Printable 1096 Form

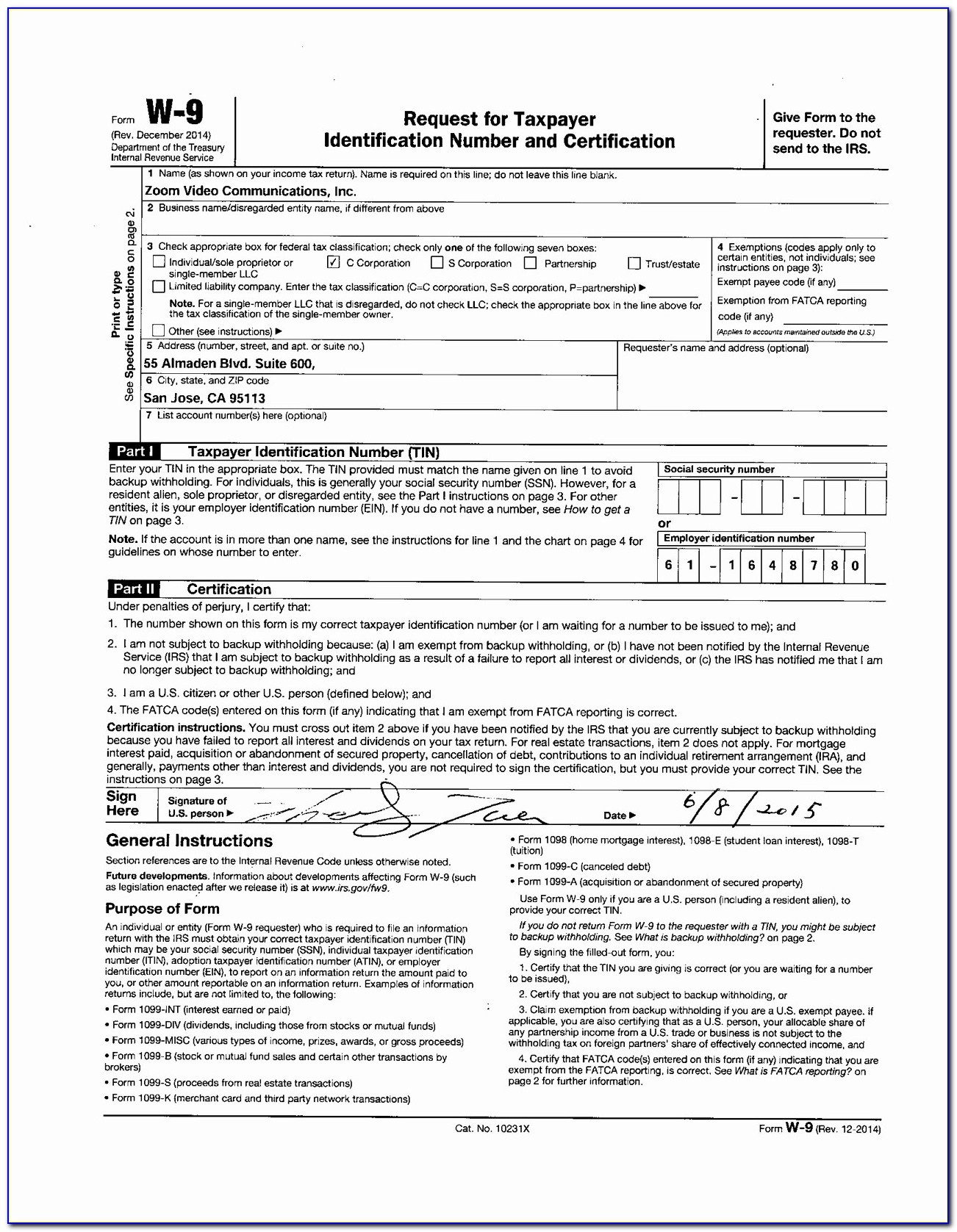

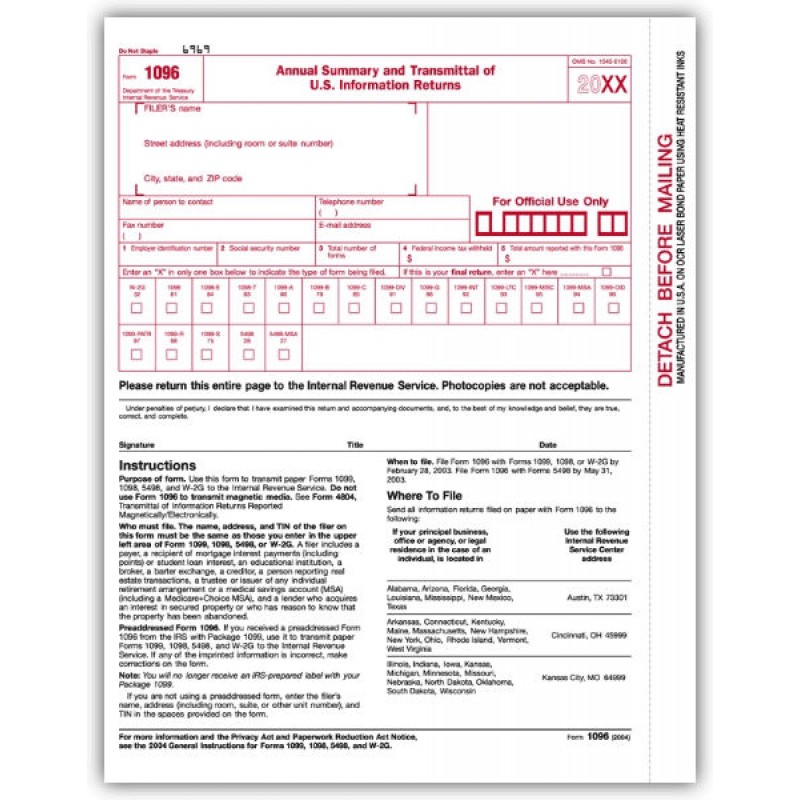

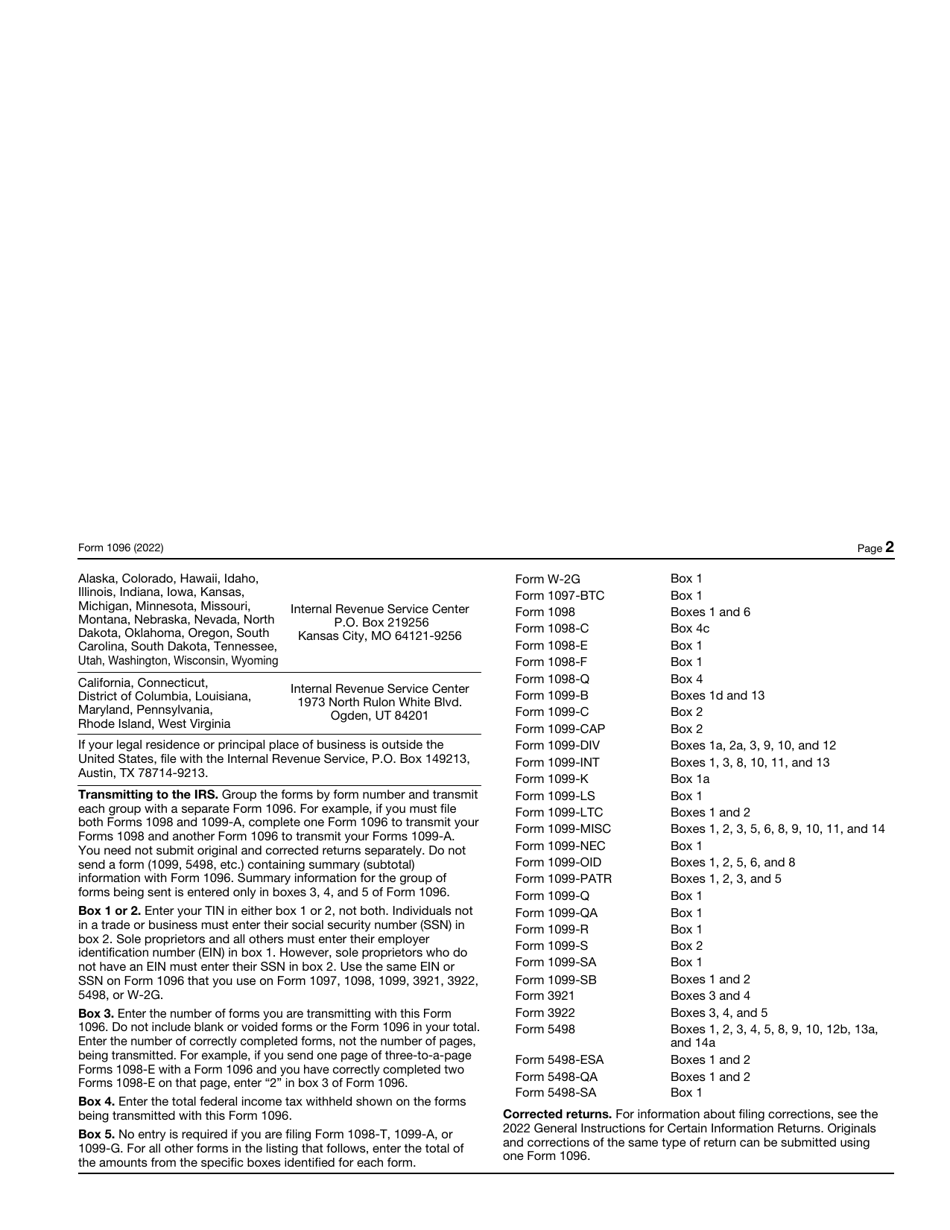

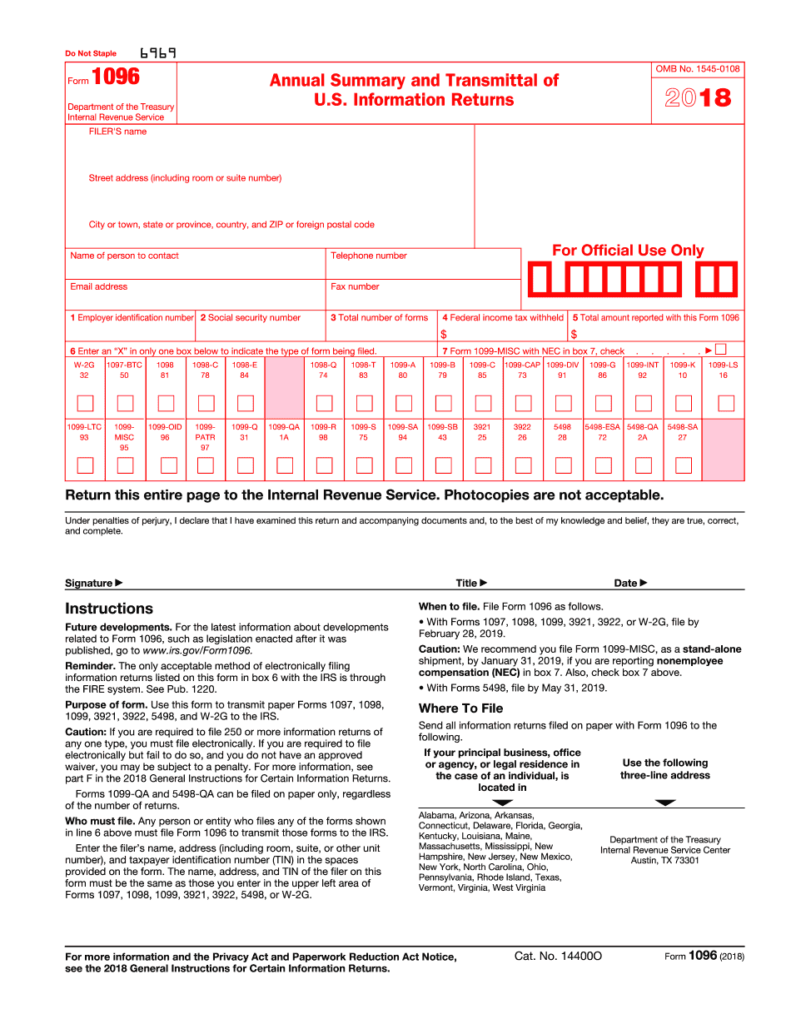

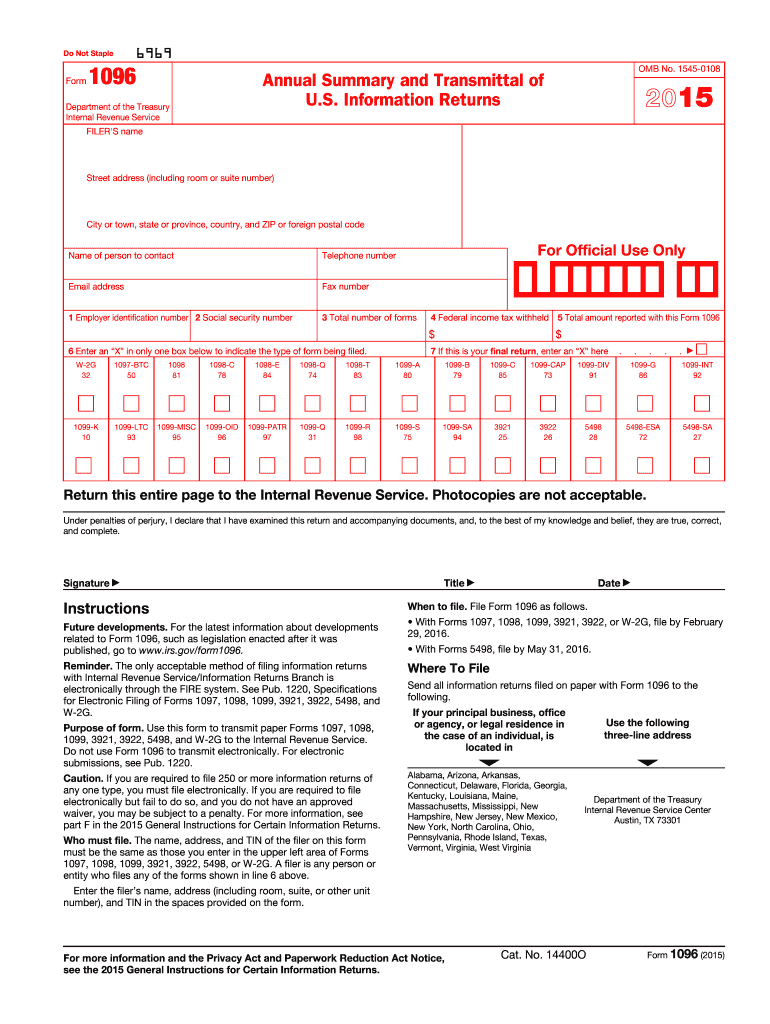

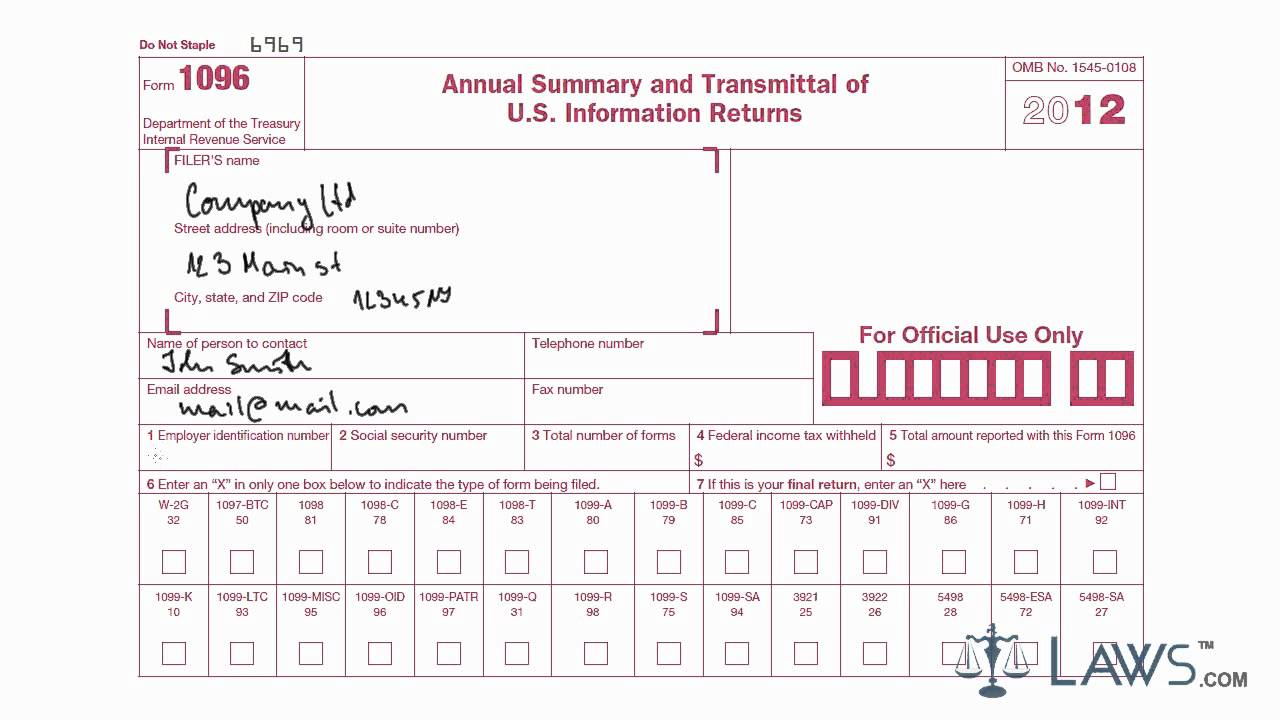

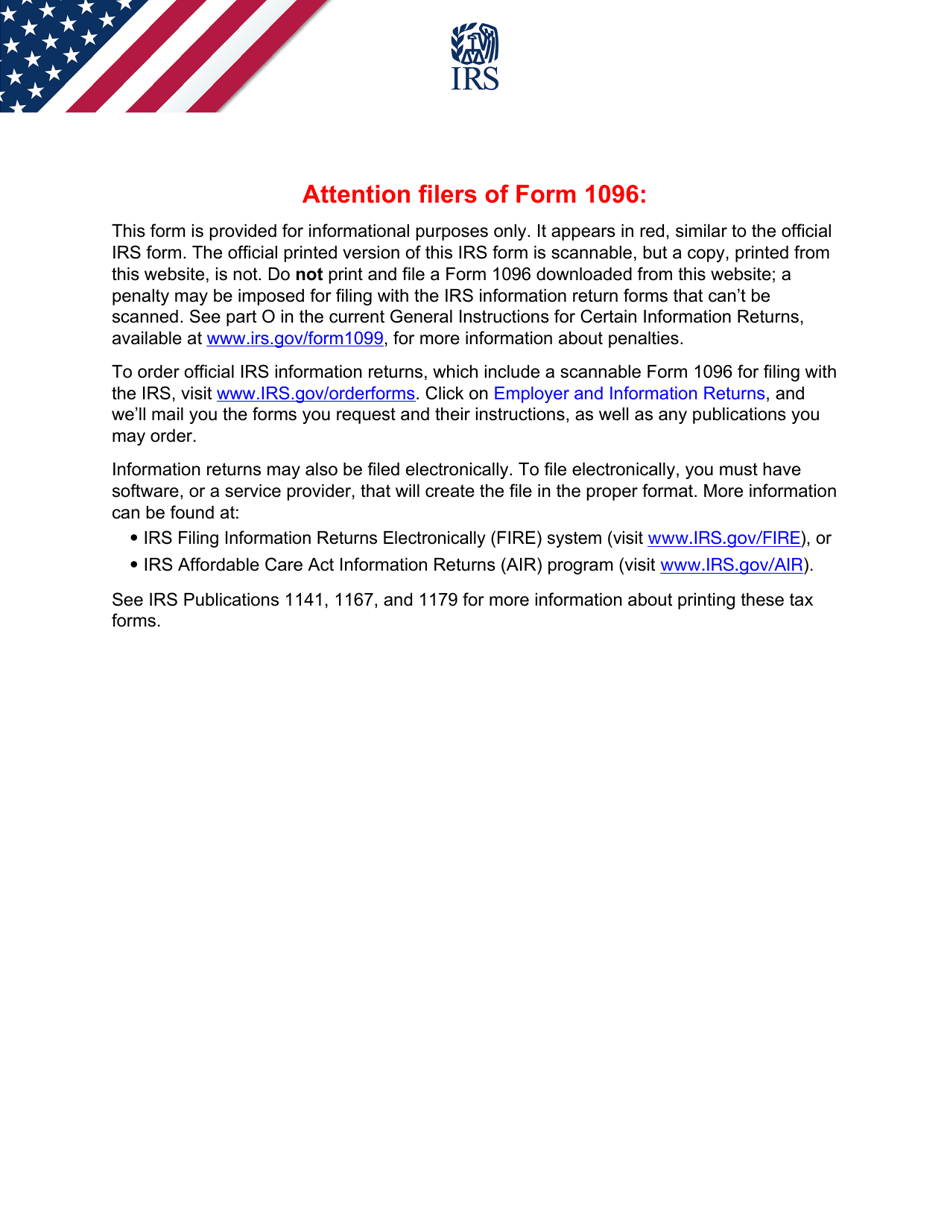

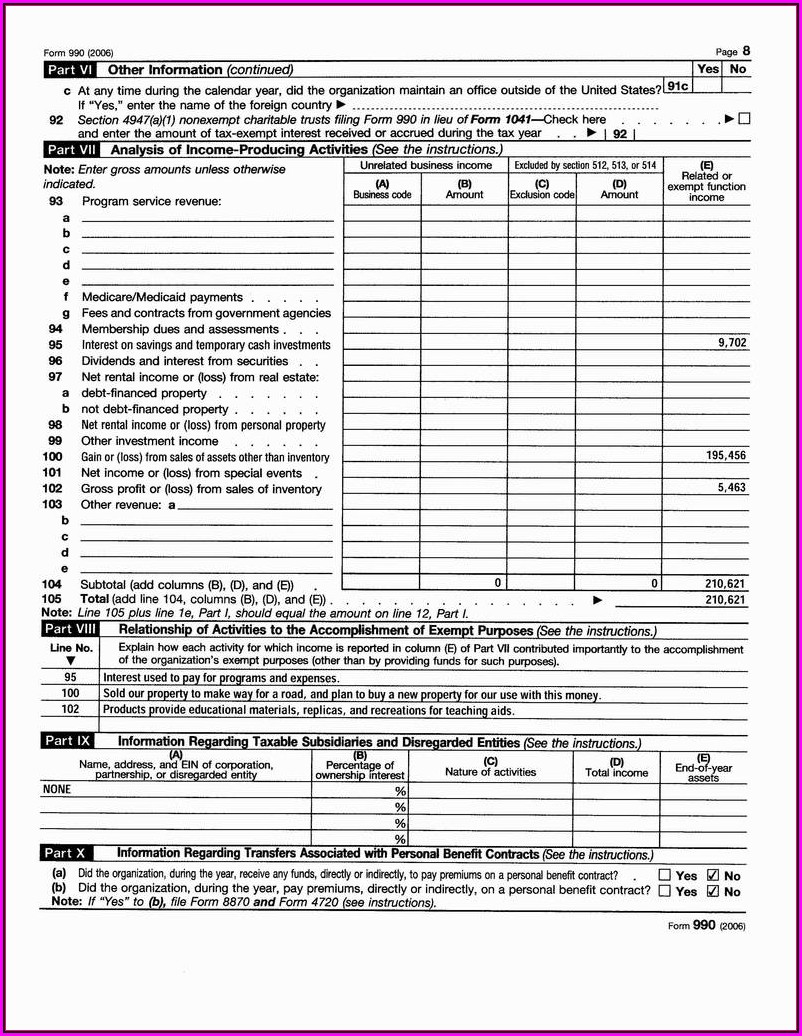

Printable 1096 Form - Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. It appears in red, similar to the official irs form. Attention filers of form 1096: This form will require the personal information for the filer. This form is provided for informational purposes only. Web solved•by quickbooks•1331•updated january 12, 2024. You may reach out to the irs to get this form or manually download the form 1096 from their site. This form is provided for informational purposes only. Information returns in january 2024, so this is the latest version of form 1096, fully updated for tax year 2023. We last updated the annual summary and transmittal of u.s. Importance of filing form 1096 : It appears in red, similar to the official irs form. Web printing and filling out your form 1096 is unavailable in quickbooks online (qbo) and quickbooks contractor payments since qbo doesn't provide form 1096 complying with irs guidelines. Office of the comptroller of the currency forms. Web solved•by quickbooks•1331•updated january 12, 2024. Treasury international capital (tic) forms and instructions. It appears in red, similar to the official irs form. Efilers, select “print onto a blank sheet” to create electronic or hard copies for your records. This form is provided for informational purposes only. To ensure irs compliance, these printouts are watermarked and not suitable for filing to the irs or ssa. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Attention filers of form 1096: Attention filers of form 1096: It appears in red, similar to the official irs form. To ensure irs compliance, these printouts are watermarked and not suitable for filing to the irs or ssa. It appears in red, similar to the official irs form. Web form 1096 is used when you're submitting paper 1099 forms to the irs. Web where to get form 1096. It is submitted as an accompanying. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Web a form 1096 is also known as an annual summary and transmittal of u.s. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. This form is provided for informational purposes only. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Attention filers of form 1096: Web solved•by quickbooks•1331•updated january 12, 2024. Web form 1096 is used when you're submitting paper 1099 forms. We last updated the annual summary and transmittal of u.s. It is submitted as an accompanying. Attention filers of form 1096: Information returns, including recent updates, related forms and instructions on how to file. Attention filers of form 1096: Attention filers of form 1096: This form is provided for informational purposes only. Anyone issuing 1099s and related forms must file form 1096 with the irs to comply with tax regulations,. It appears in red, similar to the official irs form. It appears in red, similar to the official irs form. Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. Web savings bonds and treasury securities forms. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. It appears in red, similar to the official irs form. The official. Attention filers of form 1096: This form will require the personal information for the filer. This form is provided for informational purposes only. Web information about form 1096, annual summary and transmittal of u.s. Information returns, including recent updates, related forms and instructions on how to file. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Web form 1096 as a summary document: Treasury international capital (tic) forms and instructions. To ensure irs compliance, these printouts are watermarked and not suitable for filing to the irs or ssa. Importance of filing form 1096 : You cannot download this document from the irs website. Information returns, including recent updates, related forms and instructions on how to file. Can i download a 1096 form? Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. This form is provided for informational purposes only. Web where to get form 1096. It appears in red, similar to the official irs form. Anyone issuing 1099s and related forms must file form 1096 with the irs to comply with tax regulations,. If you are filing electronically, form 1096 isn't required by the irs. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Web more about the federal form 1096 corporate income tax ty 2023.

Free irs form 1096 template tapase

Irs 1096 Printable Form Printable Forms Free Online

1096 IRS PDF Fillable Template 2023, USA Tax Form for 2023 Filing

IRS Form 1096 Download Printable PDF or Fill Online Annual Summary and

2018 2019 IRS Form 1096 Editable Online Blank In PDF Printable Form 2021

1096 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Learn How to Fill the Form 1096 Annual Summary And Transmittal Of U.S

Cómo llenar el Formulario 1096. Guía 2022 paso a paso

IRS Form 1096 Download Printable PDF or Fill Online Annual Summary and

1096 template for preprinted forms 2018 Tracsc

Information Returns In January 2024, So This Is The Latest Version Of Form 1096, Fully Updated For Tax Year 2023.

Web Solved•By Quickbooks•1331•Updated January 12, 2024.

This Form Is Provided For Informational Purposes Only.

It Appears In Red, Similar To The Official Irs Form.

Related Post: