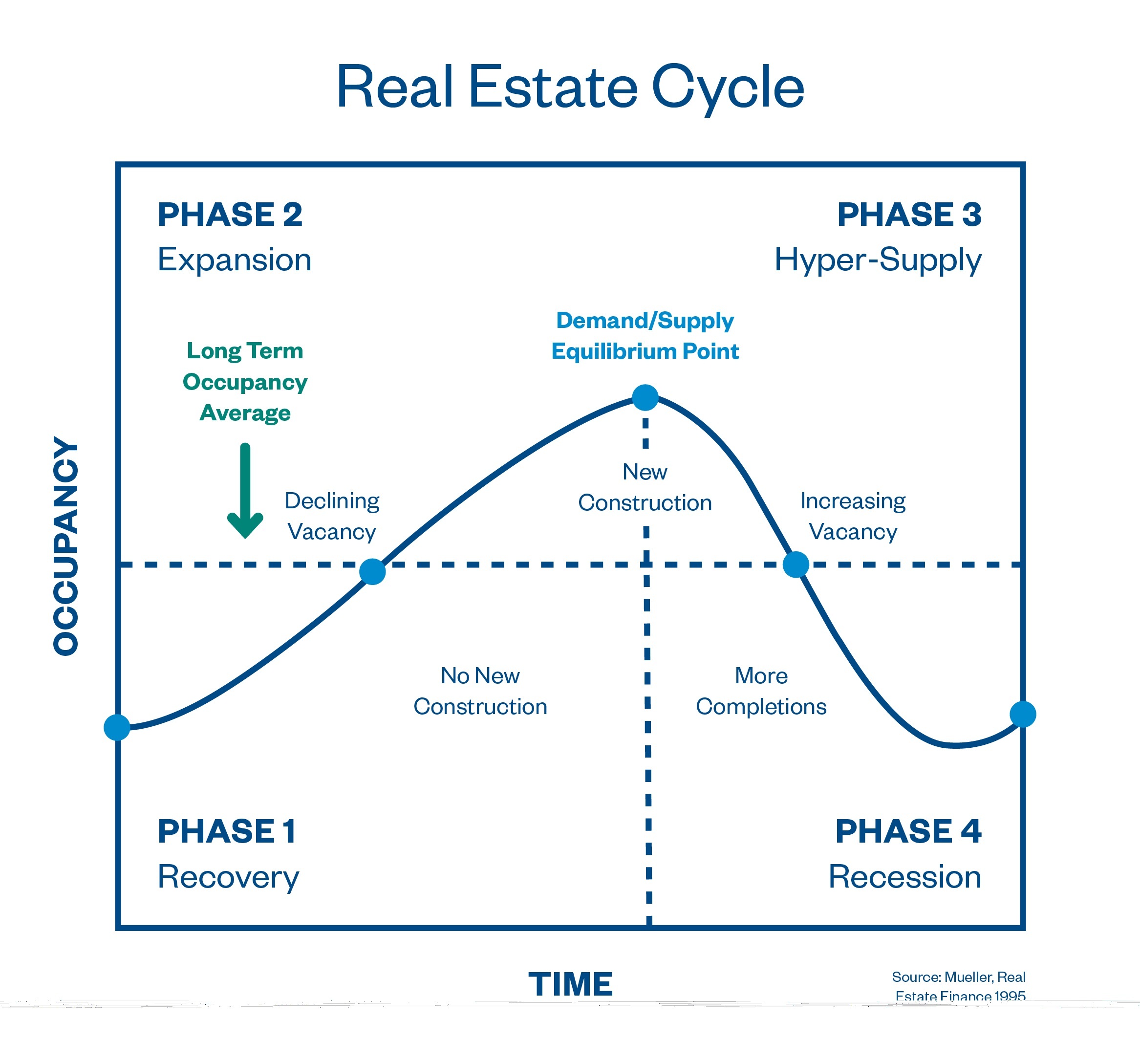

Real Estate Cycles Chart

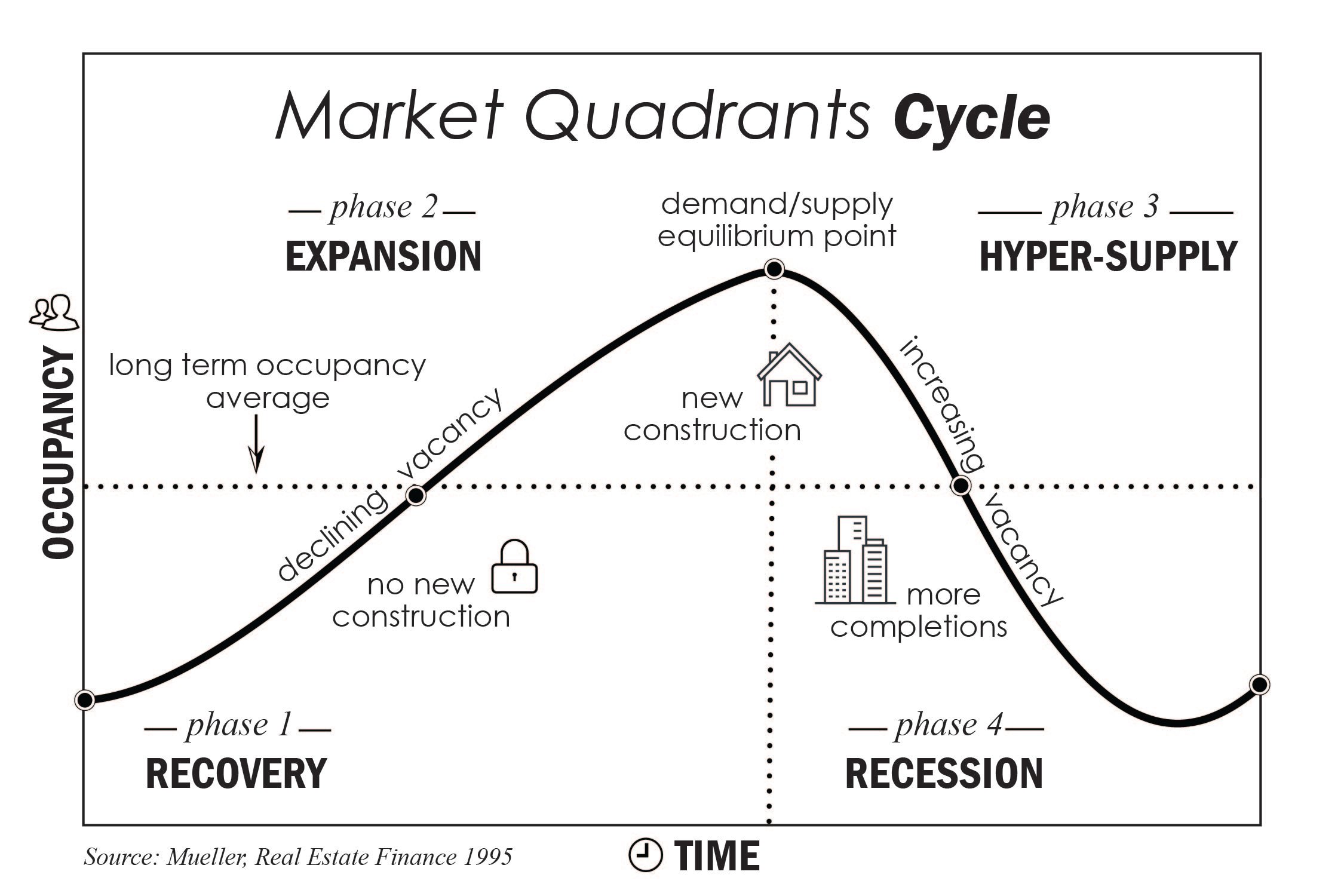

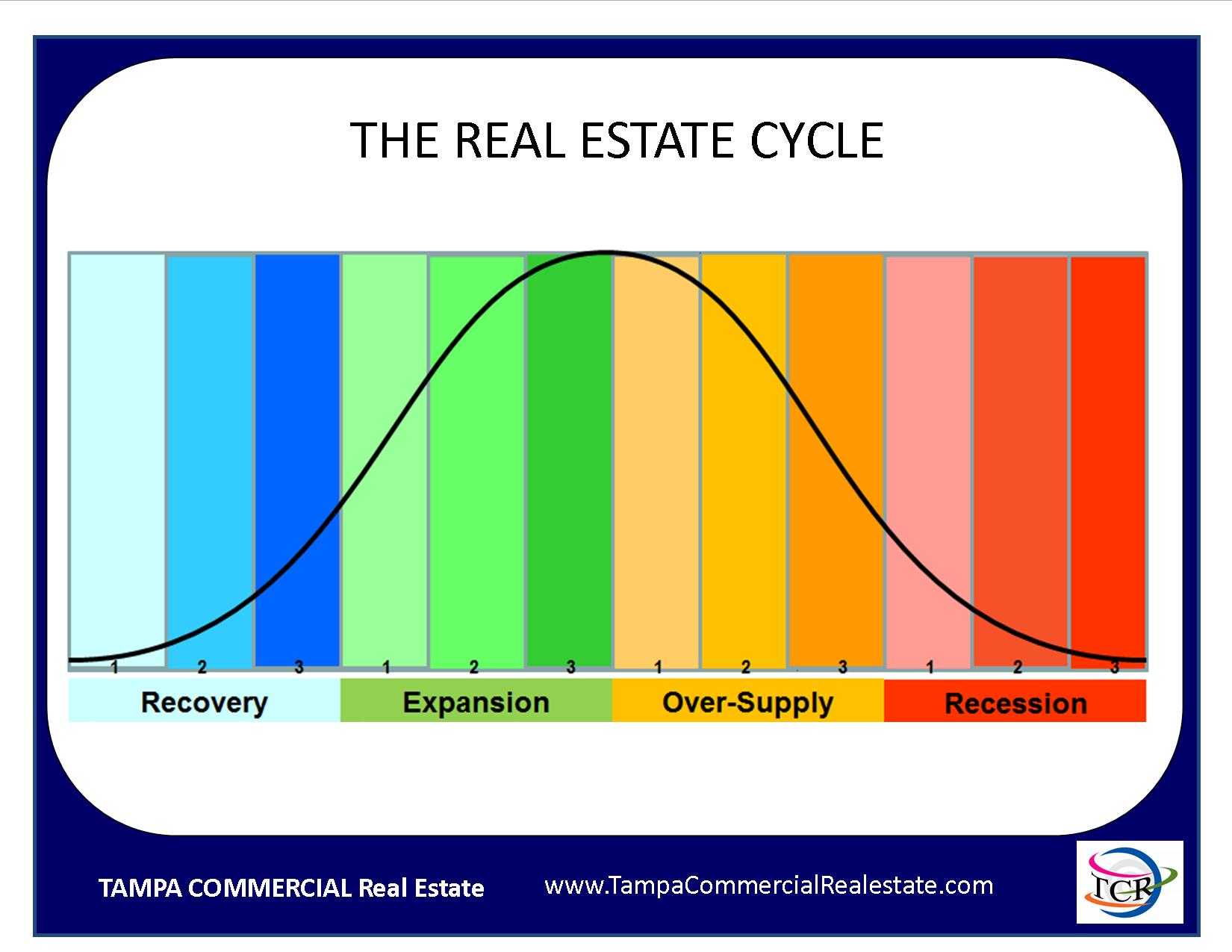

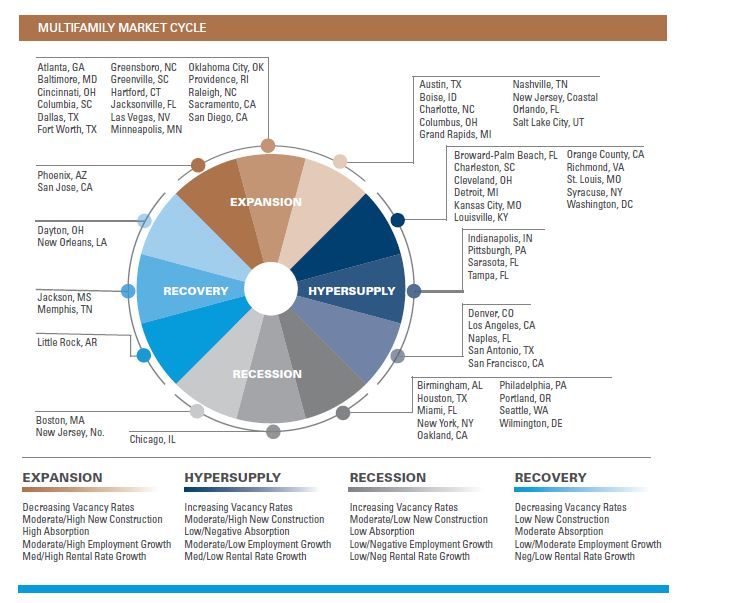

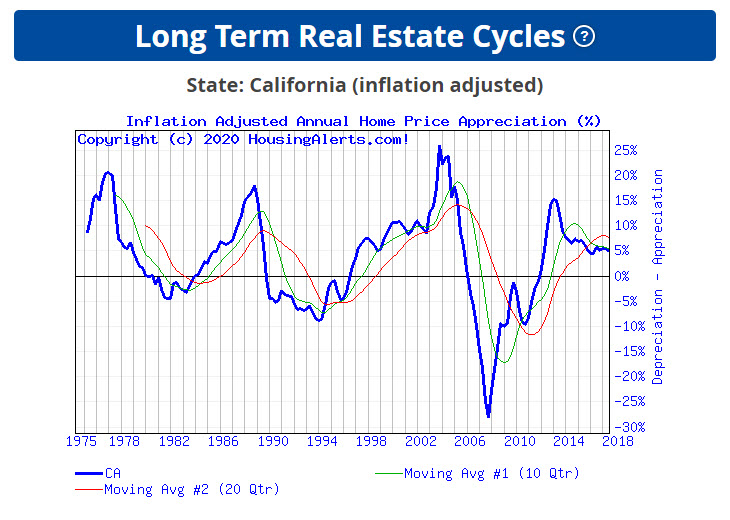

Real Estate Cycles Chart - Each phase presents unique characteristics and investment implications. By recognizing these phases, investors and homeowners can make more informed decisions, aligning their strategies with market trends. When does a real estate cycle go back up? This cyclical pattern is called the “real estate cycle” and includes four main phases. Web learn about the ins and outs of the real estate cycle and how to make smart investment decisions. Recovery, expansion, hyper supply, and recession. Web the real estate cycle, also called the property market cycle, is a pattern that represents the economic changes within the housing industry. Web these 17 insightful real estate charts can help you understand the housing market as it is now as well as what might be lurking down the road. Before i explain the four phases of the real estate market cycle, let’s discuss the basics of the chart. The recovery phase is the first stage of the real estate cycle after a recession. Importance of real estate cycle. When a real estate market is. It’s split into four economic phases, which directly indicate market health. Recovery is typically the most difficult phase to identify. Let’s start at the bottom of the curve. You have probably noticed that supply and demand are rarely perfectly balanced; Web the real estate cycle refers to the set of recurring phases one typically sees over time in the real estate market. The four phases are recovery, expansion, hyper supply, and recession. The four phases include recovery, expansion, hyper supply and recession. Web learn about the ins and. Economic factors and market cycles. Web here is a chart showing the cycle through 2007: Each phase presents unique characteristics and investment implications. Because once you understand the property cycle, you’ll know: Web real estate cycles can be separated into four distinct phases based upon the rate of change in both demand and supply. How do you buy property when the real estate cycle is down? The chart below shows these four phases and how each one impacts new construction and vacancy rates. Why the real estate market has cycles. Remember, though, that hoyt discovered his theory in the 30's, and at that point the 18 year cycle was nearly flawless. When a real. Web chart the phases of the real estate cycle and its effects on property investments. How long do real estate cycles last? Why the real estate market has cycles. Market timing and investment strategies. Each phase presents unique characteristics and investment implications. Recovery takes place at the bottom of a market swing. The housing market typically leans toward being a buyer’s market or a seller’s market. Each stage is characterized by different market conditions and indicators. Recovery, expansion, hyper supply, and recession. Web learn about the ins and outs of the real estate cycle and how to make smart investment decisions. Web these 17 insightful real estate charts can help you understand the housing market as it is now as well as what might be lurking down the road. Recovery takes place at the bottom of a market swing. Web what is the real estate cycle? What does a real estate cycle mean? Because once you understand the property cycle, you’ll. By recognizing these phases, investors and homeowners can make more informed decisions, aligning their strategies with market trends. Web while you’ll often hear that property cycles last seven to 10 years, and while that may be the case for individual state property markets, the following chart from michael matusik shows that since 1980 the overall australian property market peaked every. Each phase presents unique characteristics and investment implications. The four phases are recovery, expansion, hyper supply, and recession. Each stage is characterized by different market conditions and indicators. Web as an investor, this diagram really is all you need to know. Because once you understand the property cycle, you’ll know: Figure 1 depicts the market cycle in terms of Why the real estate market has cycles. Web what is the real estate cycle? This cyclical pattern is called the “real estate cycle” and includes four main phases. How long do real estate cycles last? The four phases of real estate cycle. Recovery, expansion, hyper supply, and recession. How to predict a real estate market crash. Web chart the phases of the real estate cycle and its effects on property investments. Get started now with crowdstreet's expert resources. Remember, though, that hoyt discovered his theory in the 30's, and at that point the 18 year cycle was nearly flawless. What stage of the real estate cycle are we in right now? It is brilliant in its simplicity, it is correct, and it unlocks the cycle for you. By recognizing these phases, investors and homeowners can make more informed decisions, aligning their strategies with market trends. You have probably noticed that supply and demand are rarely perfectly balanced; Web while you’ll often hear that property cycles last seven to 10 years, and while that may be the case for individual state property markets, the following chart from michael matusik shows that since 1980 the overall australian property market peaked every 4 years or so. The chart below shows these four phases and how each one impacts new construction and vacancy rates. Economic factors and market cycles. Web nonetheless, a typical real estate cycle consists of four different phases, namely: Web what does a typical real estate cycle look like? Web commercial and residential real estate follows a cyclical pattern, usually closely linked to local and national economic trends.

The 4 Phases of the Real Estate Cycle Explained Willowdale Equity

How to Determine Where We Are in the Real Estate Market Cycle CleanCut

REAL ESTATE CYCLES Tampa Commercial Real Estate

What Are The Four Phases Of A Real Estate Market Cycle Jake & Gino

The Basics Of Real Estate Cycle Charts By Housing Alerts

Understanding Real Estate Cycles

How to Make Profitable Investments Throughout the Real Estate Cycle

Real Estate Cycles — Mortgage Sandbox

The Four Stages of the Real Estate Cycle Ahead June 2020 Monthly

REAL ESTATE CYCLES Tampa Commercial Real Estate

As You Can See, The 18 Year Cycle Theory Looks Great Until That Huge Gap Between 1925 And 1973.

Importance Of Real Estate Cycle.

You Just Need To Remember The Following:

Web You May Be Aware That The Real Estate Market Cycle Is Cyclical With Four Distinct Phases:

Related Post: