Printable Donation Receipt

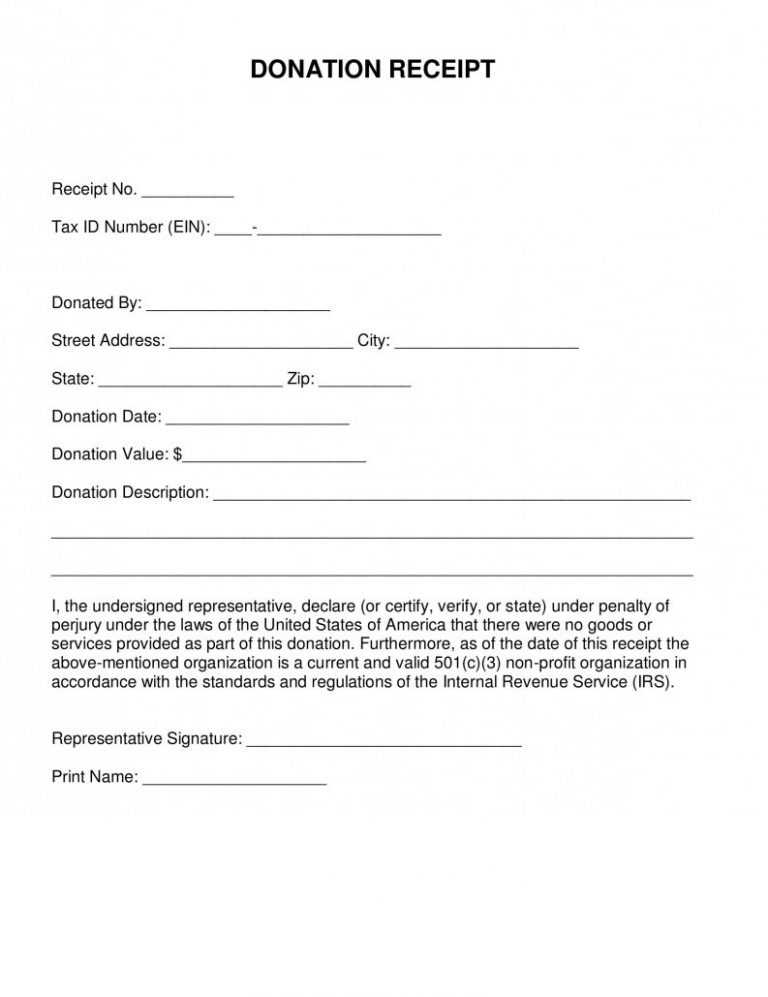

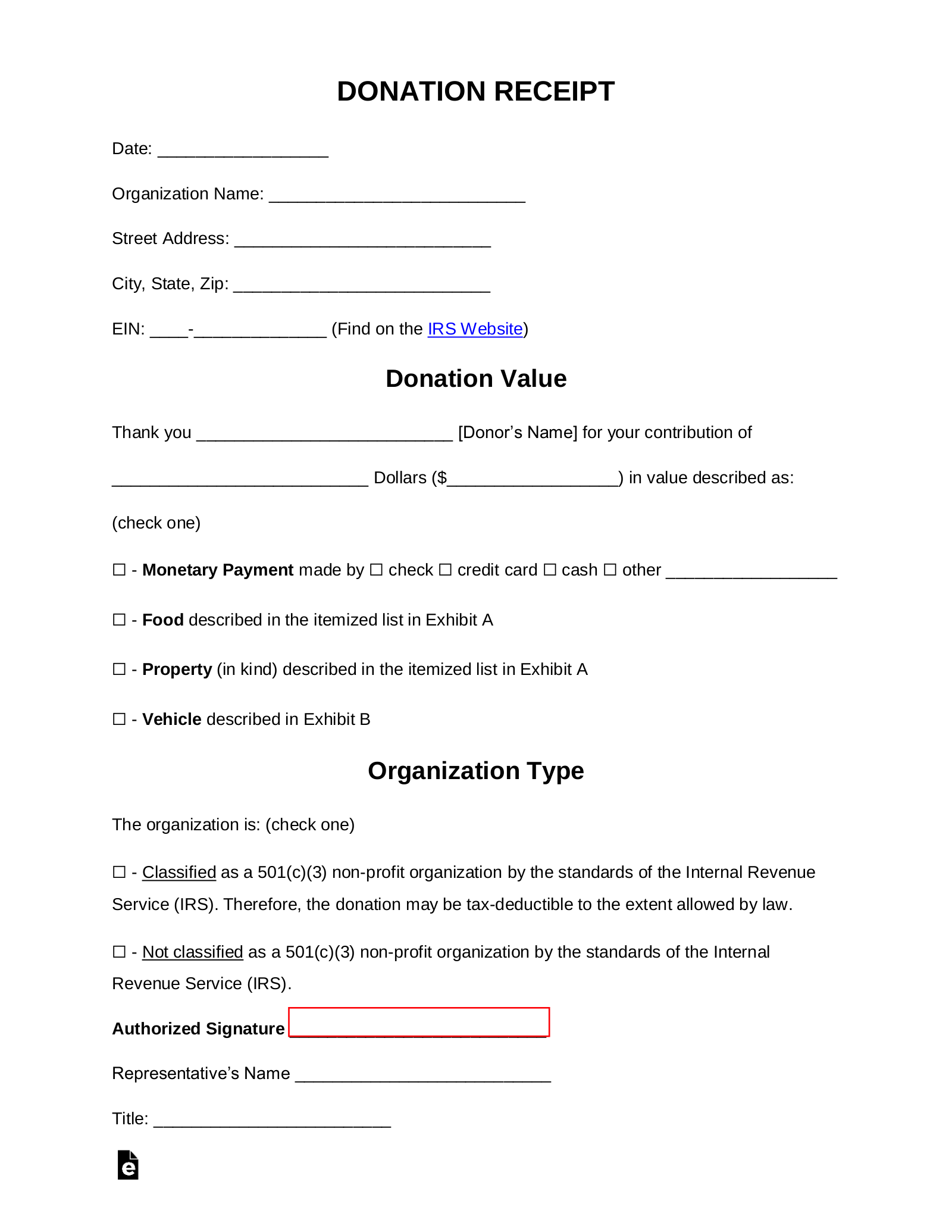

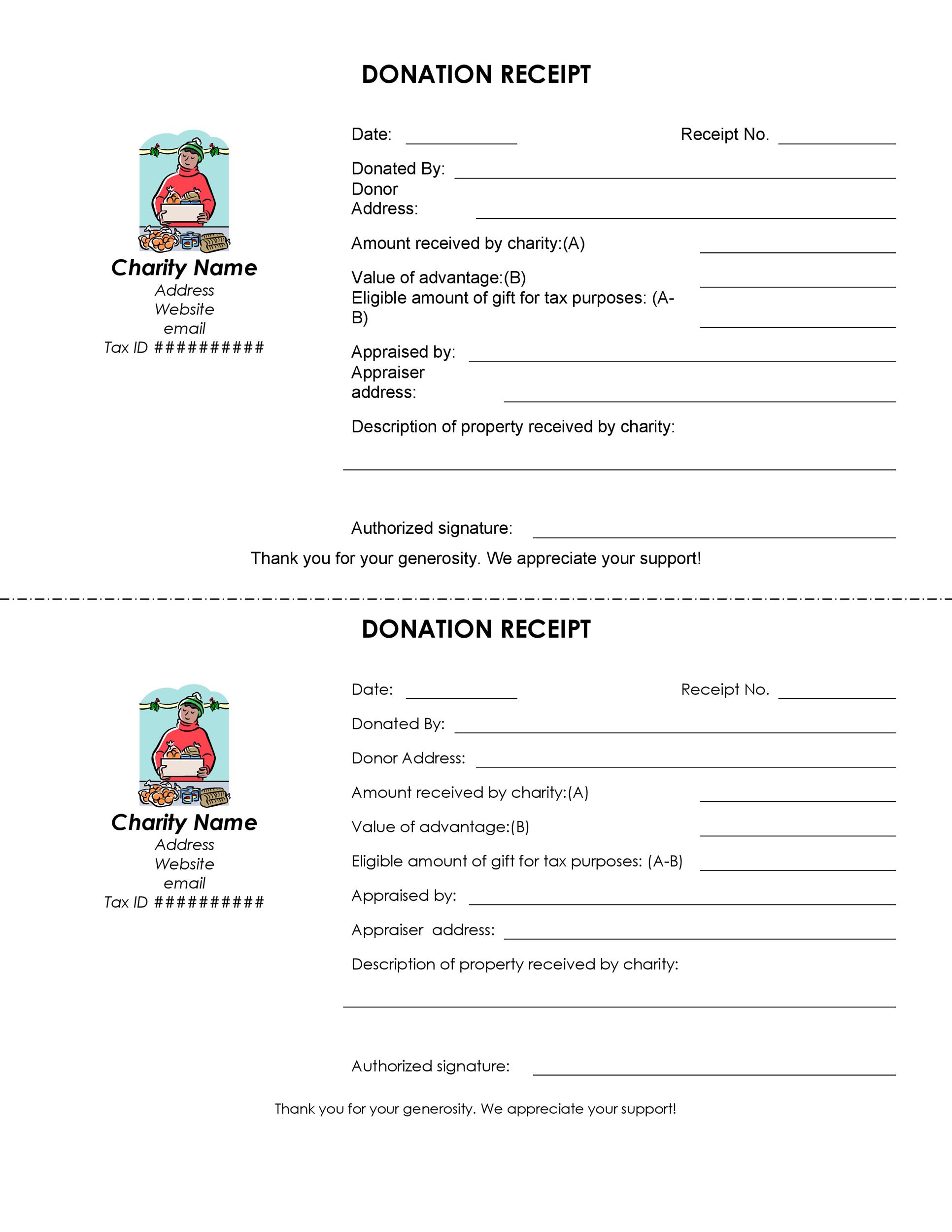

Printable Donation Receipt - Microsoft word (.docx) church donation receipt template. They promote transparency and give donors a clear record of their contributions, including the date, amount, and purpose of the donation. Web published july 5, 2023 • reading time: Tax benefits are available to taxpayers that itemize deductions. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. The salvation army, being a 501 (c) (3) organization, accepts almost anything of value, even unused airline miles. Web here are the main benefits of these helpful forms: Goodwill does not retain a copy of the tax receipt. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Microsoft word (.docx) clothing donation receipt template. From a legal perspective, donors need to obtain written acknowledgment from your organization in order to claim the charitable contribution on their federal income tax return. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Once you register, the donation tracker will generate. Here’s our collection of donation receipt templates. Web a cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Web published july 5, 2023 • reading. Goodwill does not retain a copy of the tax receipt. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web 1 donation receipt templates. Web. Just as people expect a receipt when they purchase an item from a store, your supporters expect a donation receipt when they donate to your nonprofit organization. Your donation to the cornell lab of ornithology will make a difference for birds and conservation. Web we’re making it easier than ever for you to track your goodwill donation receipts. (click image. Web here are some free 501 (c) (3) donation receipt templates for you to download and use; 5 are all gifts or donations qualified for goodwill donation receipts? Online donation receipts template canada. Goodwill industries of south central california. Web updated december 18, 2023. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Find out how you can contribute to make the planet a better place for birds, for all wildlife, and for people. With this system, you will no longer have to hold on to your paper receipt.. Goodwill industries of north georgia. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Your donation to the cornell lab of ornithology will make a difference for birds and conservation. The salvation army, being a 501 (c) (3) organization, accepts almost anything of. Goodwill industries of north georgia. Just as people expect a receipt when they purchase an item from a store, your supporters expect a donation receipt when they donate to your nonprofit organization. 6 creating your donation receipt template. Goodwill does not retain a copy of the tax receipt. 3 information which should be incorporated in a donation receipt. This donation receipt will act as official proof of the contribution, and help donors claim a. Once you register, the donation tracker will generate an electronic receipt for you and even send it. Web a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. 3 information which. From a legal perspective, donors need to obtain written acknowledgment from your organization in order to claim the charitable contribution on their federal income tax return. Web published july 5, 2023 • reading time: A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. Microsoft word (.docx) cash donation receipt template. (click. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. If a donor wishes to claim the donation on their taxes, they will need to provide a donation receipt as proof. Your donation to the cornell lab of ornithology will make a difference for birds and conservation. 3 information which should be incorporated in a donation receipt. Web updated november 14, 2023. This can include cash donations, personal property, or a vehicle. Web updated december 18, 2023. From a legal perspective, donors need to obtain written acknowledgment from your organization in order to claim the charitable contribution on their federal income tax return. Just as people expect a receipt when they purchase an item from a store, your supporters expect a donation receipt when they donate to your nonprofit organization. 5 are all gifts or donations qualified for goodwill donation receipts? What is a donation receipt? The donor determines the fair market value of an item. 6 creating your donation receipt template. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. For more templates, refer to our main receipt templates page here. (click image to download in word format)

Free Sample Printable Donation Receipt Template Form

Non Profit Donation Receipt Templates at

Free Donation Receipt Templates Samples PDF Word eForms

Free Goodwill Donation Receipt Template PDF eForms

50+ FREE Donation Receipt Templates (Word PDF)

Donation Receipt Works Fill Online, Printable, Fillable, Blank

Free Donation Receipt Template 501(c)(3) PDF Word eForms

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/03/Printable-501c3-Donation-Receipt-Template.jpg?fit=1414%2C2000&ssl=1)

501c3 Donation Receipt Template Printable [Pdf & Word]

Donation Receipt Template download free documents for PDF, Word and Excel

Web Published July 5, 2023 • Reading Time:

How To Create Donation Receipts (Plus, Real Examples!) Use Givebutter’s Free Donation Receipt Templates For Smooth Donor Appreciation.

Goodwill Does Not Retain A Copy Of The Tax Receipt.

Web A Donation Receipt Is A Form Of Receipt That Shows Concrete Evidence That A Benefactor Had Donated A Given Value To A Beneficiary.

Related Post: