Owners Drawing

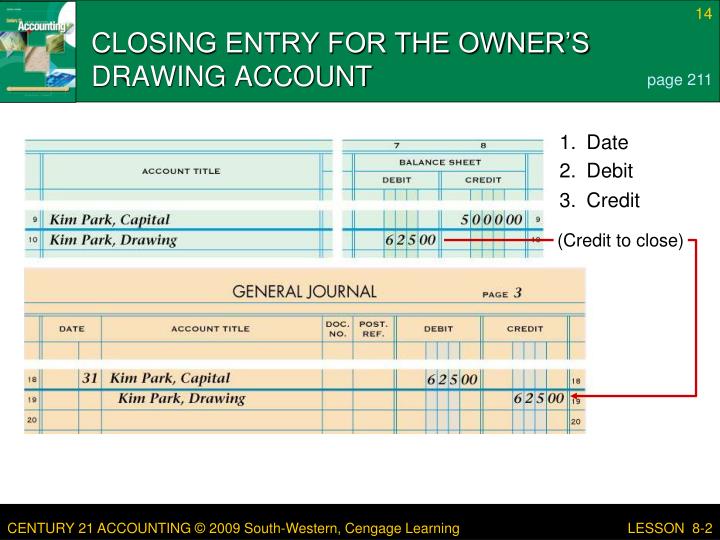

Owners Drawing - Smith, drawing (an owner’s equity account with a debit balance) a credit to cash Business owners might use a draw for compensation versus paying themselves a salary. Owner’s draw can give s corps and c corps extra business tax savings. Once you record the check, your checking account will decrease and the owner draw account will increase by the amount of the check and is shown on your balance sheet. Yuliya nechay / getty images. Web example of owner’s draws let’s assume that r. The company’s entry to record each month’s draws will be: To learn how to create accounts in your quickbooks, choose your product: Web patty contributes $70,000 to the partnership when the business forms, and alpine wines posts this owner’s draw journal entry: The post position draw for the preakness is set for monday, may 13. Rather than classifying owner's draws. Web the owner's draw method. In other words, it is a distribution of earnings to the owner (s) of a business, as opposed to a salary or wages paid to employees. You can adjust it based on your cash flow, personal expenses, or how your company is performing. If you operate as an llc (by. Owner’s draw can be used by sole proprietors, partners, and members of an llc (limited liability company. These draws can be in the form of cash or other assets, such as bonds. The choice between payment methods as a business owner is actually a choice between the ways you can be taxed. Business owners may use an owner’s draw rather. An owner’s draw gives you more flexibility than a salary because you can pay yourself practically whenever you’d like. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. They can only draw as much as their owner’s equity allows. In a corporation, owners can receive compensation by. A drawing account is an accounting record maintained to track money withdrawn from a business by its owners. Web owner's drawing account definition. Updated on july 30, 2020. Pros:using the owner's draw method can help you, as an owner, keep funds in your. When taking an owner's draw, the business cuts a check to the owner for the full amount. The company’s entry to record each month’s draws will be: Web what is an owner's draw? Web an owner's draw is a withdrawal made by the owner of a sole proprietorship, partnership, or llc from the company's profits or equity. Owner’s equity refers to your share of your business’ assets, like your initial investment and any profits your business has. These draws can be in the form of cash or other assets, such as bonds. English football league chairman rick parry has told reading fans he is trying to force out the league one club’s unpopular owner dai yongge but he cannot make. A drawing account is an accounting record maintained to track money withdrawn from a business by its. Once you record the check, your checking account will decrease and the owner draw account will increase by the amount of the check and is shown on your balance sheet. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. The owner's drawing account is used. Atlanta braves 10,000 times and released its mlb picks, predictions and best bets for sunday night baseball The choice between payment methods as a business owner is actually a choice between the ways you can be taxed. However, owners can’t simply draw as much as they want; Owner’s equity refers to your share of your business’ assets, like your initial. Business owners may use an owner’s draw rather than taking a salary from the business. If you operate as a sole proprietor (no separate legal entity), you can only be taxed as a sole proprietorship. The company’s entry to record each month’s draws will be: This method of payment is common across various business structures such as sole proprietorships, partnerships,. Rather than classifying owner's draws. The company’s entry to record each month’s draws will be: Before you can pay an owner’s draw, you need to create an owner’s equity account first. If you operate as an llc (by registering a separate. Create an owner's equity account. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. You can adjust it based on your cash flow, personal expenses, or how your company is performing. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. Web owner draws are only available to owners of sole proprietorships and partnerships. Web sportsline's model simulated new york mets vs. Owner’s drawing account is also known as. Owner’s draws are usually taken from your owner’s equity account. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Pros:using the owner's draw method can help you, as an owner, keep funds in your. Create an owner's equity account. Owner’s draw can be used by sole proprietors, partners, and members of an llc (limited liability company. Web example of owner’s draws let’s assume that r. In a corporation, owners can receive compensation by a salary or dividends from ownership shares but not owner draws. These draws can be in the form of cash or other assets, such as bonds. Owner’s draw can give s corps and c corps extra business tax savings. The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner.

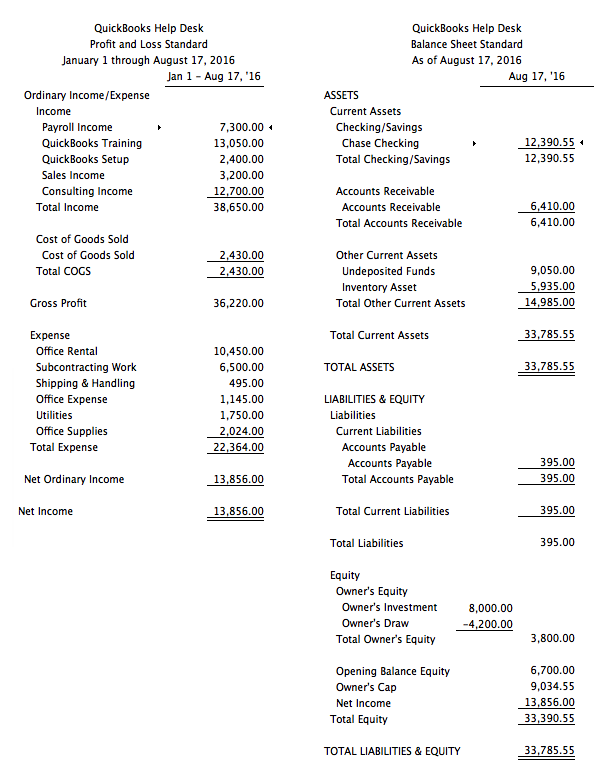

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Young caucasian owner holding key to his new house

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Owners Drawing at Explore collection of Owners Drawing

Owners Drawing at Explore collection of Owners Drawing

owner's drawing account definition and Business Accounting

Single continuous line drawing of two young happy business owner

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)

Owner's Draw What Is It?

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masako Arndt

Smith, Drawing (An Owner’s Equity Account With A Debit Balance) A Credit To Cash

When You Create Your Account, Be Sure To Choose Equity Or Owners Equity As The Type Of Account.

Owner’s Equity Is Made Up Of Different Funds, Including.

Pros And Cons Of Each.

Related Post: