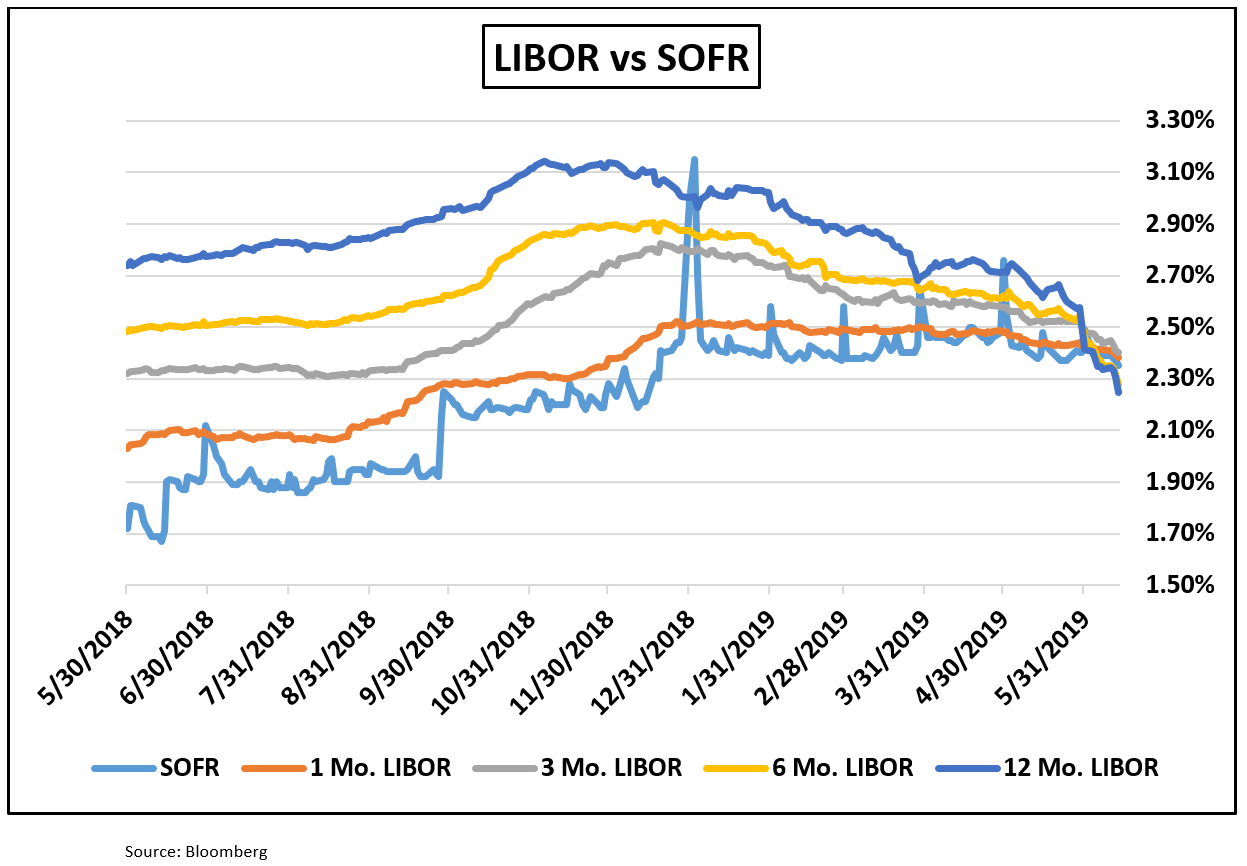

Libor Vs Sofr Rate Chart

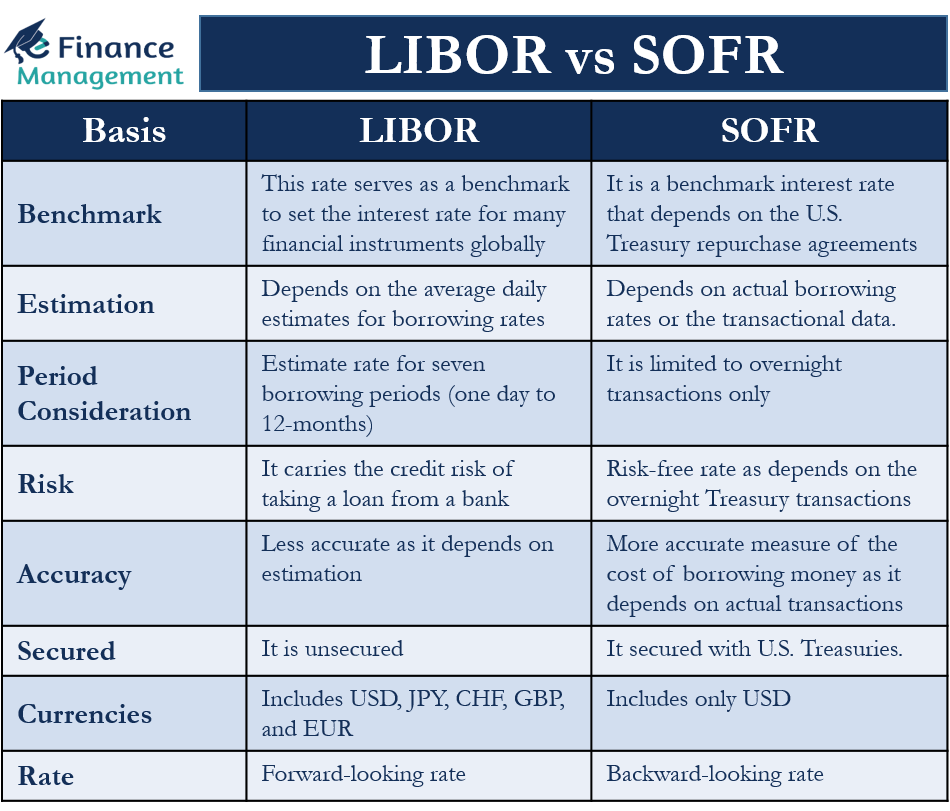

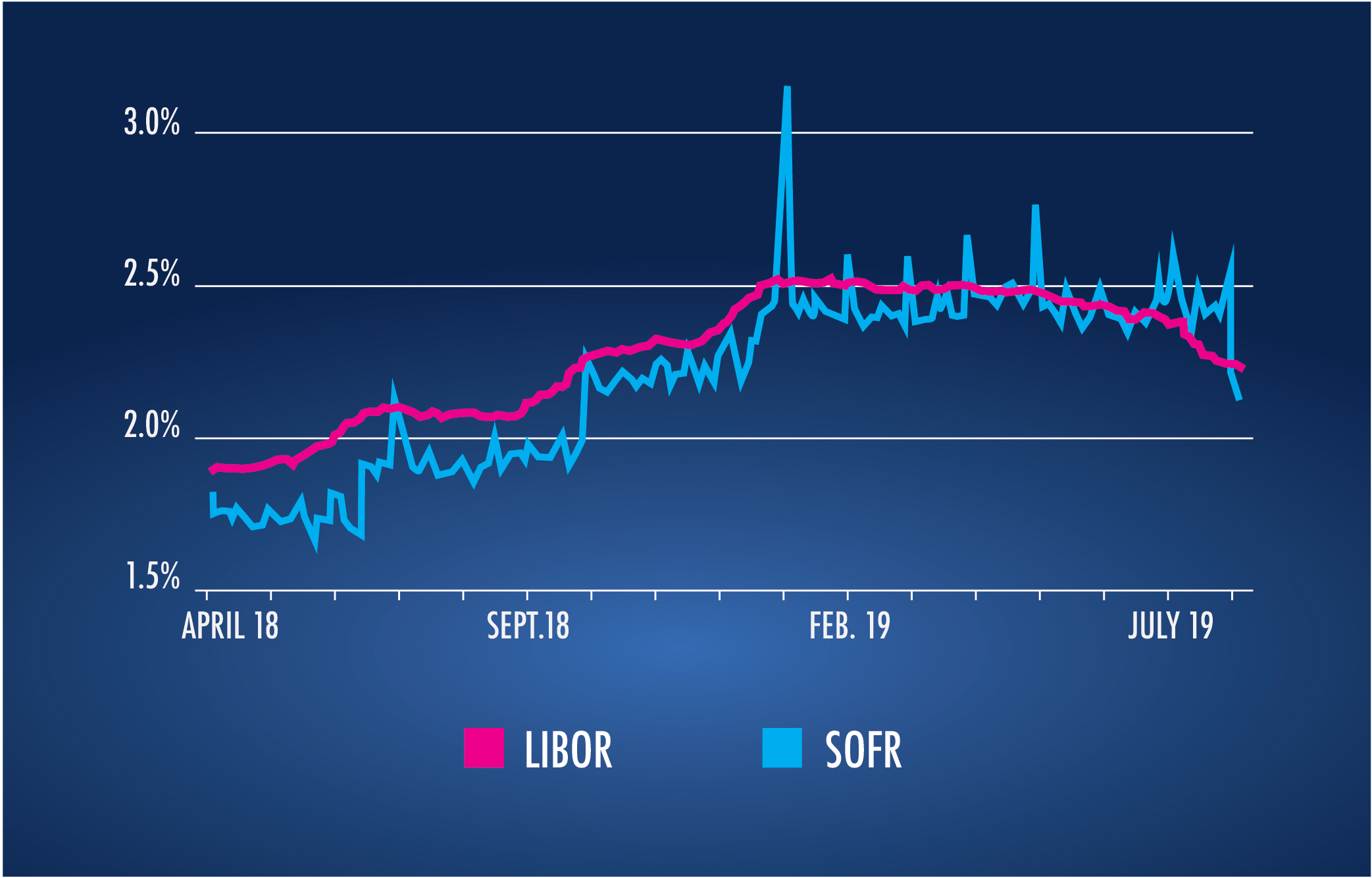

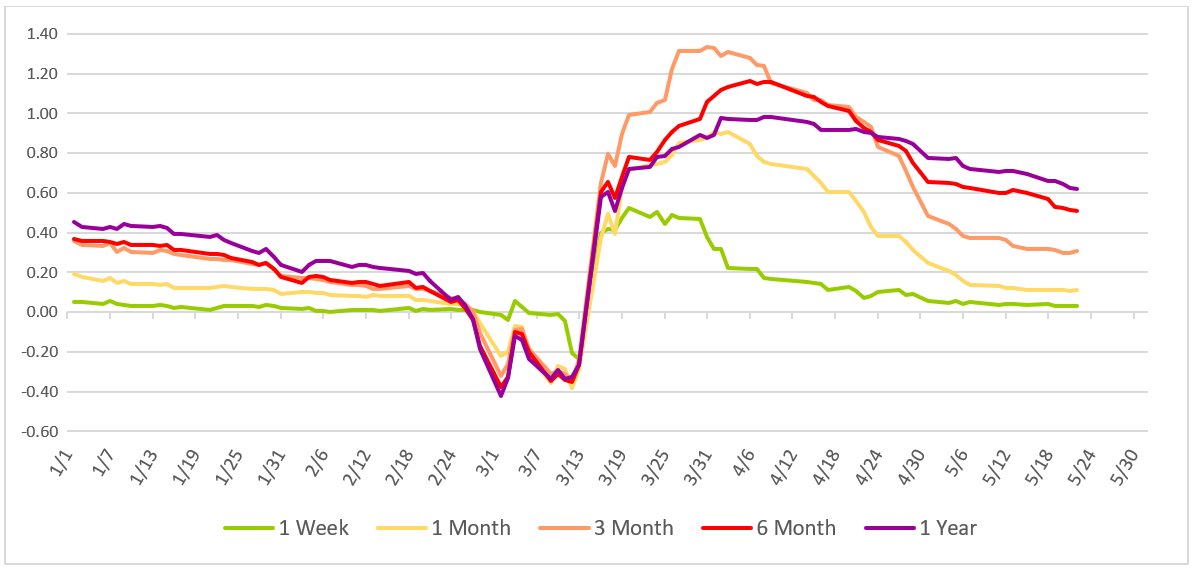

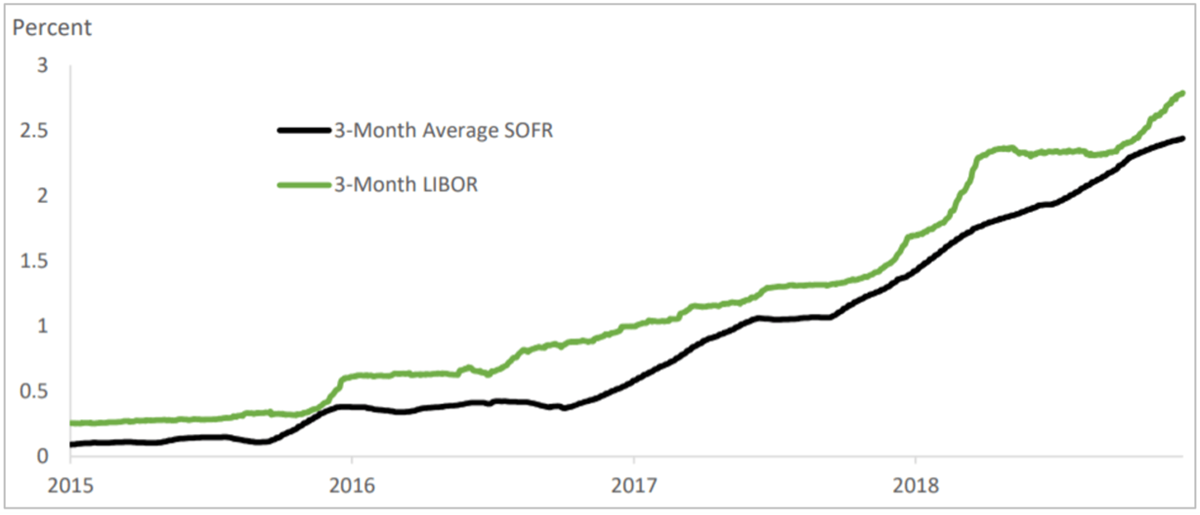

Libor Vs Sofr Rate Chart - The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. Web sofr has a number of characteristics that libor and other rates based on wholesale term similar unsecured funding markets do not: This is higher than the long term average of 2.10%. Web there are some key differences between libor and sofr. In singapore, sor and sibor were also widely used for various sgd denominated financial instruments. Libor is an interest rate benchmark used in financial markets which is being phased out. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. Web the secured overnight financing rate (sofr) is libor’s replacement in the united states. Web the secured overnight financing rate (sofr) is j.p. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. We are supporting firms to continue the active transition of any outstanding libor exposures. In singapore, sor and sibor were also widely used for various sgd denominated financial instruments. Web summary of key differences. Libor is an interest rate benchmark used in. We are supporting firms to continue the active transition of any outstanding libor exposures. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. While there are obvious advantages to moving to a truly market based rfr, there are significant challenges transitioning from an unsecured forward term rate (libor) to a secured overnight rate (sofr): For. 32 libor settings have ceased permanently. Morgan’s preferred alternative to usd libor. Web the federal reserve board on friday adopted a final rule that implements the adjustable interest rate (libor) act by identifying benchmark rates based on sofr (secured overnight financing rate) that will replace libor in certain financial contracts after june 30, 2023. Web summary of key differences. While. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. Web last updated january 30, 2024. The secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. The secured overnight financing rate or sofr is a broad measure of the cost of. Web the secured overnight financing rate (sofr) is libor’s replacement in the united states. You need to look at the exponential growth of the swaps market to understand why libor became so embedded in the derivatives space. Why is libor being replaced? Web the secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight. While there are obvious advantages to moving to a truly market based rfr, there are significant challenges transitioning from an unsecured forward term rate (libor) to a secured overnight rate (sofr): Web the federal reserve board on friday adopted a final rule that implements the adjustable interest rate (libor) act by identifying benchmark rates based on sofr (secured overnight financing. Unlike the libor, there’s extensive trading in the treasury repo market—roughly $4.8 trillion in june 2023—theoretically making it a more accurate indicator of borrowing costs. Federal home loan bank of san francisco, federal reserve board, fnma. • it is a rate produced by the federal reserve bank of new york for the public good; Secured overnight financing rate is at. The sofr includes all trades in the broad general collateral rate plus bilateral treasury repurchase agreement (repo) transactions cleared through the. For example, sofr is calculated using actual transactions and is considered a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Secured overnight financing rate is at 5.34%, compared to 5.33% the previous market day. Morgan’s preferred alternative to usd libor. Web the secured overnight financing rate (sofr) is j.p. Publication of most libor settings has now ended. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. Option to replace dollar libor, which is scheduled to phase out by end of june 2023. Rate comparison chart of prime rate and fed funds rate. Why is libor being replaced? Unlike the libor, there’s extensive trading in the treasury repo market—roughly $4.8 trillion in june 2023—theoretically making it a more accurate indicator of borrowing costs. Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by. This is higher than the long term average of 2.10%. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. Publication of most libor settings has now ended. Rate comparison chart of prime rate and fed funds rate. While there are obvious advantages to moving to a truly market based rfr, there are significant challenges transitioning from an unsecured forward term rate (libor) to a secured overnight rate (sofr): Federal home loan bank of san francisco, federal reserve board, fnma. Web last updated january 30, 2024. Web sofr has a number of characteristics that libor and other rates based on wholesale term similar unsecured funding markets do not: Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the. Interest rate derivatives research, j.p. You need to look at the exponential growth of the swaps market to understand why libor became so embedded in the derivatives space. Web what’s the main difference between libor vs. For example, sofr is calculated using actual transactions and is considered a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. • it is a rate produced by the federal reserve bank of new york for the public good; Web there are some key differences between libor and sofr. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates.

Sofr Vs Libor Chart 2021

LIBOR vs SOFR Meaning, Need, and Differences

An Update on the Transition from LIBOR to SOFR

The LIBOR Transition Mission Capital

Libor Vs Sofr Rate Chart 2023

The impact of Reference Rate reform Transition from LIBOR to SOFR

Libor To Sofr Spread

Comparing LIBOR, BSBY & SOFR Curves LSTA

Flooring It! LIBOR vs. SOFR LSTA

LIBOR to SOFR Are You Ready?

Unlike The Libor, There’s Extensive Trading In The Treasury Repo Market—Roughly $4.8 Trillion In June 2023—Theoretically Making It A More Accurate Indicator Of Borrowing Costs.

Why Is Libor Being Replaced?

Web The London Interbank Offered Rate (Libor) Was A Global Interest Rate Benchmark Used To Determine Interest Rates For Various Financial Instruments.

Morgan’s Preferred Alternative To Usd Libor.

Related Post: