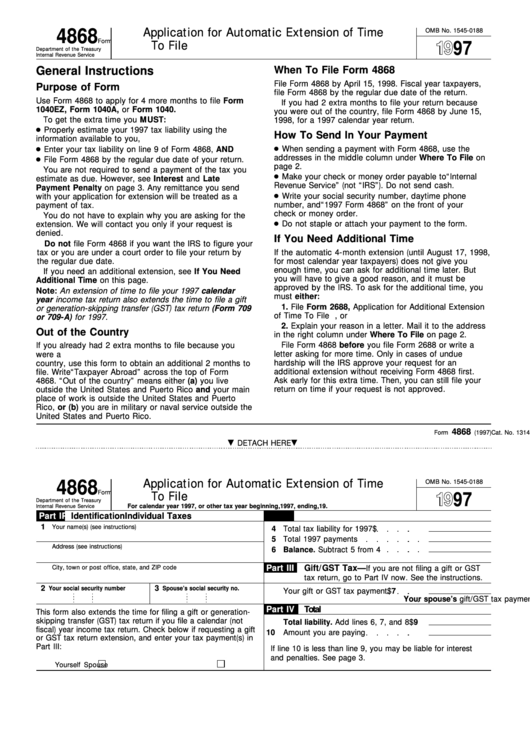

Irs Form 4868 Printable

Irs Form 4868 Printable - Payment and mailing instructions are on pages 3 and 4 of your printout. Web all you need to do is submit form 4868. One method is to return to the extension steps, review your entries, and then print a copy of the form. Just make sure it’s postmarked by april 15. Individual income tax return for 2023. Anyone can qualify for an automatic federal tax extension. Web filing the irs form 4868 for 2022 printable or online is mandatory for those individuals and businesses that need to file a federal tax return but need an extension of time to do so. Individual income tax return for 2022. Individual income tax return, but not to pay taxes owed. This form grants an automatic extension of time to file a u.s. Go to www.irs.gov/form4868 for the latest information. Anyone can qualify for an automatic federal tax extension. Money back guaranteecancel anytimetrusted by millionsfree mobile app Although the current date is requested in this process, the date is not printed on form 4868. Web there are two methods for printing form 4868 application for automatic extension of time to file u.s. Payment and mailing instructions are on pages 3 and 4 of your printout. Web there are two methods for printing form 4868 application for automatic extension of time to file u.s. Department of the treasury internal revenue service (99) application for automatic extension of time to file u.s. More about the federal form 4868 individual income tax extension ty 2023.. Go to www.irs.gov/form4868 for the latest information. You can also obtain this information from the irs form 4868 instructions (at the top of page 4). Anyone can qualify for an automatic federal tax extension. Next, proceed to summary/print (navigation bar) on left side of screen followed by print return. Individual income tax return, but not to pay taxes owed. Anyone can qualify for an automatic federal tax extension. Web form 4868, also known as the application for automatic extension of time to file u.s. Follow the instructions to fill out the form and mail it to the appropriate address depending on your state or situation. Web learn what form 4868 is, who can file it, and how to download. Want to file by paper form? Payment and mailing instructions are on pages 3 and 4 of your printout. Web download and print the official pdf form to request an automatic extension of time to file your u.s. Web form 4868, also known as the application for automatic extension of time to file u.s. Just make sure it’s postmarked by. One method is to return to the extension steps, review your entries, and then print a copy of the form. More about the federal form 4868 individual income tax extension ty 2023. Find out the benefits, drawbacks, and alternatives of this option. Find out the eligibility, deadlines, payment options, and faqs for this form. Find out the due date, the. This form grants an automatic extension of time to file a u.s. Money back guaranteecancel anytimetrusted by millionsfree mobile app Web learn how to request extra time to file your tax return by using form 8868 or other methods. Next, proceed to summary/print (navigation bar) on left side of screen followed by print return. Find out who can file, what. Individual income tax return, but not to pay taxes owed. Web download and print form 4868, fill it out, and mail it before 11:59 pm on april 15, 2024. Follow the instructions to fill out the form and mail it to the appropriate address depending on your state or situation. Web learn how to file irs form 4868 to extend. Find out the due date, the forms you need, and the special rules for different situations. Anyone can qualify for an automatic federal tax extension. Department of the treasury internal revenue service (99) application for automatic extension of time to file u.s. Web form 4868, also known as the application for automatic extension of time to file u.s. Web all. Individual income tax return, but not to pay taxes owed. Find out the benefits, drawbacks, and alternatives of this option. Want to file by paper form? Web learn how to file irs form 4868 to extend your tax deadline by six months. One method is to return to the extension steps, review your entries, and then print a copy of. Follow the instructions to fill out the form and mail it to the appropriate address depending on your state or situation. Individual income tax return for 2022. This form grants an automatic extension of time to file a u.s. Money back guaranteecancel anytimetrusted by millionsfree mobile app Web there are two methods for printing form 4868 application for automatic extension of time to file u.s. Web learn what form 4868 is, who can file it, and how to download it. Find out the eligibility, deadlines, payment options, and faqs for this form. More about the federal form 4868 individual income tax extension ty 2023. You can also obtain this information from the irs form 4868 instructions (at the top of page 4). You can file a tax extension online in one of several ways with h&r block. Individual income tax return for 2023. Web download and print the official pdf form to request an automatic extension of time to file your u.s. Go to www.irs.gov/form4868 for the latest information. Find out who can file, what information is required, and how to pay your taxes on time. Web learn how to request extra time to file your tax return by using form 8868 or other methods. Web form 4868, also known as the application for automatic extension of time to file u.s.

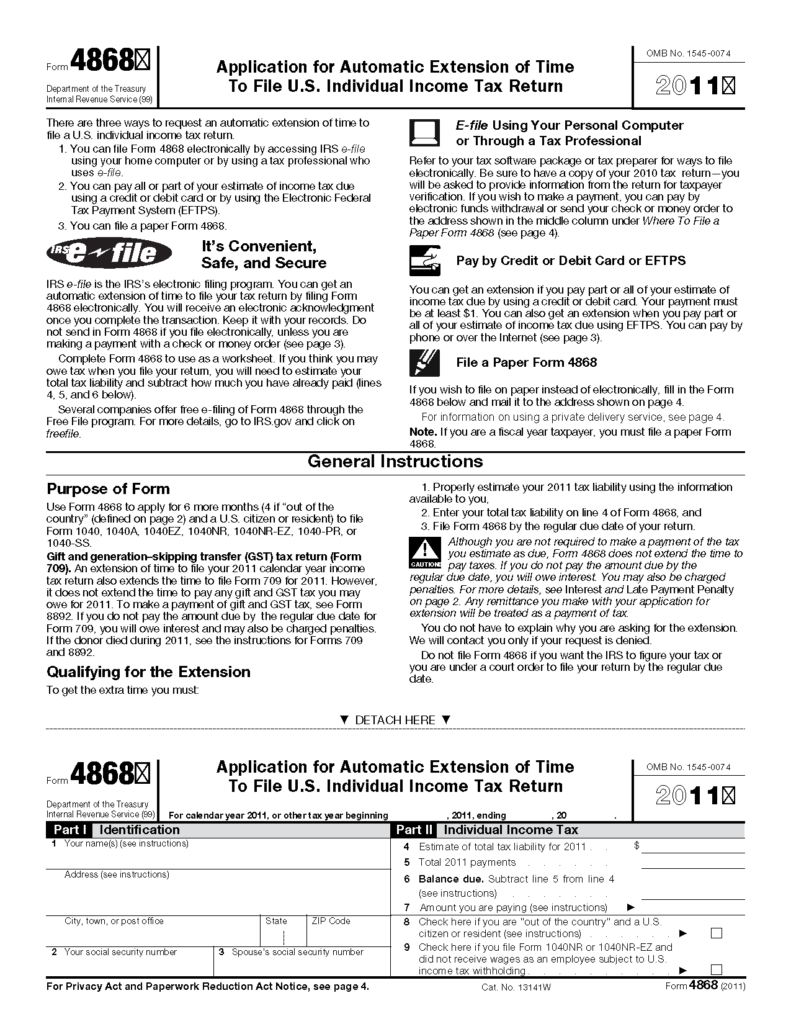

Form 4868 Application For Automatic Extension Of Time To 2021 Tax

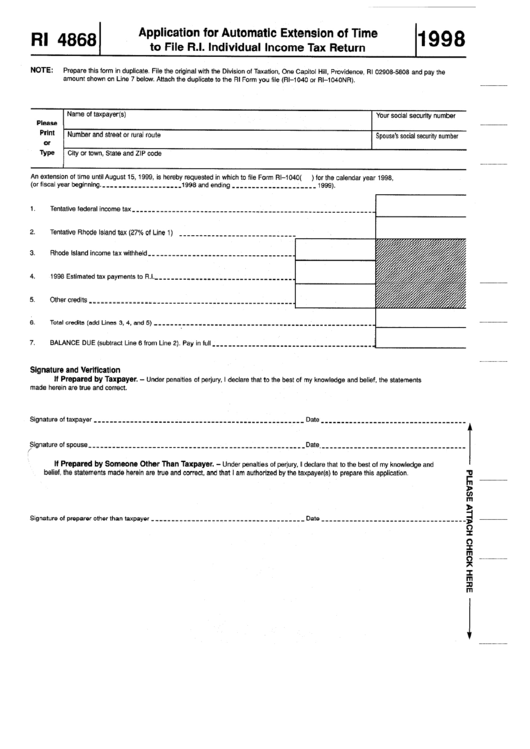

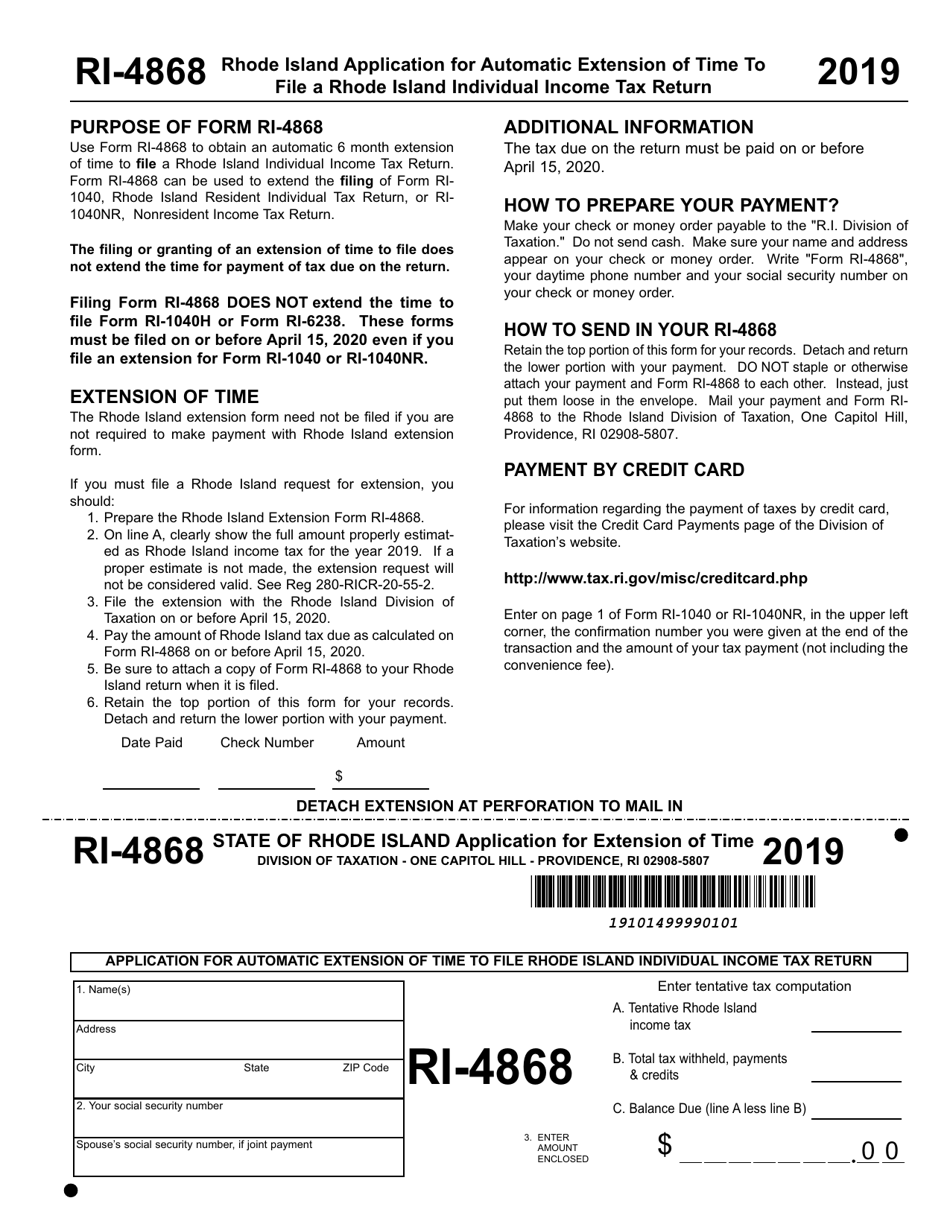

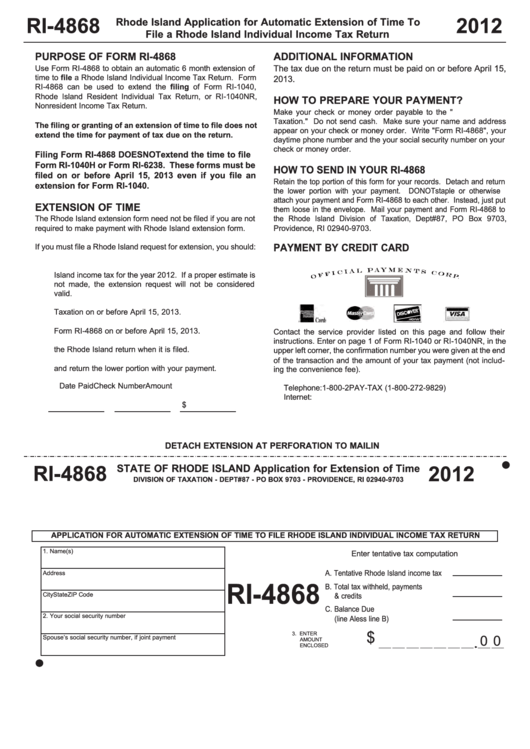

Fillable Form Ri 4868 Application For Automatic Extension Of Time To

irsform4868applicationforautomaticextensionoftimetofile

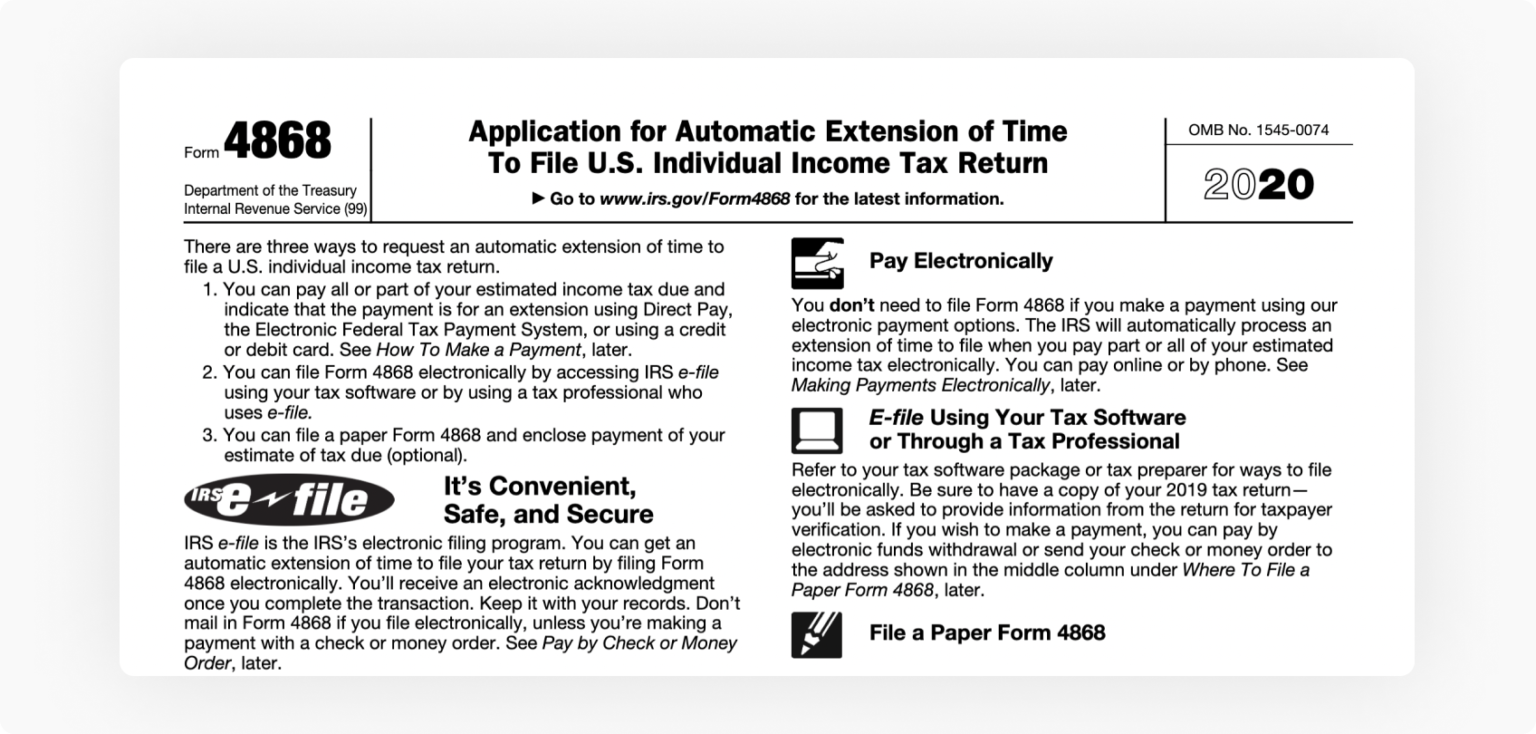

Fillable Online 2020 Form 4868. Application for Automatic Extension of

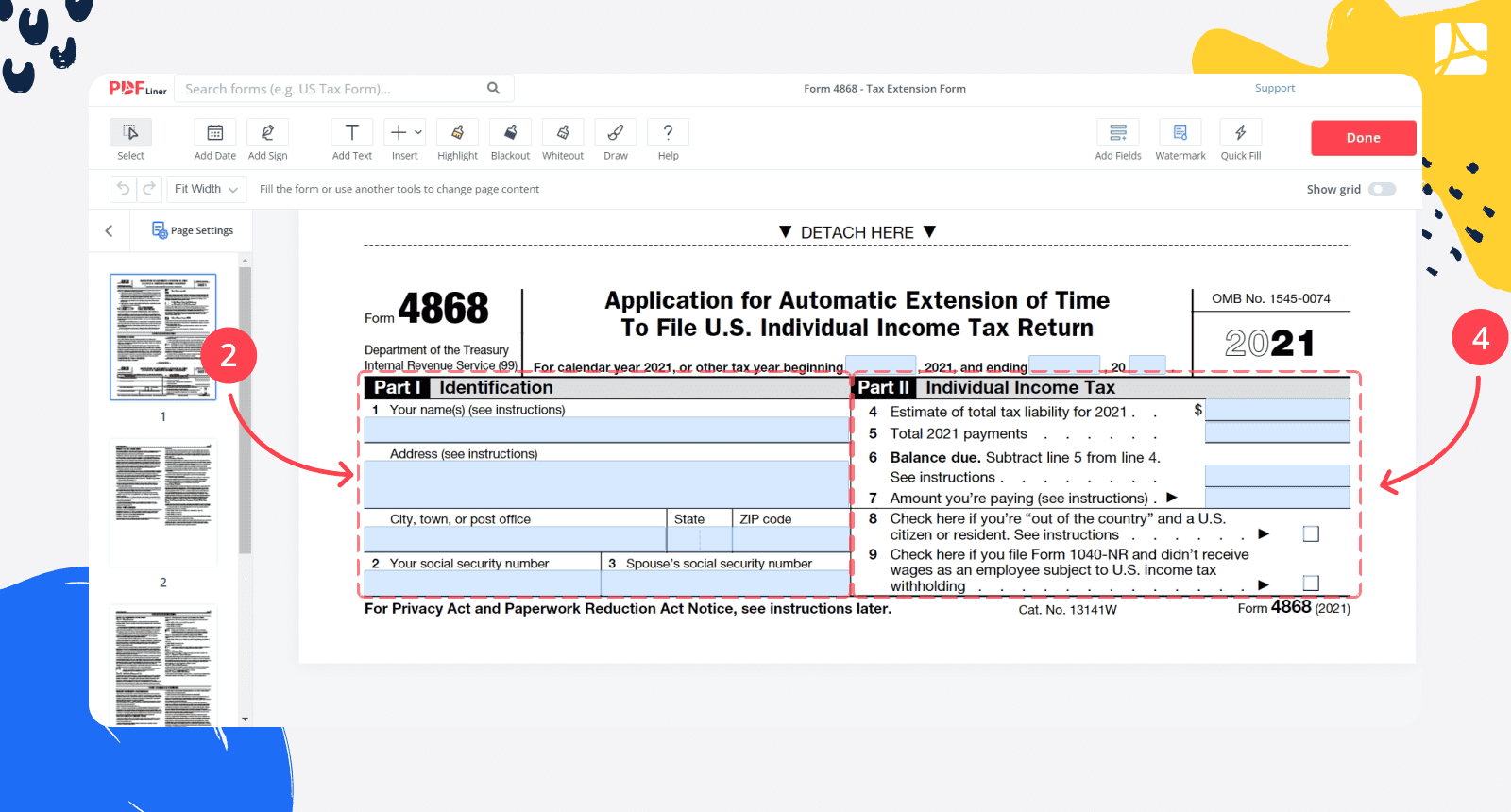

IRS Form 4868 2023, Application for Automatic Tax Extension PDFliner

irs extension form 2018 Fill Online, Printable, Fillable Blank irs

Fillable Form 4868 Application For Automatic Extension Of Time To

Printable Form 4868

Learn How to Fill the Form 4868 Application for Extension of Time To

Fillable Form Ri4868 Rhode Island Application For Automatic

Learn How To Pay Your Estimated Tax, File Electronically, Or Mail A Paper Form.

Anyone Can Qualify For An Automatic Federal Tax Extension.

Web Download And Print The Official Pdf Form To Request An Automatic Extension Of Time To File Your U.s.

Web Learn How To File Irs Form 4868 To Extend Your Tax Deadline By Six Months.

Related Post: