Smart Money Vs Dumb Money Chart Today

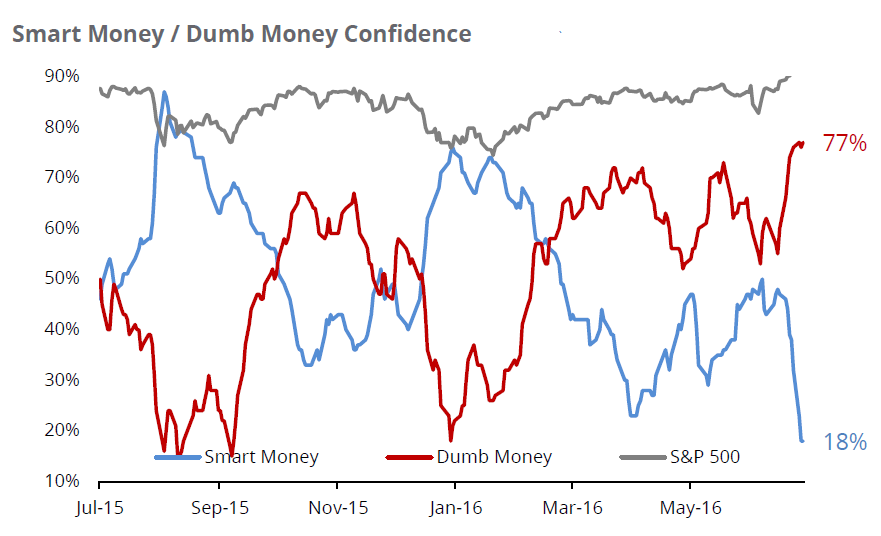

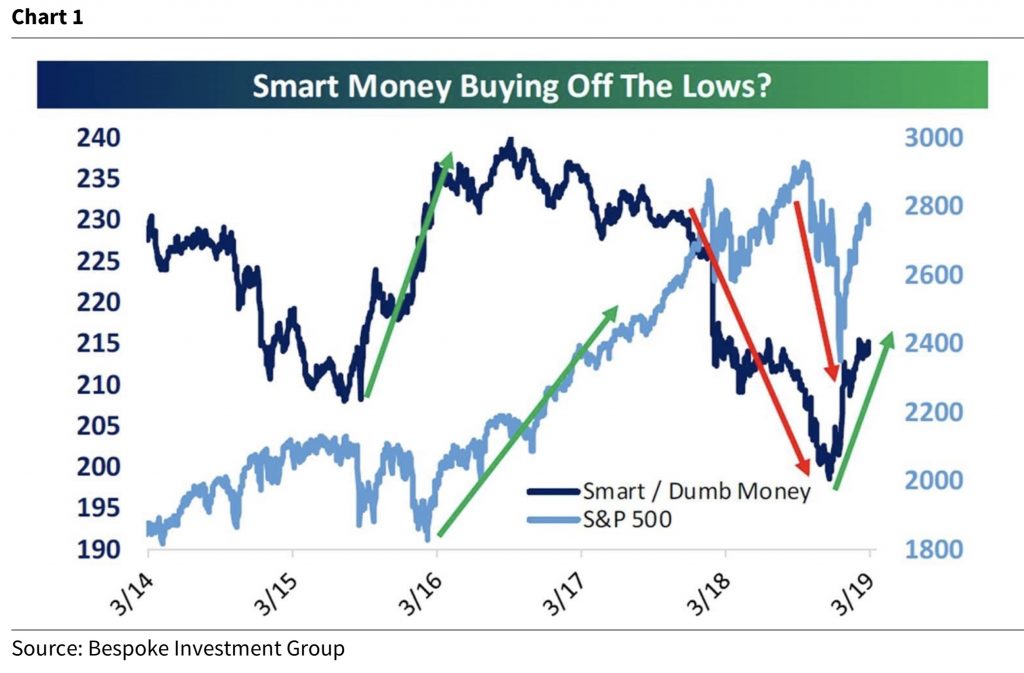

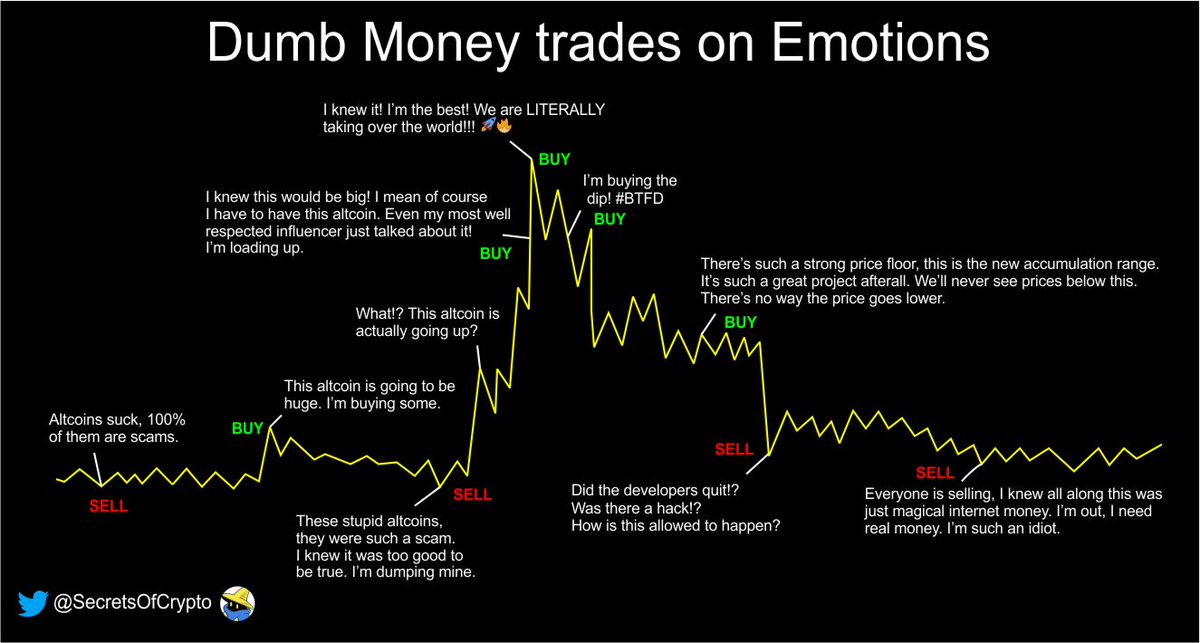

Smart Money Vs Dumb Money Chart Today - Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to. Web smart money vs. Trades made at the beginning of the day are. The smart money flow index is based on the concept of don. You will note that the “dumb” money (red line) is well over the “too. Web as a result, the typical individual investor suffers from extremely poor performance. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge. This has proven to be an overbought signal on the chart. Web nvda is 39% > than its 40 week sma currently. 11k views 1 year ago. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge. Web as a result, the typical individual investor suffers from extremely poor performance. Web smart money vs. Trades made at the beginning of the day are. Trades made at the beginning of the day are. Yet the rub is that, typically at extremes, the “smart money” correctly identifies. Web the standard smi formula is: Web as you can see in the chart below, “dumb money” confidence has surged of late; Web nvda is 39% > than its 40 week sma currently. Web as you can see in the chart below, “dumb money” confidence has surged of late; In this video, you will learn the basics of the smart/dumb money confidence indicators. The smart money flow index is based on the concept of don. Web macromicaro utilizes openai to enable charts to automatically associate with other relevant charts. Web as a result,. 11k views 1 year ago. Web as you can see in the chart below, “dumb money” confidence has surged of late; Smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to. The smart money flow index is based on the concept of don. This has proven to be an. From the chart, apparently they are the mirror image of each. Web macromicaro utilizes openai to enable charts to automatically associate with other relevant charts. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge. Web combing through the latest commitments of traders. Smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to. You will note that the “dumb” money (red line) is well over the “too. Web the standard smi formula is: In this video, you will learn the basics of the smart/dumb money confidence indicators. Institutional investors and market insiders. Yet the rub is that, typically at extremes, the “smart money” correctly identifies. Web as you can see in the chart below, “dumb money” confidence has surged of late; A simple yet powerful concept emerges in financial. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Web the standard smi formula is: In this video, you will learn the basics of the smart/dumb money confidence indicators. Web as a result, the typical individual investor suffers from extremely poor performance. Web dumb money (last 0.56) smart money confidence is a. Trades made at the beginning of the day are. 11k views 1 year ago. A simple yet powerful concept emerges in financial. The smart money flow index is based on the concept of don. Institutional investors and market insiders are labeled. You will note that the “dumb” money (red line) is well over the “too. 11k views 1 year ago. Web as you can see in the chart below, “dumb money” confidence has surged of late; Web as a result, the typical individual investor suffers from extremely poor performance. The blue line is the “smart money” confidence and the red line. This has proven to be an overbought signal on the chart. Yet the rub is that, typically at extremes, the “smart money” correctly identifies. The smart money flow index is based on the concept of don. 11k views 1 year ago. Web combing through the latest commitments of traders report from the cftc, we found that commercial traders (“smart money”) have a record number of short positions. Web nvda is 39% > than its 40 week sma currently. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Web smart money vs. In this video, you will learn the basics of the smart/dumb money confidence indicators. You will note that the “dumb” money (red line) is well over the “too. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge. Trades made at the beginning of the day are. Smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to. Web the standard smi formula is: The blue line is the “smart money” confidence and the red line is “dumb money” confidence. A simple yet powerful concept emerges in financial.

Smart Money/Dumb Money The Joseph Group

DUMB MONEY VS SMART MONEY ) for FXSPX500 by 001011001010001110110

Smart Money Dumb Money Chart

Smart Money Versus Dumb Money Which are You?

Smart Money Vs. Dumb Money Crush The Street

Here Is An important Look At What The “Smart Money” And “Dumb Money

Secrets on Twitter "5/ Dumb Money vs. Smart Money Comparison Why is it

Smart Money Versus Dumb Money Which are You?

Smart Money vs. Dumb Money? A Quick Look at a Unique Sentiment

A Dumb vs Smart Money Index (and how to get on the smart side)

From The Chart, Apparently They Are The Mirror Image Of Each.

With The Volatility In Stocks This Week, The Spread Between Smart Money And Dumb Money Confidence Rose To 55%, The Widest Since January.

Institutional Investors And Market Insiders Are Labeled.

Web As A Result, The Typical Individual Investor Suffers From Extremely Poor Performance.

Related Post: