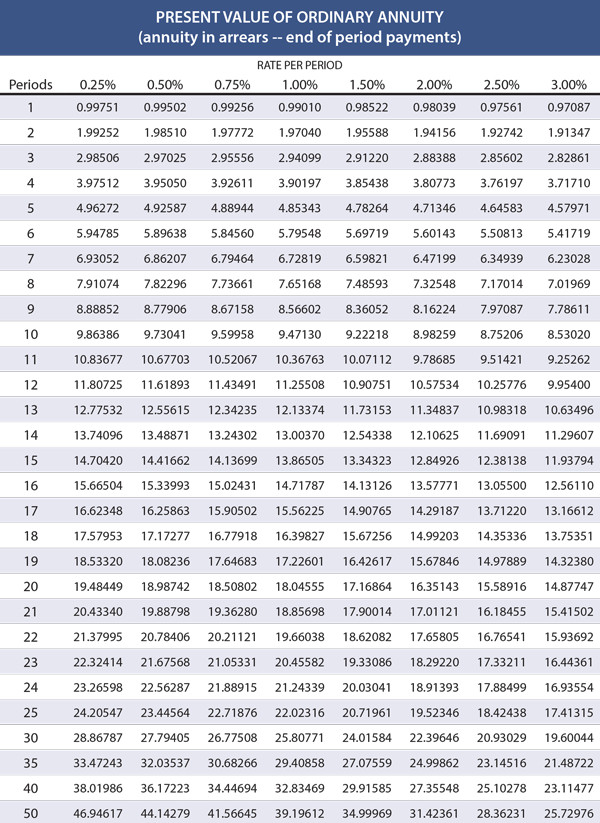

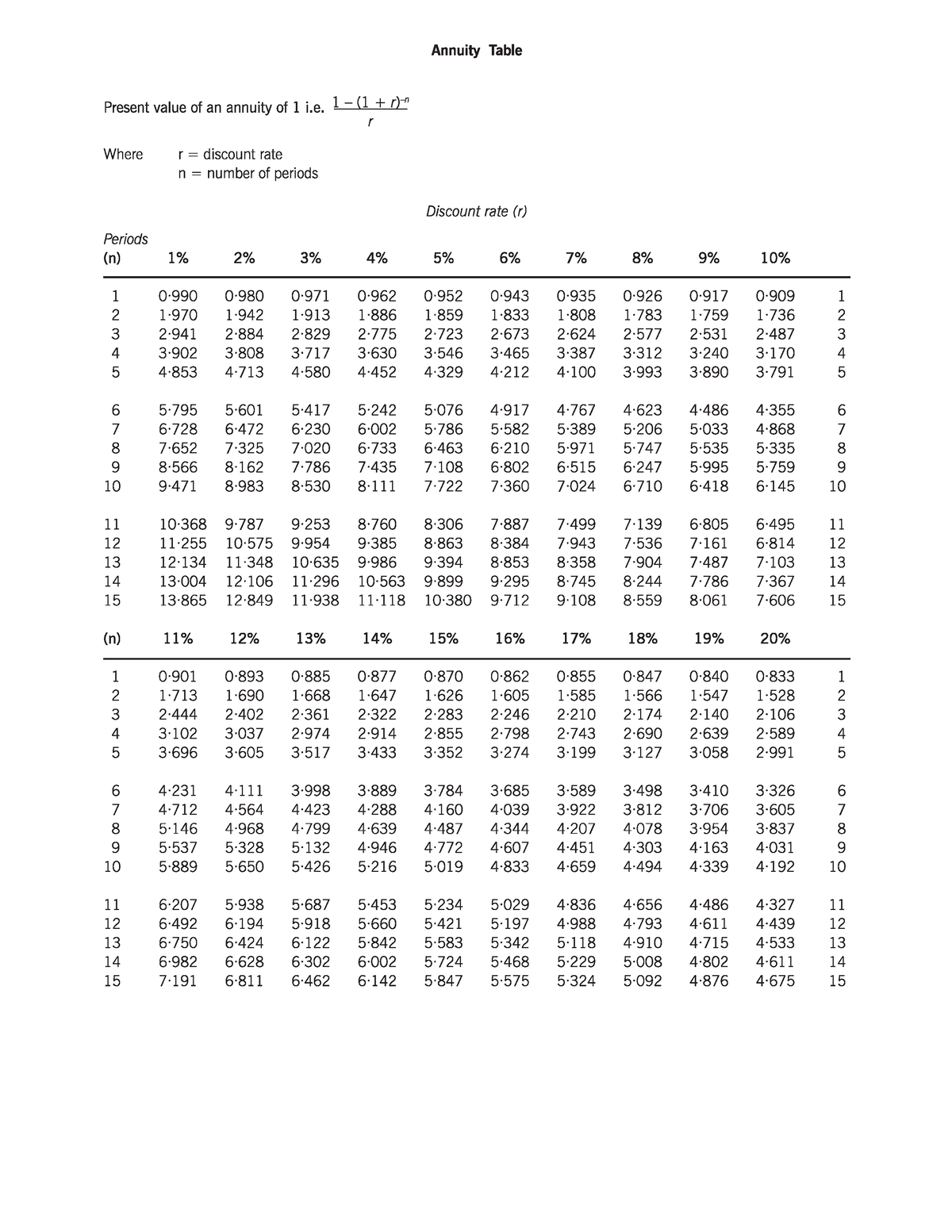

Present Value Annuity Chart

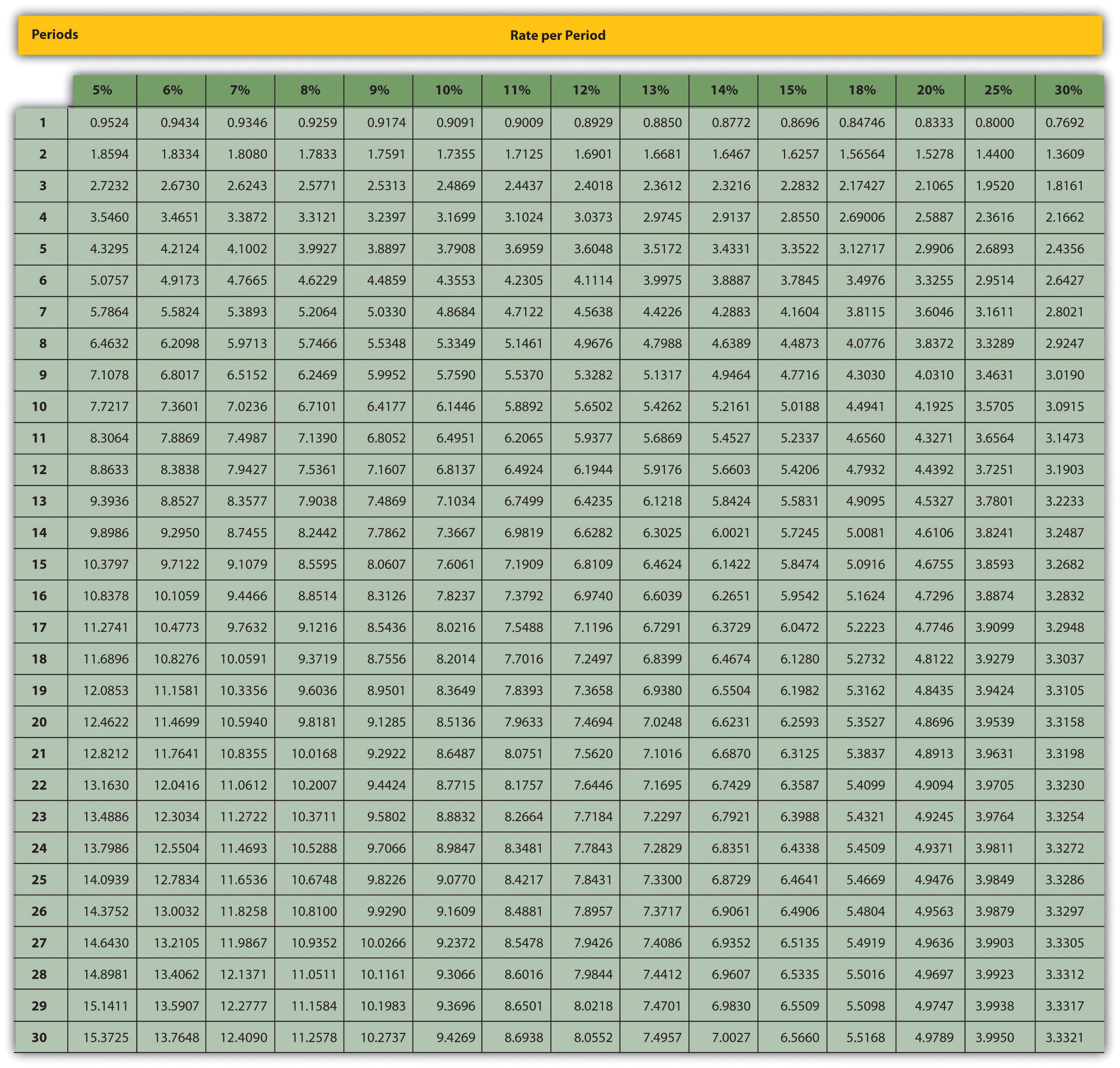

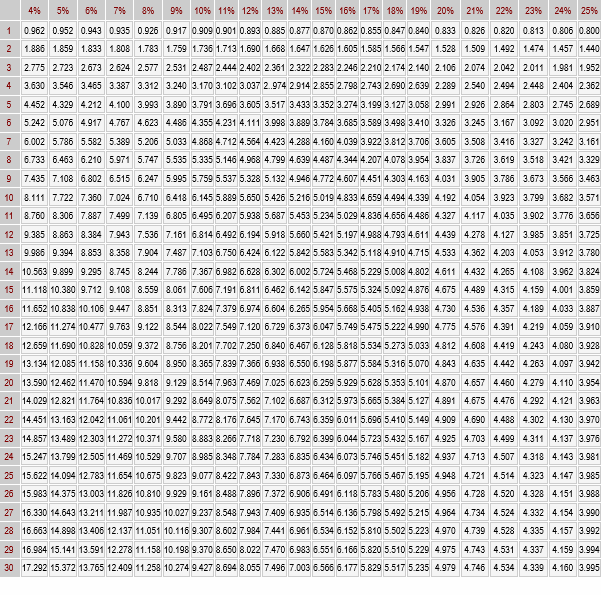

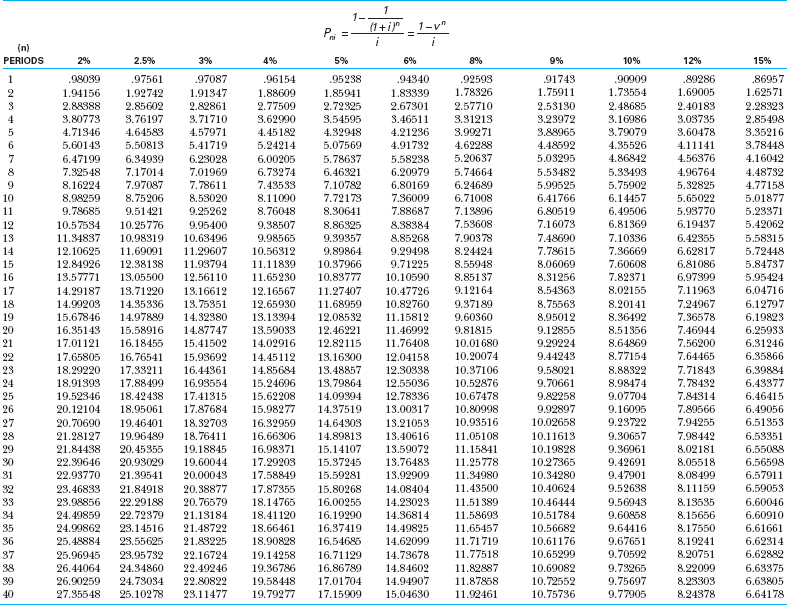

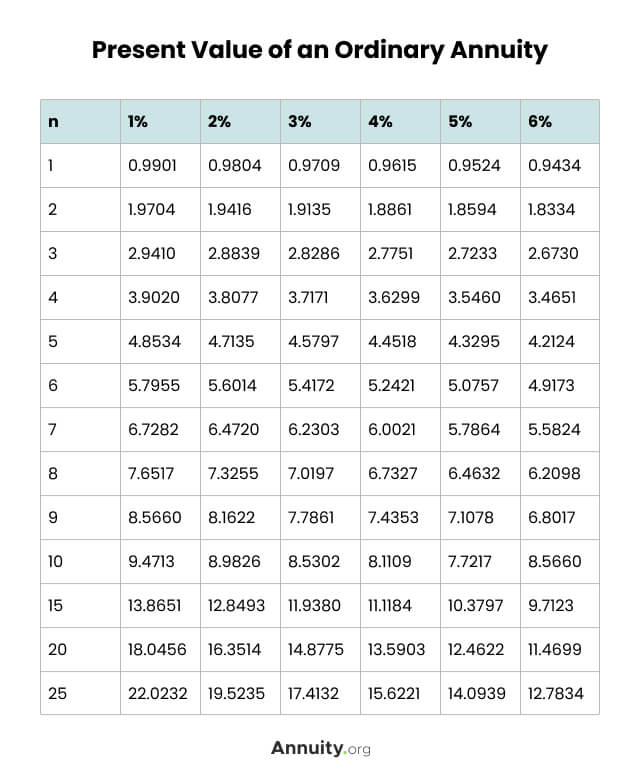

Present Value Annuity Chart - In other words, it computes the amount of money that must be invested today to equal the payment or amount of cash received on a future date. These payments can begin immediately or at a deferred date. Number of periods (t) number of periods or years. Web present value factor for an ordinary annuity (interest rate = r, number of periods = n) n \ r 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% N = number of periods in which payments will be made; The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain. The value today of a series of equal payments or receipts to be made or received on specified future dates is called the present value of an annuity. The present value of an annuity is the total value of all of future annuity payments. Web present value, often called the discounted value, is a financial formula that calculates how much a given amount of money received on a future date is worth in today’s dollars. By plugging in the values and solving the formula, you can determine the amount you’d need to invest today to receive the. Present value of periodical deposits. Pvoa = present value of an annuity stream; The present value of an annuity formula is: Web the present value of annuity formula determines the value of a series of future periodic payments at a given time. These payments can begin immediately or at a deferred date. The value today of a series of equal payments or receipts to be made or received on specified future dates is called the present value of an annuity. Web an annuity table represents a method for determining the present value of an annuity. Web the formula for calculating the present value of an ordinary annuity is: Number of periods (t). Pmt = dollar amount of each annuity payment; Web present value of annuity table. Formula and calculation of the present value of an annuity due They provide the value now of 1 received at the end of each period for n periods at a discount rate of i%. Present value of an annuity: A key factor in determining the present value of. Number of periods (t) number of periods or years. The present value of an annuity formula is: Present value of periodical deposits. Web the present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end. Web an annuity table provides a factor, based on time, and a discount rate (interest rate) by which an annuity payment can be multiplied to determine its present value. Web the present value of an annuity refers to the present value of a series of future promises to pay or receive an annuity at a specified interest rate. Present value. Calculating the future value of an ordinary annuity. Web present value, often called the discounted value, is a financial formula that calculates how much a given amount of money received on a future date is worth in today’s dollars. Web an annuity table represents a method for determining the present value of an annuity. Create a printable compound interest table. Number of periods (t) number of periods or years. This is also called discounting. Web the present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. Calculating the future value of an ordinary annuity. The present value of an annuity. Web use this calculator to find the present value of annuities due, ordinary regular annuities, growing annuities and perpetuities. Commonly a period will be a year but it can be any time interval you want as long as all inputs are consistent. This is also called discounting. The higher the discount rate, the lower the. Web the purpose of the. The value today of a series of equal payments or receipts to be made or received on specified future dates is called the present value of an annuity. When you multiply this factor by one of the payments, you arrive at the present value of the stream of. Web an annuity table provides a factor, based on time, and a. Web what is the present value of an annuity? Web the present value of annuity formula determines the value of a series of future periodic payments at a given time. Pvoa = present value of an annuity stream; Web present value of annuity table. By plugging in the values and solving the formula, you can determine the amount you’d need. In other words, with this annuity calculator, you can compute the present value of a series of periodic payments to be received at some point in the future. In other words, it computes the amount of money that must be invested today to equal the payment or amount of cash received on a future date. Web the present value of annuity calculator is a handy tool that helps you to find the value of a series of equal future cash flows over a given time. Number of periods (t) number of periods or years. Web the formula for calculating the present value of an ordinary annuity is: Web present value of annuity table. Web table of present value annuity factor number of periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain. The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain discount rate. The present value of annuity formula relies on the concept of time value of money, in that one dollar present day is worth more than that same dollar at a future date. Present value of an annuity: Web an annuity table represents a method for determining the present value of an annuity. The present value of an annuity is the total value of all of future annuity payments. When you multiply this factor by one of the payments, you arrive at the present value of the stream of. Pmt = dollar amount of each annuity payment; Commonly a period will be a year but it can be any time interval you want as long as all inputs are consistent.

Appendix Present Value Tables

Present Value Of Annuity Table change comin

Present Value Of An Annuity Chart

Present Value Of 1 Annuity Table Pdf Tutor Suhu

Present Value of Ordinary Annuity Table

What Is an Annuity Table and How Do You Use One?

The present value of an annuity formula omschedamsa’s blog

Present Value of Ordinary Annuity

What is an Annuity? Present Value Formula + Calculator

Present Value Annuity Table (F9 ACCA) Accounting Studocu

Web An Annuity Table Represents A Method For Determining The Present Value Of An Annuity.

Web What Is The Present Value Of An Annuity?

These Payments Can Begin Immediately Or At A Deferred Date.

The Present Value Of An Annuity Formula Is:

Related Post: