Quickbooks Chart Of Accounts For Construction Company

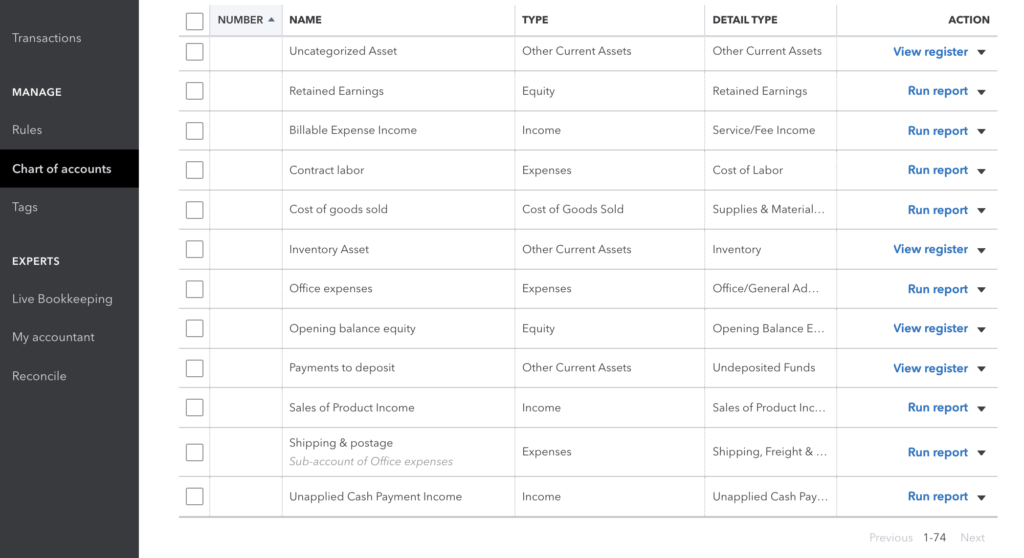

Quickbooks Chart Of Accounts For Construction Company - Web learn how to set up a chart of accounts for contractors to record transactions accurately, and download a sample chart for construction. Web we start with our standard chart of accounts or a basic quickbooks chart of accounts. Web how to create chart of accounts for construction company in excel: A chart of accounts for construction companies provides the structure to organize financial transactions. Web chart of accounts for a construction company: Construction and contractors are the foundation of a nation’s infrastructure (pun intended); Web customizing the chart of accounts in quickbooks is a crucial step for construction companies to accurately track financial data, analyze expenses, and generate comprehensive financial statements. And in my world it’s basics, but there are some nuances to construction that we just don’t find in a chart of accounts in other industries. Prepare a list of assets. The chart is formed by a list of numbered accounts with the account names and their brief descriptions. Prepare a list of assets. Web chart of accounts complete list with descriptions (for quickbooks) hector garcia. Similarly, a chart of accounts (coa) is the foundation of an excellent accounting system. Assets, liabilities and owners equity flow to the balance sheet. This free construction chart of accounts includes accounts for retainage, underbilling, and more, formatted for easy importing to quickbooks. Web knowing the right way to set up your chart of accounts can give you an advantage when it comes to keeping track of your transactions. Construction companies often have unique accounting needs due to the nature of their business operations. Web chart of accounts for a construction company: Web there are six main account types: That is the financial. We then add a few accounts that will help us to track some things that are important to builders for operations, job costing and insurance audit purposes. Revenue, cost of goods sold (cgs) and expenses flow to the income statement. Web a construction company’s chart of accounts will contain specialized accounts like job costs, equipment rentals, overbilling and underbilling. We. Typically, a chart of accounts will have four categories. Web put simply, a chart of accounts (coa) is the foundation of an accounting system of a construction company. Even the most basic chart of accounts should include most of these items. Web when setting up your chart of accounts it is important to choose the proper account type (assets, liabilities,. Assets, liabilities and owners equity flow to the balance sheet. This free construction chart of accounts includes accounts for retainage, underbilling, and more, formatted for easy importing to quickbooks. Web we start with our standard chart of accounts or a basic quickbooks chart of accounts. Therefore, it’s essential to customize the chart of accounts to reflect these specific requirements. The. Prepare a list of assets. Web customizing the chart of accounts in quickbooks is a crucial step for construction companies to accurately track financial data, analyze expenses, and generate comprehensive financial statements. We are going to create a chart of accounts for a construction company now. Think of it as the filing cabinet holding drawers (level one) into which you. We add an account for job deposits and advances held. Income and expenses are required for a profit and loss, while assets, liabilities, and equity make up the balance sheet. Web the book pays particular attention to unique aspects of construction accounting that are not encountered in other industries, including the job cost ledger, change orders, back charges, percentage of. Revenue, cost of goods sold (cgs) and expenses flow to the income statement. This article will introduce construction accounting, including the key principles and techniques for managing your construction business. Prepare a list of assets. The chart is formed by a list of numbered accounts with the account names and their brief descriptions. Typically, a chart of accounts will have. I'll be happy to steer you in the right direction. Construction companies often have unique accounting needs due to the nature of their business operations. It’s a key component of a company’s financial recording and reporting system. Assets, liabilities, equity, income, cost of goods sold, and expense accounts. Web the chart of accounts, or coa, is a list of the. Prepare a list of assets. So, let’s do it step by step. Accounts are grouped into categories that correspond to the structure of a company’s financial statements. Construction companies often have unique accounting needs due to the nature of their business operations. Web i'm building multiple spec homes and need help setting up chart of accounts for: We are going to create a chart of accounts for a construction company now. Web chart of accounts complete list with descriptions (for quickbooks) hector garcia. How to build the chart of accounts for a construction company. Construction companies often have unique accounting needs due to the nature of their business operations. Construction and contractors are the foundation of a nation’s infrastructure (pun intended); Web learn how to set up a chart of accounts for contractors to record transactions accurately, and download a sample chart for construction. Web the book pays particular attention to unique aspects of construction accounting that are not encountered in other industries, including the job cost ledger, change orders, back charges, percentage of completion calculations, and. Web download the free chart of accounts for construction and general contractors. Assets, liabilities and owners equity flow to the balance sheet. Construction trades are different from general contractors in that they focus on a specific trade. Web there are six main account types: Web put simply, a chart of accounts (coa) is the foundation of an accounting system of a construction company. And in my world it’s basics, but there are some nuances to construction that we just don’t find in a chart of accounts in other industries. This article will introduce construction accounting, including the key principles and techniques for managing your construction business. Web download a sample chart of accounts for construction companies. Income and expenses are required for a profit and loss, while assets, liabilities, and equity make up the balance sheet.

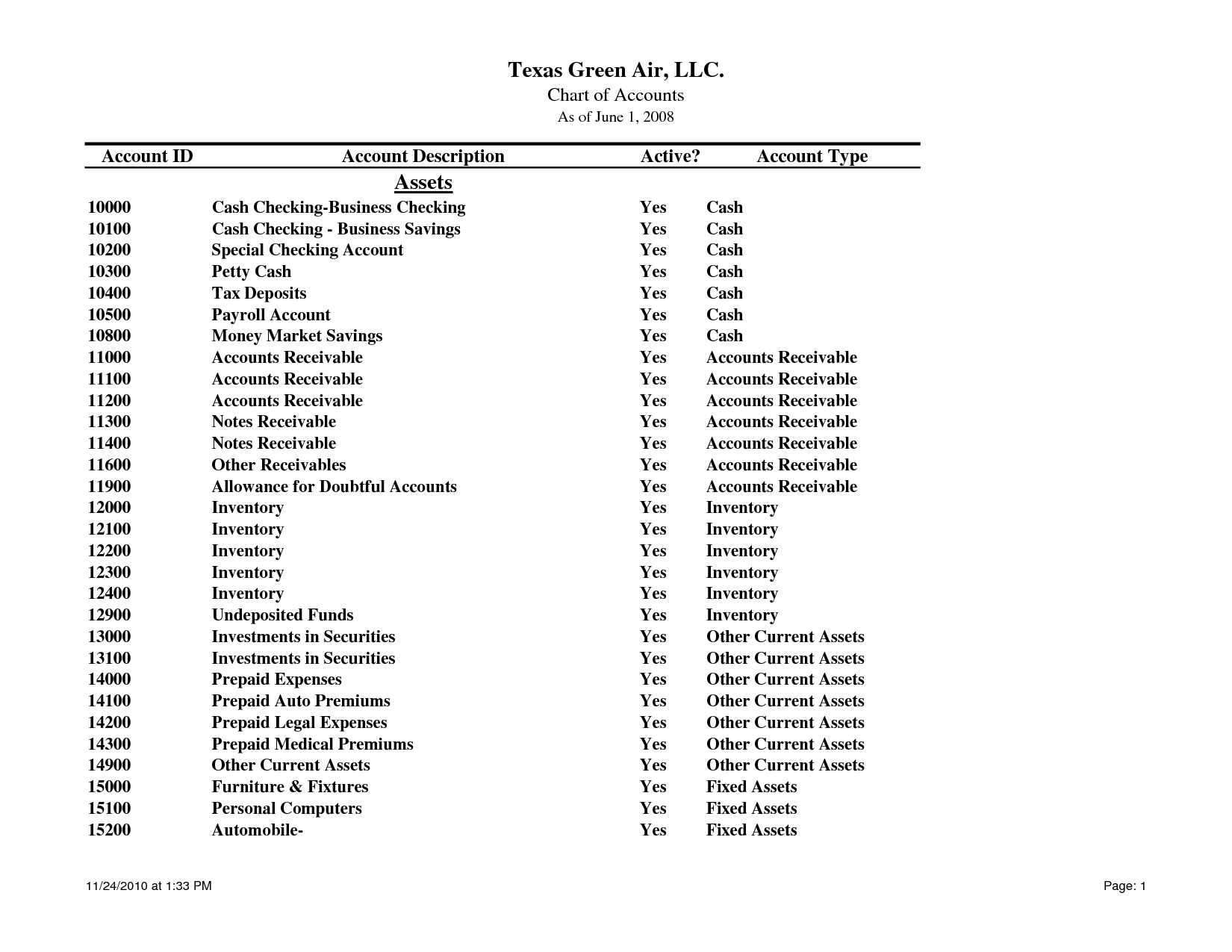

Sample chart of accounts quickbooks

Quickbooks Chart Of Accounts List Pdf

General Contractor Chart Of Accounts

Setting Up the Chart of Accounts QuickBooks for Contractors

Quickbooks Chart Of Accounts Examples

Chart Of Accounts For Construction Company Quickbooks

Chart Of Accounts Example For Construction Company

Setting Up the Chart of Accounts QuickBooks for Contractors

Chart Of Accounts Construction Company

Chart Of Accounts For Construction Company Template Flyer Template

Quickbooks Is A Powerful Program That Enables You To Seamlessly Bring Your Financials Into Focus.

Revenue, Cost Of Goods Sold (Cgs) And Expenses Flow To The Income Statement.

That Is The Financial Structure Of Building A Balance Sheet And A Profit And Loss.

Web We Start With Our Standard Chart Of Accounts Or A Basic Quickbooks Chart Of Accounts.

Related Post: