Printable Itemized Deductions Worksheet

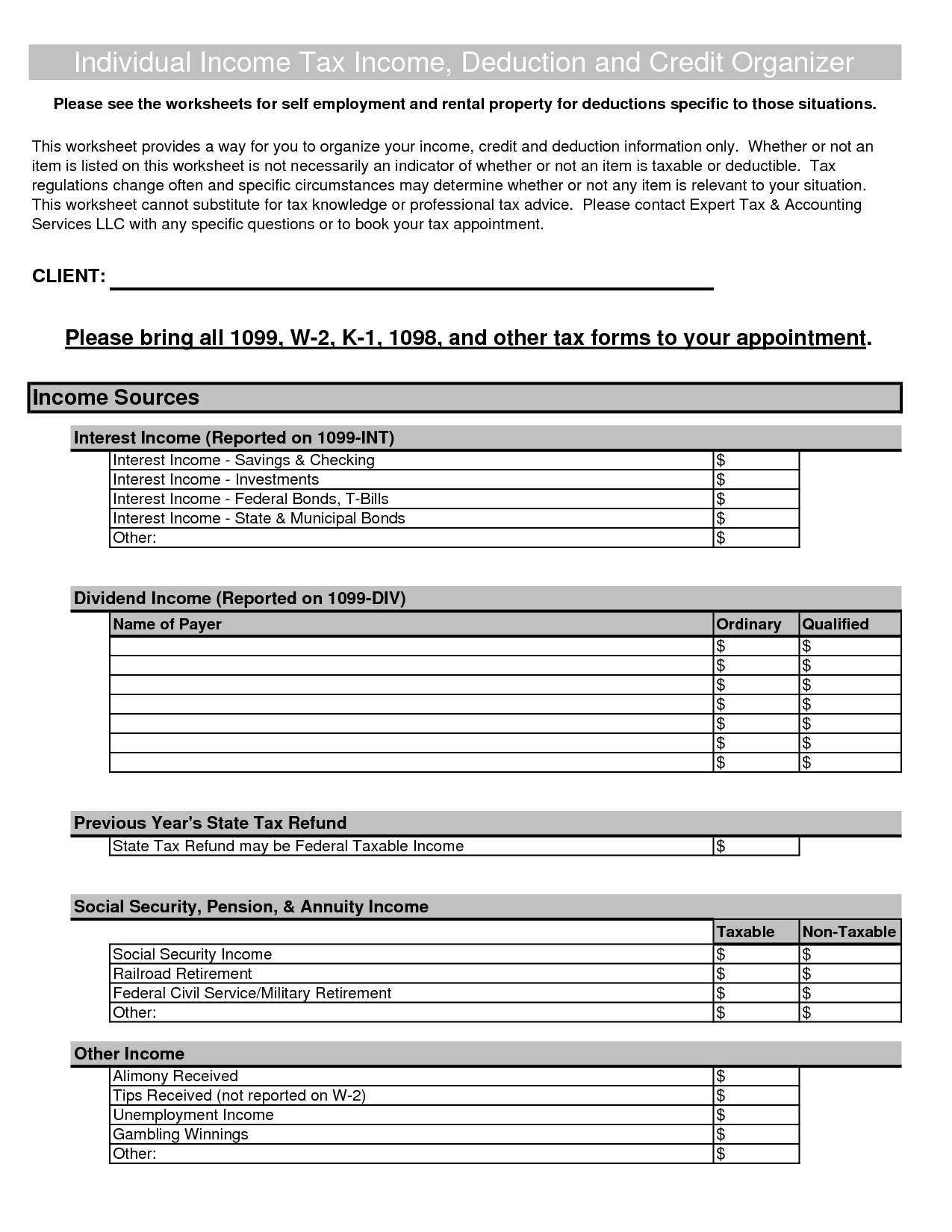

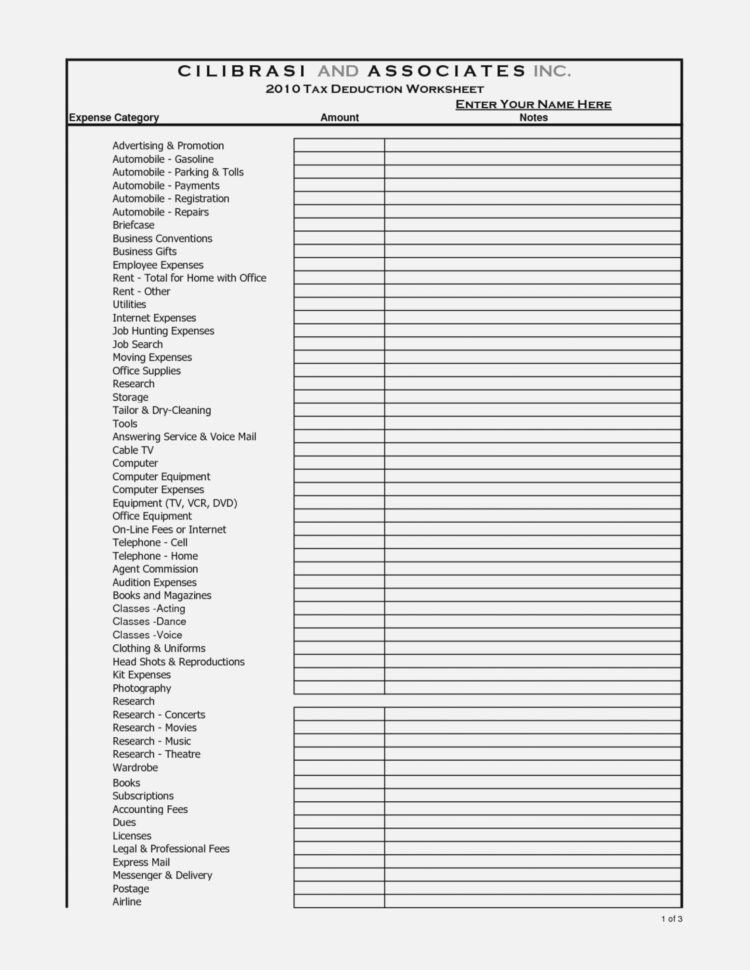

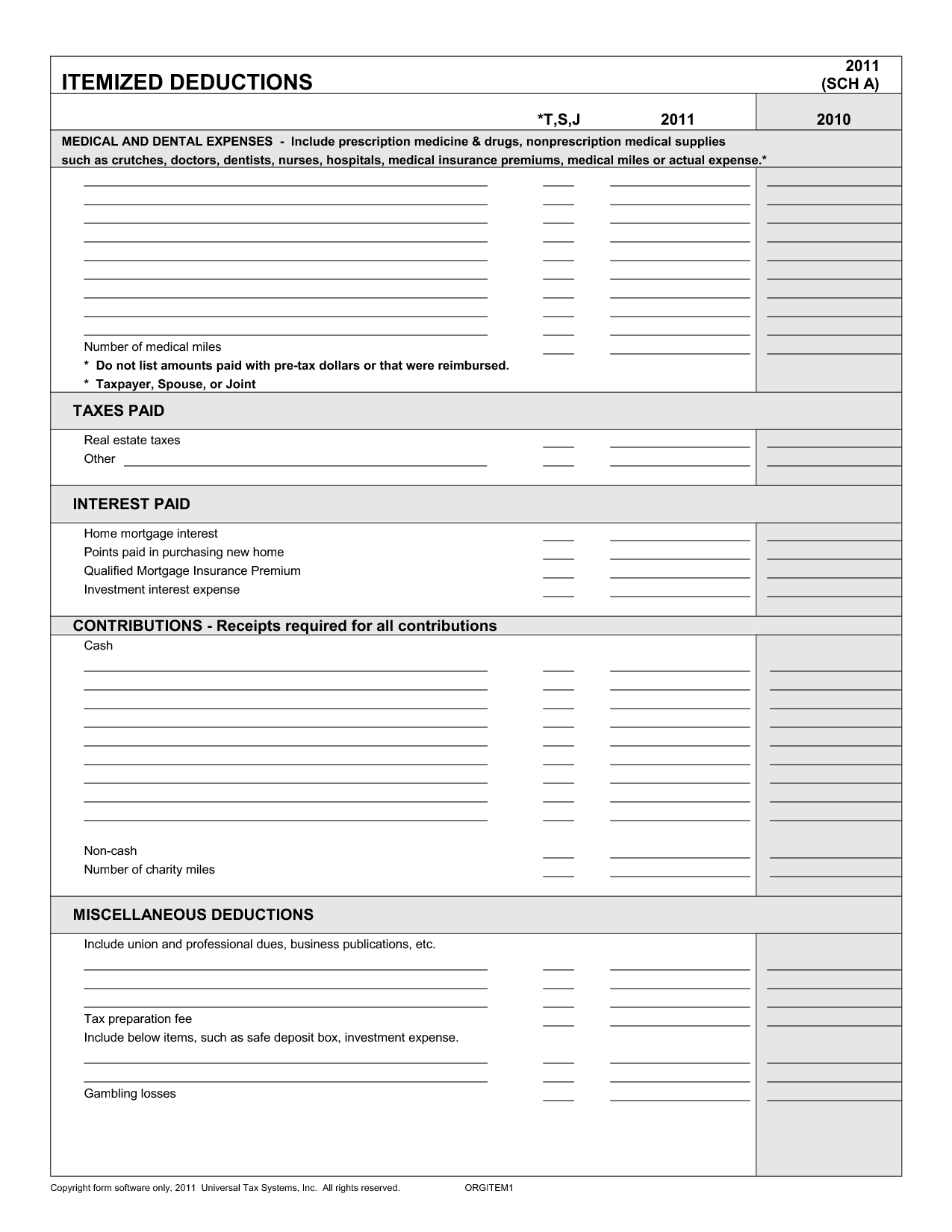

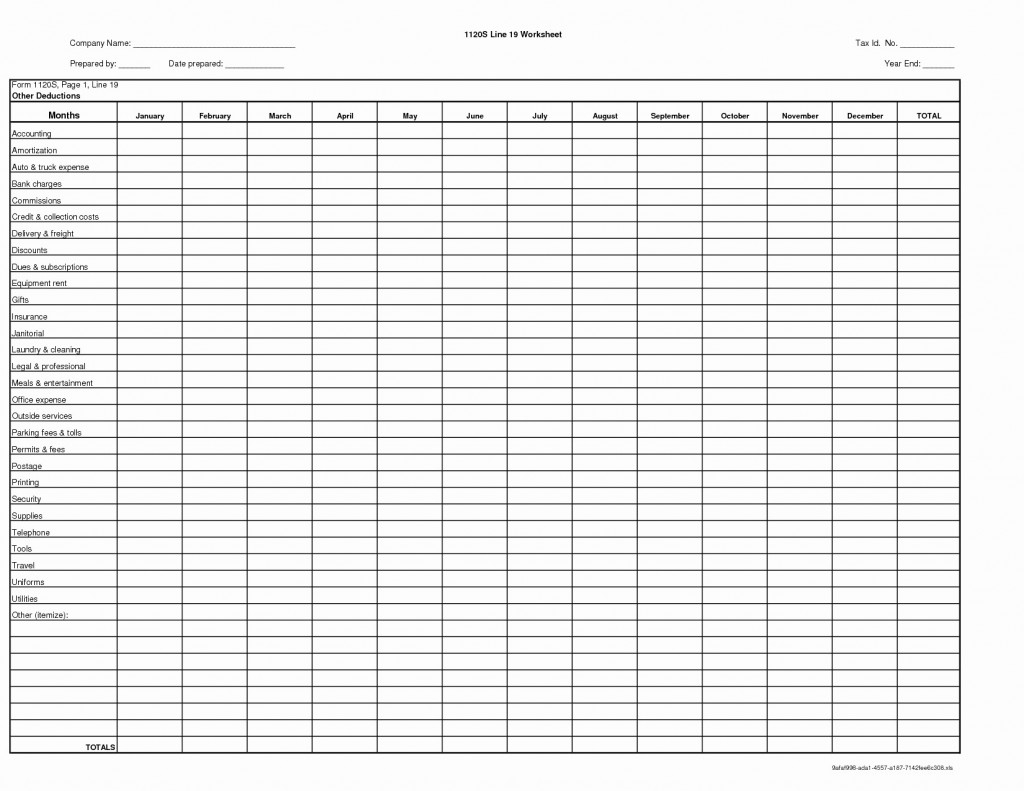

Printable Itemized Deductions Worksheet - You can deduct many of them, including, of course, the health, dental, and vision insurance premiums you pay as well as expenses from surgery to hearing aids, and more. Web itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total taxable income amount. Medical expenses you paid for yourself or Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your federal and/or state return. Do not include expenses for which you have been reimbursed, expect to be. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security, unemployment, other income). Department of the treasury internal revenue service (99) caution: It even includes necessary travel costs like bus fare or parking fees. How do small business tax deductions work? While medical costs can get pretty expensive, there is good news. My client took the standard deduction in 2020 but still made some charitable deductions that i'm hoping to carry through to 1040 line 10b. How neat can help you claim your small business tax deductions. What is a tax deduction? You may include other applicable expenses. Go to www.irs.gov/schedulea for instructions and the latest information. Go to www.irs.gov/schedulea for instructions and the latest information. Do not include expenses for which you have been reimbursed, expect to be. My client took the standard deduction in 2020 but still made some charitable deductions that i'm hoping to carry through to 1040 line 10b. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Who should you. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Single $12,950 married $25,900 hoh $19,400. 55 small business tax deductions. Single $13,850 married (filing joint) $27,700 single (65+) $15,700 married (one 65+) $29,200 married (both 65+) $30,700. Web itemized deductions worksheet you will need: Single $12,950 married $25,900 hoh $19,400. I've put the contributions on schedule a but cannot get the amount to flow through. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Single (65+) $14,700 married (one 65+) $27,300 hoh (65+) $21,150 married (both 65+) $28,700. Do not include expenses for which you have. Tax information documents (receipts, statements, invoices, vouchers) for your own records. You may include other applicable expenses. Single $12,550 married $25,100 hoh $18,800 single (65+) $14,250 married (one 65+) $26,450 hoh (65+) $20,500 married (both 65+) $27,800. What is a tax deduction? Department of the treasury internal revenue service (99) caution: A tax deduction is an expense you can subtract. Single $13,850 married (filing joint) $27,700 single (65+) $15,700 married (one 65+) $29,200 married (both 65+) $30,700. Tax information documents (receipts, statements, invoices, vouchers) for your own records. What is a tax deduction? Medical expenses you paid for yourself or My client took the standard deduction in 2020 but still made some charitable deductions that i'm hoping to carry through to 1040 line 10b. What is a tax deduction? Web schedule a (form 1040) department of the treasury internal revenue service. Web itemized deductions worksheet you will need: Single $13,850 married (filing joint) $27,700 single (65+) $15,700 married (one 65+). Single (65+) $14,700 married (one 65+) $27,300 hoh (65+) $21,150 married (both 65+) $28,700. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): I've put the contributions on schedule a but cannot get the amount to flow through. It even includes necessary travel costs. 55 small business tax deductions. Web itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total taxable income amount. Web itemized deductions worksheet you will need: What is a tax deduction? Web download or print the 2023 federal (itemized deductions) (2023) and other income tax forms from the. How neat can help you claim your small business tax deductions. A tax deduction is an expense you can subtract. It even includes necessary travel costs like bus fare or parking fees. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Web this downloadable file contains worksheets for, wages and pensions, ira. While medical costs can get pretty expensive, there is good news. Web we’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): A tax deduction is an expense you can subtract. 55 small business tax deductions. The purpose of this worksheet is to help you organize your tax deductible business expenses. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): What is a tax deduction? Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security, unemployment, other income). Single $12,550 married $25,100 hoh $18,800 single (65+) $14,250 married (one 65+) $26,450 hoh (65+) $20,500 married (both 65+) $27,800. How do small business tax deductions work? Who should you consult to confirm what you can and cannot write off? Web however, if either you or your spouse was born before january 2, 1952, you can deduct the part of your. Single $13,850 married (filing joint) $27,700 single (65+) $15,700 married (one 65+) $29,200 married (both 65+) $30,700. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Single $12,550 married $25,100 hoh $18,800 single (65+) $14,250 married (one 65+) $26,450 hoh (65+) $20,500 married (both 65+) $27,800. Single $12,950 married $25,900 hoh $19,400.

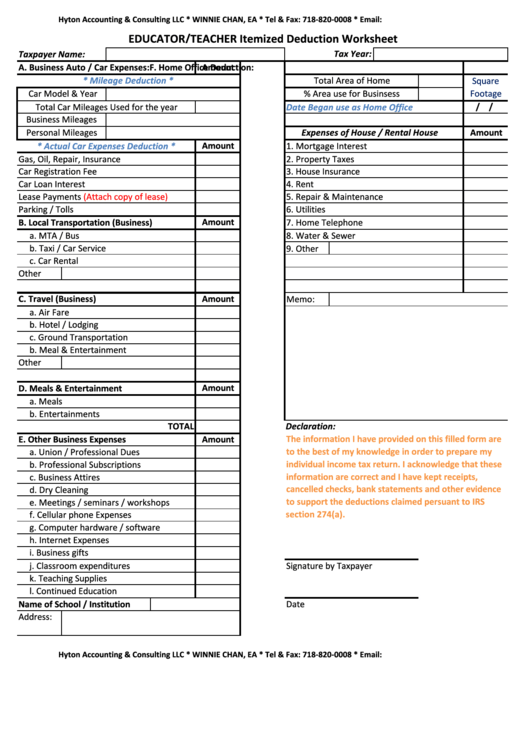

Fillable Educator/teacher Itemized Deduction Worksheet printable pdf

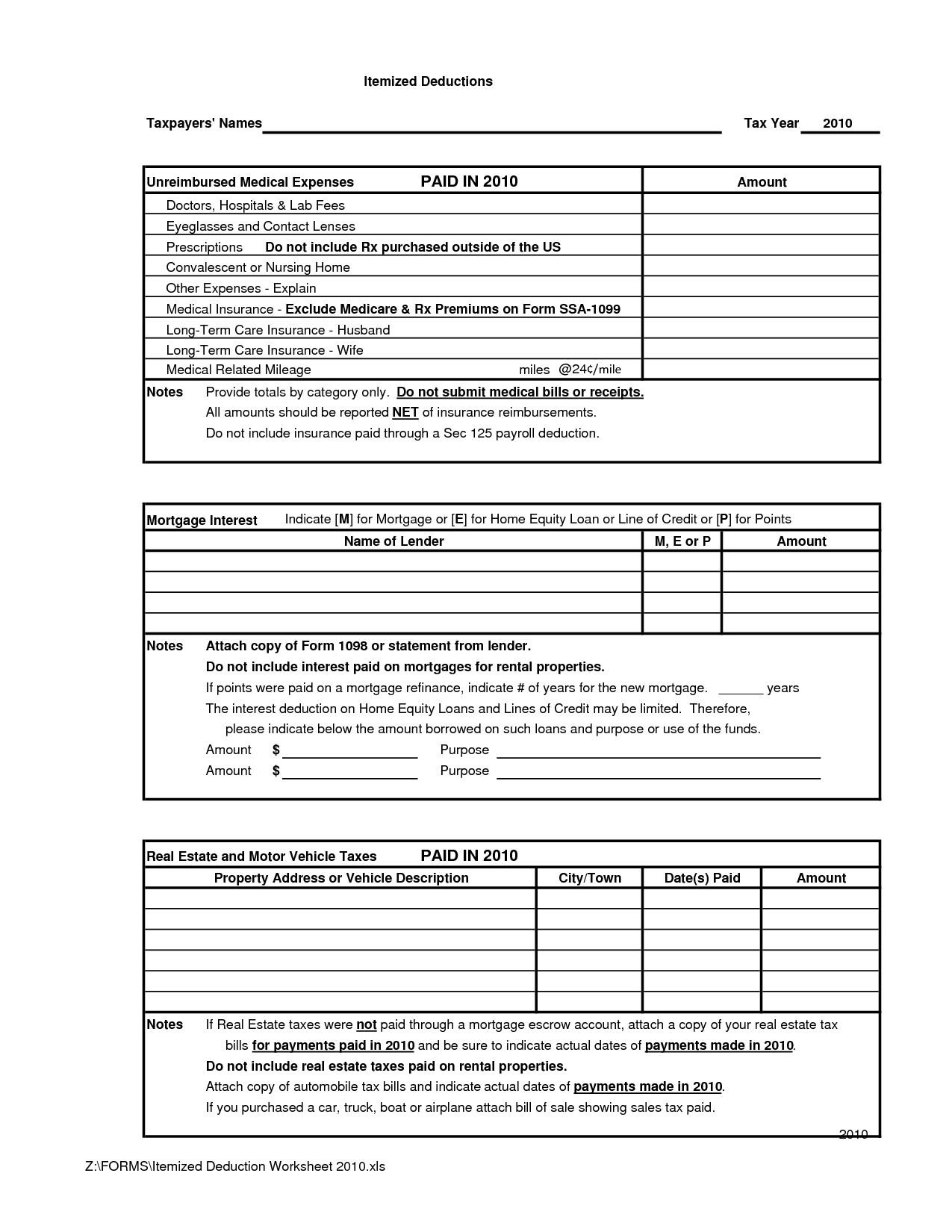

itemized deductions worksheet 20212022 Fill Online, Printable

18 Itemized Deductions Worksheet Printable /

18 Itemized Deductions Worksheet Printable /

Debt Payoff Worksheet Pdf Itemized Deductions Worksheet Db Excel

Itemized Deductions Worksheet —

Printable Itemized Deductions Worksheet

Fillable Online 2016 ITEMIZED DEDUCTIONS WORKSHEET Fax Email Print

Itemized Deductions Form 1040 Schedule A Free Download Worksheet

Itemized Deductions Spreadsheet —

You Can Deduct Many Of Them, Including, Of Course, The Health, Dental, And Vision Insurance Premiums You Pay As Well As Expenses From Surgery To Hearing Aids, And More.

You May Include Other Applicable Expenses.

How Neat Can Help You Claim Your Small Business Tax Deductions.

Do Not Include Expenses For Which You Have Been Reimbursed, Expect To Be.

Related Post: