Nonprofit Chart Of Accounts Sample

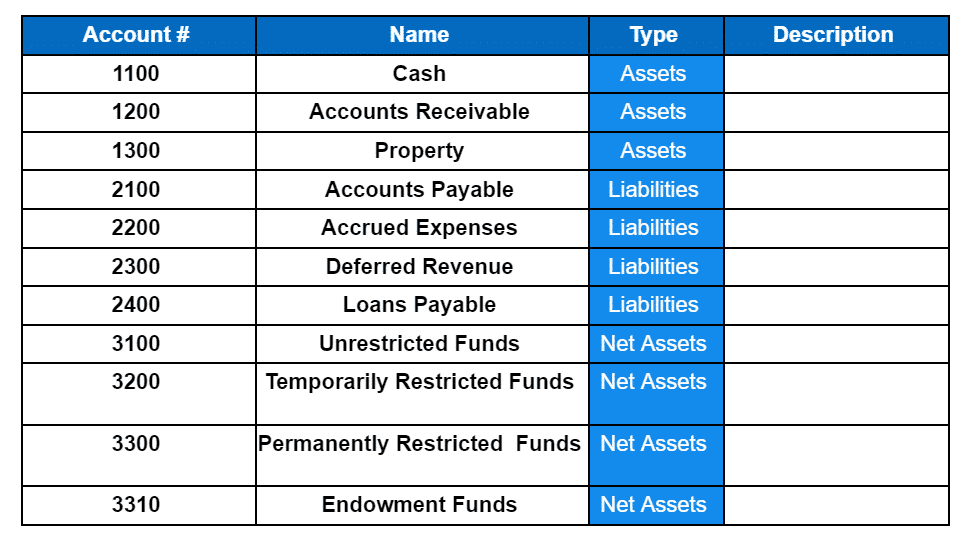

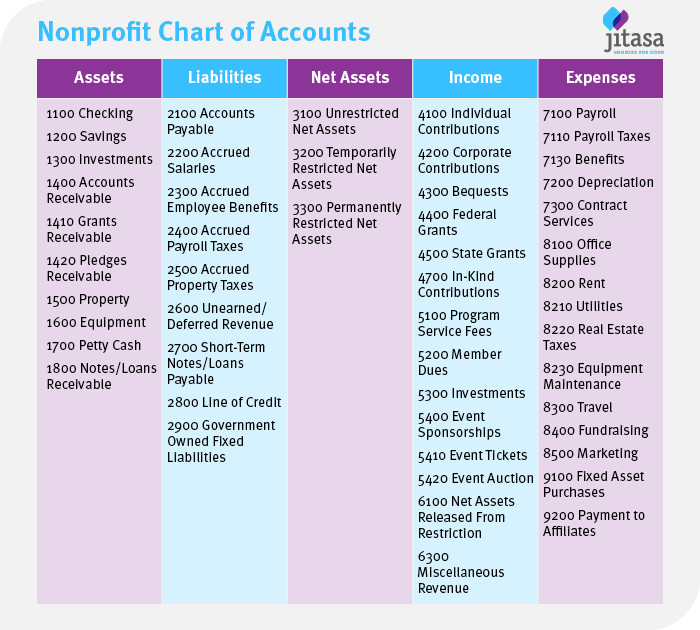

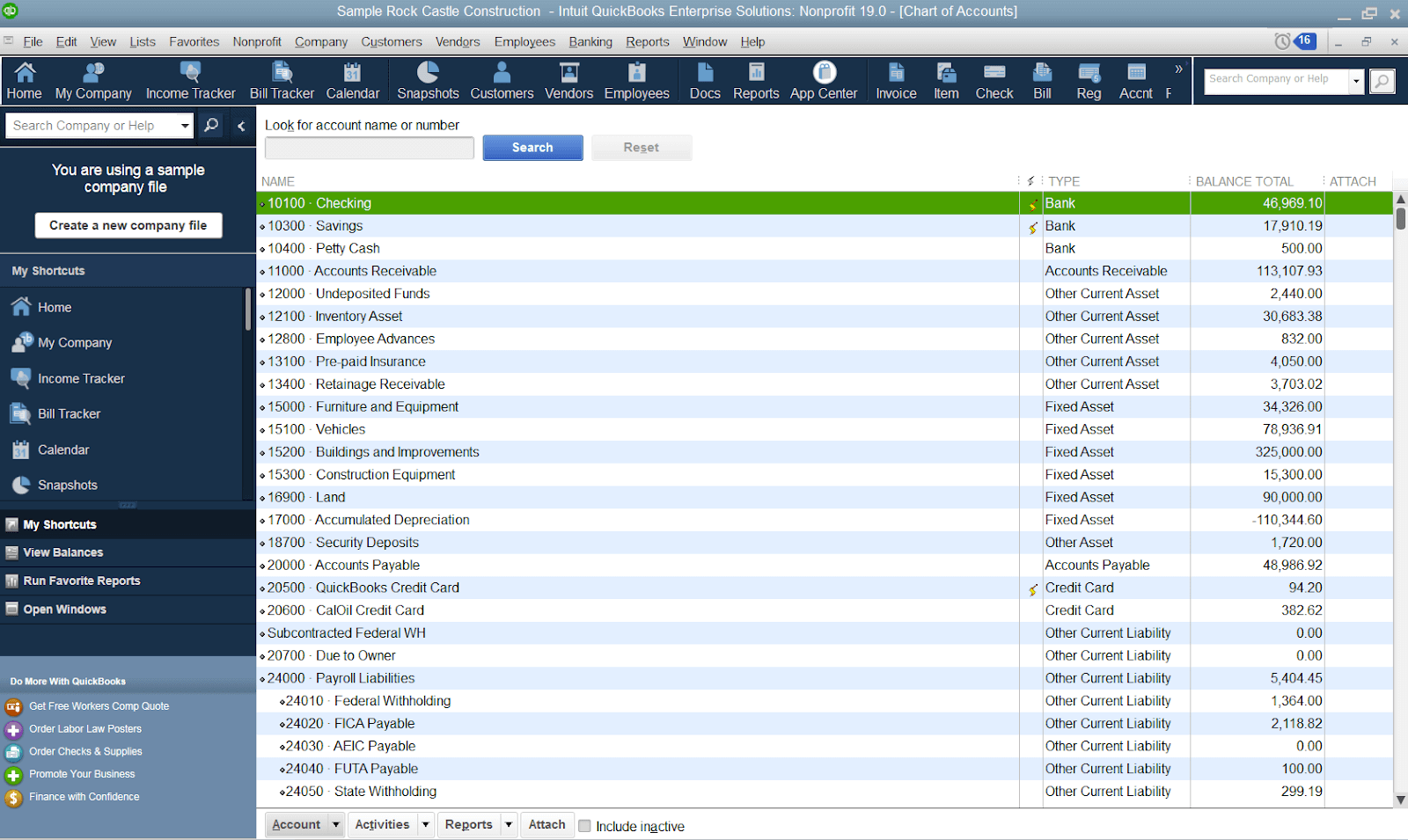

Nonprofit Chart Of Accounts Sample - The key to better reports is a shorter and more organized chart of accounts. Web the nonprofit chart of accounts is a crucial tool, offering a structured method to keep track of financial transactions, including payroll taxes, ensuring efficient financial management, regulatory adherence, and accurate reporting. Each time you put money in or take money out of your group, you need to record it to the right account. A chart of accounts is the foundation of a solid nonprofit group. What is a nonprofit chart of accounts? Account numbers are, for the most part, up to you and how you would like to organize them. Just four financial reports are required for nonprofit organizations: The second resource will give you spreadsheets that you can download and use as a learning aid. Web i will also provide you with a sample chart of accounts of my design and one called the unified chart of accounts, which was created by a number of major nonprofit support organizations. The statement of financial position (balance sheet), statement of activities (income. Both the balance sheet and profit & loss reports follow the framework of your chart of accounts. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. What is a chart of accounts? A coa must be adaptable and scalable, evolving with a business to manage its growing financial complexities effectively.. What is a chart of accounts? Web in this guide, we’ll explore the basics of the nonprofit chart of accounts, including: What are the 5 types of accounts? Web published apr 8, 2024. Web examples of a nonprofit chart of accounts. The statement of financial position (balance sheet), statement of activities (income. The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Web in this article, we will outline what a chart of accounts is, how to create one for your nonprofit organization, and provide a template and example for reference. A. Both the balance sheet and profit & loss reports follow the framework of your chart of accounts. Account numbers are, for the most part, up to you and how you would like to organize them. Why is a chart of accounts important for nonprofit organizations? Structuring a chart of accounts for nonprofit organizations; Web steps for nonprofits to implement a. The statement of financial position (balance sheet), statement of activities (income. Purpose of the nonprofit chart of accounts; Web download the model chart. When accounts are created in an accounting system, they are organized using names and numbers. “nonprofits view their accounting processes through an accountability lens rather than one based solely on profitability and revenue generation…. Web published apr 8, 2024. The statement of financial position (balance sheet), statement of activities (income. Regular reviews and updates are crucial to keeping a coa. Why is a chart of accounts important for nonprofit organizations? Use this as a guideline, and think carefully before you finalize your account numbers. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501 (c) (3) status to account for the money they receive and spend. The statement of financial position (balance sheet),. The following chart of accounts can provide you with a basic example that you can use to structure your own. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. The key to better reports is a shorter and more organized chart of accounts. Enhance executive insight benefit #5: Both the. Your coa should align with the specific needs of the organization and reflect its unique financial activities. The statement of financial position (balance sheet), statement of activities (income. Where to look for liabilities in reports? Each time you put money in or take money out of your group, you need to record it to the right account. Web the account. The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Structuring a chart of accounts for nonprofit organizations; Web download the model chart. For example, in a traditional chart of accounts, if you have 5 funds, 4 grants, 3 programs and 1 restriction,. What is a nonprofit chart of accounts? What is a chart of accounts? This guide and example for constructing a nonprofit chart of accounts was compiled by jitasa on august 11, 2021. Web download the model chart. Web establishing a nonprofit chart of accounts. Your coa should align with the specific needs of the organization and reflect its unique financial activities. Web in this article, we will outline what a chart of accounts is, how to create one for your nonprofit organization, and provide a template and example for reference. Web in this guide, we’ll cover the basics of the nonprofit chart of accounts, including: For example, in a traditional chart of accounts, if you have 5 funds, 4 grants, 3 programs and 1 restriction,. The second resource will give you spreadsheets that you can download and use as a learning aid. How do you structure a chart of accounts? A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501 (c) (3) status to account for the money they receive and spend. Where to look for liabilities in reports? Nonprofit chart of accounts example; Enhance executive insight benefit #5: Web the account numbers, account number ranges, account names, breakdowns of each account category, and account descriptions will vary based on the nonprofit's structure and needs. What are the 5 types of accounts?

Chart Of Accounts For Nonprofit Sample

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

sample nonprofit chart of accounts

The Beginner’s Guide to Nonprofit Chart of Accounts

Nonprofit Chart of Accounts How to Get Started + Example

Quickbooks Nonprofit Chart Of Accounts

Sample Nonprofit Chart Of Accounts Quickbooks

sample nonprofit chart of accounts

Example Of Chart Of Accounts For Nonprofit

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Use This As A Guideline, And Think Carefully Before You Finalize Your Account Numbers.

A Chart Of Accounts Is The Foundation Of A Solid Nonprofit Group.

Web The Nonprofit Chart Of Accounts Is A Crucial Tool, Offering A Structured Method To Keep Track Of Financial Transactions, Including Payroll Taxes, Ensuring Efficient Financial Management, Regulatory Adherence, And Accurate Reporting.

Web In This Guide, We’ll Explore The Basics Of The Nonprofit Chart Of Accounts, Including:

Related Post: