Printable 50 30 20 Rule

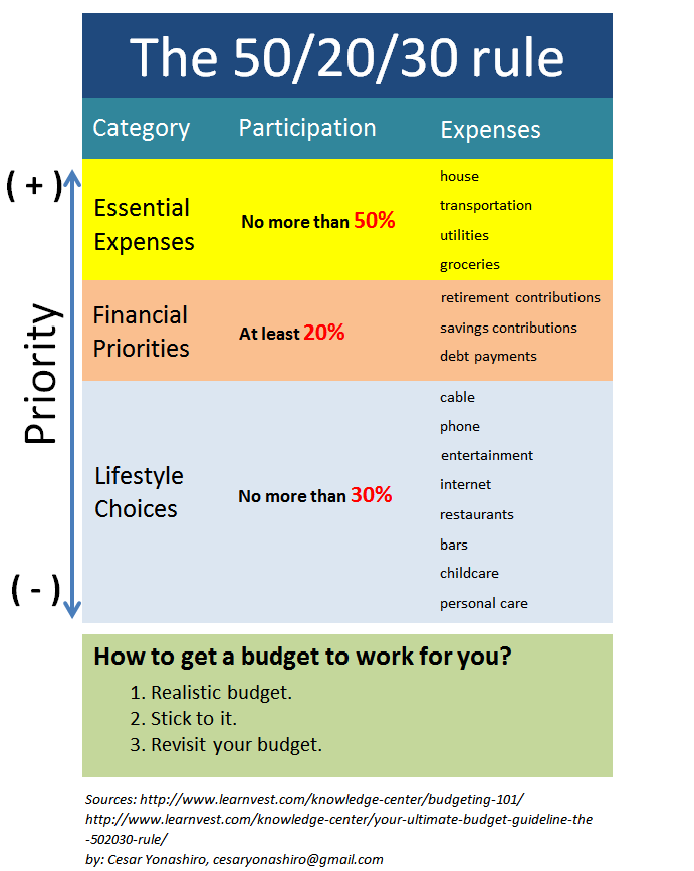

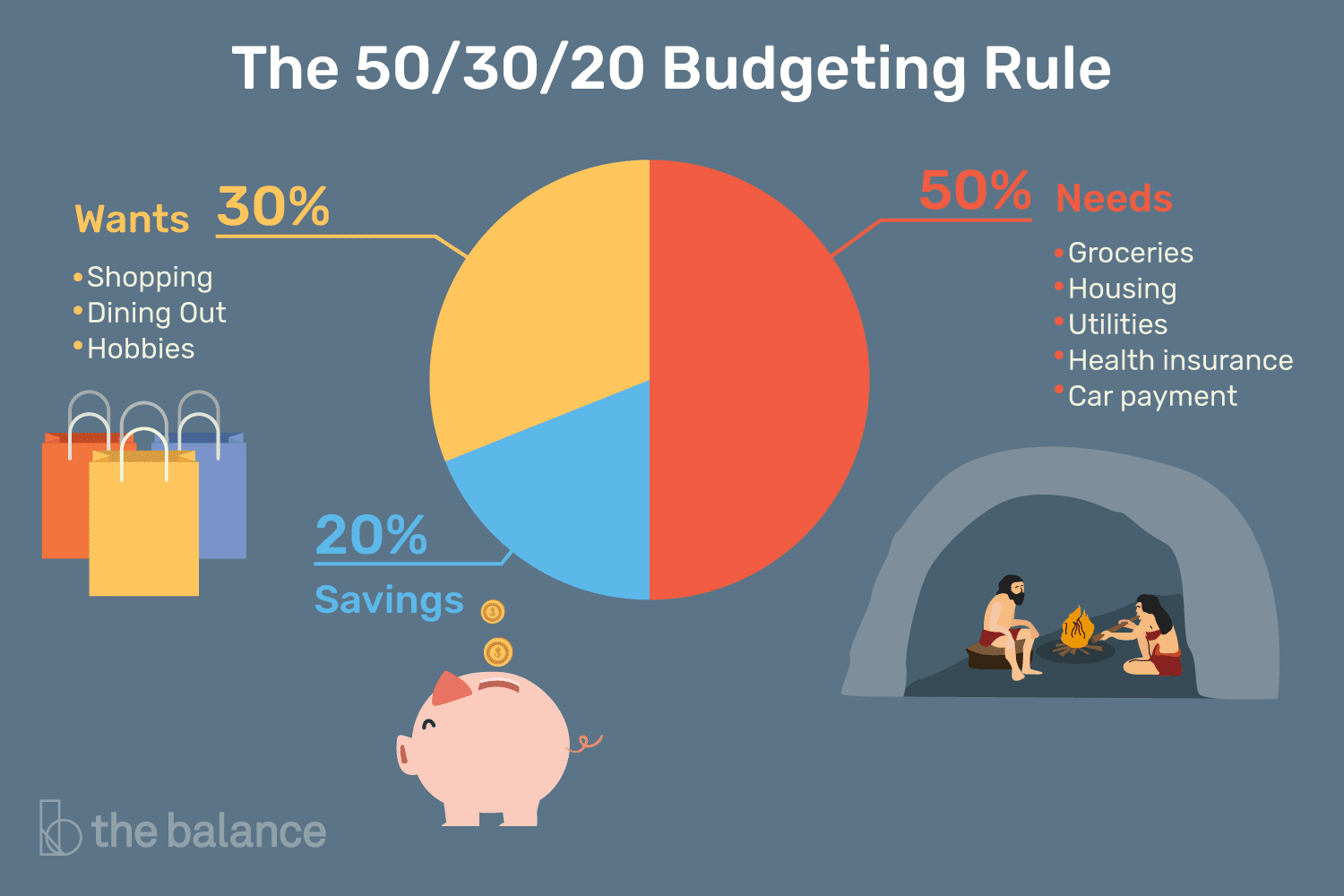

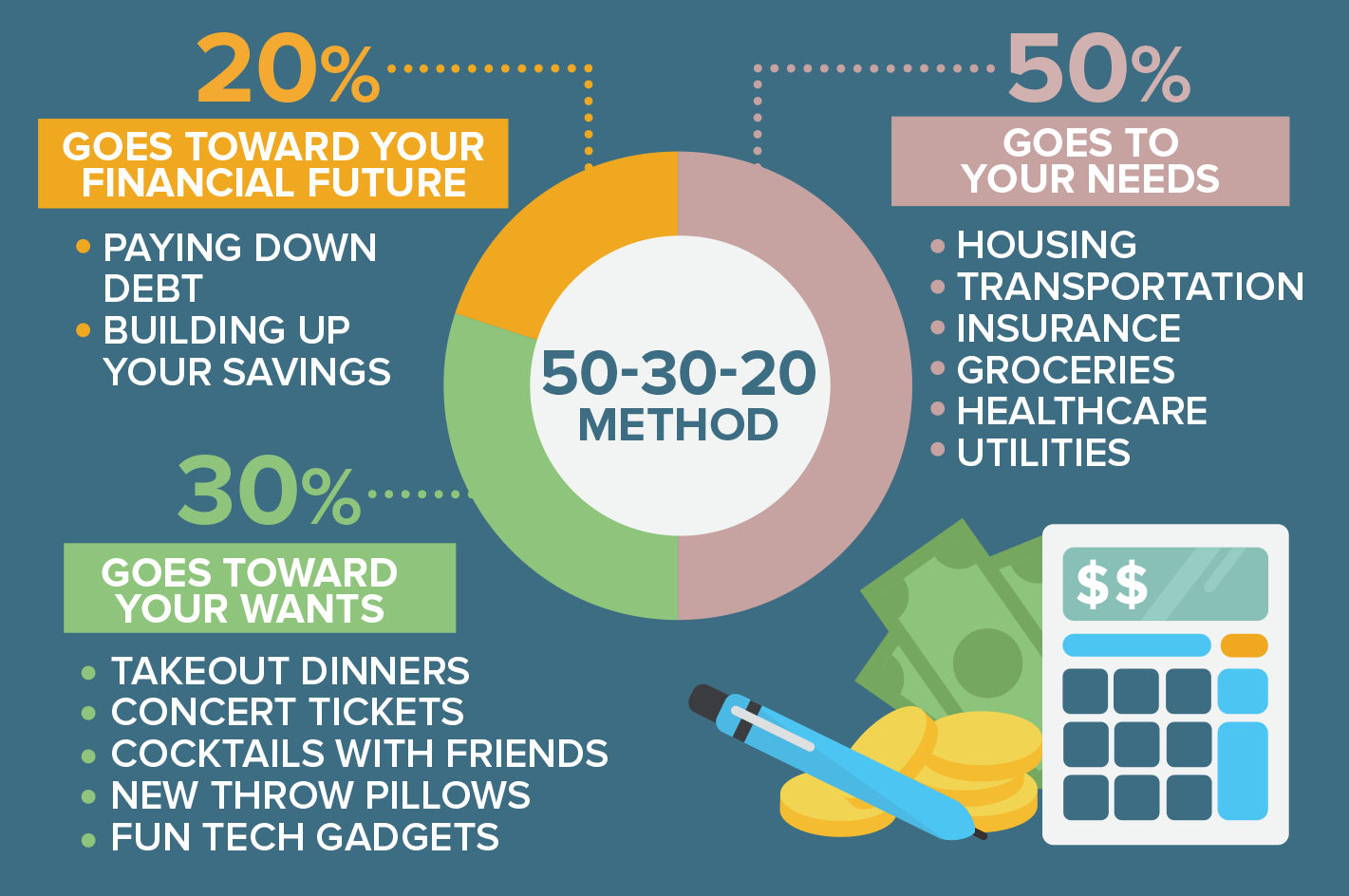

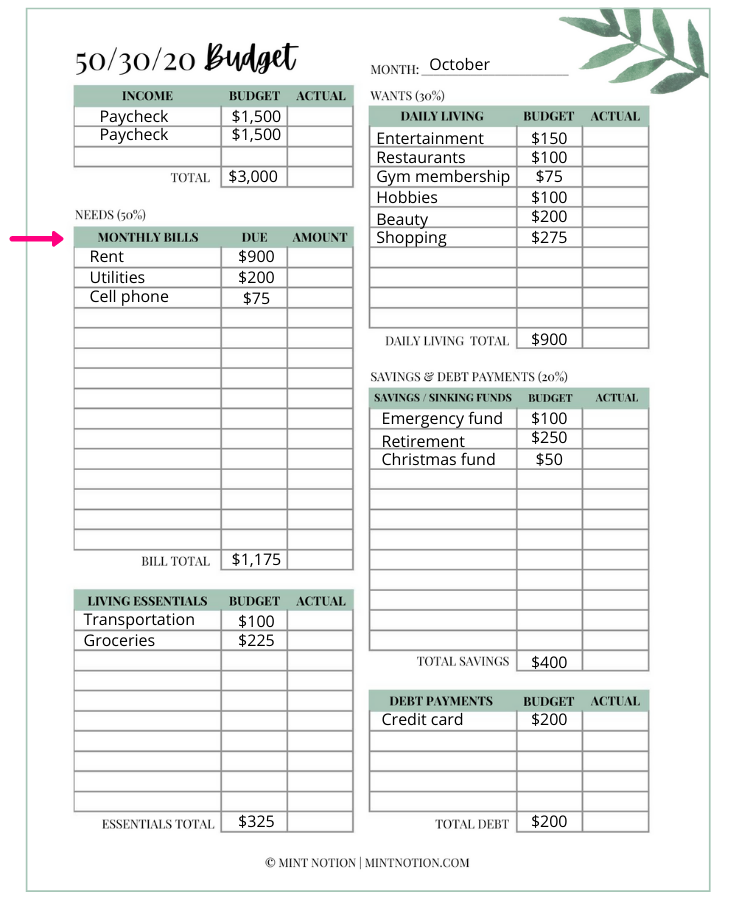

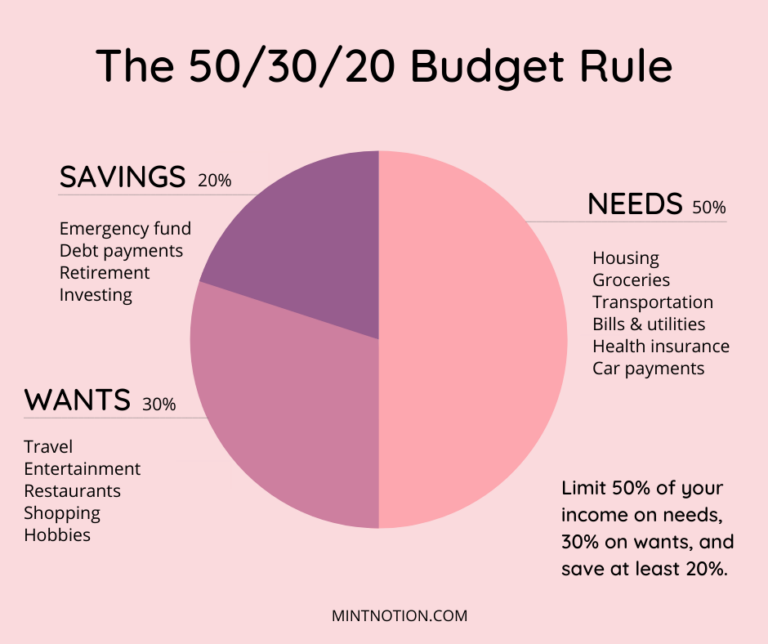

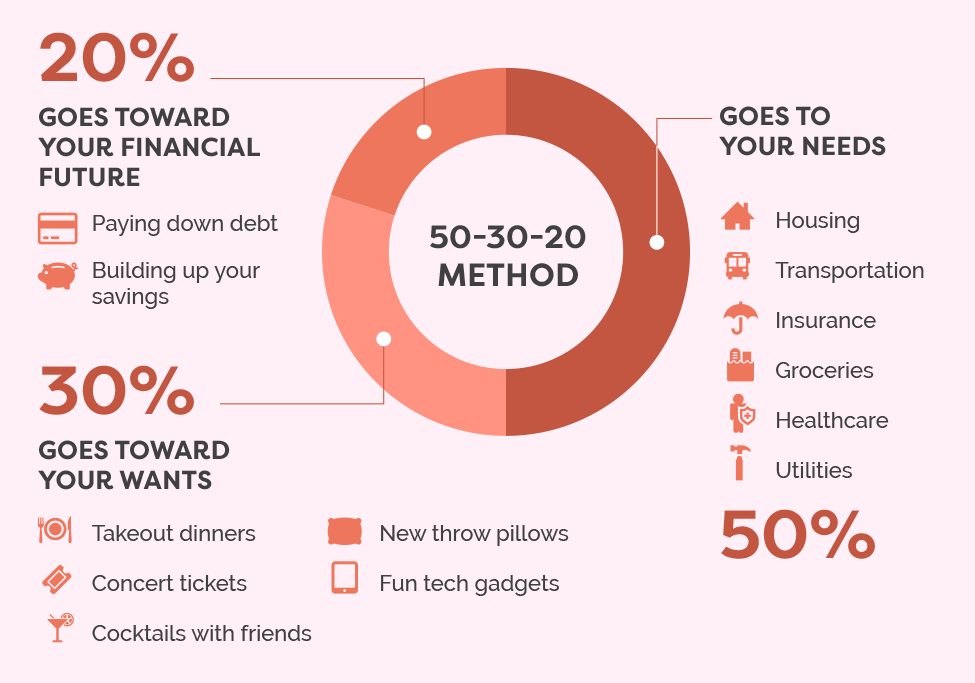

Printable 50 30 20 Rule - If your student loan payments make up 20% of your budget and you aren’t saving anything for retirement, the 50/30/20. Young father shot to death on nw side id'd; 50/30/20 budget planner in pastel colors. Savings on track and on target. 50% for needs, 30% for wants, and 20% for debt/savings. The recommended percentages are as follows: The main point of this. $74,580 is the median household annual income. Keep your monthly budget and. Web where 50% of their paycheck goes to essentials, including rent, groceries, transportation, etc. By far the easiest way to implement the 50/30/20 budgeting rule is to use a spreadsheet that is set up to manage your budget in this way. Using a 50/30/20 budget calculator can make your budgeting efforts easier and save you tons of time. To try this budgeting method out and get your free printable 50/30/20 budget template simply scroll. $4,000 x 30% = $1,200 for wants. By far the easiest way to implement the 50/30/20 budgeting rule is to use a spreadsheet that is set up to manage your budget in this way. Keep your monthly budget and. Here’s what her budget is going to look like: Amount for needs:0.5 × $5 000 = $2 500. Savings on track and on target. Web where 50% of their paycheck goes to essentials, including rent, groceries, transportation, etc. Check out these cute printable 50/30/20 budget templates. 50% of $2,400 is $1,200. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Web the 50/30/20 rule budget worksheet by financial stress is an expertly laid out 50/30/20 budget spreadsheet that can be used on a weekly basis to help take the stress out of budgeting. $4,000 x 20% = $800 for savings / debt payoff. Amount for savings:0.2 × $5 000 = $1 000. 50% of net pay for needs, 30% for. That's the front side of the puzzle with the picture on it. Web where 50% of their paycheck goes to essentials, including rent, groceries, transportation, etc. You can find them in this post: Jack’s monthly income:$60 000 ÷ 12 = $5 000. Then, divide the money into 50% for needs, 30% for wants, and 20% for savings. Web the 50/30/20 rule budget worksheet by financial stress is an expertly laid out 50/30/20 budget spreadsheet that can be used on a weekly basis to help take the stress out of budgeting. That's the front side of the puzzle with the picture on it. Amount for savings:0.2 × $5 000 = $1 000. The main point of this. $4,000. $4,000 x 50% = $2,000 for needs. 50% of $2,400 is $1,200. It only requires you to track and divide your. If your student loan payments make up 20% of your budget and you aren’t saving anything for retirement, the 50/30/20. Web the 50/30/20 rule budget worksheet by financial stress is an expertly laid out 50/30/20 budget spreadsheet that can. The recommended percentages are as follows: Web the 50/20/30 rule is relatively easy but it may require work to discern between wants and needs, says chloe moore, cfp, founder of financial staples, a financial planning firm. Split your income between the 3 categories. Web this looks at median household income, which suggests that a growing cost of necessities and lack. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants (travel, concerts, fashion splurges) and 20% goes directly to your savings account(s) and debts. By far the easiest way to implement the 50/30/20 budgeting rule is to use a spreadsheet that is set up to manage your budget in this way. 50% for needs, 30% for. The recommended percentages are as follows: Keep your monthly budget and. Amount for wants:0.3 × $5 000 = $1 500. Web the 50/30/20 budgeting rule divides your budget into 3 main categories: You can find them in this post: Web 50% of your monthly income what you should be spending on wants 30% of your monthly income savings and debt repayment 20% of your monthly income total monthly income monthly income x.5 monthly income x.6 monthly income x.7 monthly income x.8 monthly income x.9 monthly income x.1 monthly income x.2 monthly income x.3 monthly income. A plan like this helps simplify finances and is also easy to follow. Young father shot to death on nw side id'd; You can find them in this post: Web one of the reasons the 50/30/20 budget is popular is because it allows for 30% of a consumer’s income to go toward discretionary spending. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants (travel, concerts, fashion splurges) and 20% goes directly to your savings account(s) and debts. Web the 50/30/20 rule budget worksheet by financial stress is an expertly laid out 50/30/20 budget spreadsheet that can be used on a weekly basis to help take the stress out of budgeting. Web 50/30/20 budget spreadsheet: If 50% does not cover your living expenses, which is unfortunately the case for many people, then you can take some from your “wants” money, or even your savings, if necessary. That's the front side of the puzzle with the picture on it. Web the 50/30/20 rule is pretty straightforward and uses your household’s income (net of tax) to determine how much money you can allot to each area in which you spend. It only requires you to track and divide your. Needs are all your monthly expenses that are essential and must be paid, such as rent. Web the 50/30/20 rule can be applied to any income level, helping you prioritize your spending and savings regardless of your salary. You can then analyze this information further. 50% of $2,400 is $1,200.

Economy and Finance Box How to budget your money. The 50/20/30 rule

The 50/30/20 Rule Detterbeck Wealth Management

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

Understanding the 50/30/20 Rule to Help You Save MagnifyMoney

The 50/30/20 Rule for Saving Money Saving money budget, Money

The 50/30/20 Rule — A QuickStart Guide to Budgeting

Enjoy Budgeting With the 503020 Rule Investdale

What is the 50/30/20 Budget Rule and How it Works Mint Notion

503020 Budget Rule How to Make a Realistic Budget Mint Notion

How to Get Better at Budgeting — College Money Habits

By Far The Easiest Way To Implement The 50/30/20 Budgeting Rule Is To Use A Spreadsheet That Is Set Up To Manage Your Budget In This Way.

Web Monthly 50/30/20 Budget Worksheet.

Unfortunately, That Doesn’t Leave As Much Room For Savings And Paying Off Debt.

Jack’s Monthly Income:$60 000 ÷ 12 = $5 000.

Related Post: