Printable 1099 Misc

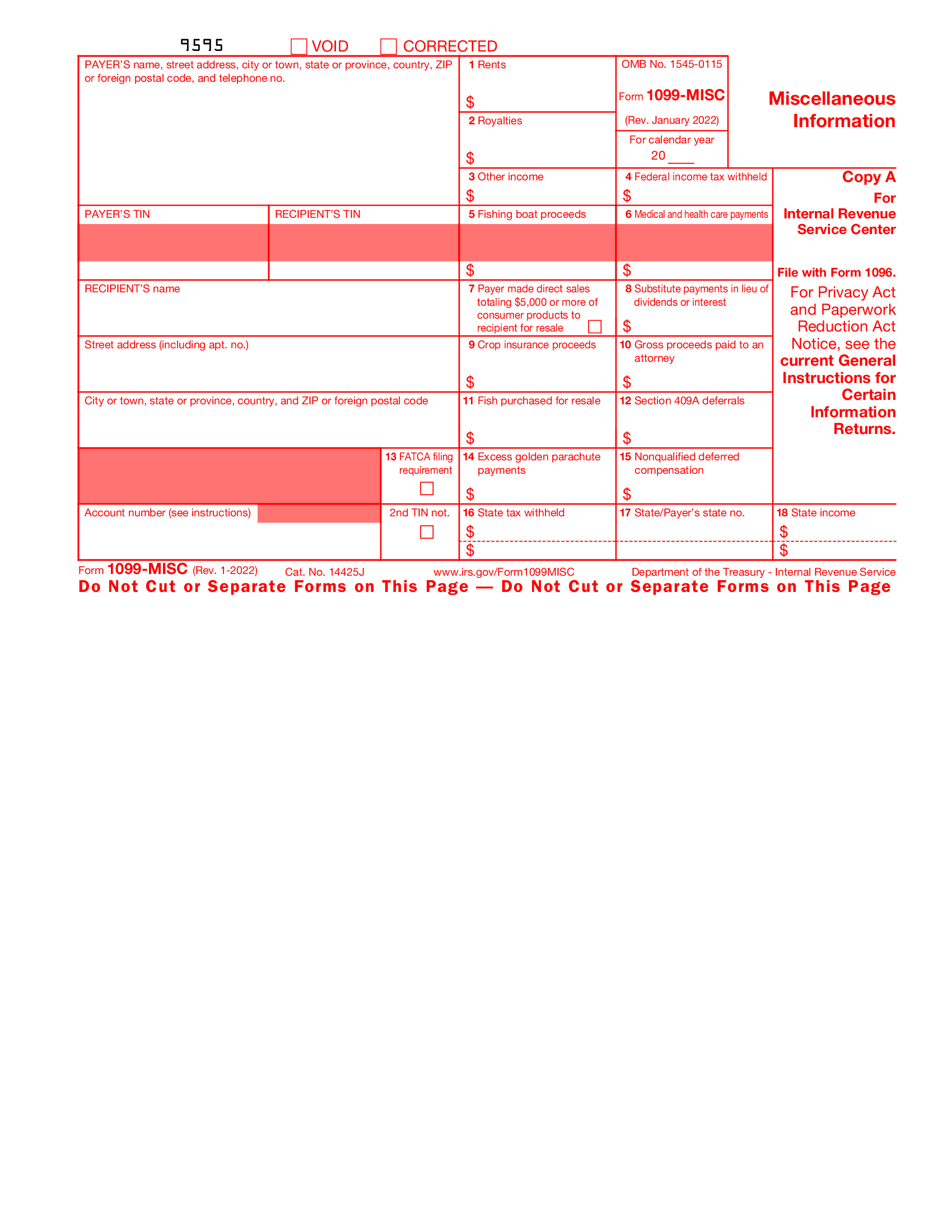

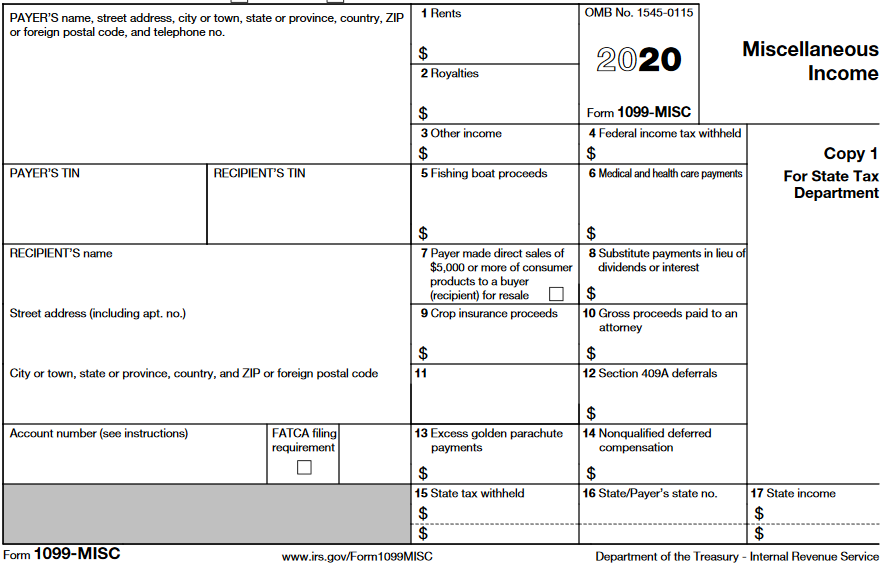

Printable 1099 Misc - However, the payer has reported your complete tin to the irs. The first four types of 1099 forms involve investment income, while the rest cover income derived from rents, royalties, and. A 1099 form is a record that an entity or person other than your employer gave or paid you money. Their full legal name and address. Web page last reviewed or updated: How to print 1099s from a pdf. Gather information for all of your payees. The treatment of amounts reported on this form generally depends upon which box of the form the income is reported in. Businesses and individuals making payments to other businesses or individuals may be required to issue a 1099 so that those payments. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. What it is, how it works. Where to order printable 1099 forms. A 1099 form is a record that an entity or person other than your employer gave or paid you money. The payer fills out the 1099 and sends copies to you and the irs. Section references are to the internal revenue code unless otherwise noted. Gather information for all of your payees. How to print 1099s from a spreadsheet. What is a 1099 form used for? The official printed version of copy a of this irs form is scannable, but the online version of. How to print 1099s from a pdf. The official printed version of copy a of this irs form is scannable, but the online version of. What is a 1099 form used for? What it is, how it works. Can you print 1099s on plain paper? When and where to file. How to print 1099s from a spreadsheet. Printing 1099s from sage 50. What it is, how it works. If someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in. Web for your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin),. Web page last reviewed or updated: How to print 1099s from a spreadsheet. Web for your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Copy a of this form is provided for informational purposes only. If someone. Copy a of this form is provided for informational purposes only. Businesses and individuals making payments to other businesses or individuals may be required to issue a 1099 so that those payments. Printing 1099s from sage 50. Web for your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Printing 1099s from sage 50. If someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in. The first four types of 1099 forms involve investment income, while the rest cover income derived from rents,. Web for your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). When and where to file. A 1099 form is a record that an entity or person other than your employer gave or paid you money. Receipts,. Copy a of this form is provided for informational purposes only. A 1099 form is a record that an entity or person other than your employer gave or paid you money. What to do before you print your 1099s. The payer fills out the 1099 and sends copies to you and the irs. Quick & secure online filing. Businesses and individuals making payments to other businesses or individuals may be required to issue a 1099 so that those payments. Their full legal name and address. When and where to file. How to print 1099s from quickbooks. If someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in. The first four types of 1099 forms involve investment income, while the rest cover income derived from rents, royalties, and. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Copy a appears in red, similar to the official irs form. Until 2020, it also was used to. Receipts, invoices and any other payment information. How to print 1099s from a pdf. Web what is a 1099? January 2024) miscellaneous information and nonemployee compensation. How to print 1099s from quickbooks. The official printed version of copy a of this irs form is scannable, but the online version of. Web for your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). When and where to file. When should you print and send your 1099s? Pricing starts as low as $2.75/form. What is a 1099 form used for? Gather information for all of your payees.

How to Print and File 1099MISC, Miscellaneous

How to Fill Out and Print 1099 MISC Forms

Fillable 1099 Misc Irs 2022 Fillable Form 2024

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

What is a 1099Misc Form? Financial Strategy Center

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

Printable 1099 Misc Tax Form Template Printable Templates

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Your Ultimate Guide to 1099MISC

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Web Page Last Reviewed Or Updated:

Copy A Of This Form Is Provided For Informational Purposes Only.

The Treatment Of Amounts Reported On This Form Generally Depends Upon Which Box Of The Form The Income Is Reported In.

What To Do Before You Print Your 1099S.

Related Post: