Hmda Reportable Chart

Hmda Reportable Chart - Regulation c, 12 cfr part. Is the comprehensive edition for the. Edition effective january 1, 2022 (for hmda submissions due march 1, 2023) guide is the comprehensive edition for the 2022. Edition effective january 1, 2021 (for hmda submissions due march 1, 2022) this edition of the. The chart serves as a reference. Learn how to use the hmda tools and resources. This page includes all updates related to data. These resources are briefly described in this section and are further detailed. Web register, and how to fi le your hmda data collected in 2023 with the bureau. A regulatory and reporting overview reference chart for hmda data collected in 2022. Web hmda requires many financial institutions to maintain, report, and publicly disclose information about mortgages. A regulatory and reporting overview reference chart. This chart is intended to be used as a reference tool for data. This document is not a substitute for regulation c. This section may be useful for employees in a variety of roles, for example, your institution’s: The chart serves as a reference. Web register, and how to fi le your hmda data collected in 2023 with the bureau. This section may be useful for employees in a variety of roles, for example, your institution’s: Edition effective january 1, 2021 (for hmda submissions due march 1, 2022) this edition of the. This chart is intended to be. Learn how to use the hmda tools and resources. Edition effective january 1, 2023 (for hmda submissions due march 1, 2024) this edition of the guide is the comprehensive edition. Edition effective january 1, 2021 (for hmda submissions due march 1, 2022) this edition of the guide is the comprehensive edition. Web the hmda data and reports are the most. Web the cfpb recently posted the reportable hmda data: The chart serves as a reference. Web this section provides instructions on entering data in the loan/application register for hmda data collected in 2024. This chart is intended to be used as a reference tool for data. Edition effective january 1, 2021 (for hmda submissions due march 1, 2022) this edition. Is the comprehensive edition for the. This section may be useful for employees in a variety of roles, for example, your institution’s: On march 25, 2024, the 2023 modified lar was released. Web this section provides instructions on entering data in the loan/application register for hmda data collected in 2024. Web hmda data collected in 2024 with the consumer financial. A regulatory and reporting overview reference chart. This document is not a substitute for regulation c. Web this section provides instructions on entering data in the loan/application register for hmda data collected in 2024. Web the cfpb recently posted the reportable hmda data: On march 25, 2024, the 2023 modified lar was released. The chart serves as a reference. Edition effective january 1, 2022 (for hmda submissions due march 1, 2023) guide is the comprehensive edition for the 2022. Web this section provides instructions on entering data in the loan/application register for hmda data collected in 2024. Data fields and data points chart; Web the cfpb recently posted the reportable hmda data: Web find the official documentation for hmda data collection, reporting, and disclosure. These resources are briefly described in this section and are further detailed. Regulation c, 12 cfr part. Web on february 9, the cfpb published the 2023 reportable hmda data: Web on january 27, the cfpb published the reportable hmda data: Web register, and how to fi le your hmda data collected in 2023 with the bureau. Edition effective january 1, 2022 (for hmda submissions due march 1, 2023) guide is the comprehensive edition for the 2022. This chart is intended to be used as a reference tool for data. Web hmda requires many financial institutions to maintain, report, and publicly. Is the comprehensive edition for the. Regulation c, 12 cfr part 1003; Learn how to use the hmda tools and resources. Web hmda requires many financial institutions to maintain, report, and publicly disclose information about mortgages. These resources are briefly described in this section and are further detailed. Web hmda requires many financial institutions to maintain, report, and publicly disclose information about mortgages. This page includes all updates related to data. Edition effective january 1, 2023 (for hmda submissions due march 1, 2024) this edition of the guide is the comprehensive edition. Web on february 9, the cfpb published the 2023 reportable hmda data: Web register, and how to fi le your hmda data collected in 2023 with the bureau. Regulation c, 12 cfr part 1003; Web the cfpb recently posted the reportable hmda data: Official interpretation to regulation c, 12 cfr part 1003; Data fields and data points chart; This document is not a substitute for regulation c. On march 25, 2024, the 2023 modified lar was released. This chart is intended to be used as a reference tool for data. These resources are briefly described in this section and are further detailed. A regulatory and reporting overview reference chart for hmda data collected in 20201. The chart serves as a reference. Web on january 27, the cfpb published the reportable hmda data:

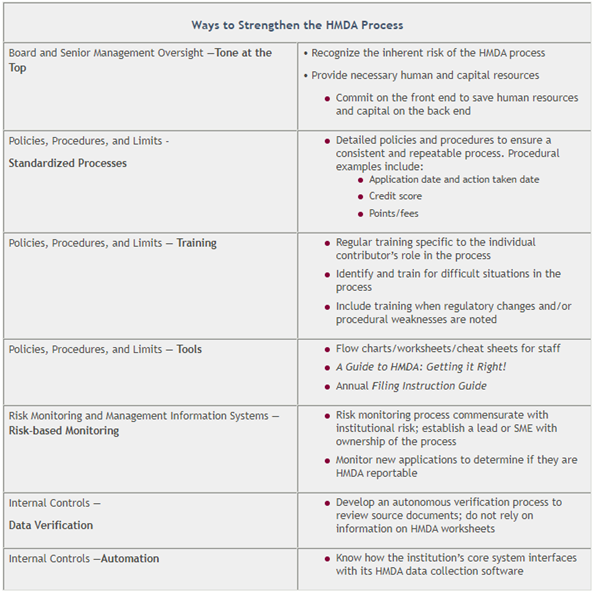

Sound Practices for Effective HMDA Compliance NAFCU

Home Mortgage Disclosure Act FAQs Consumer Financial Protection Bureau

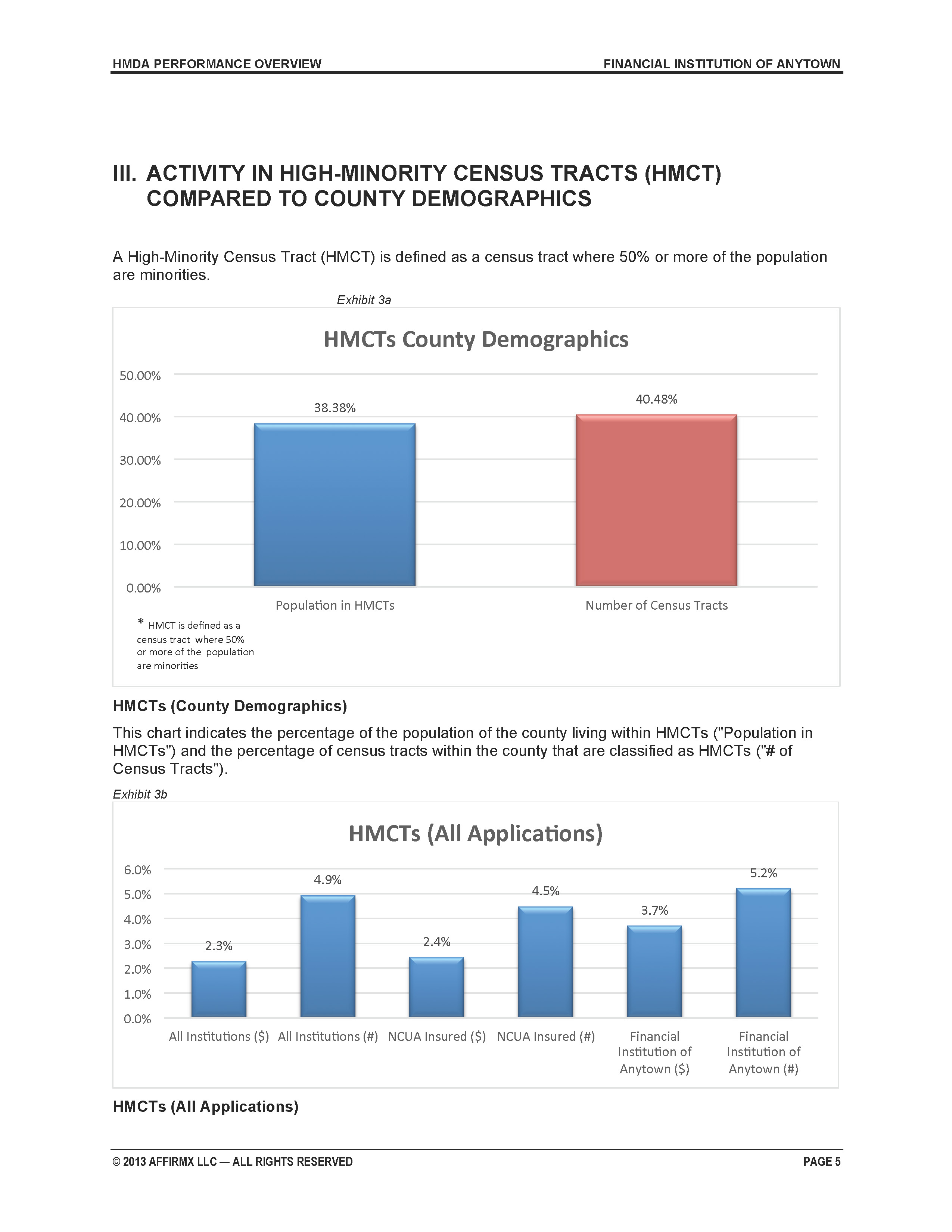

HMDA Performance Overview Report AdvisX

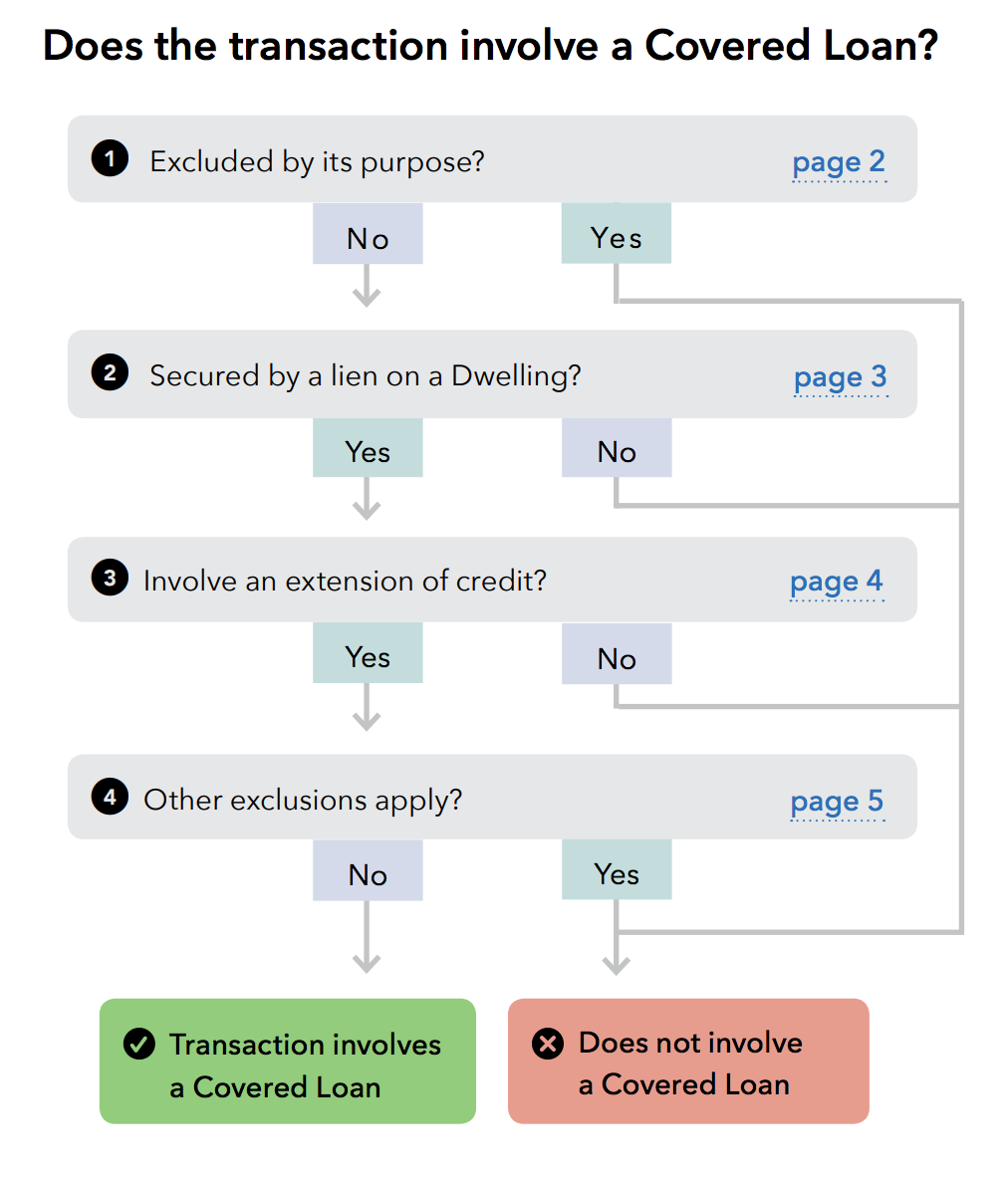

Reportable HMDA Data A Regulatory and Reporting Overview · This

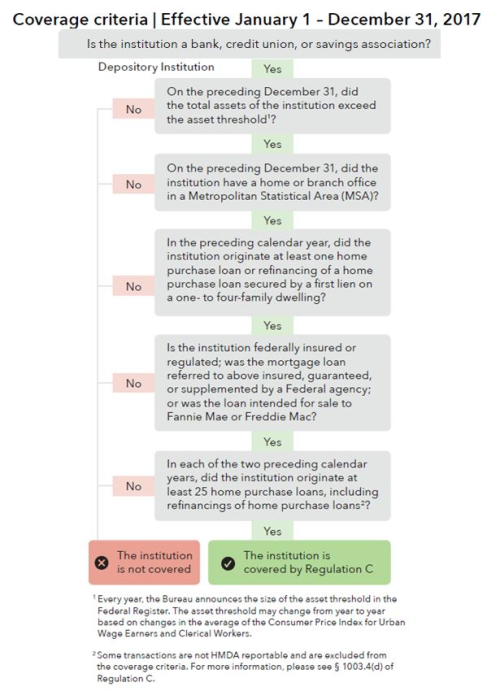

2017 Adjusted Threshold Levels for Regulations Z and C; Updated HMDA

hmdatridchart

Home Mortgage Disclosure Act (HMDA) changes in 2018

Your top 10 HMDA questions answered Part 6 HousingWire

HMDA Flowchart

HMDA Reporting Process

Web The Hmda Data And Reports Are The Most Comprehensive Publicly Available Information On Mortgage Market Activity.

A Regulatory And Reporting Overview Reference Chart For Hmda Data Collected In 2022.

Edition Effective January 1, 2022 (For Hmda Submissions Due March 1, 2023) Guide Is The Comprehensive Edition For The 2022.

Web Hmda Data Collected In 2024 With The Consumer Financial Protection Bureau (Bureau) In 2025.

Related Post: