Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Annual expenses and income worksheet. Long haul trucker/otr driver deductible expenses worksheet; Web forms that you should file as a truck driver depends on your type of employment: Web when determining passenger vehicle expenses, you cannot use, under current irs rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and. Web truck drivers can claim a variety of tax deductions while on the road. With this form, you can track your mileage, fuel costs, and other expenses. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Cost per mile/profit per mile spreadsheet by rts. Trucking expenses spreadsheet by spreadsheet point. In order for an expense to be deductible, it must be considered an ''ordinary. 4 ways to minimize business. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Cost per mile/profit per mile spreadsheet by rts. You'll use those 1099s, plus. Annual expenses and income worksheet. In order for an expense to be deductible, it must be considered an ''ordinary. Web when determining passenger vehicle expenses, you cannot use, under current irs rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and. Cost per mile/profit per mile spreadsheet by rts. You'll use those 1099s, plus. Web this truck driver expenses worksheet form can help make the process a little easier. Long haul trucker/otr driver deductible expenses worksheet; Web when determining passenger vehicle expenses, you cannot use, under current irs rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and. Trucker's income and expense worksheet. Mileage, daily meal allowances, truck. Web trucker tax deduction worksheet. You'll use those 1099s, plus. Long haul trucker/otr driver deductible expenses worksheet; Trucker's income and expense worksheet. Web when determining passenger vehicle expenses, you cannot use, under current irs rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and. Web forms that you should file as a truck driver depends on your type of employment: For tax year 2021, participants with family coverage, the floor. Web this truck driver expenses worksheet form can help make the process a little easier. Cost per mile/profit per mile spreadsheet by rts. With this form, you can track your mileage, fuel costs, and. Web send owner operator truck driver tax deductions worksheet via email, link, or fax. In order for an expense to be deductible, it must be considered an ''ordinary. With this form, you can track your mileage, fuel costs, and other expenses. In order for an expense to be deductible, it must be considered an “ordinary. Annual expenses and income worksheet. Web when determining passenger vehicle expenses, you cannot use, under current irs rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and. Web trucker tax deduction worksheet. Trucking expenses spreadsheet by spreadsheet point. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense. 3 how to track business expenses for taxes. Trucking expenses spreadsheet by spreadsheet point. Web this truck driver expenses worksheet form can help make the process a little easier. Web trucker tax deduction worksheet. For tax year 2021, participants with family coverage, the floor. 4 ways to minimize business. Trucking expenses spreadsheet by spreadsheet point. Web forms that you should file as a truck driver depends on your type of employment: 3 how to track business expenses for taxes. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web this truck driver expenses worksheet form can help make the process a little easier. Mileage, daily meal allowances, truck repair. H&r block's long haul/overnight truck driver deductions. Web forms that you should file as a truck driver depends on your type of employment: Web send owner operator truck driver tax deductions worksheet via email, link, or fax. You'll use those 1099s, plus. For tax year 2021, participants with family coverage, the floor. In order for an expense to be deductible, it must be considered an “ordinary. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Trucker's income and expense worksheet. Annual expenses and income worksheet. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web trucker tax deduction worksheet. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and union dues are. 3 how to track business expenses for taxes. With this form, you can track your mileage, fuel costs, and other expenses. Web truck drivers can claim a variety of tax deductions while on the road. 4 ways to minimize business.

Truck Driver'S Tax Deductions printable pdf download

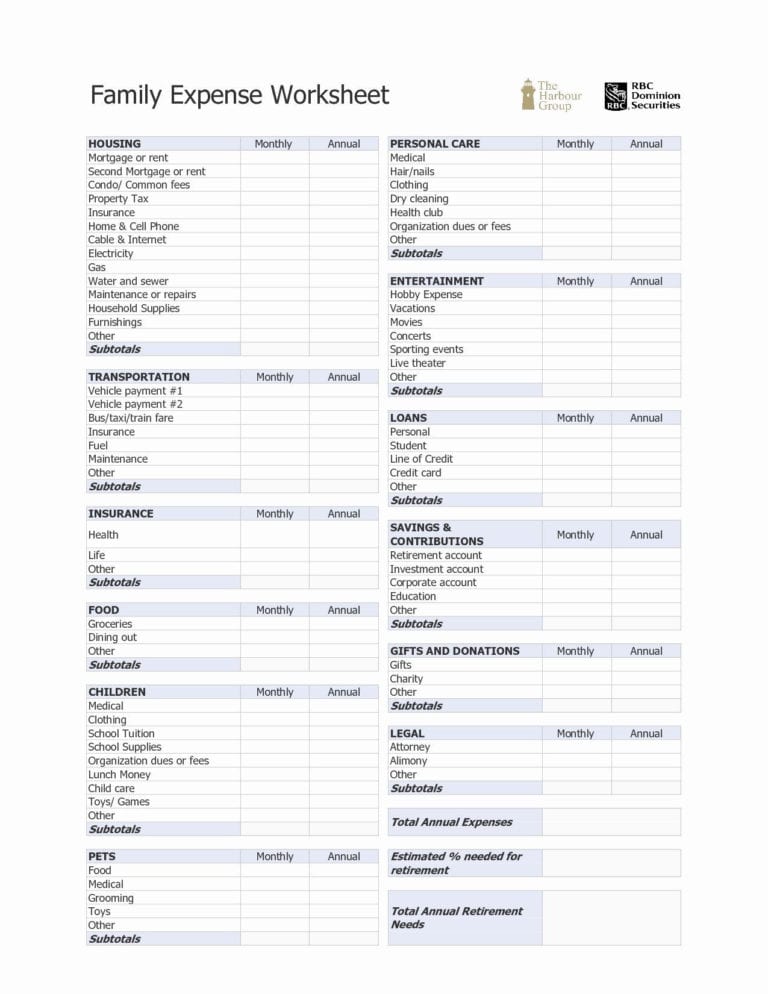

Home Office Expense Spreadsheet Printable Spreadsheet home office tax

Anchor Tax Service Truck driver deductions

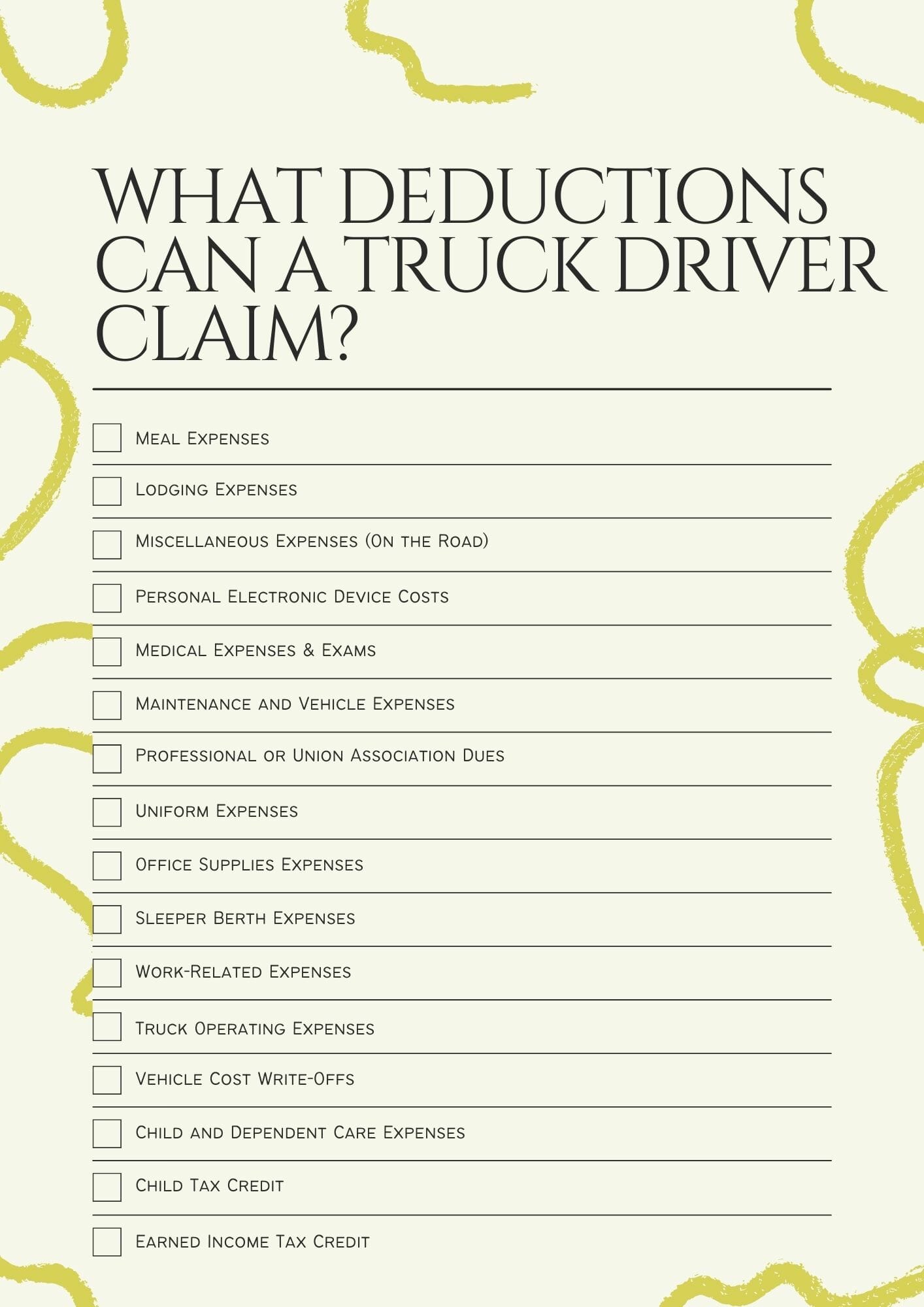

Tax Deduction List for Owner Operator Truck Drivers

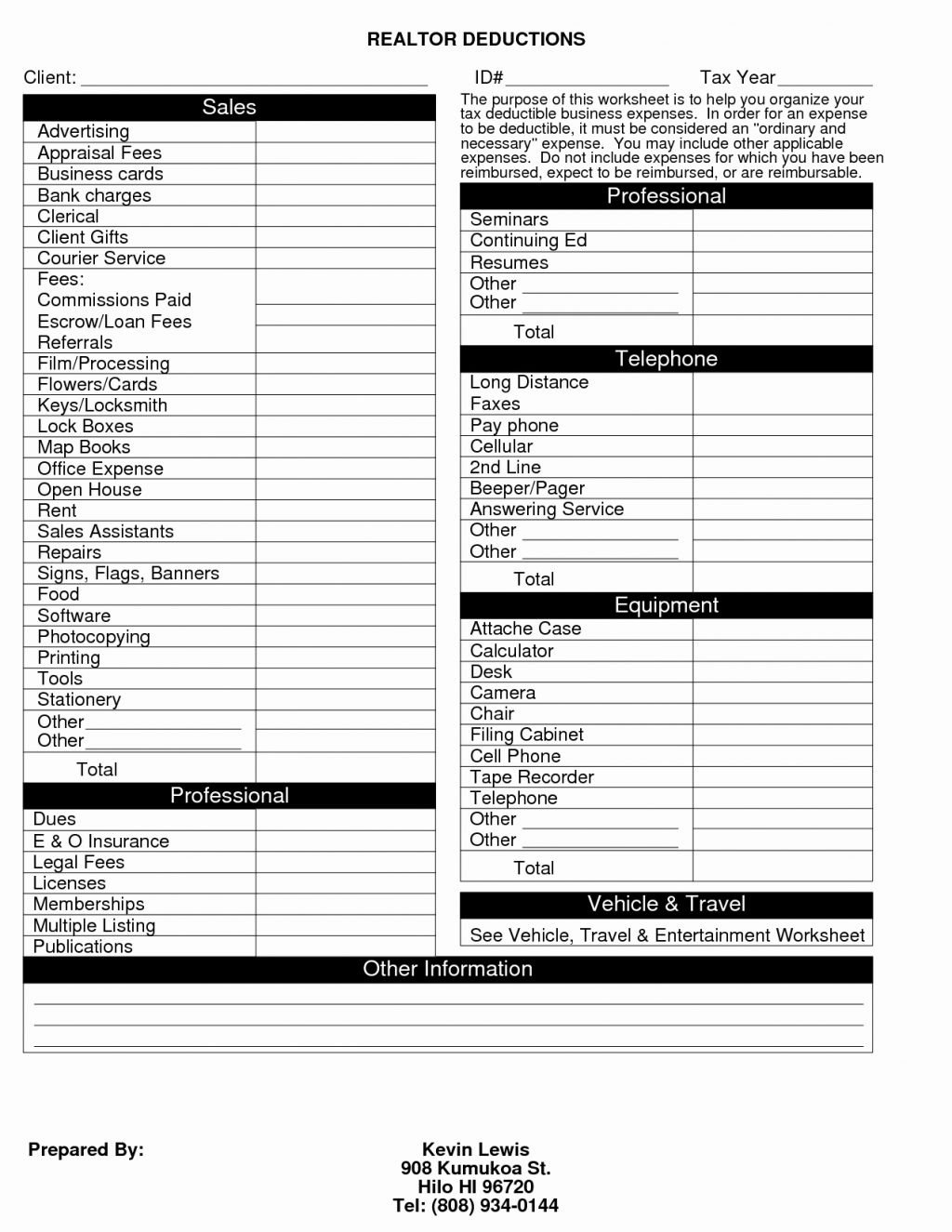

Anchor Tax Service Self employed (general)

Truck Driver Expense Spreadsheet Spreadsheet Softwar truck driver

Free Owner Operator Expense Spreadsheet in Truck Driver Expenset

ULTIMATE 2020 Tax Guide for truckers (Owner Operators, Company Drivers

Truck Driver Tax Deductions 2023 (+ Download Free Worksheet)

Truck Driver Expense Spreadsheet Of Truck Driver Tax —

Our List Of The Most Common Truck Driver Tax Deductions Will Help You Find Out How You Can Save Money On Your Taxes!

In Order For An Expense To Be Deductible, It Must Be Considered An ''Ordinary.

Long Haul Trucker/Otr Driver Deductible Expenses Worksheet;

Web When Determining Passenger Vehicle Expenses, You Cannot Use, Under Current Irs Rules And Regulations, The Standard Mileage Rate (Which Is 48.5 Cents Per Mile For 2007 And.

Related Post: