Sofr Vs Libor Chart

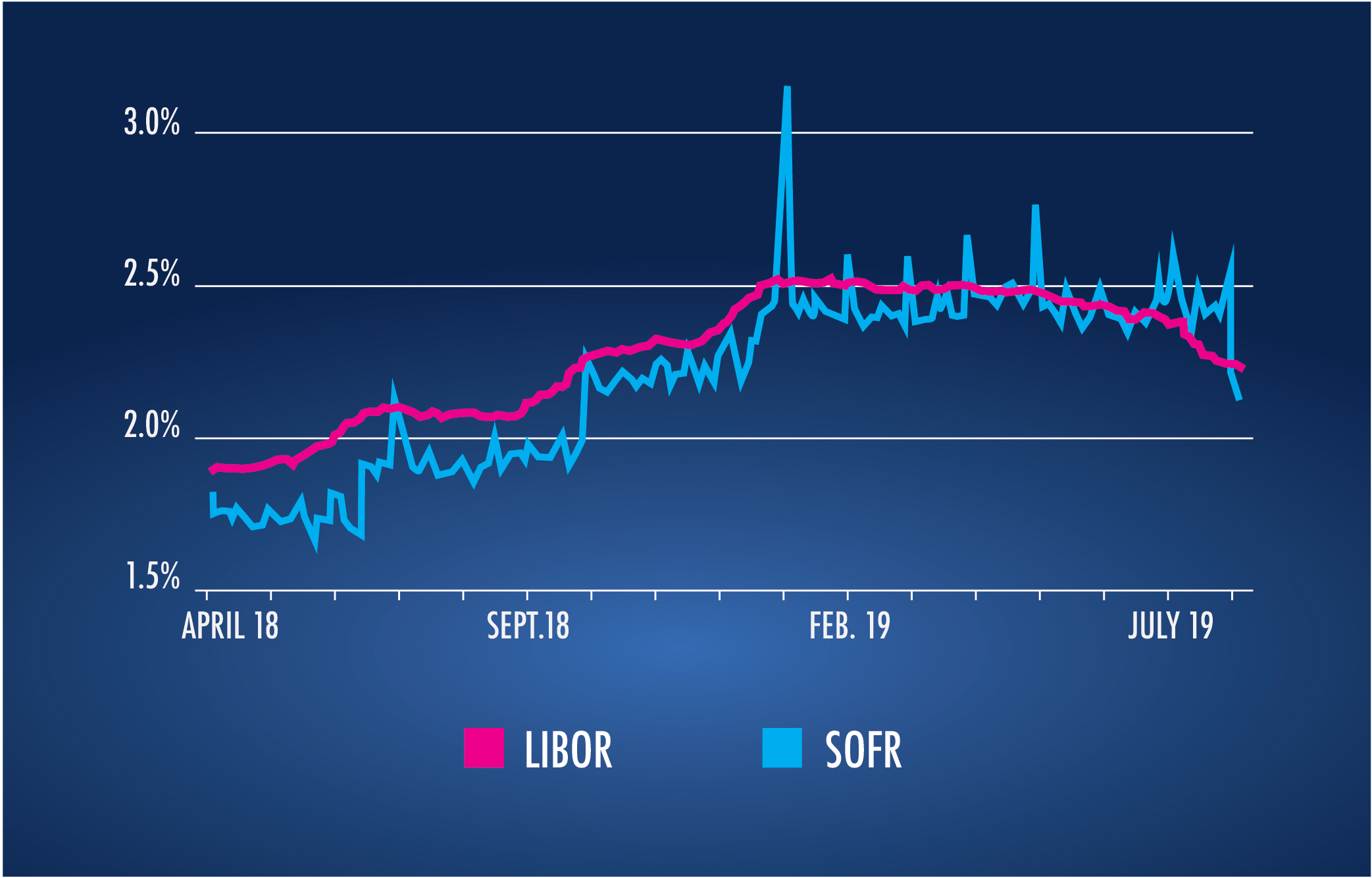

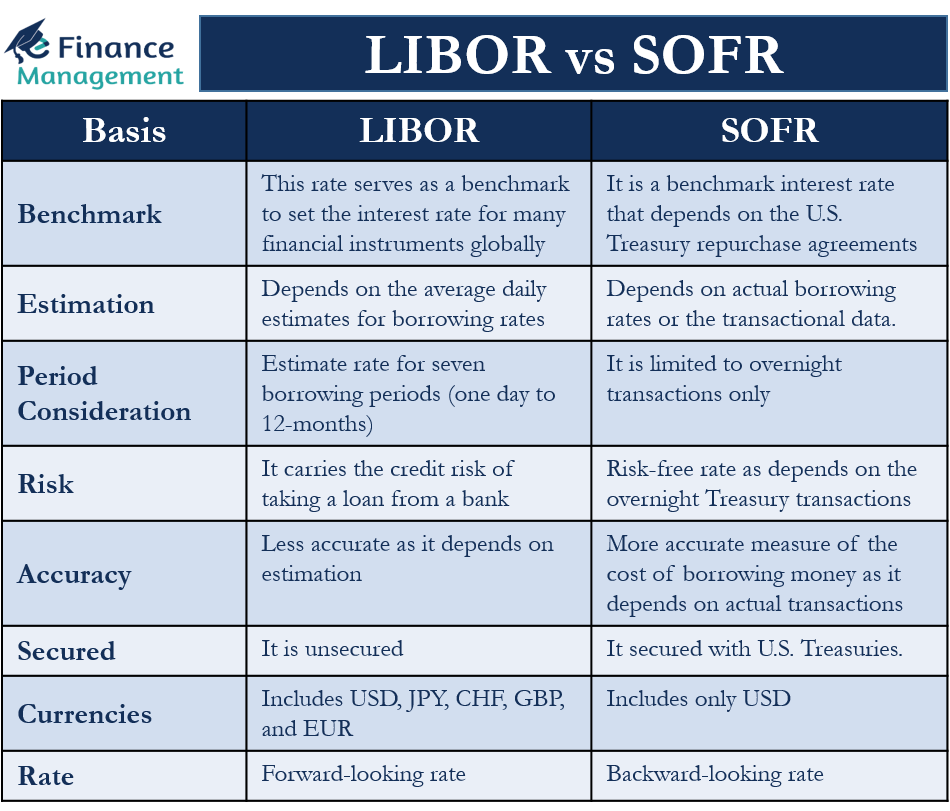

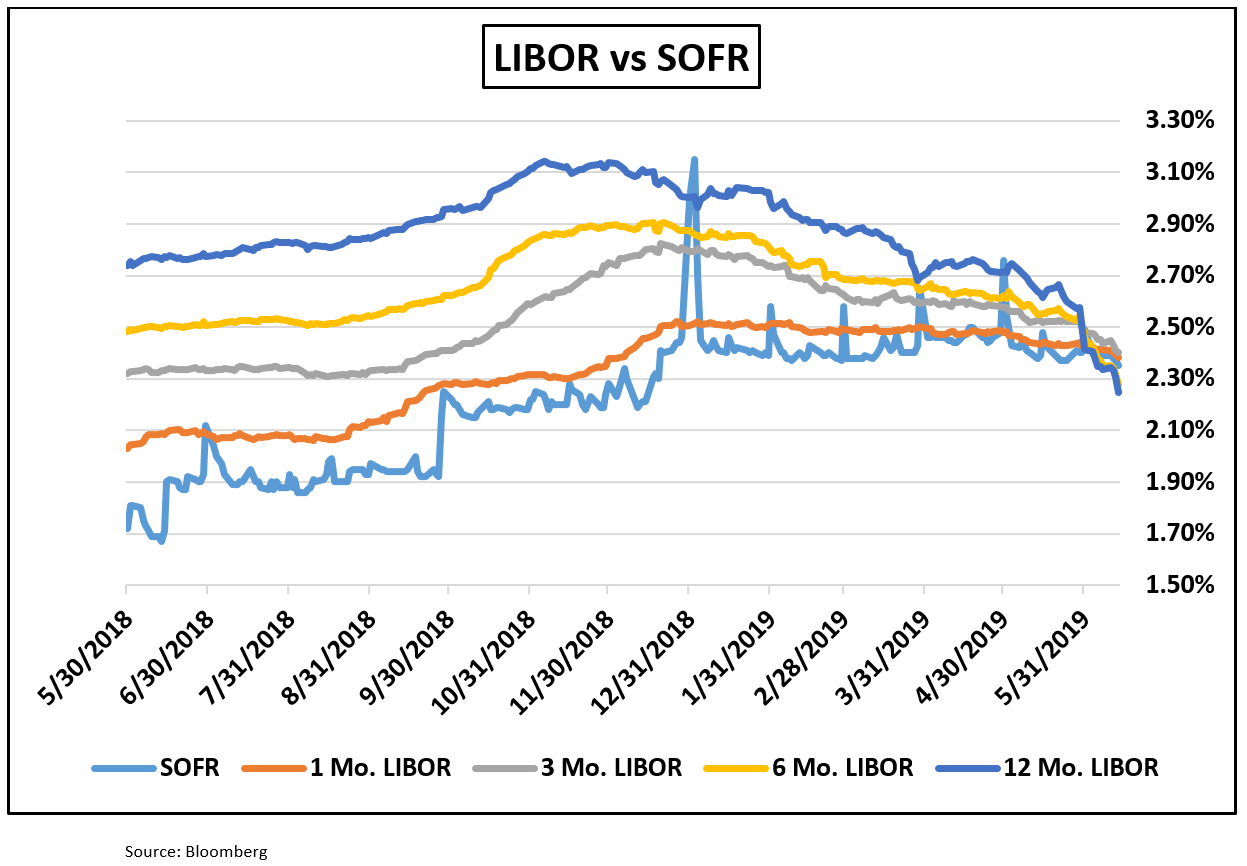

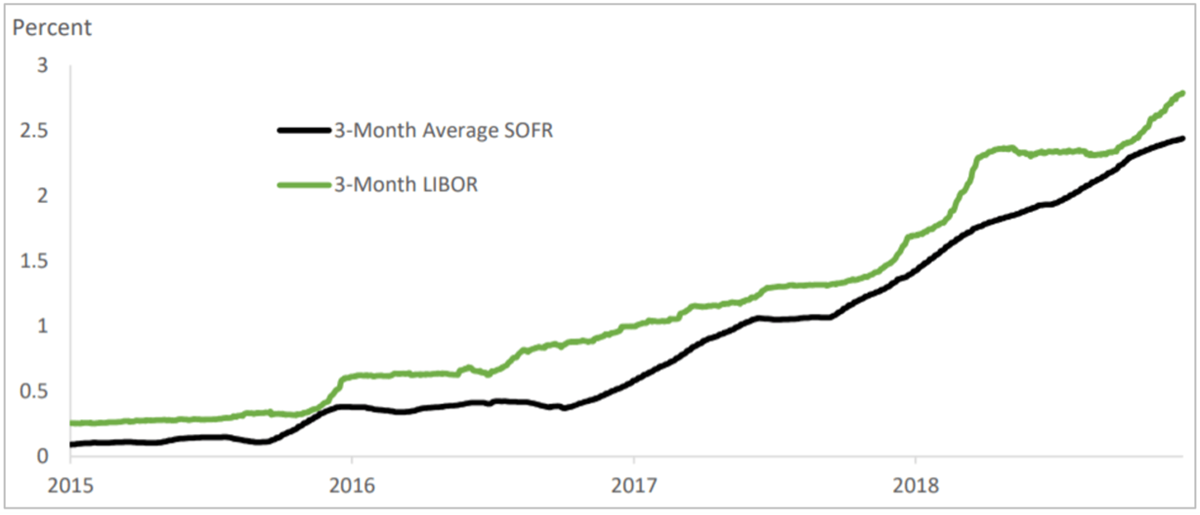

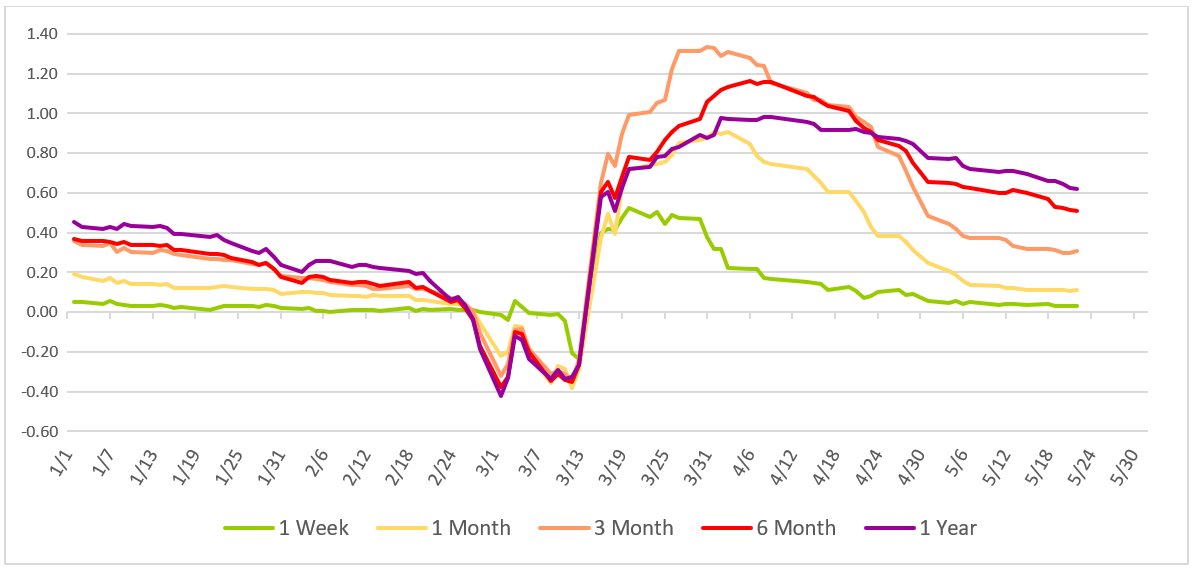

Sofr Vs Libor Chart - Web here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the change. Sofr is a benchmark that financial institutions use to price loans for businesses. As an overnight secured rate, sofr better reflects the way financial institutions fund themselves today. Morgan’s preferred alternative to usd libor. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. Web as you can see in the chart above, we employ the 5yr median spread between sofr and libor as calculated by the international swaps and derivatives association (isda) to be employed in the calculation of fallback rates. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. Web the resulting overnight libor fallback rate for may 31, 2024 is 5.34644% using the fixed 0.00644% overnight fallback spread. This is higher than the long term average of 2.10%. Treasury repurchase agreements data, reflecting borrowing. The transition from libor to sofr in june 2023 marked a significant shift in interest rate benchmarks, enhancing reliability in financial markets. The transaction volumes underlying sofr regularly are over $1 trillion in daily volumes. As an overnight secured rate, sofr better reflects the way financial institutions fund themselves today. Web there are some. Web sofr is nearly risk free as an overnight secured rate collateralized with u.s. The new york federal reserve releases it. The secured overnight financing rate or sofr is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Treasury repurchase agreements data, reflecting borrowing. Web sofr is based on transactions in the overnight repurchase markets. So for example, that spread is 26.2bp for the 3mth rate. Since sofr derivatives markets are based on collateral, sofr has a credit risk premium. Secured overnight financing rate (sofr) is a benchmark interest rate for derivatives and loans in usd that has replaced the london interbank offered rate (libor). Web there are some key differences between libor and sofr.. Sofr (secured overnight financing rate) is a backward. Web here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the change. Web sofr is a much more resilient rate than libor was because of how it is produced and the depth and liquidity of the markets that underlie it. For. Morgan’s preferred alternative to usd libor. The transition from libor to sofr in june 2023 marked a significant shift in interest rate benchmarks, enhancing reliability in financial markets. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. So for example, that spread is 26.2bp for the 3mth rate. Points 2 and. Web in 2014, the federal reserve convened the alternative reference rates committee (arrc) and tasked the group with identifying an alternative to u.s. Web the secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web the resulting overnight libor fallback rate for may 31, 2024 is 5.34644% using the. Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Web sofr is nearly risk free as an overnight secured rate collateralized with u.s. Web here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the change. The transition. Morgan’s preferred alternative to usd libor. Sofr is based on actual transactions and not an estimate of where interest rates may be in the future. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. Sofr (secured overnight financing rate) is. Points 2 and 3 particularly make the transition from libor to sofr challenging. The secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the change. Treasury repurchase agreements. Web founded in the 1980s and marred by manipulation during the great financial crisis, the u.s. The secured overnight financing rate or sofr is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web the resulting overnight libor fallback rate for may 31, 2024 is 5.34644% using the fixed 0.00644% overnight fallback spread. Sofr is. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. Web sofr is nearly risk free as an overnight secured rate collateralized with u.s. Web as you can see in the chart above, we employ the 5yr median spread between sofr and libor as calculated by the international swaps and derivatives association (isda) to be employed in the calculation of fallback rates. Web founded in the 1980s and marred by manipulation during the great financial crisis, the u.s. Web the resulting overnight libor fallback rate for may 31, 2024 is 5.34644% using the fixed 0.00644% overnight fallback spread. Web the secured overnight financing rate (sofr) is j.p. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. Web sofr is a much more resilient rate than libor was because of how it is produced and the depth and liquidity of the markets that underlie it. Web there are some key differences between libor and sofr. Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Web the secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. Sofr is based on actual transactions and not an estimate of where interest rates may be in the future. Web here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the change. Sofr is a benchmark that financial institutions use to price loans for businesses. Treasury repurchase agreements data, reflecting borrowing.

The LIBOR Transition Mission Capital

The LIBOR Transition, Part 2 Challenges Associated with SOFR

Comparing LIBOR, BSBY & SOFR Curves LSTA

LIBOR vs SOFR Meaning, Need, and Differences

An Update on the Transition from LIBOR to SOFR

Libor To Sofr Spread

Flooring It! LIBOR vs. SOFR LSTA

The impact of Reference Rate reform Transition from LIBOR to SOFR

Libor Vs Sofr Rate Chart 2023

Sofr Vs Libor Chart 2021

The Secured Overnight Financing Rate Or Sofr Is A Broad Measure Of The Cost Of Borrowing Cash Overnight Collateralized By Treasury Securities.

Web There Are Three Major Differences Between Sofr And Usd Libor.

This Is Higher Than The Long Term Average Of 2.10%.

Secured Overnight Financing Rate (Sofr) Is A Benchmark Interest Rate For Derivatives And Loans In Usd That Has Replaced The London Interbank Offered Rate (Libor).

Related Post: