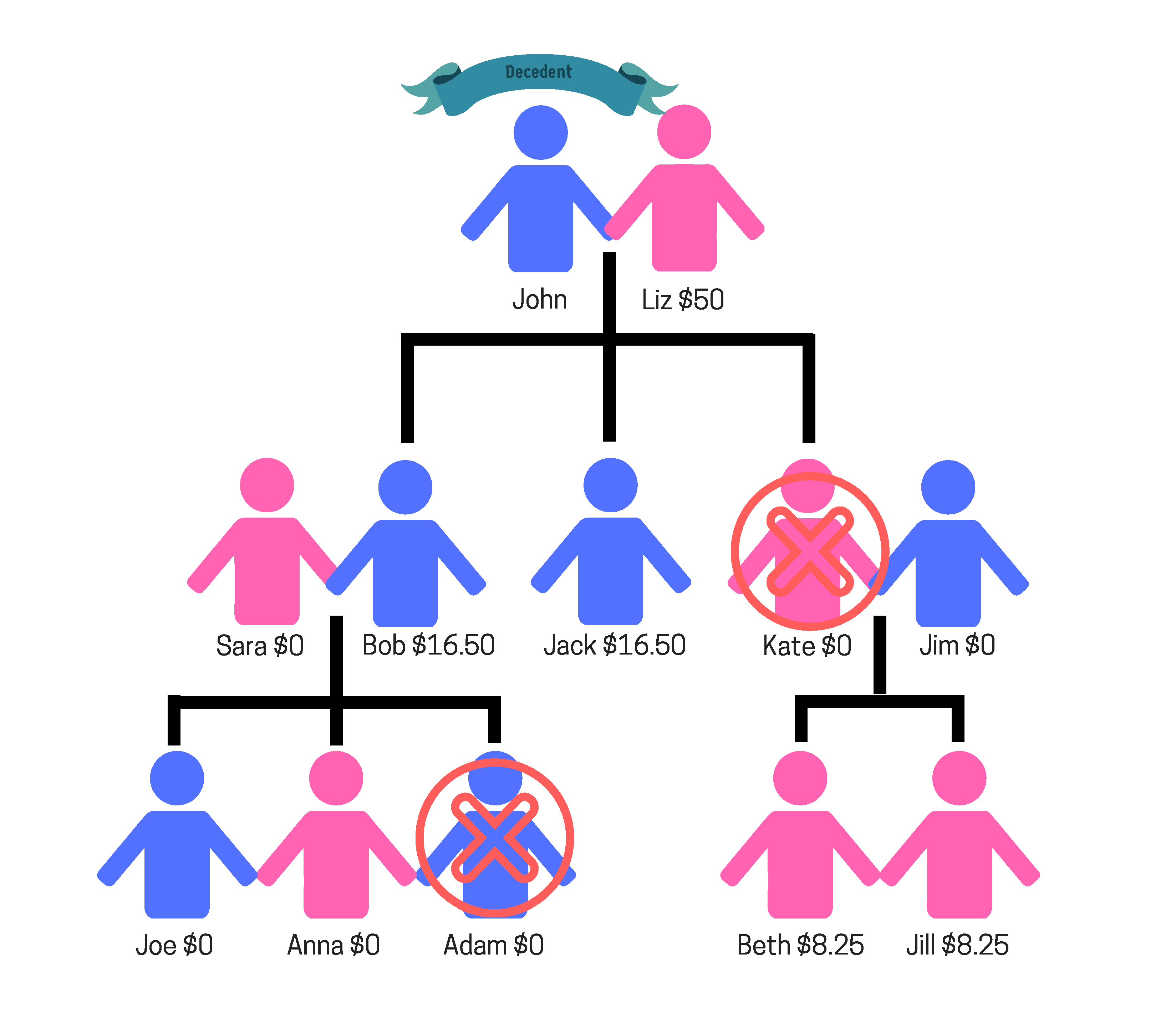

Illinois Intestate Succession Chart

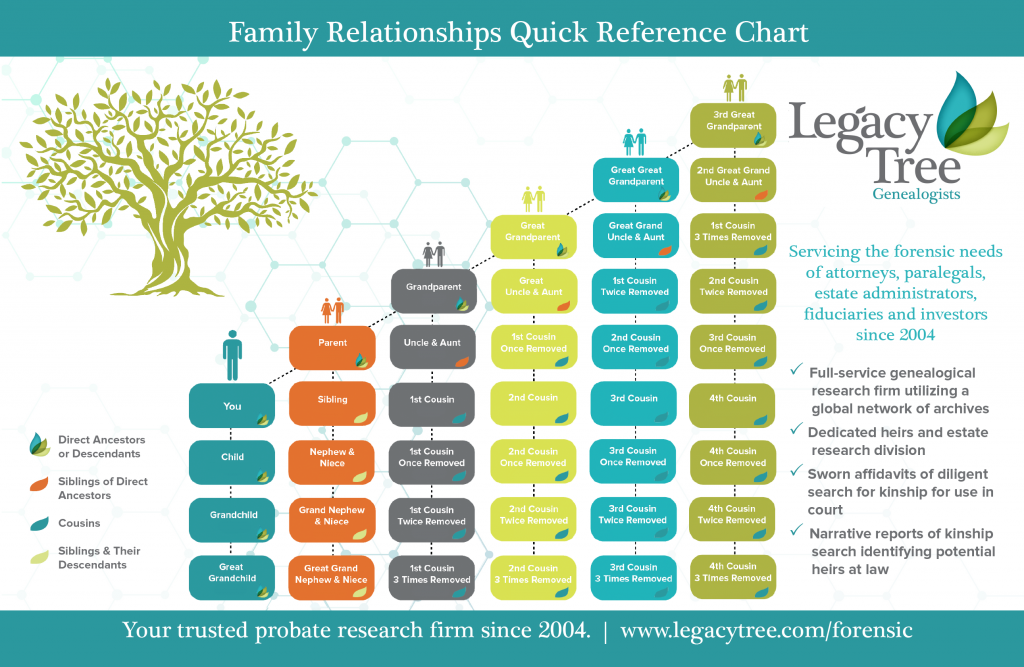

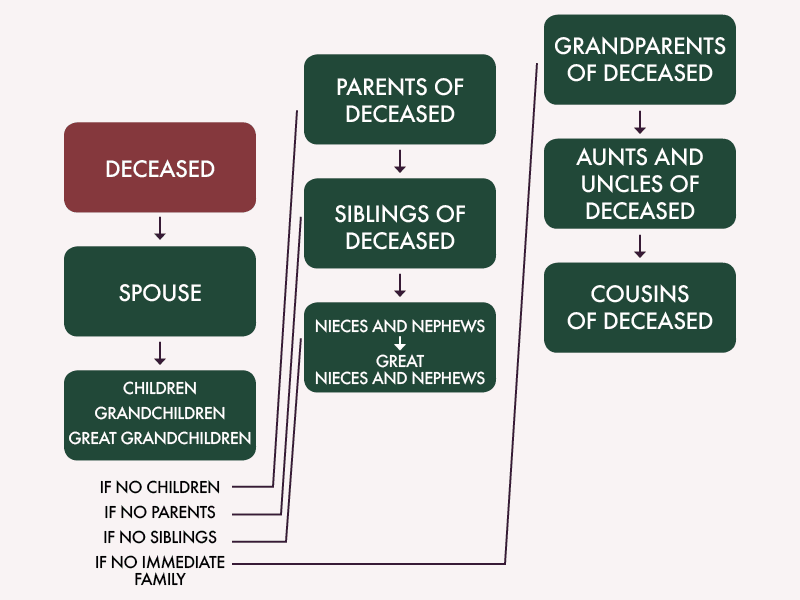

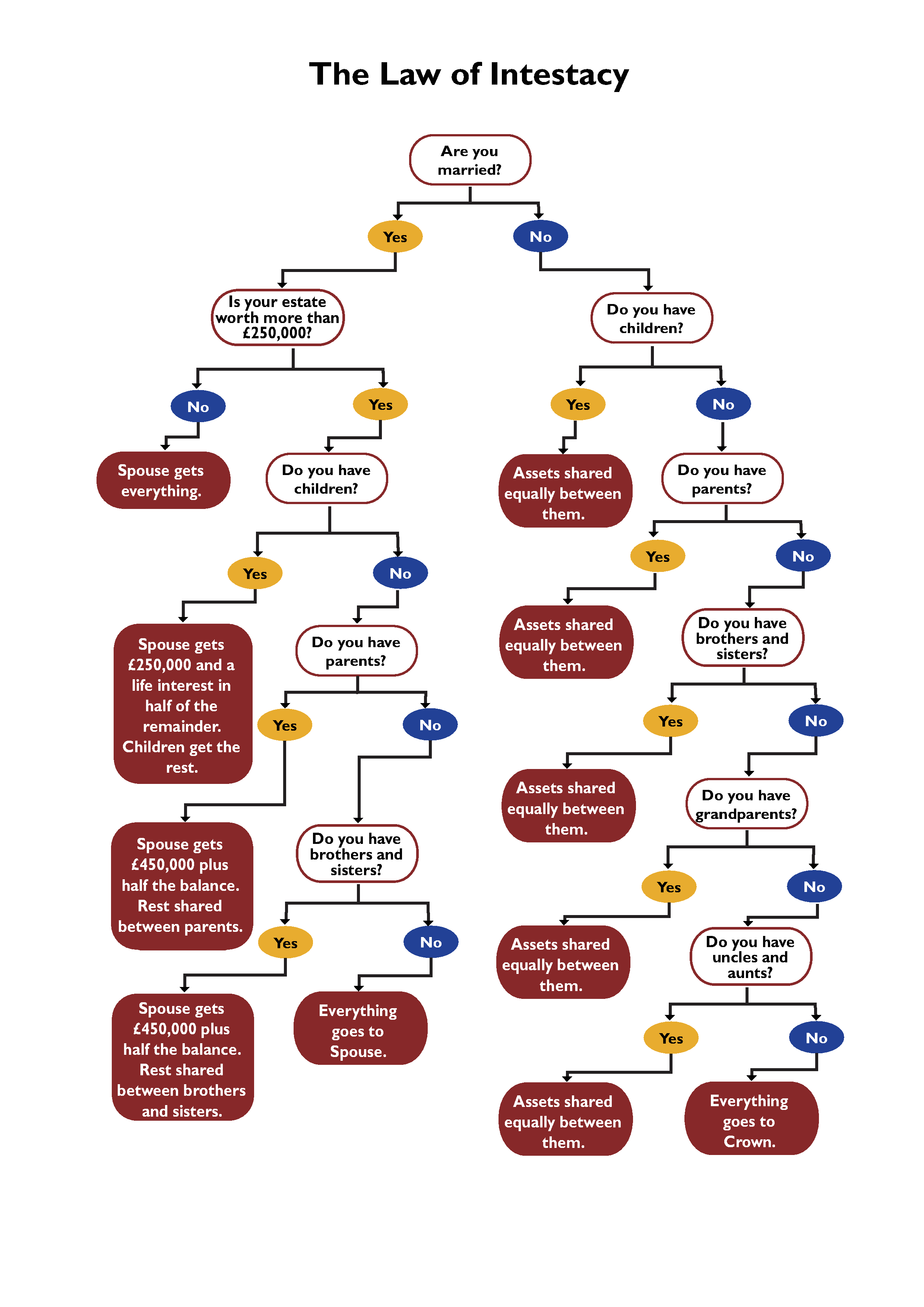

Illinois Intestate Succession Chart - A brief overview of the probate process. (1) ascendant means an individual who precedes another individual in lineage, in the direct line of ascent from the other individual. Web property that is owned jointly with the right of survivorship or in tenancy by the entirety passes automatically to the other living owner (s) at the time of death. Web in illinois, the intestate laws are as follows: Using a small estate affidavit. Web (a) the surviving spouse or any person nominated by the surviving spouse. Illinois law governing these rules. Web specifically, the illinois intestate succession laws dictate that your estate shall be distributed as follows: Web the intestate real and personal estate of a resident decedent and the intestate real estate in this state of a nonresident decedent, after all just claims against his estate are fully paid, descends and shall be distributed as follows: If a person dies without a will, the person died intestate. Fact checked by emily ernsberger. Web updated on december 21, 2023. There are two primary ways that an estate is administered in illinois. Web share this post: Web the main reason that is important to determine a decedent’s next of kin is for purposes of intestate succession. (1) ascendant means an individual who precedes another individual in lineage, in the direct line of ascent from the other individual. The spouse receives the entire probate property. Web our intestate succession chart shows which heirs would receive what percentage of the decedent’s assets depending on which of them survive the decedent. The decedent's property is given to the decedent's. Deceased person is survived by spouse and descendants: Web (a) if there is a surviving spouse and also a descendant of the decedent: Web updated on december 21, 2023. (b) the legatees or any person nominated by them, with preference to legatees who are children. The following is a summary of the rules for distributing their assets in the state. There are two primary ways that an estate is administered in illinois. Canceling or revoking a transfer on death instrument todi. If a person dies without a will, the person died intestate. Web if you die without a will in illinois, your assets will go to your closest relatives under state intestate succession laws. Who gets what in illinois? Web (a) the surviving spouse or any person nominated by the surviving spouse. Web in illinois, the intestate laws are as follows: Deceased person is survived by spouse and no descendants: In this article, we break down illinois inheritance laws, including what happens if you die without a valid will and where you may stand if you’re not part of. Web the main reason that is important to determine a decedent’s next of kin is for purposes of intestate succession. The intestate real and personal estate of a resident decedent and the intestate real estate in this state of a nonresident decedent, after all just claims against his estate are fully paid, descends and shall be distributed as follows: Under. Web the intestate real and personal estate of a resident decedent and the intestate real estate in this state of a nonresident decedent, after all just claims against his estate are fully paid, descends and shall be distributed as follows: Web if you die without a will in illinois, this means you have passed “intestate.” when this happens, state intestacy. There are two primary ways that an estate is administered in illinois. The person who died is called the decedent. For example, in illinois, property is distributed in the following manner: Deceased person is survived by spouse and descendants: To understand this intestate succession chart, it’s vital to know the difference between how community property and separate property are handled. The intestate real and personal estate of a resident decedent and the intestate real estate in this state of a nonresident decedent, after all just claims against his estate are fully paid, descends and shall be distributed as follows: The entire estate to the decedent's descendants per stirpes. A brief overview of the probate process. Fact checked by emily ernsberger.. If you die with a spouse but no descendants, then the spouse inherits everything. Web if you die without a will in illinois, your assets will go to your closest relatives under state intestate succession laws. The spouse receives half the property and the children split the remaining half. Who gets what in illinois? The following is a summary of. Web specifically, the illinois intestate succession laws dictate that your estate shall be distributed as follows: For example, in illinois, property is distributed in the following manner: (c) the children or any person nominated by them. Who gets what in illinois? Fact checked by emily ernsberger. A brief overview of the probate process. Deceased person is survived by spouse and descendants: When a person dies in illinois, the decedent’s debts must be paid and any property remaining must be distributed to the decedent’s heirs and/or legatees (people who receive gifts under a will). Deceased person is survived by spouse and no descendants: Here are some details about how intestate succession works in illinois. Only assets that pass through probate are affected by intestate succession laws. Web (a) the surviving spouse or any person nominated by the surviving spouse. When an illinois resident dies without having made a last will and testament, the intestacy succession laws found in the illinois statutes will dictate who inherits the deceased person's probate estate. The person who died is called the decedent. Web illinois intestate succession chart (00440827).docx. Illinois law governing these rules.

What Happen to Our Wealth After Death? My Stocks Investing

Intestate Succession by State Statutes & Laws Legacy Tree

Laws of Intestate Succession By State

Do You Really Need a Last Will? Reda Ciprian Magnone, LLC

Illinois Renunciation and Disclaimer of Property received by Intestate

Illinois Succession Form Fill Out and Sign Printable PDF Template

What are Rules of Intestacy Mind At Rest Wills

Illinois Renunciation and Disclaimer of Property received by Intestate

Who Inherits If No Will in Illinois A Guide for Heirs and Executors

Intestate succession illinois Fill out & sign online DocHub

Which Assets Pass By Intestate Succession.

Web Our Intestate Succession Chart Shows Which Heirs Would Receive What Percentage Of The Decedent’s Assets Depending On Which Of Them Survive The Decedent.

The Intestate Real And Personal Estate Of A Resident Decedent And The Intestate Real Estate In This State Of A Nonresident Decedent, After All Just Claims Against His Estate Are Fully Paid, Descends And Shall Be Distributed As Follows:

If You Die With A Spouse But No Descendants, Then The Spouse Inherits Everything.

Related Post: