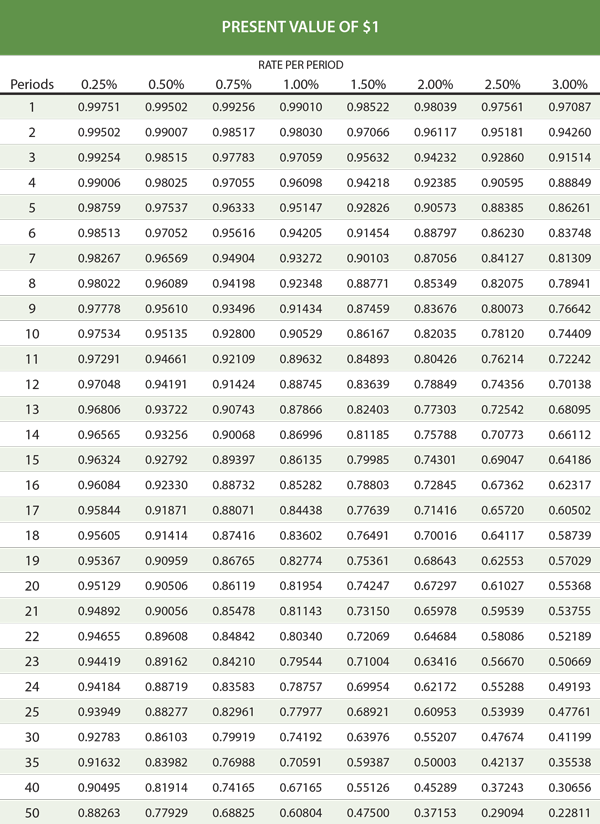

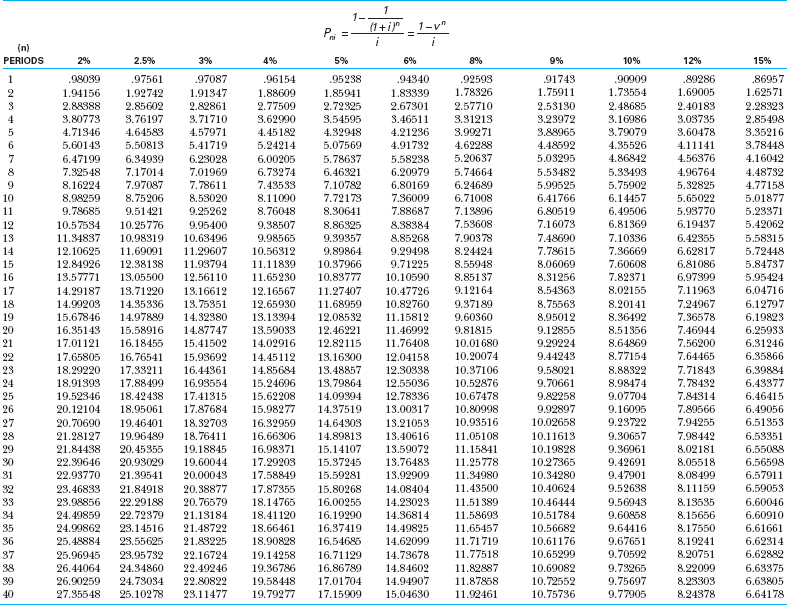

Present Value Chart 1

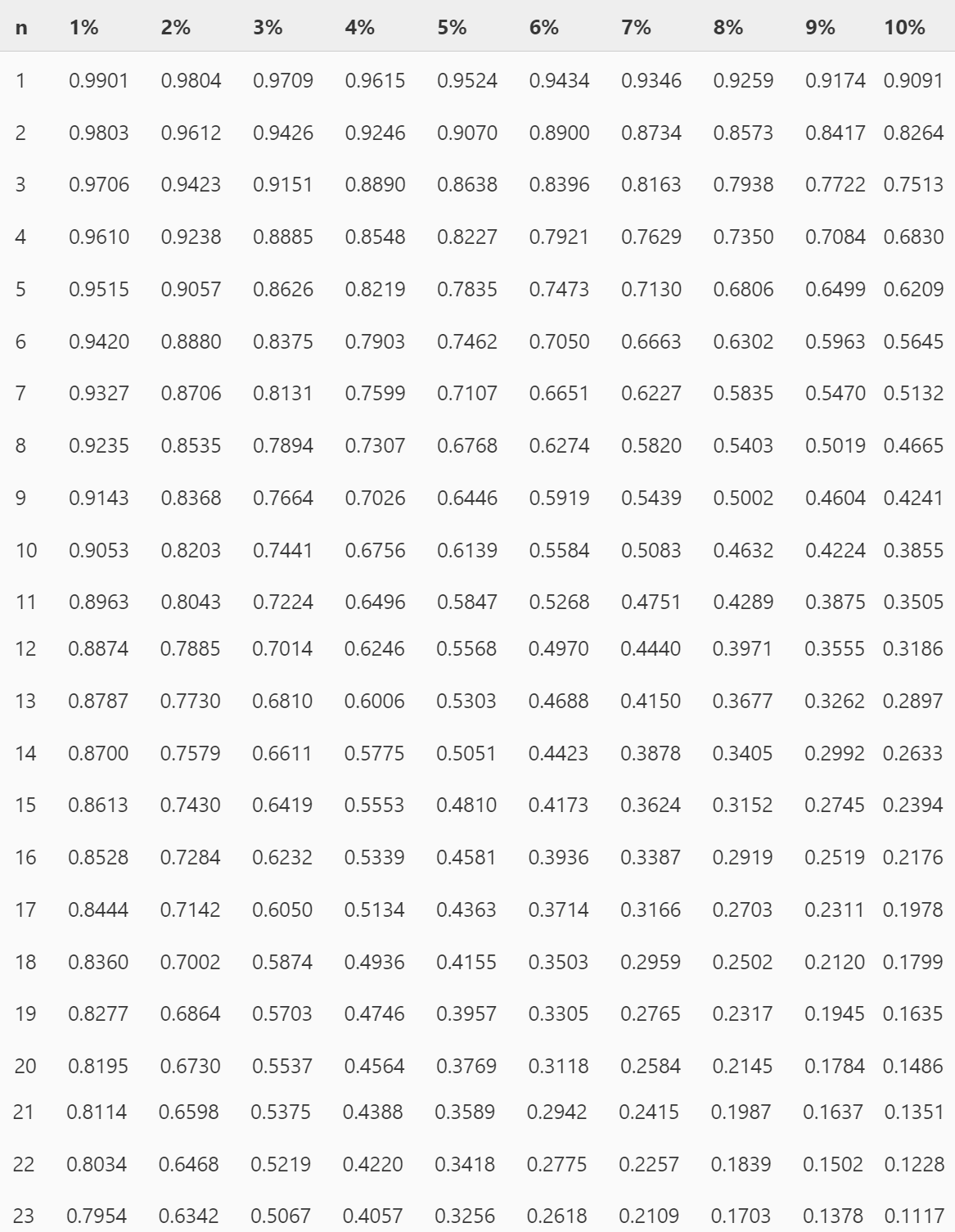

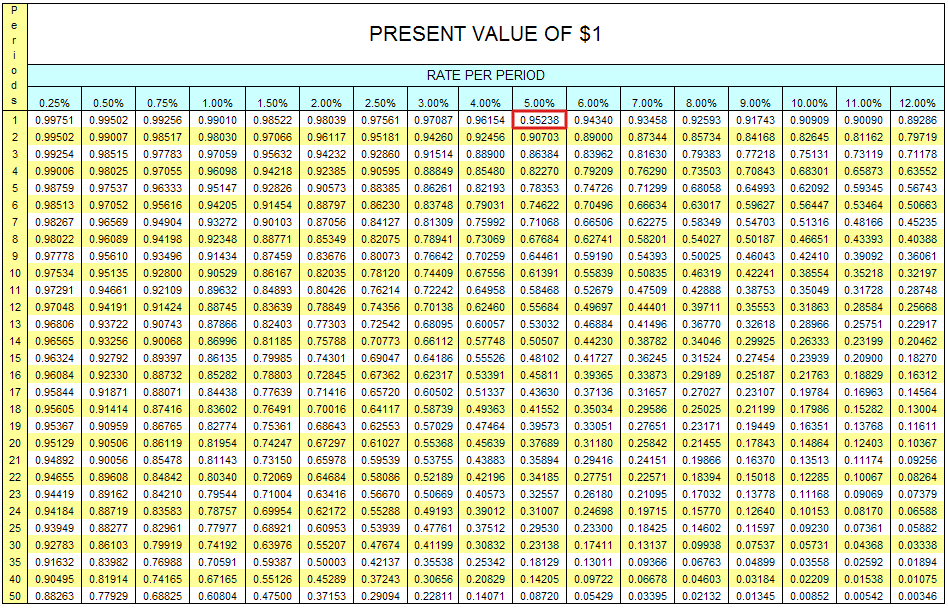

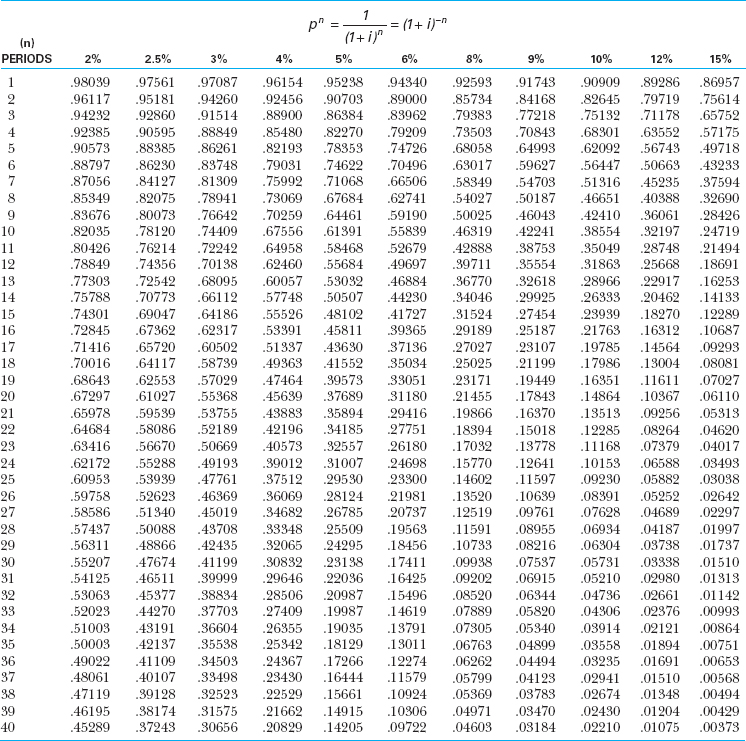

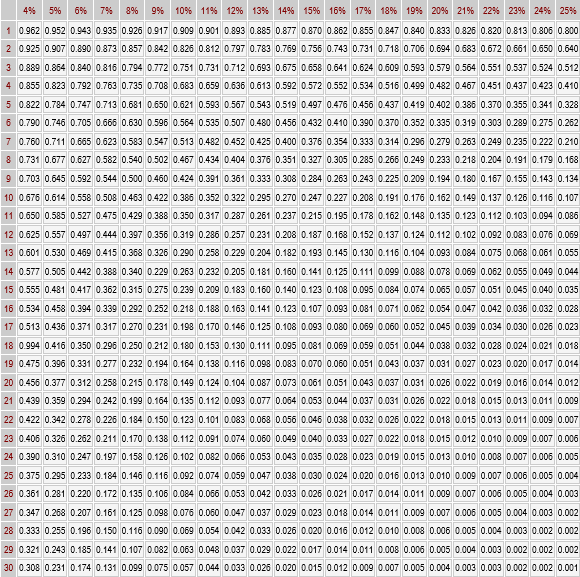

Present Value Chart 1 - In other words, it is a table. Present value helps compare money received today to money received in the future. Thanks to this formula, you can estimate the present value of an income. Present value (pv) is the current value of an expected future stream of cash flow. Web what is a present value of 1 table? P = the present value of the annuity stream to be. Web pv = $570 / (1+0. Where fv is the future value, r is the required rate of return, and n is the number of time periods. Web the formula for this is: Web a present value (pv) chart is a graphical representation used in finance to illustrate the present value of future cash flows or investments over time. Period $0 $250 $500 $750 $1k $1.25k 0 5 10 accumulated deposits accumulated interest. Present value, or pv, is defined as the. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value divided by the sum of 1 plus interest rate per period raised to. Present value (pv) is the current. 15 = $495.65 (to nearest cent) or what if you don't get the money for 3 years example: What is $570 in 3 years worth now, at an interest rate of. A present value of 1 table states the discount rates that are used for various combinations of and time periods. The video explains the concept of present value in. Web a present value (pv) chart is a graphical representation used in finance to illustrate the present value of future cash flows or investments over time. Web the formula for this is: N/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 1. A present value table is a tool that. Web the present value formula is pv=fv/(1+i) n, where you divide the future value fv by a factor of 1 + i for each period between present and future dates. Web updated january 9, 2021. In other words, it is a table. Where fv is the future value, r is the required rate of return, and n is the number. Web present value tables present value of one dollar period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980. What is $570 in 3 years worth now, at an interest rate of. A present value of 1 table states the discount rates that are used for. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value divided by the sum of 1 plus interest rate per period raised to. A present value table is a tool that helps analysts calculate the pv of an amount of money by multiplying it by a coefficient found on the table.. A present value of 1 table states the discount rates that are used for various combinations of and time periods. Web the formula for this is: 15) 1 = $570 / 1. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value divided by the sum of 1 plus interest rate. Web table 2 present value of $1. P = the present value of the annuity stream to be. A present value table is a tool that helps analysts calculate the pv of an amount of money by multiplying it by a coefficient found on the table. Web the present value formula is pv=fv/(1+i) n, where you divide the future value. Present value helps compare money received today to money received in the future. Web table 2 present value of $1. Web pv = $570 / (1+0. N/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 1. Web the formula for calculating the present value of an ordinary annuity is: 15) 1 = $570 / 1. Web the formula for this is: Web the present value formula is pv=fv/(1+i) n, where you divide the future value fv by a factor of 1 + i for each period between present and future dates. Present value helps compare money received today to money received in the future. Web pv = fv /. 15) 1 = $570 / 1. 15 = $495.65 (to nearest cent) or what if you don't get the money for 3 years example: Present value, or pv, is defined as the. Web present value (pv) = $10,000 ÷ (1 + 12%)^(2 × 1) = $7,972 thus, the $10,000 cash flow in two years is worth $7,972 on the present date, with the downward. Web what is a present value of 1 table? Web pv = fv / (1 + r) where: In other words, it is a table. Present value helps compare money received today to money received in the future. Web updated january 9, 2021. Web the formula for calculating the present value of an ordinary annuity is: The video explains the concept of present value in finance. Web a present value (pv) chart is a graphical representation used in finance to illustrate the present value of future cash flows or investments over time. A present value table is a tool that helps analysts calculate the pv of an amount of money by multiplying it by a coefficient found on the table. P = the present value of the annuity stream to be. A present value of 1 table states the discount rates that are used for various combinations of and time periods. Present value (pv) is the current value of an expected future stream of cash flow.Present Value Tables PDF

Present Value of 1 Table PVIF Printable and Excel Template

Present Value Chart PDF Present Value Mathematical Finance

What is a Present Value Table? Definition Meaning Example

Present Value Tables Double Entry Bookkeeping

Present Value Of 1 Annuity Table Pdf Tutor Suhu

Present value of 1 table Accounting for Management

Present Value Table.pdf Present Value Mathematical Finance

Present Value of 1

Present Value Of 1 Annuity Table Pdf Tutor Suhu

Web In An Effort To Help You Find Trades That Could Improve Your Fantasy Team, We Present The Dynasty Trade Value Chart.you Can Use This Chart To Compare Players And.

Web The Present Value Formula Pv = Fv/ (1+I)^N States That Present Value Is Equal To The Future Value Divided By The Sum Of 1 Plus Interest Rate Per Period Raised To.

Period $0 $250 $500 $750 $1K $1.25K 0 5 10 Accumulated Deposits Accumulated Interest.

Present Value = Fv/ (1 + R)N.

Related Post: