Sifma Rate Chart

Sifma Rate Chart - View federal reserve activities, data and resources › Explore this interactive data visualization on our bond markets to understand trends in issuance and outstanding securities. Issuance data is broken out into investment grade/high yield, nonconvertible/convertible, callable/noncallable and fixed rate/floating rate. The browse is calculated and published by bloomberg. Web sifma was formed on november 1, 2006, from the merger of the bond market association and the securities industry association. Today's guests are mandy xu, cboe, jess. Web the municipal market monitor (tm3) login. Western asset views the significant upward rate move as driven by a confluence of factors: Web us treasury securities statistics. Additionally, we show the trends for the first quarter. Register for a 14 days trial. In general, the sifma rate trades as a. Not a tm3 registered user? 3:44p 3:44p 3:44p 3:44p 3:44p 3:44p 3:44p 3:44p 4.21. The browse is calculated and published by bloomberg. For new developments from the federal reserve, treasury and more subscribe to the sifma rates update. Web what is the sifma municipal swap index? Western asset views the significant upward rate move as driven by a confluence of factors: The most widely used pricing tool in the municipal market is the mmd scales (mmd) published by thomson reuters. Bloomberg 1month. Web the sifma™ municipal swap index. +0.01 +0.17% as of 12:00 am edt 05/28/24. Sifma (securities industry and financial markets association) is a trading organization in us. Actual issues are selected from the msrb short system based on several specific criteria. Explore this interactive data visualization on our bond markets to understand trends in issuance and outstanding securities. Register for a 14 days trial. Web bloomberg television brings you the latest news and analysis leading up to the final minutes and seconds before and after the closing bell on wall street. Issuance data is broken out into investment grade/high yield, nonconvertible/convertible, callable/noncallable and fixed rate/floating rate. Sifma (securities industry and financial markets association) is a trading organization in. As of 12:00 am edt 05/15/24. The most widely used pricing tool in the municipal market is the mmd scales (mmd) published by thomson reuters. Who index are maintained for sifma’s municipal swap index committee. For new developments from the federal reserve, treasury and more subscribe to the sifma rates update. Web sifma was formed on november 1, 2006, from. Actual issues are selected from the msrb short system based on several specific criteria. Web bloomberg television brings you the latest news and analysis leading up to the final minutes and seconds before and after the closing bell on wall street. Explore this interactive data visualization on our bond markets to understand trends in issuance and outstanding securities. Treasury yields,. Sifma municipal swap index yield. In general, the sifma rate trades as a. Who index are maintained for sifma’s municipal swap index committee. Enter your username and password to access tm3. Fixed income markets, including issuance, trading, and outstanding data breaking out u.s. Bloomberg 1month short term bank yield index (usd) bsby1m:ind. View federal reserve activities, data and resources › Not a tm3 registered user? Web in light of these market dislocations, sifma research is tracking daily market metrics (prices, volumes, rates) across equities, listed options and various fixed income and securitized products markets. Sifma research tracks issuance, trading and outstanding data for. Sifma municipal swap index yield. Actual issues are selected from the msrb short system based on several specific criteria. Enter your username and password to access tm3. Web america’s capital markets are the largest and most robust in the world. Web sifma is the sponsor of the sifma municipal swap index, an index derived from remarketing rates on certain variable. Sifma research tracks issuance, trading and outstanding data for the u.s. Sifma municipal swap index yield. The index is calculated and published by bloomberg. Web what is the sifma municipal swap index? Sifma’s members use a variety of indexes and yield curves. In general, the sifma rate trades as a. Sifma municipal swap index yield. Web in light of these market dislocations, sifma research is tracking daily market metrics (prices, volumes, rates) across equities, listed options and various fixed income and securitized products markets. Web the municipal market monitor (tm3) login. Web america’s capital markets are the largest and most robust in the world. Web what is the sifma municipal swap index? Treasury yields, usd libor, sofr, term sofr, fed funds effective rate, prime, and sifma. Who index are maintained for sifma’s municipal swap index committee. Web sifma is the sponsor of the sifma municipal swap index, an index derived from remarketing rates on certain variable rate demand notes that meet the index criteria. Additionally, we show the trends for the first quarter. Treasury market issuance (gross and net), average daily trading volume (primary dealer), outstanding and yield data, as well as information on holders of ust. Western asset views the significant upward rate move as driven by a confluence of factors: The browse is calculated and published by bloomberg. Web the following charts and data represents a selection of helpful resources for rates professionals and market participants. Bloomberg 1month short term bank yield index (usd) bsby1m:ind. Enter your username and password to access tm3.SIFMA (SIFMA) / Twitter

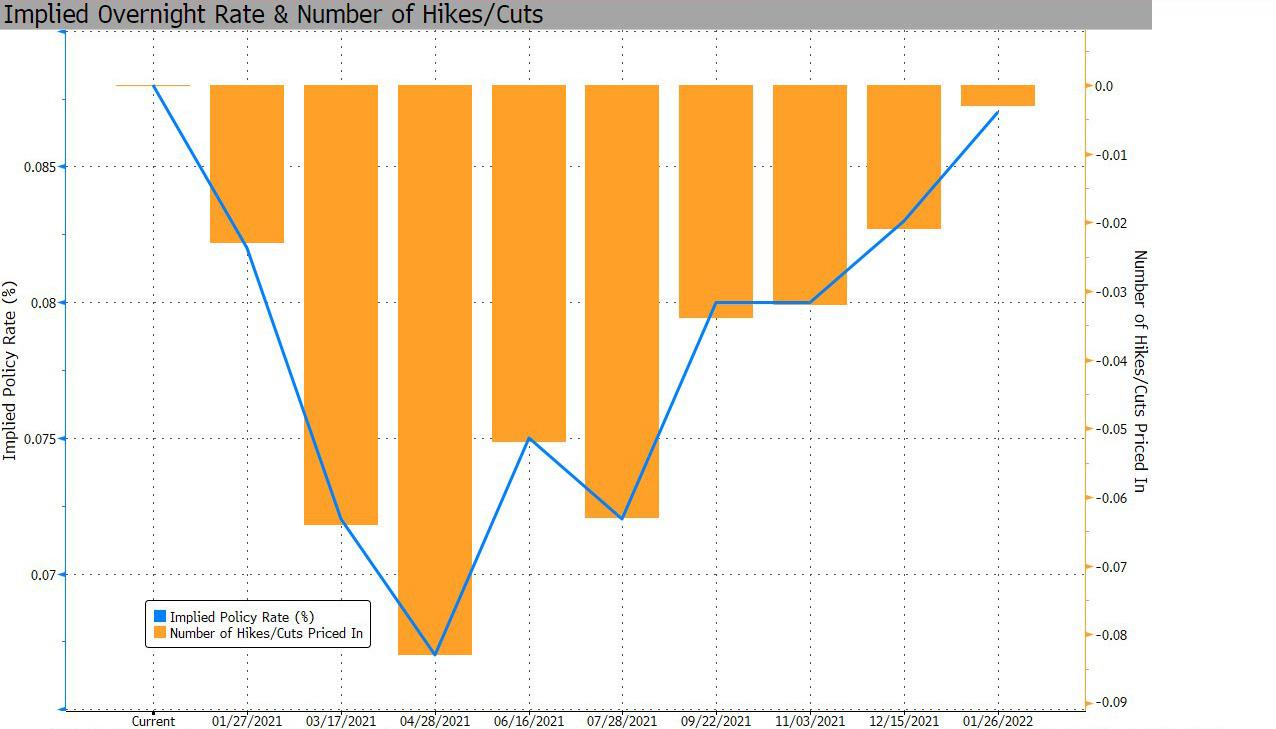

Viable Opposition The Federal Reserve's Bond Market Distortion

The Impact of Fed Liquidity Moves on the Municipal Market Lord Abbett

Ten Years Later What's Changed? SIFMA Ten Years Later What’s

US Repo Markets A Chart Book SIFMA US Repo Markets A Chart Book

SIFMA Issues Paper To Assist With Planning For Negative Rates In The US

Podcast VIX and the Virus SIFMA Podcast VIX and the Virus SIFMA

Fragmentation and liquidity issues must be addressed to maintain a

SIFMA survey, Federal Reserve expect sluggish GDP growth Pensions

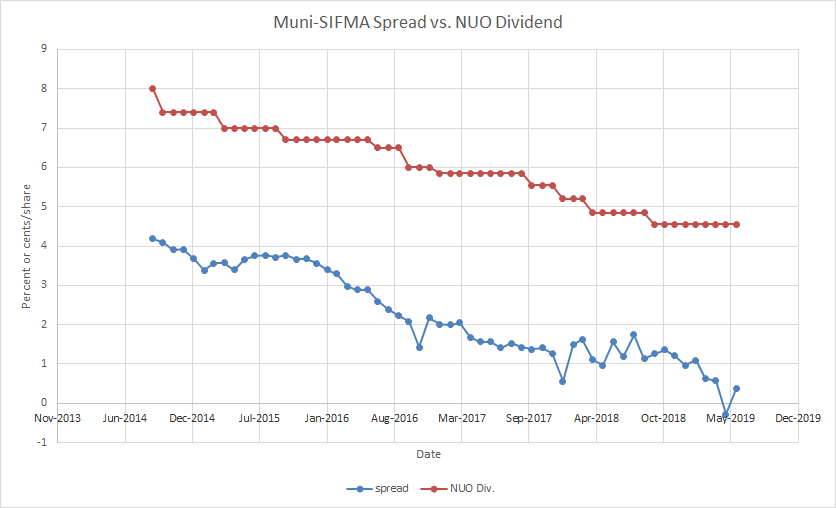

Leveraged Municipal Bond Funds Expect Dividend Growth (NYSENZF

Explore This Interactive Data Visualization On Our Bond Markets To Understand Trends In Issuance And Outstanding Securities.

Fixed Income Markets, Including Issuance, Trading, And Outstanding Data Breaking Out U.s.

Web Charts And Data And Helpful Resources For Rates Professionals And Market Participants.

3:44P 3:44P 3:44P 3:44P 3:44P 3:44P 3:44P 3:44P 4.21.

Related Post: