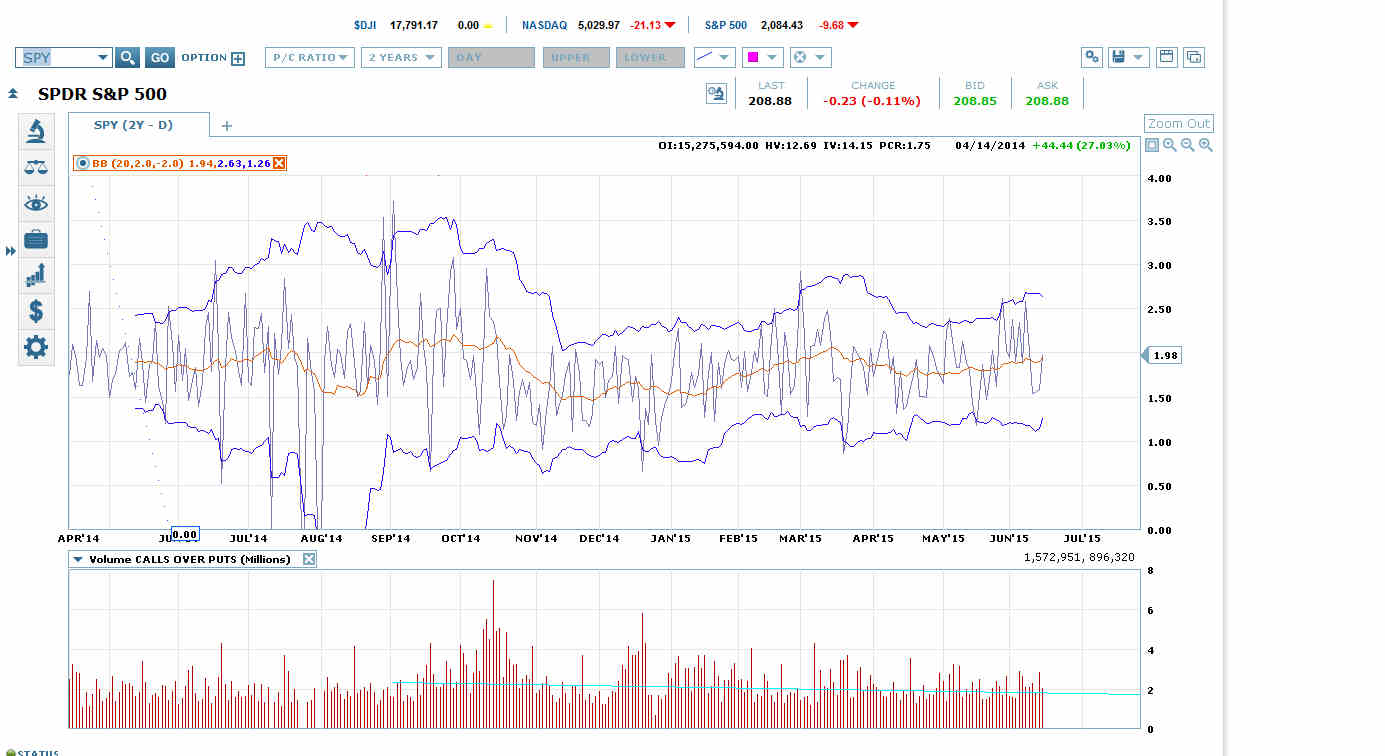

Spy Put Call Ratio Chart

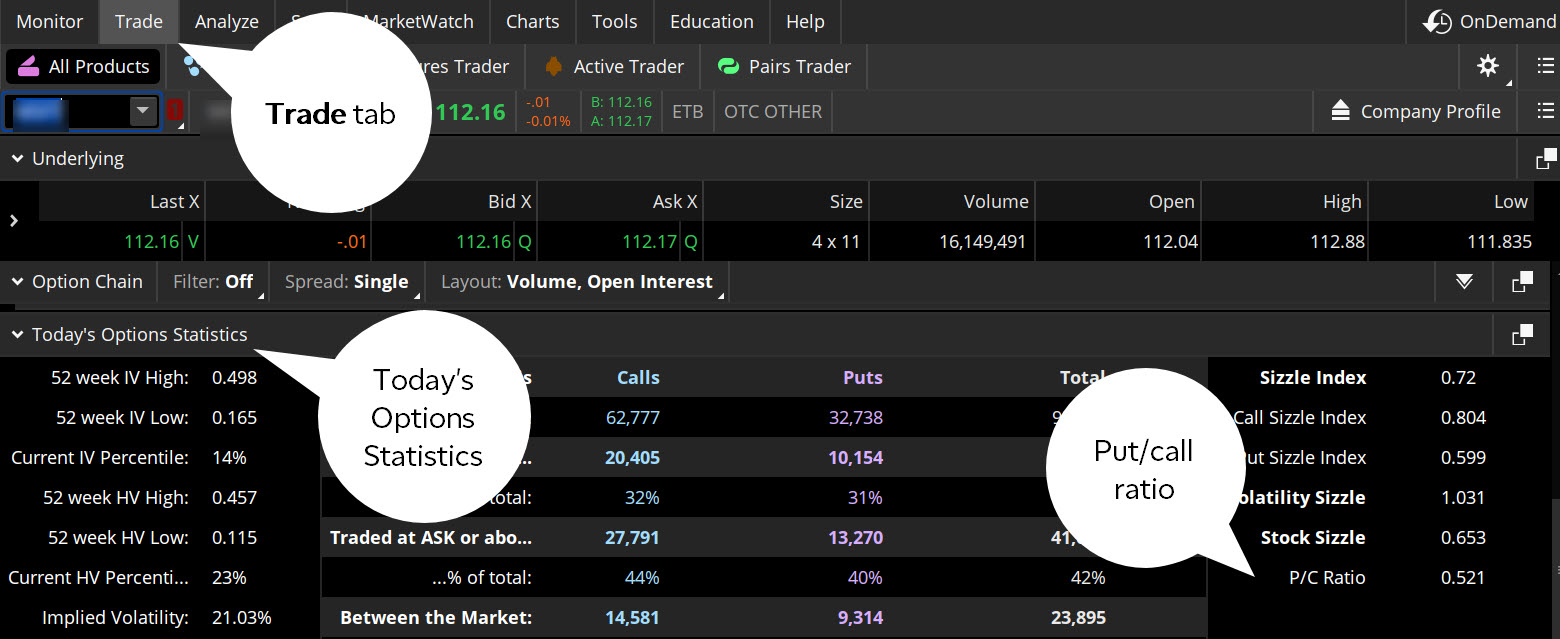

Spy Put Call Ratio Chart - The total open interest of all call options. The ratio of outstanding put contracts to outstanding call contracts at the close of the trading day, for options with the relevant expiration. Web the chart shows the data for the put and call volumes for equity, index, and total options. The ratio of puts traded to calls traded, for options with the relevant expiration date. The put call ratio can be. The ratio is almost always above one, meaning there are. Put/call oi ratio 2.31 ; Today's open interest 19,786,446 ; The total open interest of all put options. Web put/call vol ratio 1.21 ; The ratio is almost always above one, meaning there are. Web loading chart for spy. Furthermore, call open interest is up 6.5% in the last 5 days. The put call ratio can be. The ratio of outstanding put contracts to outstanding call contracts at the close of the trading day, for options with the relevant expiration. This page shows all open options expirations for the symbol, with put/call totals for each expiration date for options traded during the current session. Analyzing this information can help you spot developing trends in long and short options trading activity. Interactive chart for spdr s&p 500 etf trust (spy), analyze all the data with a huge range of indicators. Web. Web view comprehensive spy options with our latest charts on volume, open interest, max pain, and implied volatility. Interactive chart for spdr s&p 500 etf trust (spy), analyze all the data with a huge range of indicators. Analyzing this information can help you spot developing trends in long and short options trading activity. Web the chart shows the data for. Web 26 rows 1.26 for may 30 2024. The total open interest of all call options. The put call ratio can be. Web a high put/call ratio can signify the market is oversold as more traders are buying puts rather than calls, and a low put/call ratio can signify the market is overbought as more. Web put/call vol ratio 1.21. Web a high put/call ratio can signify the market is oversold as more traders are buying puts rather than calls, and a low put/call ratio can signify the market is overbought as more. The total open interest of all put options. Today's open interest 19,786,446 ; Interactive chart for spdr s&p 500 etf trust (spy), analyze all the data with. Web 26 rows 1.26 for may 30 2024. Furthermore, call open interest is up 6.5% in the last 5 days. The ratio of puts traded to calls traded, for options with the relevant expiration date. Web a high put/call ratio can signify the market is oversold as more traders are buying puts rather than calls, and a low put/call ratio. Furthermore, call open interest is up 6.5% in the last 5 days. The ratio of puts traded to calls traded, for options with the relevant expiration date. Put/call oi ratio 2.31 ; Web put/call vol ratio 1.21 ; The put call ratio can be. Web the chart shows the data for the put and call volumes for equity, index, and total options. The ratio of puts traded to calls traded, for options with the relevant expiration date. The total open interest of all put options. The equity put/call ratio on this particular day was 0.64, the index options. The ratio is almost always above. The total open interest of all put options. Web the chart shows the data for the put and call volumes for equity, index, and total options. The ratio is almost always above one, meaning there are. The ratio of puts traded to calls traded, for options with the relevant expiration date. Web 26 rows 1.26 for may 30 2024. Web put open interest total: Web spy call open interest: The ratio is almost always above one, meaning there are. Web put/call vol ratio 1.21 ; The equity put/call ratio on this particular day was 0.64, the index options. Today's open interest 19,786,446 ; Web put/call vol ratio 1.21 ; The open interest in spy call options increased by 2.5% to 6.1 million contracts. Web a high put/call ratio can signify the market is oversold as more traders are buying puts rather than calls, and a low put/call ratio can signify the market is overbought as more. The ratio of puts traded to calls traded, for options with the relevant expiration date. The put call ratio can be. This page shows all open options expirations for the symbol, with put/call totals for each expiration date for options traded during the current session. Web put open interest total: The total open interest of all put options. Web loading chart for spy. Furthermore, call open interest is up 6.5% in the last 5 days. Web the chart shows the data for the put and call volumes for equity, index, and total options. Interactive chart for spdr s&p 500 etf trust (spy), analyze all the data with a huge range of indicators. Analyzing this information can help you spot developing trends in long and short options trading activity. The ratio is almost always above one, meaning there are. Web spy call open interest:

SPY PutCall Ratio Returns To 20 DMA

What is Put Call Ratio Types and How to Read? Espresso Bootcamp

Put/Call Ratio (5 day MA) vs. SPY dla USIPCC autorstwa TomaszIgnasiak

Technical Patterns And What We Expect For Markets Part II

Put Call Ratios Made Easy YouTube

SPY / SPDR S&P 500 ETF Trust Put/Call Ratio, Options Sentiment

What PutCall Ratio Tells Us About SPY QQQ for USIPC by ttrending

Spy Put Call Ratio Chart A Visual Reference of Charts Chart Master

/PutCallRatio-5c813e7946e0fb00019b8efa.png)

Spy Put Call Ratio Chart Online Shopping

Put Call Ratio Live Data !! pcr YouTube

The Equity Put/Call Ratio On This Particular Day Was 0.64, The Index Options.

The Ratio Of Outstanding Put Contracts To Outstanding Call Contracts At The Close Of The Trading Day, For Options With The Relevant Expiration.

View The Basic Spy Option Chain And Compare Options Of Spdr.

Web View Comprehensive Spy Options With Our Latest Charts On Volume, Open Interest, Max Pain, And Implied Volatility.

Related Post: