Multistate Withholding Requirements State Comparison Chart

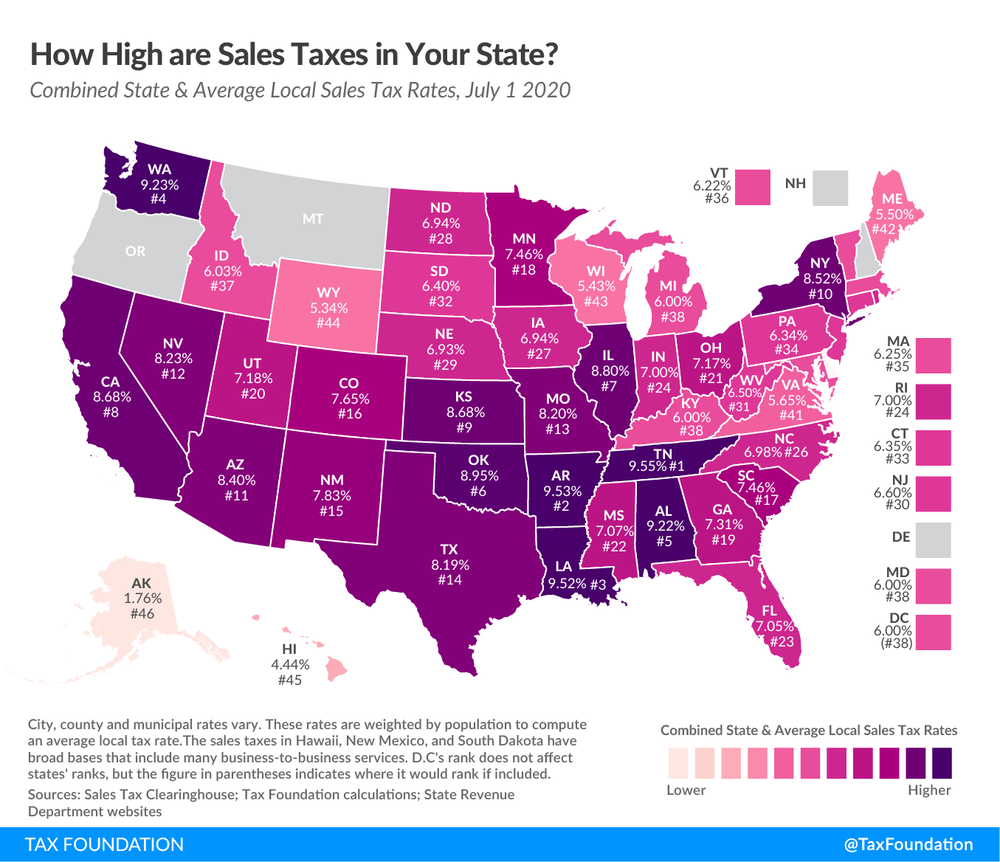

Multistate Withholding Requirements State Comparison Chart - If an employer has operations in more than one state, income tax might need to be withheld for multiple states. Web the assortment of state income tax withholding & nonresident archiving rules can create headaches for equally employers and employees. Web • state meal period and rest break laws chart: Web ah, the joys of employerhood. — the employer is ultimately responsible for proper withholding and reporting of their. Web this means an employer must withhold taxes on employee earnings after the employee has worked more than 60 days in that state. Web designed for multistate employers, this tool helps you overcome the challenge of complying with a potentially intricate web of state and federal laws. Employees who reside in one state but work in another can create withholding questions for payroll. Requirements and obligations of employer are well defined in most cases. In fact, at times the employer might need to. Employees who reside in one state but work in another can create withholding questions for payroll. Web multistate laws comparison tool. Web this rule can be applied in most situations where the employee lives and works in the same state (assuming it is not one of the nine states without income tax withholding: But, getting this hang of payroll—especially payroll. You must be aware of the specific tax requirements of each state you operate in and stay up to date with any. Web • state meal period and rest break laws chart: Web designed for multistate employers, this tool helps you overcome the challenge of complying with a potentially intricate web of state and federal laws. Web this rule can. Requirements and obligations of employer are well defined in most cases. If an employer has operations in more than one state, income tax might need to be withheld for multiple states. Receive it right by learning. Web this means an employer must withhold taxes on employee earnings after the employee has worked more than 60 days in that state. A. Web withholdings vary by state, as discussed below. A tool to view or compare state and federal employment laws by topic, across multiple jurisdictions, presented in a customizable chart or matrix. Web elements of multistate payroll tax withholding compliance. Web multistate laws comparison tool. Web designed for multistate employers, this tool helps you overcome the challenge of complying with a. Web ah, the joys of employerhood. If an employer has operations in more than one state, income tax might need to be withheld for multiple states. Web the multistate program included dozens of states led by both republicans and democrats, but the system became the target of conspiracy theories and criticism on the. Web withholdings vary by state, as discussed. Multistate compliance requires managing sets of state and local laws, regulations, and deadlines. Web this rule can be applied in most situations where the employee lives and works in the same state (assuming it is not one of the nine states without income tax withholding: Web withholdings vary by state, as discussed below. A tool to view or compare state. Employees who reside in one state but work in another can create withholding questions for payroll. Web multistate laws comparison tool. To a team of employees to help how your business can be a beautiful thing. Web • state meal period and rest break laws chart: — the employer is ultimately responsible for proper withholding and reporting of their. To a team of employees to help how your business can be a beautiful thing. Web designed for multistate employers, this tool helps you overcome the challenge of complying with a potentially intricate web of state and federal laws. Web multistate laws comparison tool. Web elements of multistate payroll tax withholding compliance. For the states imposing a personal income tax,. Web multistate laws comparison tool. Web withholdings vary by state, as discussed below. For the states imposing a personal income tax, the. Requirements and obligations of employer are well defined in most cases. To a team of employees to help how your business can be a beautiful thing. Web the multistate program included dozens of states led by both republicans and democrats, but the system became the target of conspiracy theories and criticism on the. For the states imposing a personal income tax, the. Web designed for multistate employers, this tool helps you overcome the challenge of complying with a potentially intricate web of state and federal laws.. To a team of employees to help how your business can be a beautiful thing. You must be aware of the specific tax requirements of each state you operate in and stay up to date with any. Web this rule can be applied in most situations where the employee lives and works in the same state (assuming it is not one of the nine states without income tax withholding: Receive it right by learning. Web designed for multistate employers, this tool helps you overcome the challenge of complying with a potentially intricate web of state and federal laws. Web the assortment of state income tax withholding & nonresident archiving rules can create headaches for equally employers and employees. Multistate compliance requires managing sets of state and local laws, regulations, and deadlines. For the states imposing a personal income tax, the. Web elements of multistate payroll tax withholding compliance. In fact, at times the employer might need to. Employees who reside in one state but work in another can create withholding questions for payroll. Web this means an employer must withhold taxes on employee earnings after the employee has worked more than 60 days in that state. Web multistate laws comparison tool. Requirements and obligations of employer are well defined in most cases. Web • state meal period and rest break laws chart: But, getting this hang of payroll—especially payroll taxes—takes time.

Top State Tax Rates for All 50 States Chris Banescu

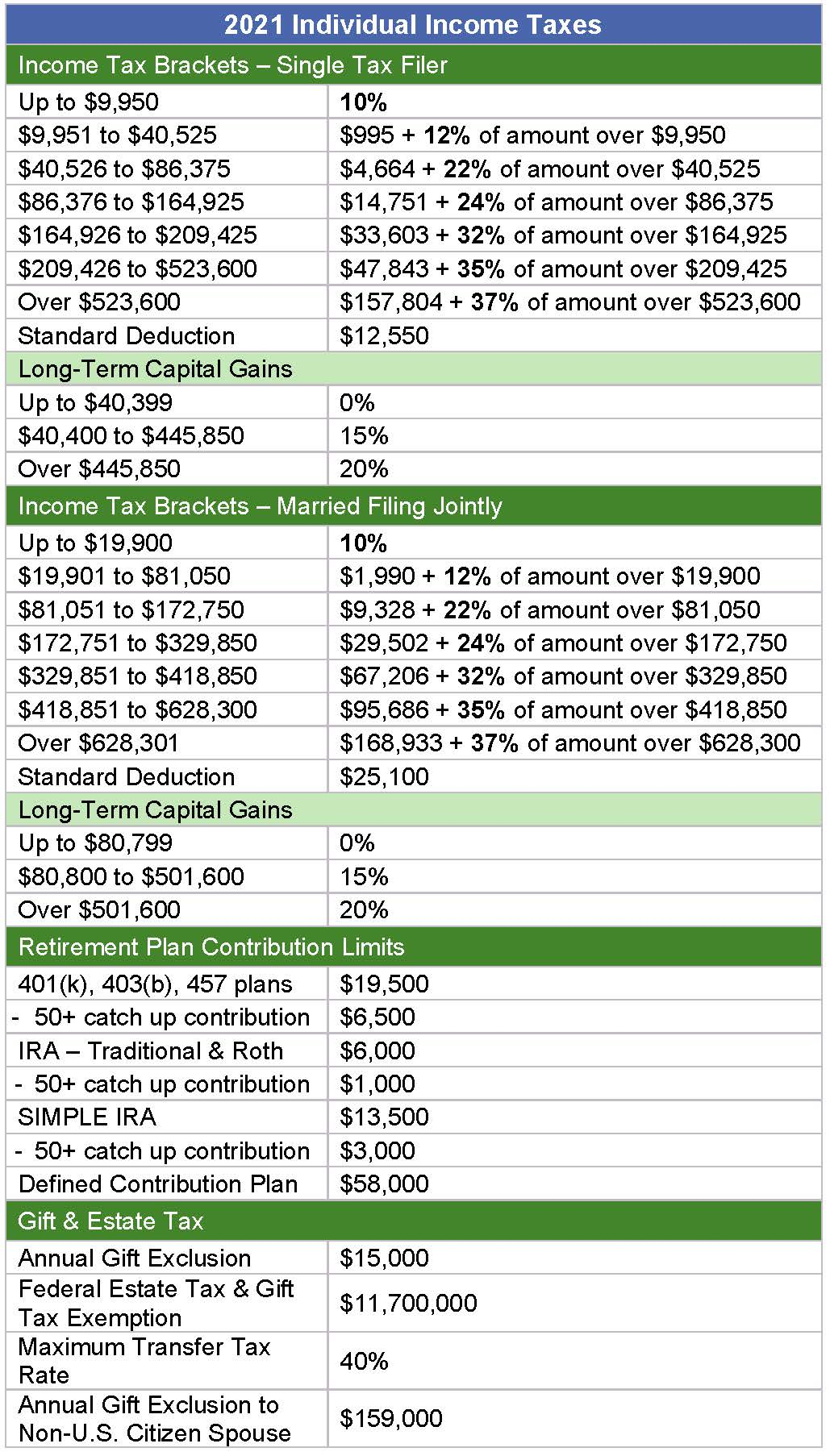

Tax Brackets 2022 Vs 2021 Debbie Hughes blog

Fidelity National Financial Fraud Insights WRAPPING up real estate

Inspired Image of State Tax Reciprocity Agreements letterify.info

The problem? A patchwork of confusing rules for employees and employers

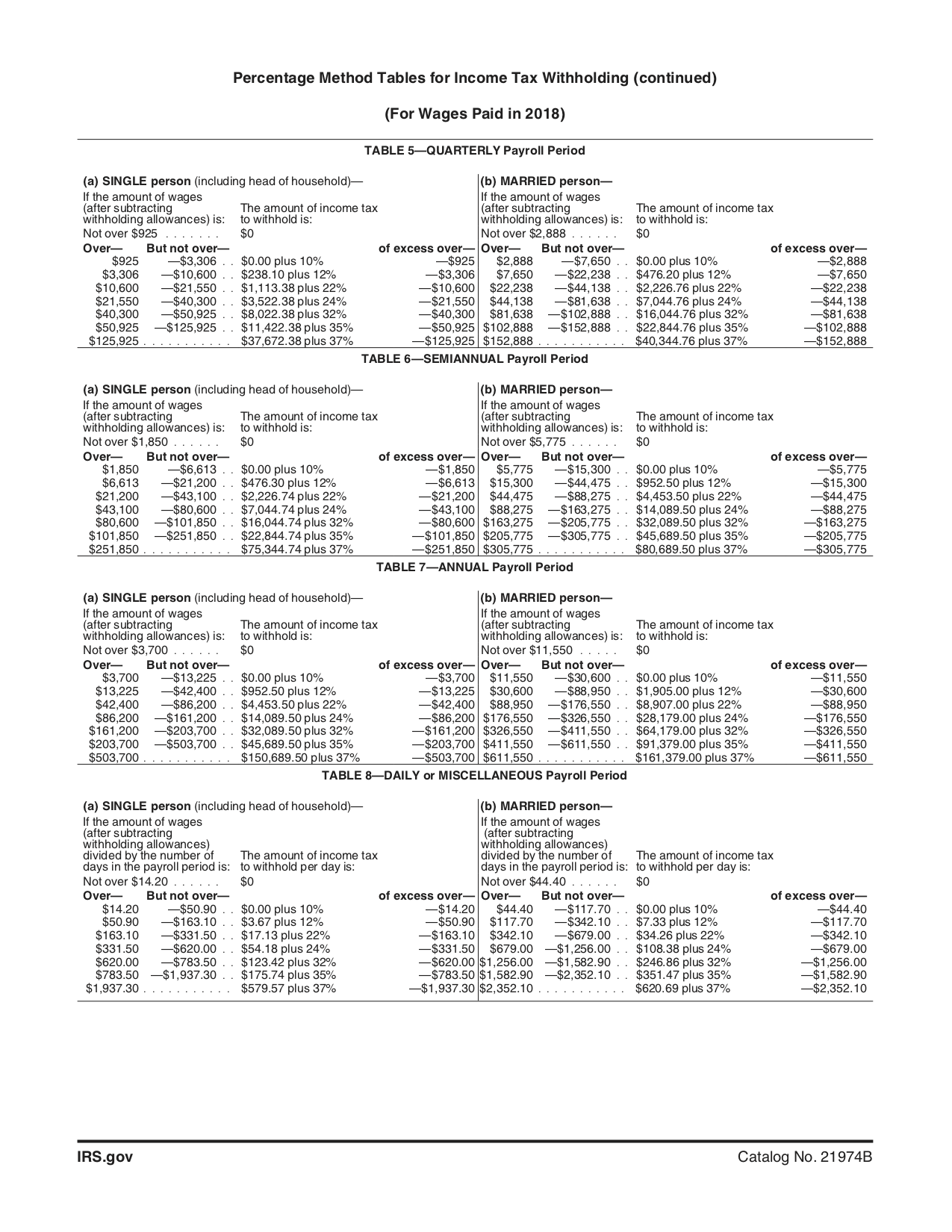

Federal Tax Withholding Tables 2018

What Are The Federal Tax Tables For 2021 Federal Withholding Tables 2021

Printable Federal Withholding Tables 2022 California Onenow

eBay Sales Tax Guide

Multistate Tax Accounting, Nexus Requirements what you need to know, by

Web Ah, The Joys Of Employerhood.

Each State’s Designated Category Are Revenue.

— The Employer Is Ultimately Responsible For Proper Withholding And Reporting Of Their.

Web Withholdings Vary By State, As Discussed Below.

Related Post: