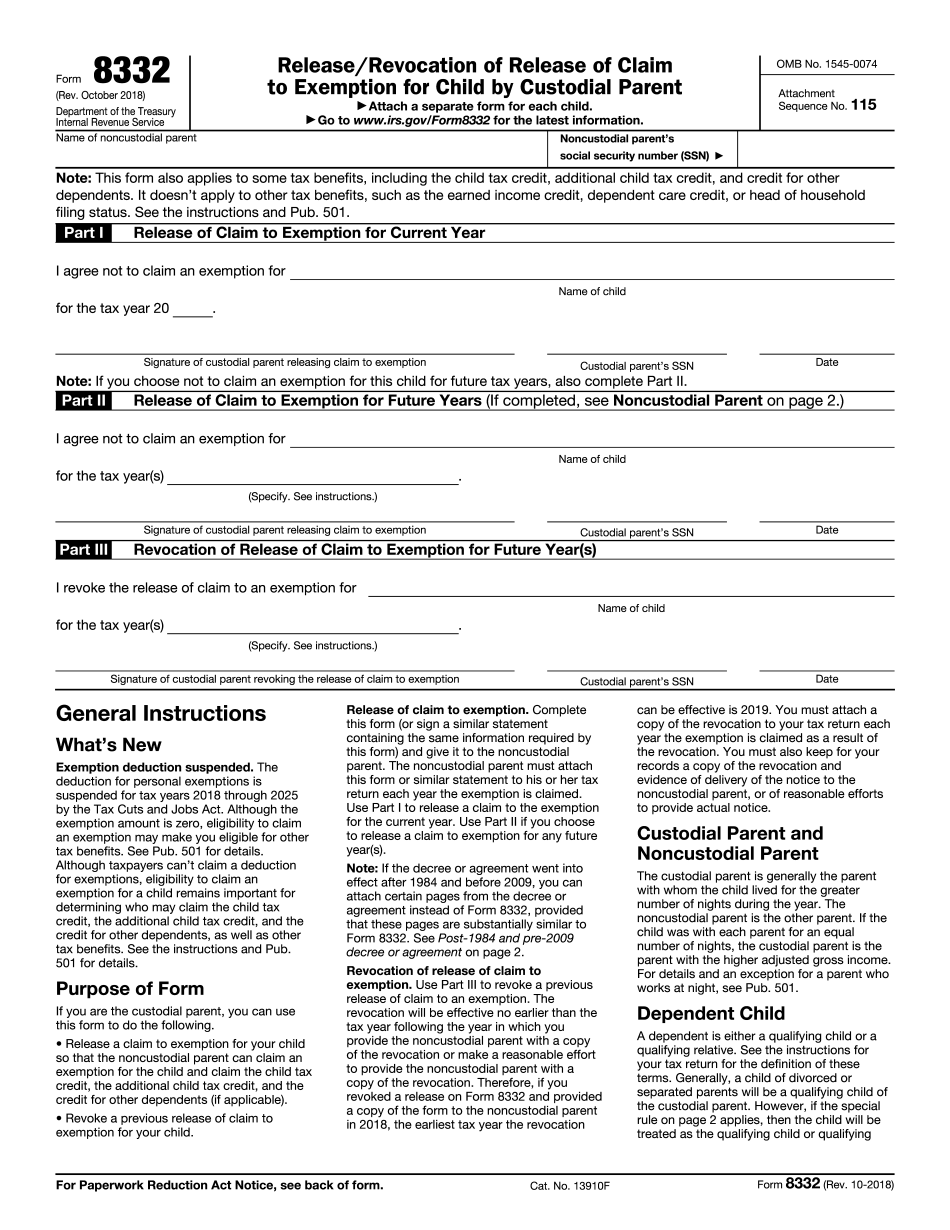

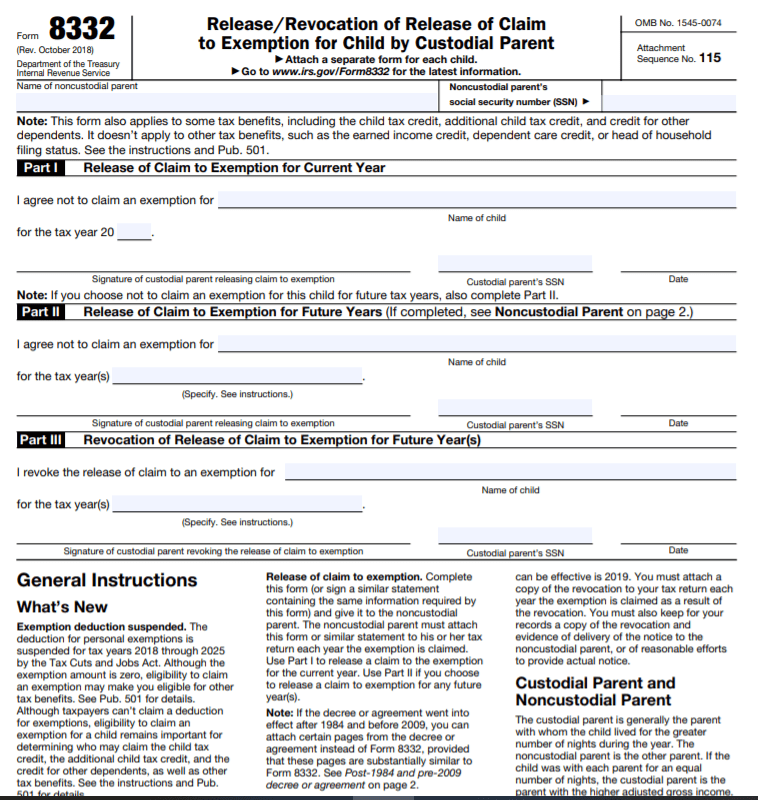

Irs Form 8332 Printable

Irs Form 8332 Printable - Then fill out the relevant section: Permission can also be granted for future tax years so you do not need to repeatedly file this form. Web this would enable the return to be electronically filed and form 8332 to be sent to the irs along with form 8453. If you completed part iii of form 8332 and provided a copy of the form to the noncustodial parent in 2018, the revocation will be effective for 2019 and 2020. Custodial parents fill out the form. Form 8332 is used by custodial parents to release their claim to their child's exemption. Web however, if the special rule on page 2 applies, then the child will be treated as the qualifying child or qualifying form 8332 (rev. Web the tcja eliminated dependent exemptions until 2025. Review the child tax credit charts in the volunteer This form also applies to some tax benefits, including the: Web information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Web however, if the special rule on page 2 applies, then the child will be treated as the qualifying child or qualifying form 8332 (rev. Complete the lower part of screen 8332.. Print, sign, and distribute to noncustodial parent. Web however, if the special rule on page 2 applies, then the child will be treated as the qualifying child or qualifying form 8332 (rev. When you print/preview the federal electronic filing instructions a few screens later, you will be provided the address where to mail form 8453 and the form 8332 that. Web the irs noted that regs. While the tax benefit of exemptions is $0 until 2025 under tax reform, there are other tax benefits a noncustodial can claim with a release from the custodial parent. There are three parts to form 8832. Either release your exemption (i.e., you won't claim the exemption) or revoke your. Web when to use form. Review the child tax credit charts in the volunteer Web information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. While the tax benefit of exemptions is $0 until 2025 under tax reform, there are other tax benefits a noncustodial can claim with. Name name of of noncustodial noncustodial parent parent claiming claiming exemption. This form also applies to some tax benefits, including the: Release/revocation of release of claim to exemption for child by custodial parent. Then fill out the relevant section: Person (including a resident alien), to provide your correct tin. This form also applies to some tax benefits, including the: The most important reason to file a form 8606 is to clarify your tax picture regarding iras and inherited iras, so that you don’t end up paying more. Web form 8332 is generally attached to the claimant's tax return. Web how do i complete irs form 8332? Web when to. Web how do i complete irs form 8332? Be sure to keep copies of. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll need to fill out form 8332. Web prepare the form 8332 on the custodial parent's return. Web however, if the special. Fill out the release/revocation of release of claim to exemption for child by custodial parent online and print it out for free. Custodial parents fill out the form. Form 8332 is used by custodial parents to release their claim to their child's exemption. Complete the lower part of screen 8332. In 2018, you decided to revoke the previous release of. All noncustodial parents must attach form 8332 or a similar statement to their return each year the custodial parent provides the release. Custodial parents fill out the form. Fill out the release/revocation of release of claim to exemption for child by custodial parent online and print it out for free. Attach to noncustodial parent’s return each year exemption is claimed.. Web when to use form 8332. Be sure to keep copies of. December 2000) department of the treasury internal revenue service. Permission can also be granted for future tax years so you do not need to repeatedly file this form. Make entries in these fields: Web form 8332 is generally attached to the claimant's tax return. Web the role of tax form 8332 in tax reform. You must attach a copy of the revocation to your 2019 Then fill out the relevant section: See what is backup withholding, later. The credit for other dependents is limited to $500 per qualifying dependent, and it’s only available to. Follow the onscreen instructions to complete the return. Print, sign, and distribute to noncustodial parent. Form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. Web this would enable the return to be electronically filed and form 8332 to be sent to the irs along with form 8453. Clarify your ira tax situation. Prepare the form 8332 on the noncustodial parent's return. All noncustodial parents must attach form 8332 or a similar statement to their return each year the custodial parent provides the release. The irs also stated it was permissible for part i not to be completed. Either release your exemption (i.e., you won't claim the exemption) or revoke your. Thus, the irs concluded that the father was correct in claiming the children.

Boost Efficiency With Our PDF Converter For IRS Form 8332

Irs Form 4506 T Printable Printable Forms Free Online

Irs Form 8332 Printable

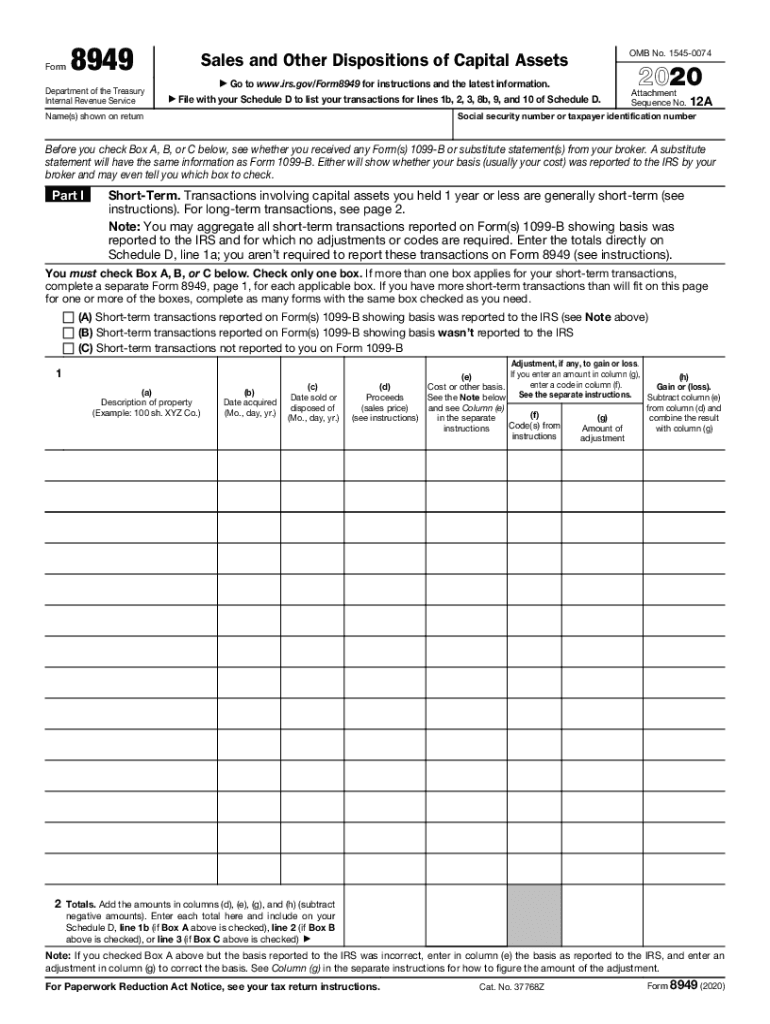

Fillable Irs Form 8949 Printable Forms Free Online

Irs Form 8332 Printable

Form 8332 Release/Revocation of Release of Claim to Exemption for Ch…

Tax Form 8332 Printable

Irs Fillable Forms 2020 Fill Online Printable Fillable Blank Form

IRS Form 8332 How Can I Claim a Child? The Handy Tax Guy

Printable Irs Form 8822 Printable Forms Free Online

Web The Full Name Of Form 8332 Is Release/Revocation Of Release Of Claim To Exemption For Child By Custodial Parent.

Attach To Noncustodial Parent’s Return Each Year Exemption Is Claimed.

While The Tax Benefit Of Exemptions Is $0 Until 2025 Under Tax Reform, There Are Other Tax Benefits A Noncustodial Can Claim With A Release From The Custodial Parent.

This Can Be Done By Writing “All Future.

Related Post: