How Do You Balance A Cash Drawer

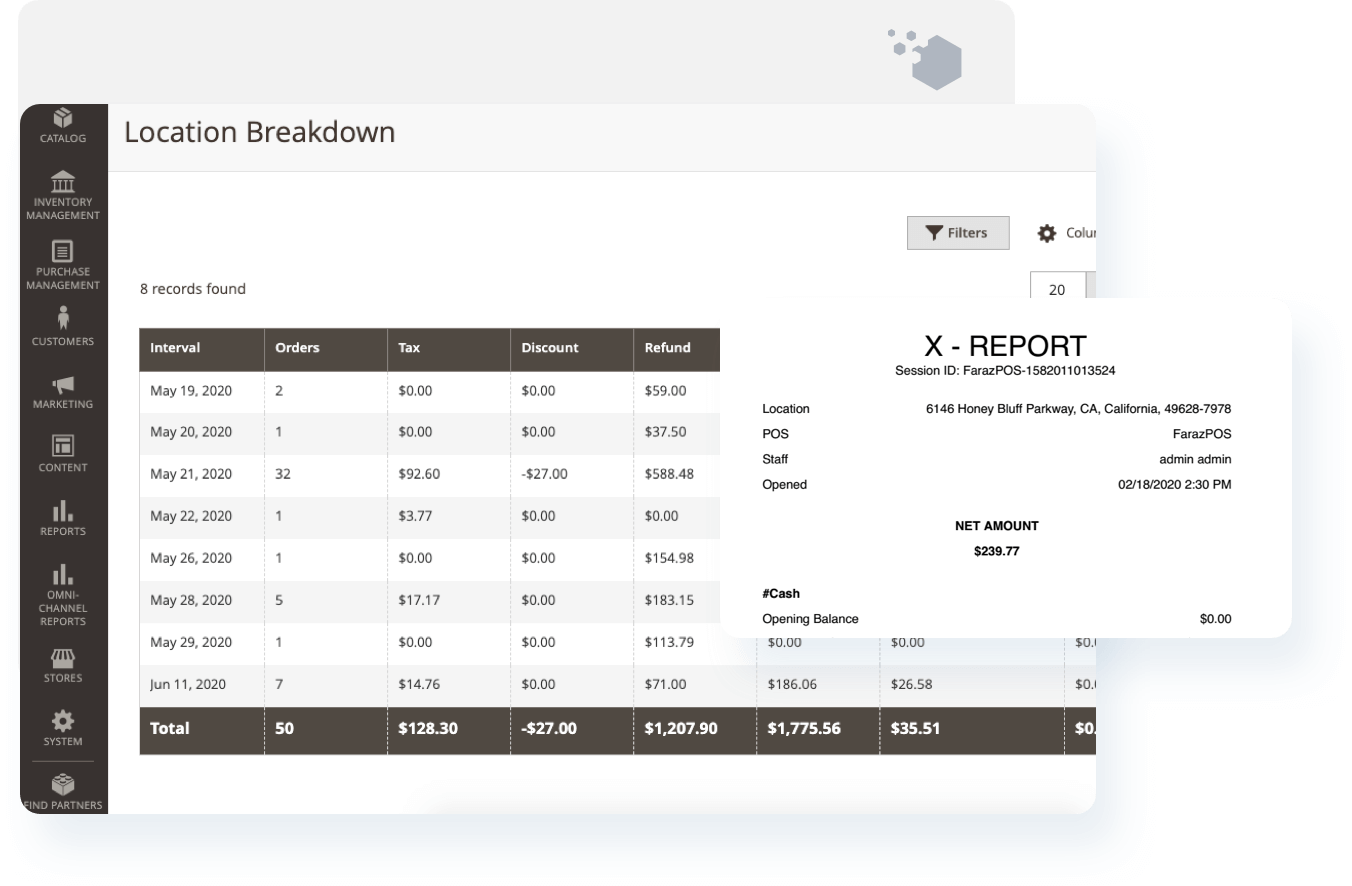

How Do You Balance A Cash Drawer - Write an iou for $215 to the server and pay them out when you go to the bank and get the safe back up to operating balances. After you start a cash drawer session, you’ll see basic information on the current session, including starting cash amount, cash sales, cash refunds, cash paid in/out and the expected cash amount in the drawer. Web add up the total of the cash drawer and reconcile it against your ending figure from step 1. Once everything is added up, you’ll compare your total with the total given by your pos. Open your retail pos app and tap checkout. Web the best process for how to balance a cash register is simple to introduce with just a few easy steps. At the end of the night the drawer should have the starting balance. Accurate balancing of cash drawers requires a reliable point of reference. Count your cash drawer at the start of each workday. Print it out and pull the cash drawer, before retreating to a discrete area. This will pull up a number pad where you can set the new starting balance to the cash drawer. For a small business, $100 to $150 should be more than enough. If you have an overage or shortage, recount the cash. For example, count your $100 dollar bills and write the amount on the spreadsheet under $100 denominations. Fingers crossed,. You could also pay them out the $50 that you have in the safe (so they can at least tip out the service staff) and write them a $165 iou instead. Add sales report to pos. The pos report will also break down transactions by payment method (cash. Fingers crossed, this amount should align perfectly. Web the most fundamental aspect. Accurate balancing of cash drawers requires a reliable point of reference. If your store is small and has one counter, you can leave cash in your cash drawer overnight. Write an iou for $215 to the server and pay them out when you go to the bank and get the safe back up to operating balances. You could also pay. For accurate balancing, a reliable point of reference is essential. If the cash you have in your drawer matches with the cash on your pos tally, then your accounts are likely balanced. Web beginning of a work shift. When recording your cash register totals, be sure to account for your beginning balance (e.g. This feature acts as a check and. Fill out a deposit slip for that specific amount of money and place it in the envelope. To balance the till, make sure you have a separate person count the cash, remove what is in your drawer, and see that it gets deposited. Web generally, one drawer is easier to balance than many, but it also depends on how many. If your store is small and has one counter, you can leave cash in your cash drawer overnight. Fill out a deposit slip for that specific amount of money and place it in the envelope. Web let your manager and the bookkeeping office know the difference, and then pull the amount from the envelope and put it back in the. This report serves as a crucial tool for comparing against the physical count of cash. At the end of each shift or business day, pull the pos report for each drawer. For a small business, $100 to $150 should be more than enough. When recording your cash register totals, be sure to account for your beginning balance (e.g. Web generally,. The cash register should contain a consistent number of bills and coins so you can make change for your customers. Web in general, though, it’s best not to do this during peak hours, so if you’re working at lunchtime, then midday probably isn’t an ideal time for counting money. However, keep the process the same. When you reach a stopping. If you have an overage or shortage, recount the cash. The store owner should witness this with an. Balancing can be done with blindly or with the values showing. This report serves as a crucial tool for comparing against the physical count of cash. For accurate balancing, a reliable point of reference is essential. Web on the bottom will be the option to adjust starting balance. Count your cash on hand. Once you’ve counted the current cash balance, subtracted the starting balance, and added any cash drops made during the shift, your total cash should match the cash sales listed on the sales report. If your drawers vary by starting amount, you can adjust. Your cash on hand is the amount of money that your drawer contained when you started balancing. Once everything is added up, you’ll compare your total with the total given by your pos. From the navigation bar at the bottom of your screen, tap ≡ more. Check out using cash drawers during your shift to learn more. Web the best process for how to balance a cash register is simple to introduce with just a few easy steps. Tally up the sum totals of all coins, notes and. Tap the three dots (•••) to open the actions menu. Withdrawn cash drawer and x read to hand, begin the physical count. Web add a line to your p&l statements to account for cash discrepancies. Set reset balance type to. If the cash you have in your drawer matches with the cash on your pos tally, then your accounts are likely balanced. After you count your drawer and check out any discrepancies, record your cash drawer transactions in your books. Web start a cash drawer session. Web in general, though, it’s best not to do this during peak hours, so if you’re working at lunchtime, then midday probably isn’t an ideal time for counting money. Under primary cash drawer, set the starting cash drawer balance to the amount of cash the drawers will start with each day. Print it out and pull the cash drawer, before retreating to a discrete area.

Balancing Your Cash Drawer Steps, Tips, & More

How to Balance a Cash Register Drawer like a Pro Lightspeed

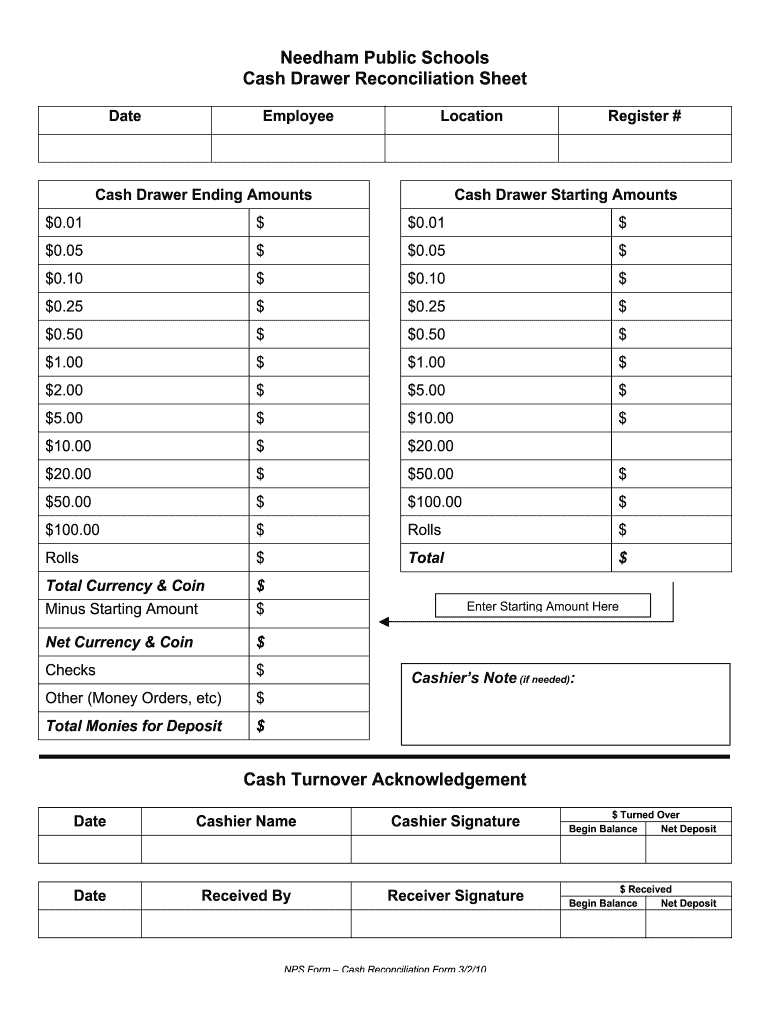

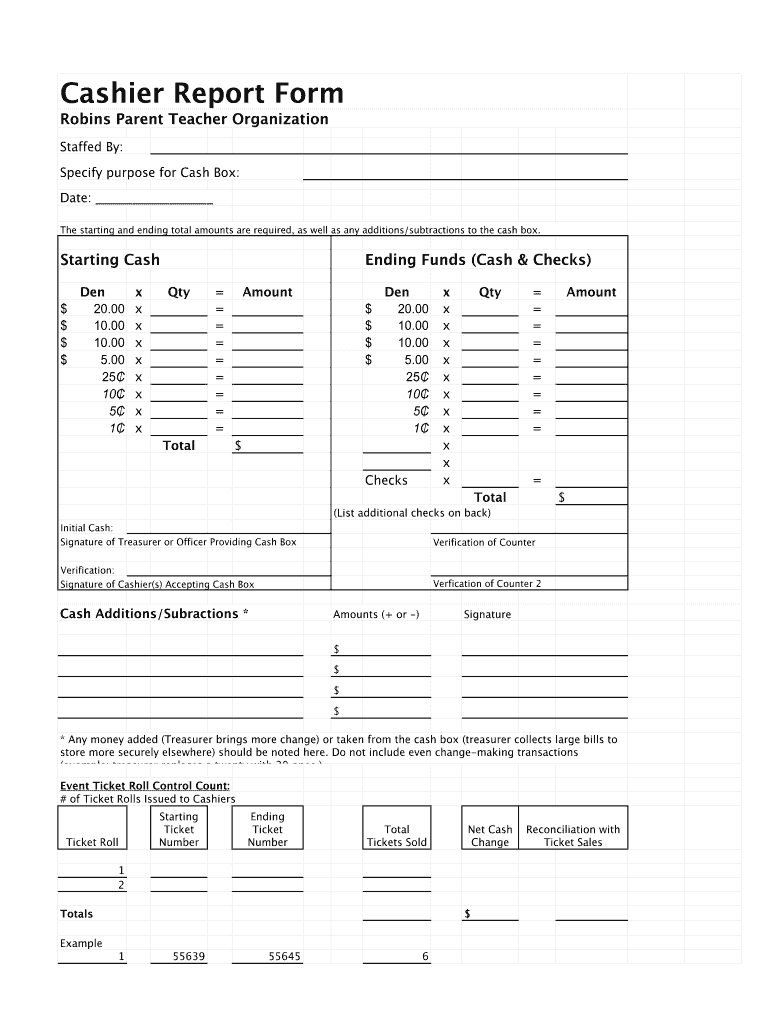

Printable Daily Cash Drawer Count Sheet

Daily Cash Drawer Balance Sheet Template Free Cash Drawer Balance

How to Balance Cash Drawers Quickly and Accurately Star Micronics

How to Balance Cash Drawers Easily in 5 Seconds

How to balance a cash drawer

How to Balance Cash Drawers Easily in 5 Seconds

How to Balance a Cash Drawer in Your Restaurant Glimpse Corp

How to Balance the Cash Drawer Beambox

The Cash Register Should Contain A Consistent Number Of Bills And Coins So You Can Make Change For Your Customers.

After You Start A Cash Drawer Session, You’ll See Basic Information On The Current Session, Including Starting Cash Amount, Cash Sales, Cash Refunds, Cash Paid In/Out And The Expected Cash Amount In The Drawer.

Once You’ve Counted The Current Cash Balance, Subtracted The Starting Balance, And Added Any Cash Drops Made During The Shift, Your Total Cash Should Match The Cash Sales Listed On The Sales Report.

Accurate Balancing Of Cash Drawers Requires A Reliable Point Of Reference.

Related Post: