Printable Promissory Note

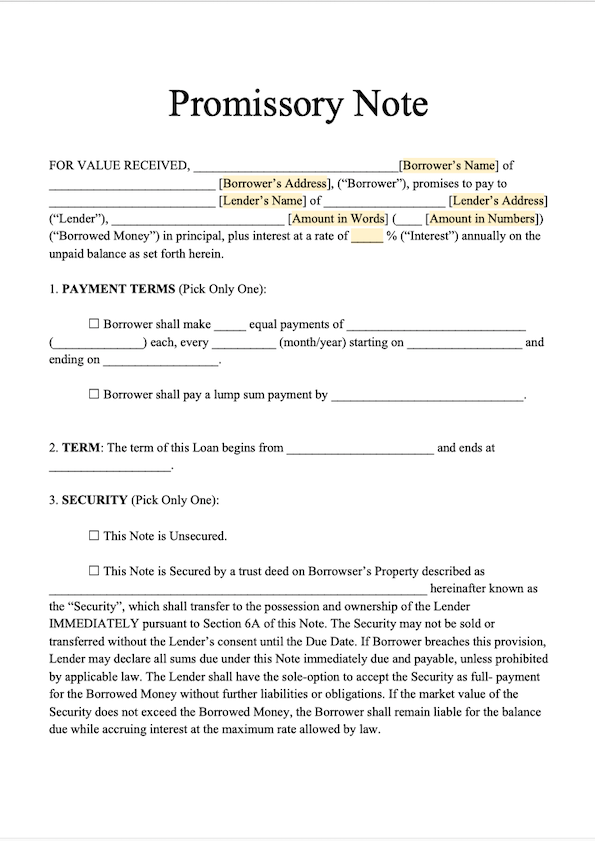

Printable Promissory Note - Meanwhile, the central bank also announced that it will launch a larger bill. Small loans might only need a simple promissory note to be protected, but you should still create this. By type, promissory notes can be either secured or unsecured, with secured notes requiring collateral and unsecured notes relying. It is a legal, financial tool which makes the terms for a loan written. Below are the following repayment types. It provides clear guidelines for both the borrower and lender, ensuring a fair and transparent transaction. Web this promissory note template can help you create the right note in order to keep track of that transaction. Web what is a promissory note? The promissory note is a special financial instrument, which states that a specific person pays back another person on a specified date, or when demanded by the person who lent the money. Promissory notes are used for all types of loans, like auto loans. Easy to build, a promissory note is an effective way for any lender to record the terms and. Web a promissory note outlines the terms of a loan agreement. Promissory notes are used for all types of loans, like auto loans. Unsecured notes may be used. Loan amount and interest, which is a lending fee calculated. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. This agreement also outlines what will happen if the debt is not repaid. Below are the following repayment types. The security shall transfer to the possession and ownership of the lender immediately pursuant to section 11. Download now our free printable promissory note template. Web the 10,000 peso note is worth $11 at the country’s official exchange rate and $9 at the black market exchange rate. The promissory note is a special financial instrument, which states that a specific person pays back another person on a specified date, or when demanded by the person who lent. The maker must duly draw and sign it. Web a promissory note outlines the terms of a loan agreement. By type, promissory notes can be either secured or unsecured, with secured notes requiring collateral and unsecured notes relying. Examples of unsecured promissory notes include personal loans, credit card debt, and student loans without any collateral attached. Banks and other financial. Term, or length, of the contract. For a promissory note, there’s no need for a witness or notary (though, neither is a. Web our promissory note template will customize your document specifically for the laws of your location. Select the state where the loan is taking place. Below are the following repayment types. Payment schedule (single payment or regular payments) Web a promissory note outlines the terms of a loan agreement. Select the state where the loan is taking place. Before the requested fund is provided, the lender and the borrower document terms mutually agreed upon on a promissory note, such as the repayment schedule, interest. Describe the relationship between the lender and. Select the state where the loan is taking place. The parties.this promissory note (the “note”) is made this [mm/dd/yyyy], (the “start date”), by and between [borrower name] of [borrower address] (the “borrower”), who has received and promises to payback [lender name] of [lender address] (the “lender”) the principal sum of $. An unsecured promissory note is a promissory note that. Before the requested fund is provided, the lender and the borrower document terms mutually agreed upon on a promissory note, such as the repayment schedule, interest. Choose from our promissory note templates that are drafted by attorneys. Examples of unsecured promissory notes include personal loans, credit card debt, and student loans without any collateral attached. If the borrower does not. Small loans might only need a simple promissory note to be protected, but you should still create this. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. Web formswift’s promissory note template can be used for personal loans, business loans, and student loans. As a. Web this note shall be: Describe the relationship between the lender and the borrower (e.g., friend or family member). It is a legal, financial tool which makes the terms for a loan written. Include the names and addresses of all lenders and borrowers. The proceeds of the loans can be used for many different purposes, including but not limited to: Web a promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details, interest, late fees, any collateral, and more. It provides clear guidelines for both the borrower and lender, ensuring a fair and transparent transaction. Unsecured notes may be used. It is a legal, financial tool which makes the terms for a loan written. Below are the following repayment types. They are used in significant financial transactions like mortgages, car loans, student loans, and business loans. Describe the relationship between the lender and the borrower (e.g., friend or family member). Before the requested fund is provided, the lender and the borrower document terms mutually agreed upon on a promissory note, such as the repayment schedule, interest. Web the government has multiplied the size of its biggest bank note in circulation by five — to 10,000 pesos, worth about $10 — so people don't have to carry so much cash worth so little. For a promissory note, there’s no need for a witness or notary (though, neither is a. Web this note shall be: This note may not be modified or amended except by written agreement signed by borrower and lender. The security shall transfer to the possession and ownership of the lender immediately pursuant to section 11 of this note. Examples of unsecured promissory notes include personal loans, credit card debt, and student loans without any collateral attached. By type, promissory notes can be either secured or unsecured, with secured notes requiring collateral and unsecured notes relying. If the borrower is in default under this note or is in default under another provision of this note, and such default is not cured within the minimum allotted time by law after written notice of such default, then lender may, at its option, declare all outstanding sums owed on this note to be immediately due and payable.![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-23.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Free Promissory Note Template Download Secured Promissory Note PDF

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-40.jpg?w=395)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-01.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

Free Promissory Note (Loan) Release Form PDF Word eForms

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-45.jpg?w=790)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-43.jpg?w=395)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-26.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-32.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Web The Note, Worth About $11 Based On Thursday Exchange Rates, Tops The 2,000 Peso Note As The Country's Biggest Bill.

There Shall Be No Security Provided In This Note.

Gives The Lender A Good Feel As To How The Borrower Is Making Good On Their Word.

Details Included In This Note Include The Amount Borrowed, Personal Information Of The Borrower, And Payment Terms.

Related Post: