Rsi Shares Charts

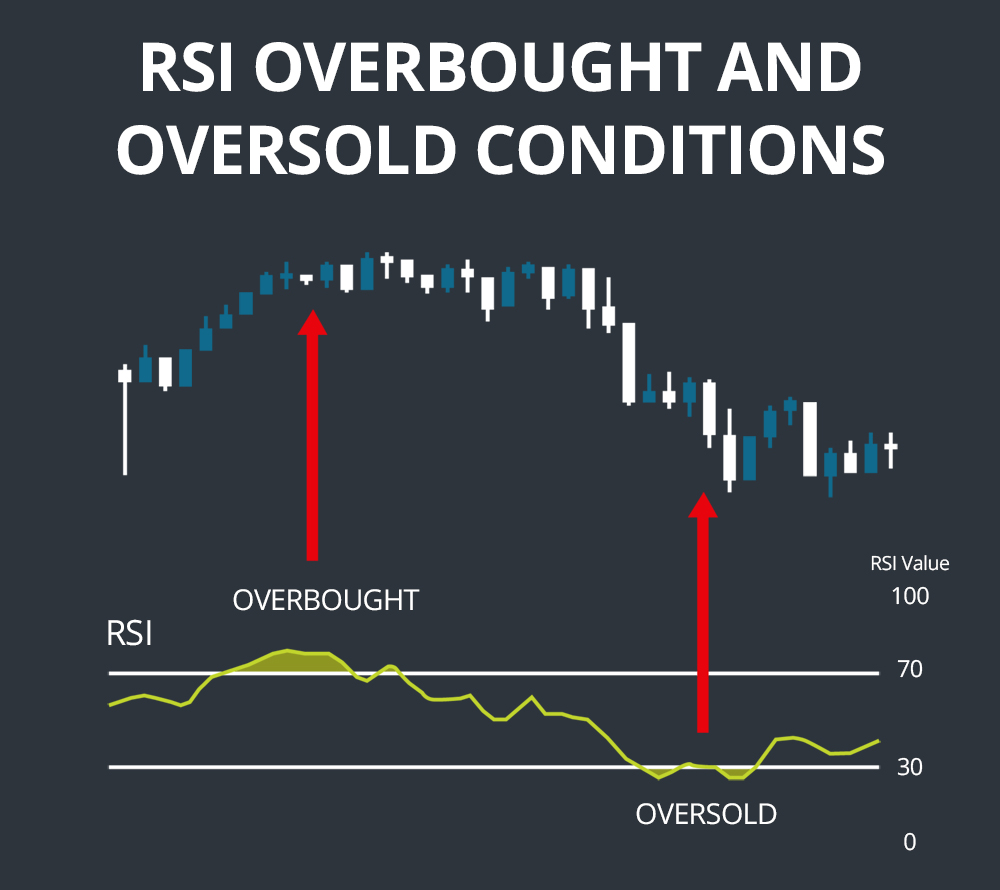

Rsi Shares Charts - Web next year eps consensus estimate: Web the relative strength index (rsi) is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down. However, this doesn't mean using rsi is. | updated may 16, 2024. Web create advanced interactive price charts for rsi, with a wide variety of chart types, technical indicators, overlays, and annotation tools. Web the relative strength index (rsi) indicator is a popular momentum oscillator that compares upward and downward movements in closing price. Web what is the relative strength index (rsi)? Rush street interactive last announced its earnings data on may 1st, 2024. Stocks with relative strength index (rsi) below 30 are considered oversold. The rsi, a momentum oscillator developed by j. Welles wilder in the 70s. Rush street interactive last announced its earnings data on may 1st, 2024. The relative strength index (rsi) is a momentum indicator that measures. The rsi, a momentum oscillator developed by j. Rsi indicator (relative strength index) explained. Stocks with relative strength index (rsi) below 30 are considered oversold. Rush street interactive last announced its earnings data on may 1st, 2024. Web the relative strength index is a technical indicator used to measure the strength and momentum of a financial instrument's price movements. Web rush street interactive, inc. It’s a momentum oscillator that measures the rate of change. Web updated september 30, 2023. Stocks with relative strength index (rsi) below 30 are considered oversold. Web the relative strength index (rsi) is a technical indicator used in the analysis of financial markets. The index is trading above its key moving average supports. Web the relative strength index is a technical indicator used to measure the strength and momentum of. Web using rsi to spot divergences and identify potential oversold and overbought conditions can help investors find potential trading signals. However, this doesn't mean using rsi is. Web create advanced interactive price charts for rsi, with a wide variety of chart types, technical indicators, overlays, and annotation tools. Web rush street interactive, inc. Stocks with relative strength index (rsi) below. Rsi indicator (relative strength index) explained. Some traders, in an attempt. Web the relative strength index (rsi) is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down. 1 day 1.72% 5 days 2.55% 1 month 42.51% 6 months 111.72% year to date 100.68% 1 year 206.23%. 8.95 +0.10 (+1.13%) at close: Web the relative strength index (rsi) is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down. Web rush street interactive, inc. Web the relative strength index (rsi) indicator is a popular momentum oscillator that compares upward and downward movements in closing. Web next year eps consensus estimate: 2 comments / technical indicators / by ankita sarkar. Welles wilder, measures the speed and change of price movements. Web updated september 30, 2023. Web the relative strength index is a technical indicator used to measure the strength and momentum of a financial instrument's price movements. It is intended to chart the current and historical strength or weakness of a stock. Also, look for support or resistance on the. Web using rsi to spot divergences and identify potential oversold and overbought conditions can help investors find potential trading signals. Web updated september 30, 2023. Web rush street interactive, inc. Web what is the relative strength index (rsi)? The relative strength index or in. However, this doesn't mean using rsi is. The index is trading above its key moving average supports. The rsi, a momentum oscillator developed by j. Rsi earnings date and information. Web the relative strength index is a technical indicator used to measure the strength and momentum of a financial instrument's price movements. Web next year eps consensus estimate: | updated may 16, 2024. It’s a momentum oscillator that measures the rate of change of up. It is intended to chart the current and historical strength or weakness of a stock. Web what is the relative strength index (rsi)? 8.95 +0.10 (+1.13%) at close: Web nifty ended tuesday’s session 44 points lower at 22,888 to form a bearish candle on the daily scale. Rush street interactive last announced its earnings data on may 1st, 2024. Web create advanced interactive price charts for rsi, with a wide variety of chart types, technical indicators, overlays, and annotation tools. 1 day 1.72% 5 days 2.55% 1 month 42.51% 6 months 111.72% year to date 100.68% 1 year 206.23% 5 years −8.29% all time −8.29% upcoming earnings. Web rush street interactive, inc. Web the relative strength index (rsi) is a well versed momentum based oscillator which is used to measure the speed (velocity) as well as the change (magnitude) of directional. Welles wilder in the 70s. Web the relative strength index (rsi) indicator is a popular momentum oscillator that compares upward and downward movements in closing price. Also, look for support or resistance on the. Web updated september 30, 2023. The index is trading above its key moving average supports. The relative strength index or in. Web the relative strength index (rsi) is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down.

Beginner Guide to the RSI Indicator 24/7 Charts

Using RSI In Stocks Can You Beat The Market? JB Marwood

How To Trade Blog What Is The RSI Indicator? How To Use The RSI

Technical Analysis Using the Relative Strength Index WiseStockBuyer

Relative Strength Index RSI Guide for Stock Traders

![RSI Divergence Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/rsi-divergence-cheat-sheet-2048x1448.png)

RSI Divergence Cheat Sheet [FREE Download] HowToTrade

The Ultimate Guide to the RSI Indicator New Trader U

The Ultimate Guide to The RSI Indicator + Free Bonus Strategy Rsi

Relative Strength Index (RSI) Definition

3 Trading Tips for RSI

| Updated May 16, 2024.

Web The Rsi Is Always Between 0 And 100, With Stocks Above 70 Considered Overbought And Stocks Below 30 Oversold.

This Implies That Stock May Rebound.

Includes Trading Signals In Ranging.

Related Post: