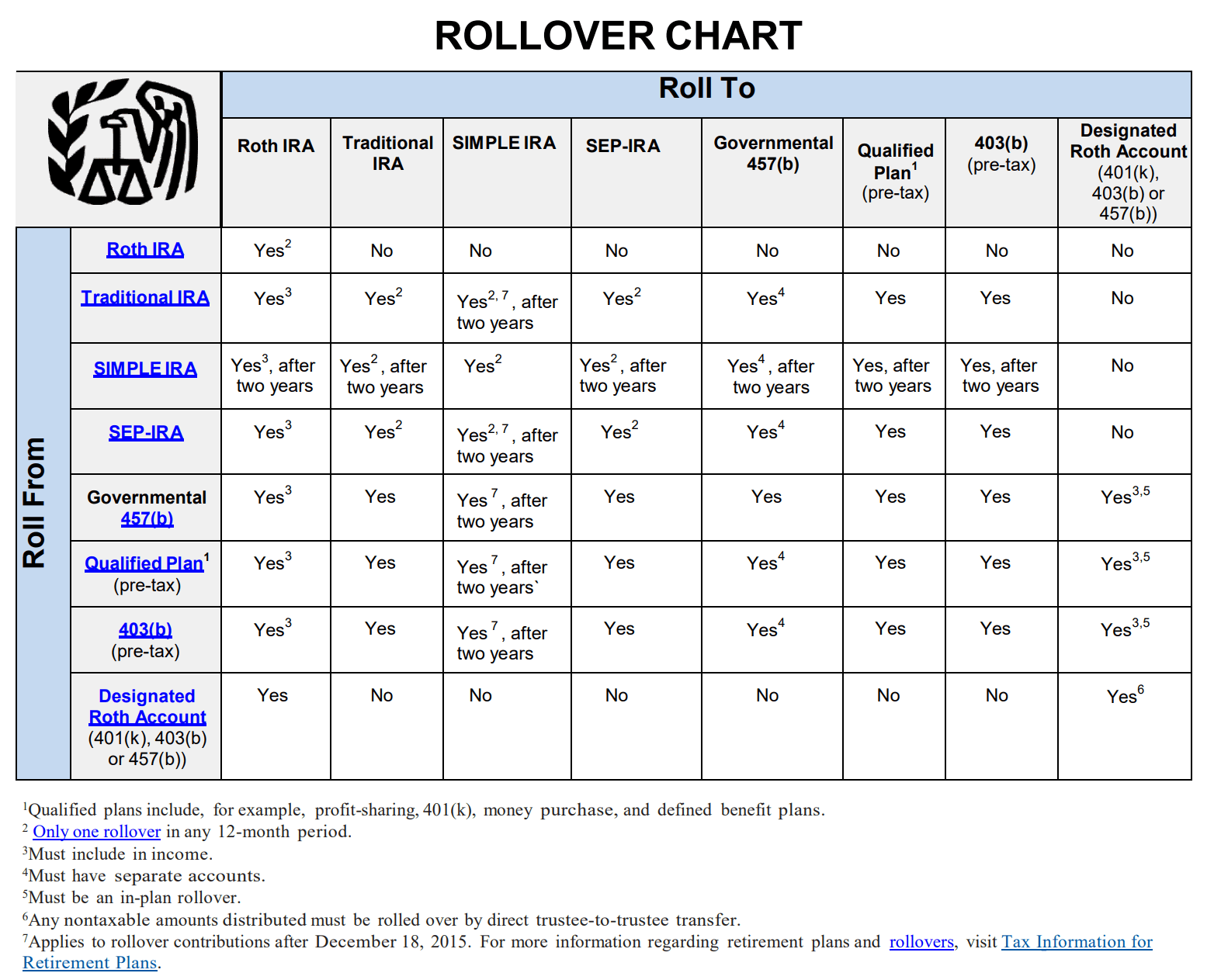

Rollover Chart Irs

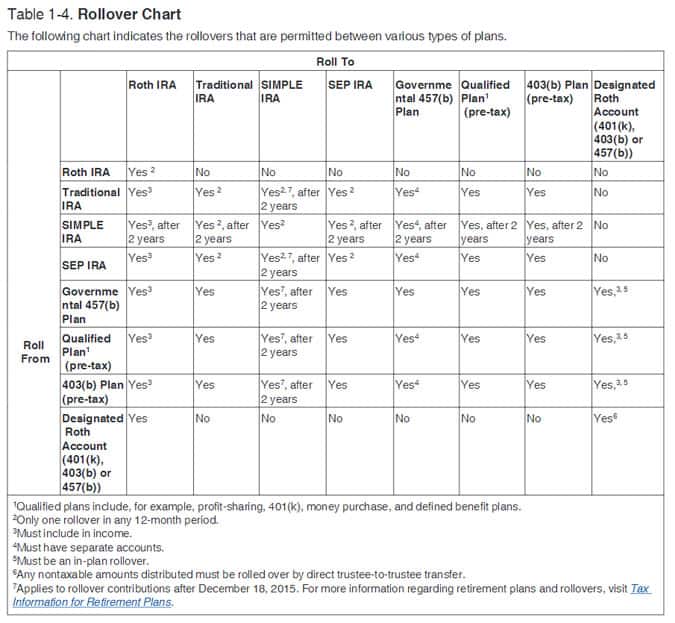

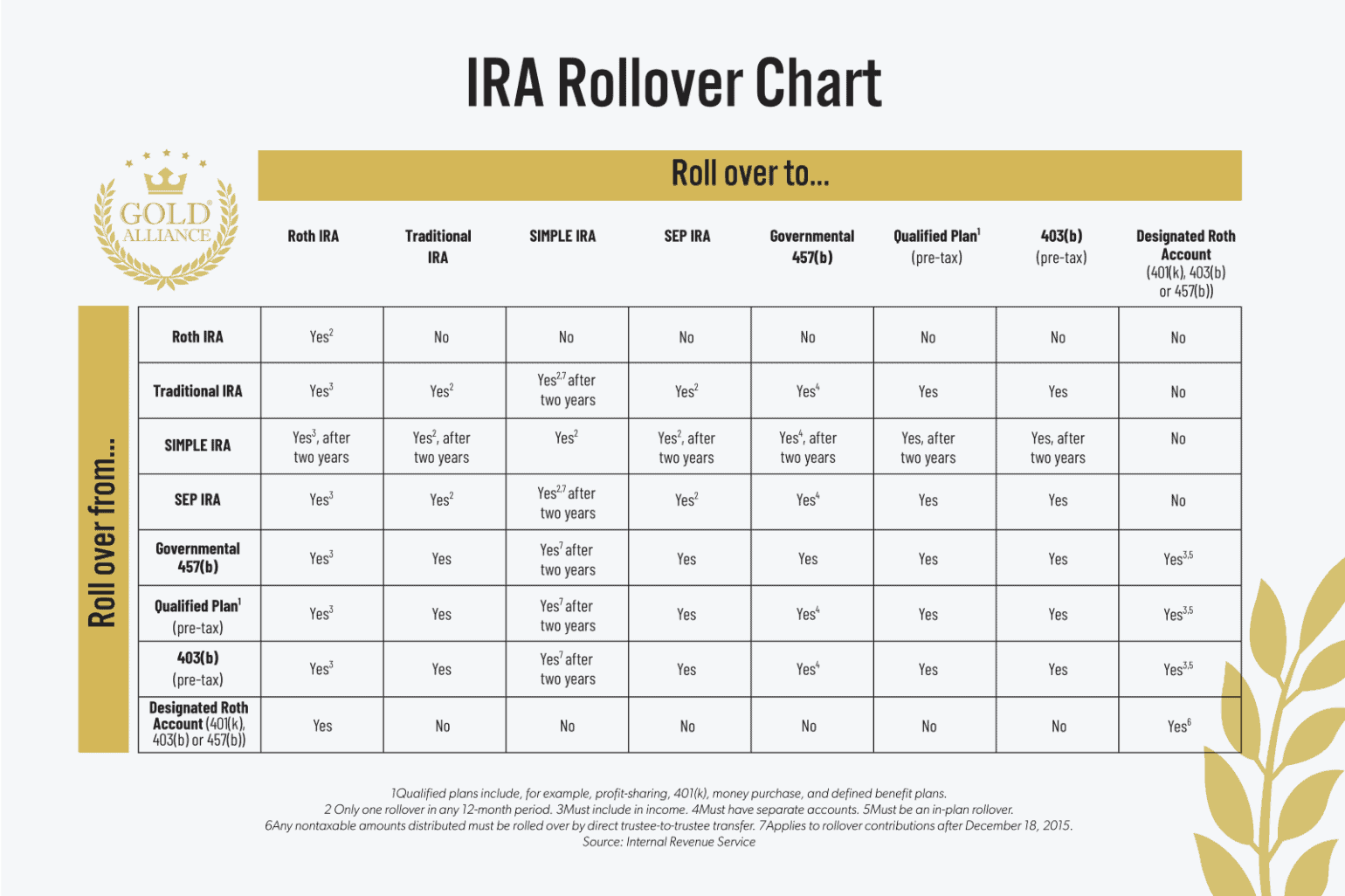

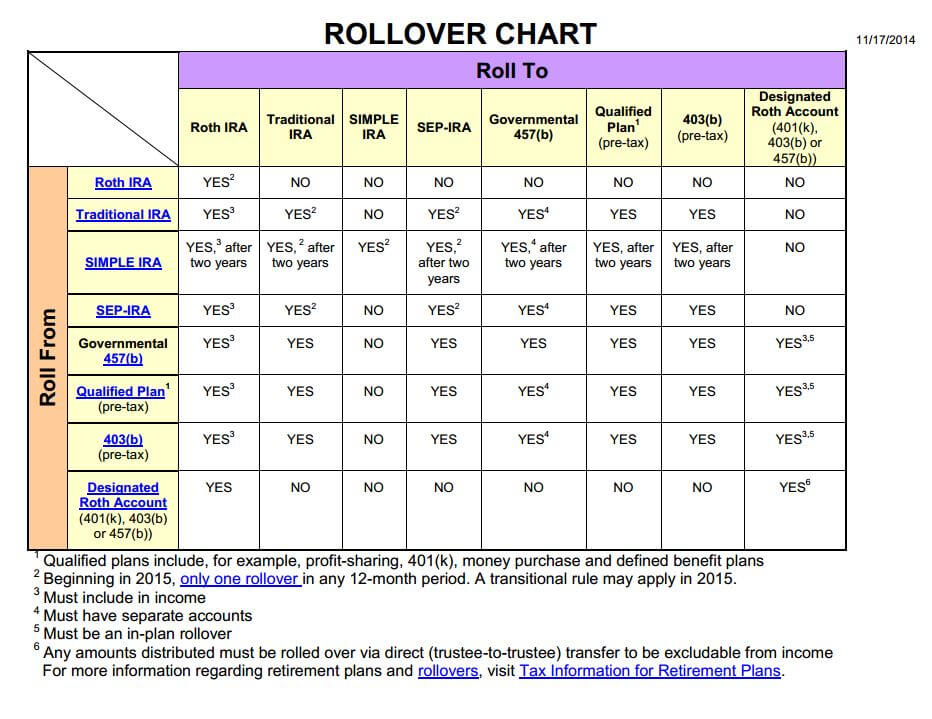

Rollover Chart Irs - Web the rules for allowable rollovers are detailed in a rollover chart provided by the irs. Web the irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). You must pay taxes whenever you convert from a traditional ira to a roth ira in the conversion year. This is a chart of what the internal revenue service regards as permissible when rolling funds over from one type of retirement account to another. It is possible to pay the taxes due from the traditional ira. Which brokerages to open your account at. Page last reviewed or updated: Many people roll their 401 (k) into an individual retirement. A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira. This rollover transaction isn't taxable, unless the rollover is to a roth ira or a designated roth account. Web the irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). Which brokerages to open your account at. Web are you eligible to receive a distribution from your 401 (k), 403 (b) or governmental 457 (b) retirement plan? This rollover transaction. Web here’s a recent and handy rollover chart by the internal revenue service updated for new rules that may be helpful. You may want to note the differences between. Web updated february 13, 2024. How to decide which rollover is right for you. Web your guide to 401 (k) and ira rollovers. What it means for individuals. Web ira rollover chart. How to decide which rollover is right for you. A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan. Always check with a tax advisor before rolling funds between plans. Which brokerages to open your account at. One of the most common reasons for rolling over a retirement account is to move it out of a former employer’s plan. Savings can also be converted into a roth ira or recharacterized from it. Web the irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column). Web ira rollover chart. In that case, a 401 (k) is rolled into an ira at another brokerage of your. How to decide which rollover is right for you. Savings can also be converted into a roth ira or recharacterized from it. However, qualified plans are not required by law to have a provision to accept rollovers,” kaplan explains. A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan. Individual retirement arrangements (iras) types of retirement plans. What it means for individuals. This chart is intended for informational purposes only and is not legal, tax, or investment advice. A. Rolling over your 401 (k) plan to an ira when you switch jobs can provide you with more. Definition of eligible rollover distributions. A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan. Always check with a tax advisor before. How do eligible rollover distributions work? Always check with a tax advisor before rolling funds between plans. One of the most common reasons for rolling over a retirement account is to move it out of a former employer’s plan. In that case, a 401 (k) is rolled into an ira at another brokerage of your. What it means for individuals. In that case, a 401 (k) is rolled into an ira at another brokerage of your. Savings can also be converted into a roth ira or recharacterized from it. This chart is intended for informational purposes only and is not legal, tax, or investment advice. Web ira rollover chart. Rules regarding rollovers and conversions. What is a rollover ira? A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira. Definition of eligible rollover distributions. It is possible to pay the taxes due from the traditional ira. Individual retirement arrangements (iras) types of retirement plans. You may want to note the differences between. This is a chart of what the internal revenue service regards as permissible when rolling funds over from one type of retirement account to another. Always check with a tax advisor before rolling funds between plans. This chart is intended for informational purposes only and is not legal, tax, or investment advice. You can roll over eligible rollover distributions from these plans to a roth ira or to a designated roth account in the same plan (if the plan allows rollovers to designated roth accounts). Web updated may 03, 2024. What is an eligible rollover distribution? One of the most common reasons for rolling over a retirement account is to move it out of a former employer’s plan. Web the rules for allowable rollovers are detailed in a rollover chart provided by the irs. You must pay taxes whenever you convert from a traditional ira to a roth ira in the conversion year. Savings can also be converted into a roth ira or recharacterized from it. What it means for individuals. In that case, a 401 (k) is rolled into an ira at another brokerage of your. What is a rollover ira? Web ira rollover chart. A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira.

IRS Rollover Chart

Follow the Rules When Rolling Over Your EmployerSponsored Retirement

Ira Types Chart

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

Learn the Rules of IRA Rollover & Transfer of Funds

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII

irsrolloverchart Snider Advisors

PDF PDF Télécharger Download

IRS issues updated Rollover Chart The Retirement Plan Blog

Learn the Rules of IRA Rollover & Transfer of Funds

This Chart Is For Informational Purposes Only And Is Not Legal, Tax And Investment Advice.

Updated On June 30, 2022.

Individual Retirement Arrangements (Iras) Types Of Retirement Plans.

Which Brokerages To Open Your Account At.

Related Post: