Printable 1099 Tax Form

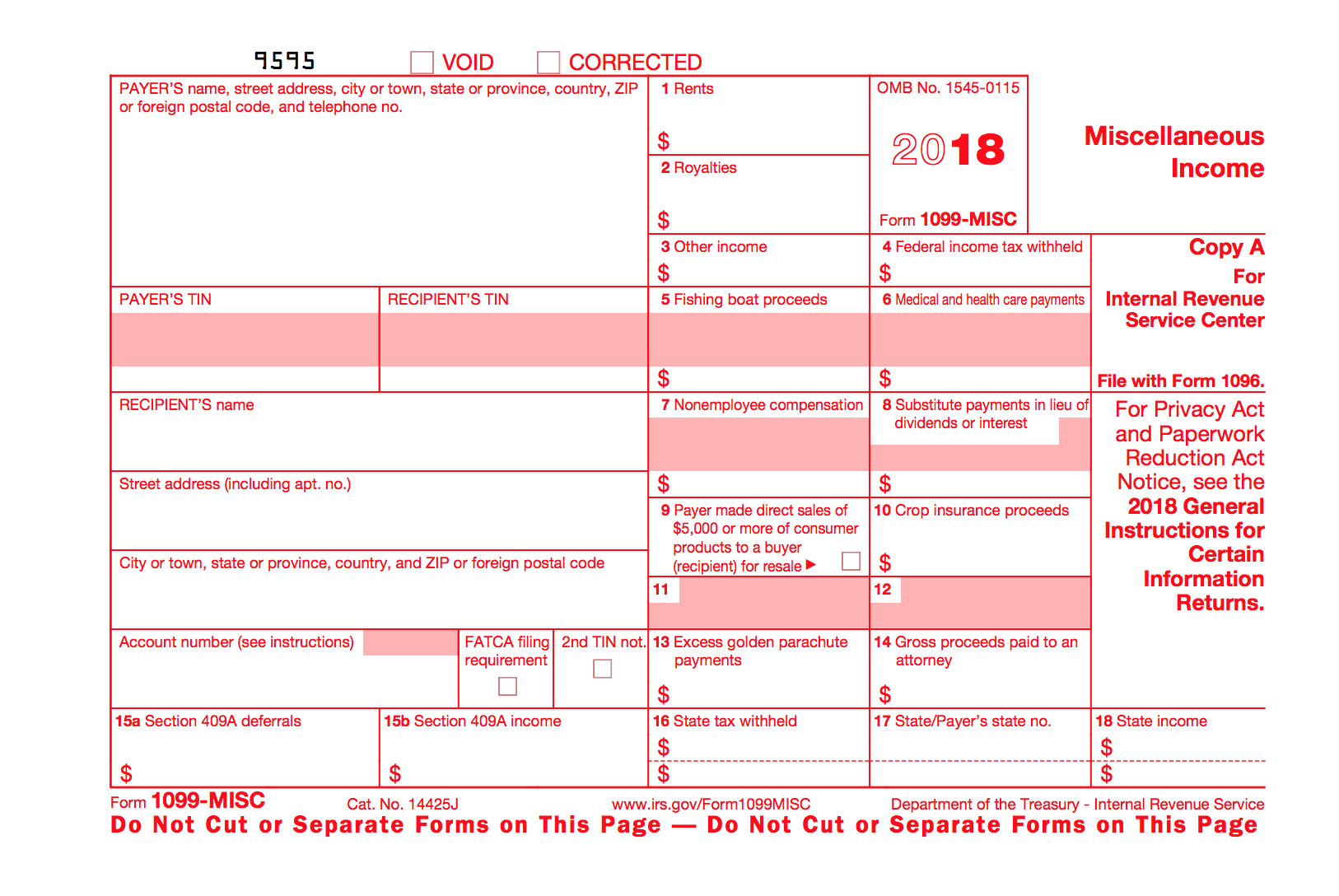

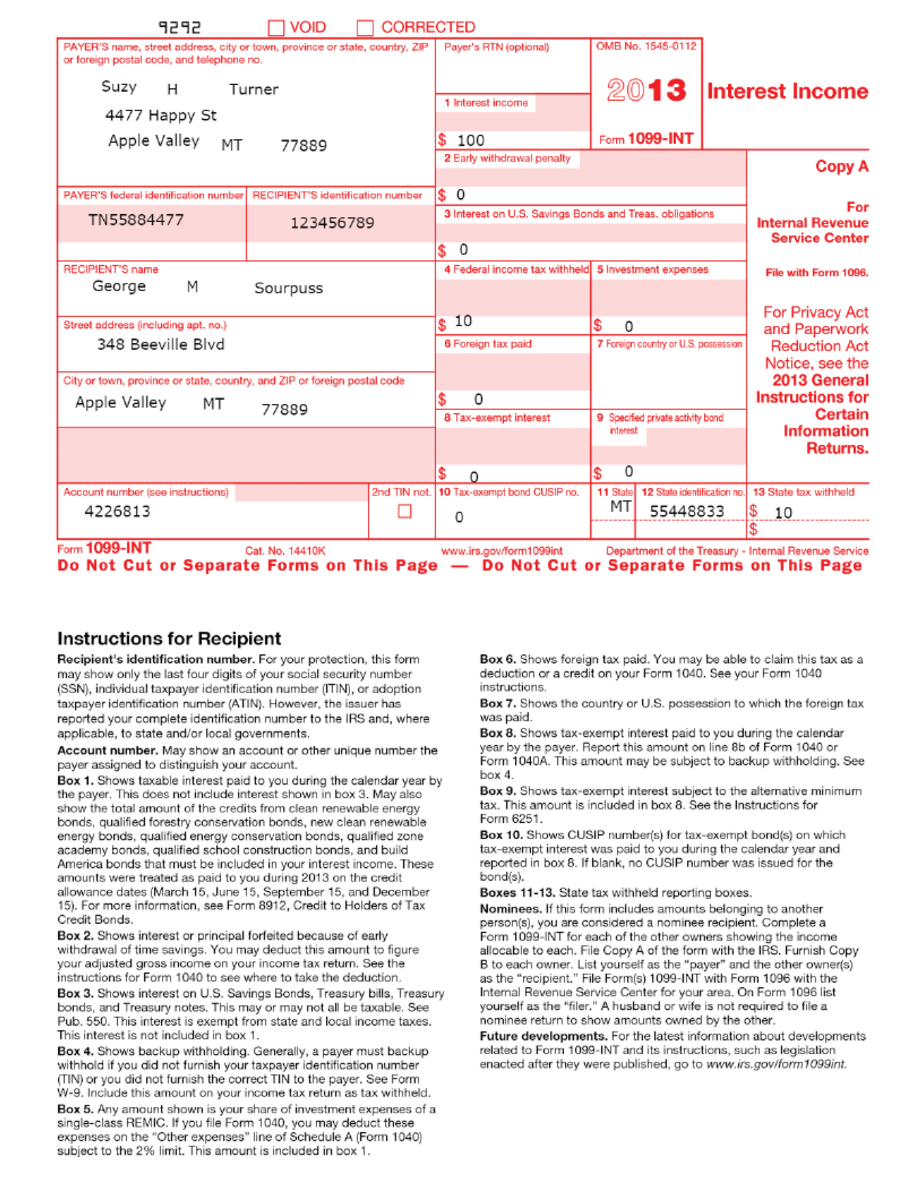

Printable 1099 Tax Form - *the featured form (2022 version) is the current version for all succeeding years. Learn how to download, print, and file this form, and what to do if it is incorrect or in error. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Written by sara hostelley | reviewed by brooke davis. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. There are various types of 1099s, depending on the type of income in question. The list of payments that require a business to file a. Used for the 2021 tax year only. Find out who gets a 1099, when to file, and how to get paper copies. What it is, how it works. 1099 forms can report different types of incomes. Learn how to download, print, and file this form, and what to do if it is incorrect or in error. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Download your 1099 or 1042s tax form in your social security account. How to file. 1099 forms can report different types of incomes. Download your 1099 or 1042s tax form in your social security account. *the featured form (2022 version) is the current version for all succeeding years. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. These can include payments. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Fill out a 1099 form. 1099 forms can report different types of incomes. Used for the 2021 tax year only. Fast shippingread ratings & reviewsshop our huge selectionexplore amazon devices Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. The 1099 form is a common irs form covering several potentially taxable income situations. Find out who gets a 1099, when to file, and how to get paper copies. Web download a copy of your 1099 or 1042s tax. Sign in to your account. Fill out a 1099 form. 1099 forms can report different types of incomes. Written by sara hostelley | reviewed by brooke davis. The 1099 form is a common irs form covering several potentially taxable income situations. Fill out a 1099 form. Who gets a 1099 form? Web 10 or more returns: Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. File to download or integrate. Web 10 or more returns: Learn how to download, print, and file this form, and what to do if it is incorrect or in error. Who gets a 1099 form? The list of payments that require a business to file a. There are various types of 1099s, depending on the type of income in question. The list of payments that require a business to file a. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Download your 1099 or 1042s tax form in your social security account. These can include payments to independent contractors, gambling winnings, rents,. How to file a. Find out where to order printable 1099 forms, how to print from pdf or spreadsheet, and what software to use. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Most people get a copy in the mail. 1099 forms can report different types of incomes. Your 2023 tax form will be available. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Most people get a copy in the mail. The list of payments that require a business to file a. Learn how to fill out, file, and report different types of payments on this form. Web a 1099 form is. Most people get a copy in the mail. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Find out who gets a 1099, when to file, and how to get paper copies. What it is, how it works. Fill out a 1099 form. Learn how to download, print, and file this form, and what to do if it is incorrect or in error. Sign in to your account. File to download or integrate. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Your 2023 tax form will be available online on february 1, 2024. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or. The 1099 form is a common irs form covering several potentially taxable income situations. Written by sara hostelley | reviewed by brooke davis. Used for the 2021 tax year only. The list of payments that require a business to file a. Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.Tax Form 1099MISC Instructions How to Fill It Out Tipalti

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

Free Printable 1099 Tax Form Universal Network

What is a 1099Misc Form? Financial Strategy Center

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

How to Print and File 1099MISC, Miscellaneous

1099 Form Template. Create A Free 1099 Form Form.

Free Printable Irs 1099 Misc Form Printable Forms Free Online

1099MISC 3Part Continuous 1" Wide Formstax

How to Fill Out and Print 1099 MISC Forms

1099 Forms Can Report Different Types Of Incomes.

There Are Various Types Of 1099S, Depending On The Type Of Income In Question.

Starting Tax Year 2023, If You Have 10 Or More Information Returns, You Must File Them Electronically.

These Can Include Payments To Independent Contractors, Gambling Winnings, Rents,.

Related Post: