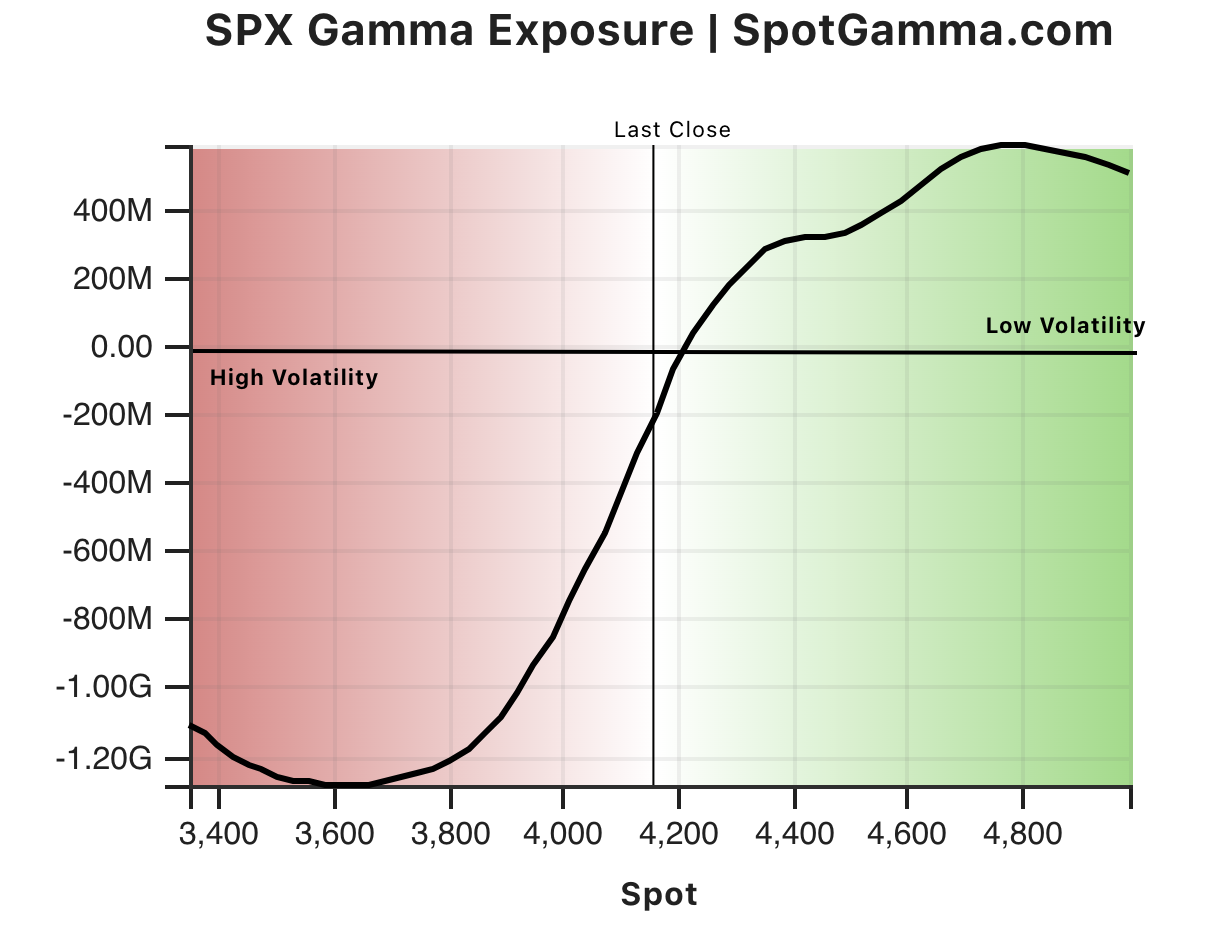

Gamma Exposure Chart

Gamma Exposure Chart - A simple gamma chart, provided by spotgamma, plotting spx gamma exposure every single trading day. See how to access the net gamma exposure tool and overlay it on stock. 26k views 1 year ago gamma exposure gex. You can create your own trigger levels based on options positioning. Web this chart visually represents the net gamma exposure for all options contracts related to spy at the current moment. Gex, as an extension, quantifies the aggregate gamma. Web a brief surface level intro to a gamma exposure chart and how to read it. Web learn what gamma exposure is and how it relates to delta hedging, liquidity, and volatility in options trading. They allow traders to quickly identify areas where gamma is increasing. Web the chart below shows net gamma exposure, based on puts vs calls so we can see where exposure is concentrated to one side, like puts, or another, such as calls. Gamma exposure is the second order price sensitivity of a certain derivative to changes in the price of its underlying. It is a valuable tool in helping you forecast changes in the delta of. Gex shows how much of a stock mms must buy/sell per 1% move in order to remain neutral in their. Gamma is part of the second. Web learn what gamma exposure is and how it relates to delta hedging, liquidity, and volatility in options trading. Equity universe on the russell 2000. See how to use the gamma exposure tools on the quant data platform. Understanding gamma exposure or gex as it's called can provide a tremendous edge when trading. Tsla fundamental data by tradingview. Gex shows how much of a stock mms must buy/sell per 1% move in order to remain neutral in their. This will help you understand the expected. The green bars signify net call gamma, indicating a. Equity universe on the russell 2000. Web this chart visually represents the net gamma exposure for all options contracts related to spy at the. Web below is a sample of our gamma exposure charts. Understanding gamma exposure or gex as it's called can provide a tremendous edge when trading. Web learn how to use gamma exposure (gex) to read structural flows and anticipate market movements. Web first of all, what is gamma exposure? Gamma is part of the second order of greeks which measure. 15, 2016 3:02 pm et spdr® s&p 500 etf trust (spy), qqq, dia pbf 41 comments. Are you tired from constantly. Equity universe on the russell 2000. Gex shows how much of a stock mms must buy/sell per 1% move in order to remain neutral in their. Tsla fundamental data by tradingview. Web below is a sample of our gamma exposure charts. Gamma exposure is the second order price sensitivity of a certain derivative to changes in the price of its underlying. A simple gamma chart, provided by spotgamma, plotting spx gamma exposure every single trading day. Gex shows how much of a stock mms must buy/sell per 1% move in order. The green bars signify net call gamma, indicating a. Web the chart below shows net gamma exposure, based on puts vs calls so we can see where exposure is concentrated to one side, like puts, or another, such as calls. Web so what is gex? Gamma is part of the second order of greeks which measure the sensitivity of first. Gamma is part of the second order of greeks which measure the sensitivity of first order greeks (delta) to changes in factors of the underlying. A simple gamma chart, provided by spotgamma, plotting spx gamma exposure every single trading day. Web learn how to use gamma exposure (gex) to read structural flows and anticipate market movements. Understanding gamma exposure or. They allow traders to quickly identify areas where gamma is increasing. Web this chart visually represents the net gamma exposure for all options contracts related to spy at the current moment. Web the chart below shows net gamma exposure, based on puts vs calls so we can see where exposure is concentrated to one side, like puts, or another, such. 26k views 1 year ago gamma exposure gex. Web below is a sample of our gamma exposure charts. Tsla symbol info by tradingview. It is a valuable tool in helping you forecast changes in the delta of. Gamma exposure is the second order price sensitivity of a certain derivative to changes in the price of its underlying. Web first of all, what is gamma exposure? Web below is a sample of our gamma exposure charts. Web so what is gex? 15, 2016 3:02 pm et spdr® s&p 500 etf trust (spy), qqq, dia pbf 41 comments. A simple gamma chart, provided by spotgamma, plotting spx gamma exposure every single trading day. Web a tool to calculate and compare gamma exposure (gex) for stocks with options. See how to use the gamma exposure tools on the quant data platform. 26k views 1 year ago gamma exposure gex. Web this chart visually represents the net gamma exposure for all options contracts related to spy at the current moment. Gex shows how much of a stock mms must buy/sell per 1% move in order to remain neutral in their. Web learn how to use gamma exposure (gex) to read structural flows and anticipate market movements. Equity universe on the russell 2000. The green bars signify net call gamma, indicating a. Tsla fundamental data by tradingview. Web learn what gamma exposure is and how it relates to delta hedging, liquidity, and volatility in options trading. Are you tired from constantly.

Free Gamma Exposure Chart SpotGamma™

Tier1 Alpha 100 Free Gamma Exposure Models!

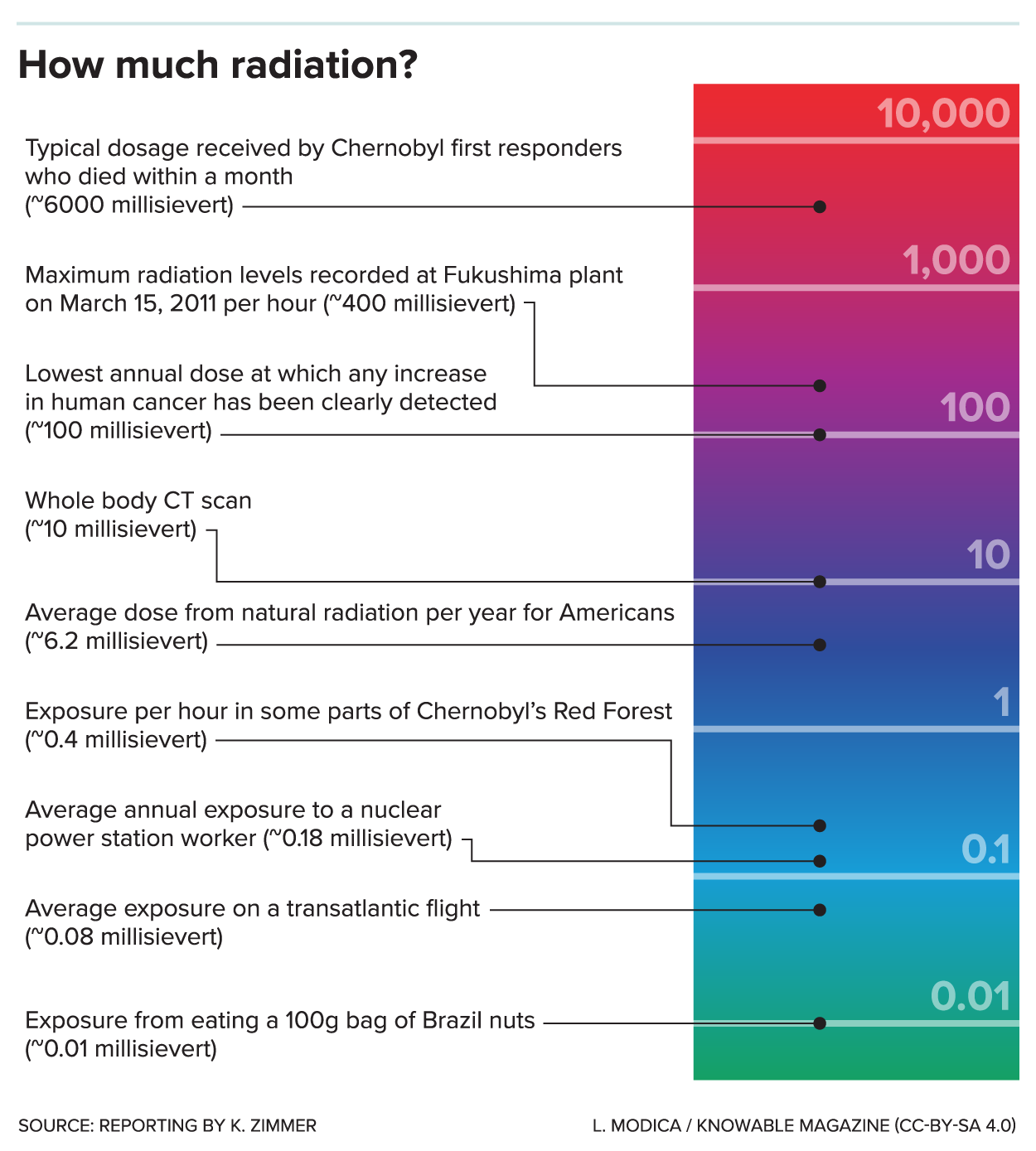

FileG radiationlevel scale 01.png Wikimedia Commons

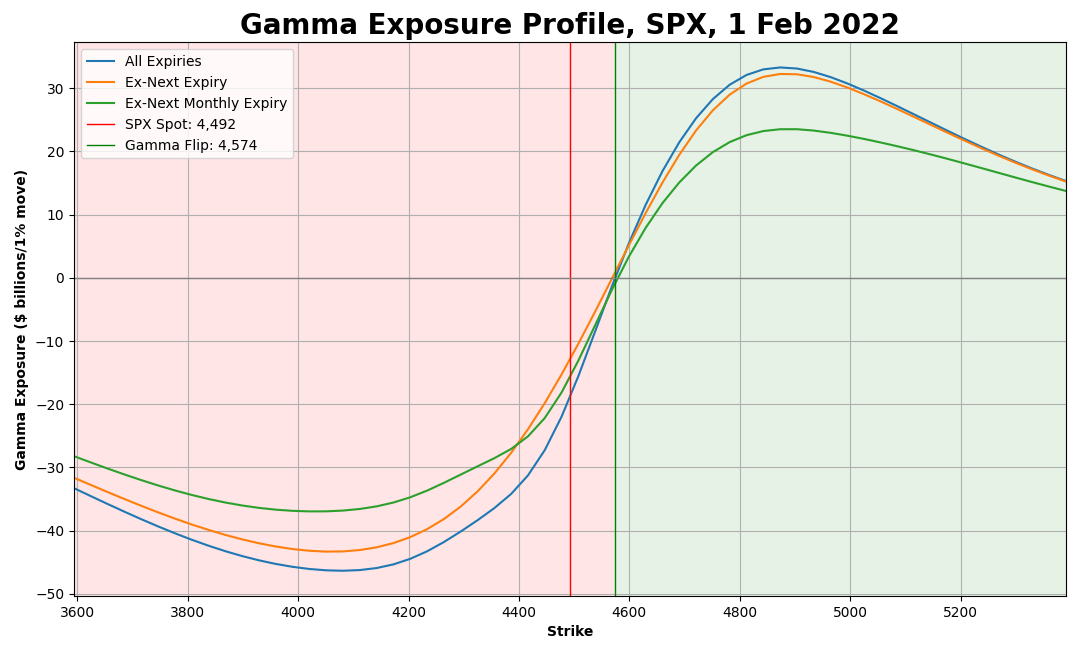

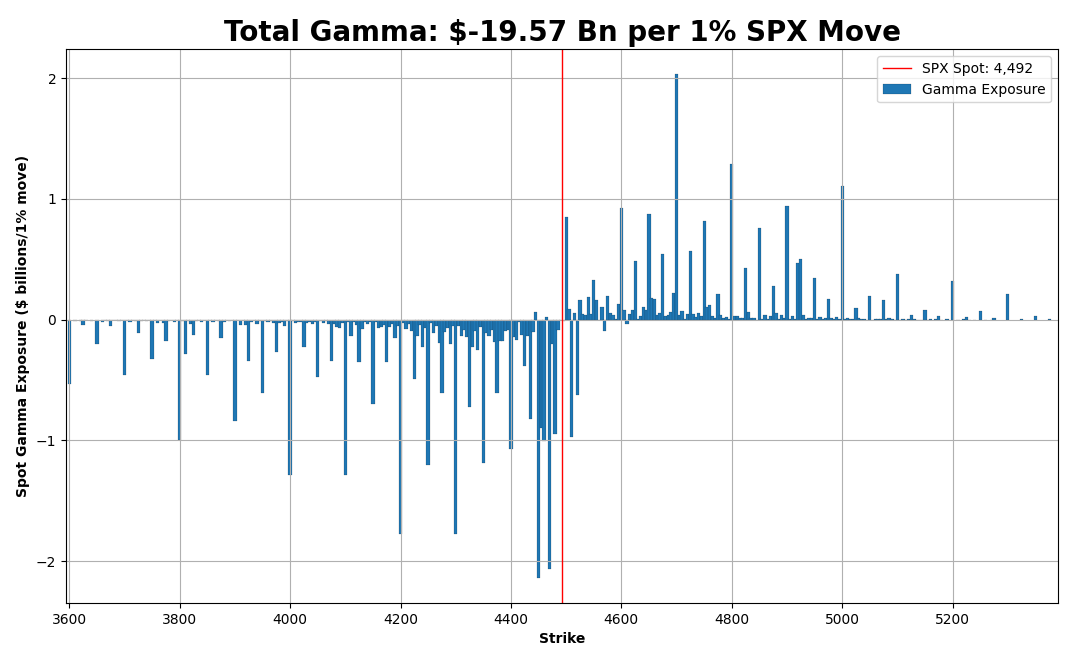

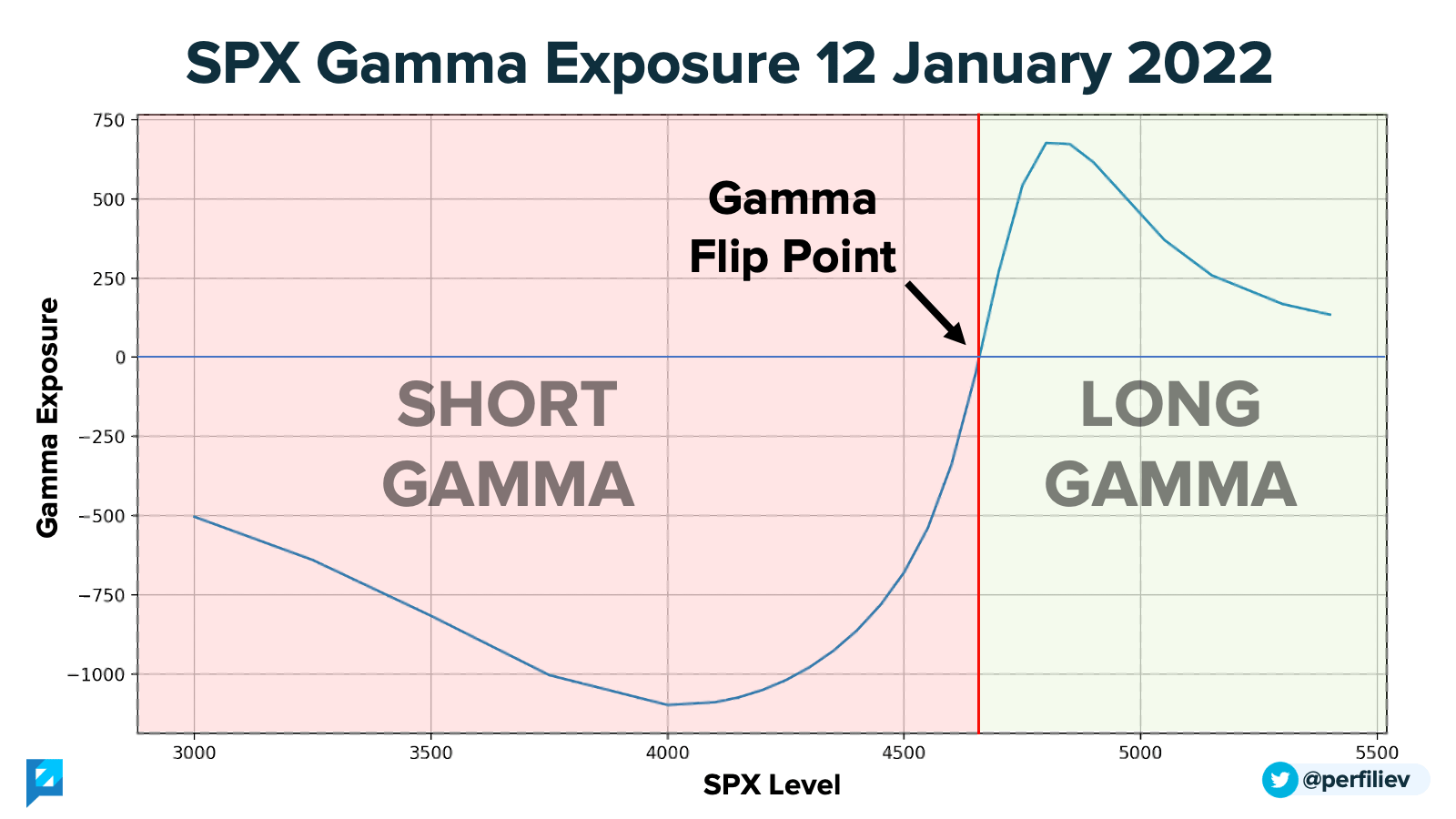

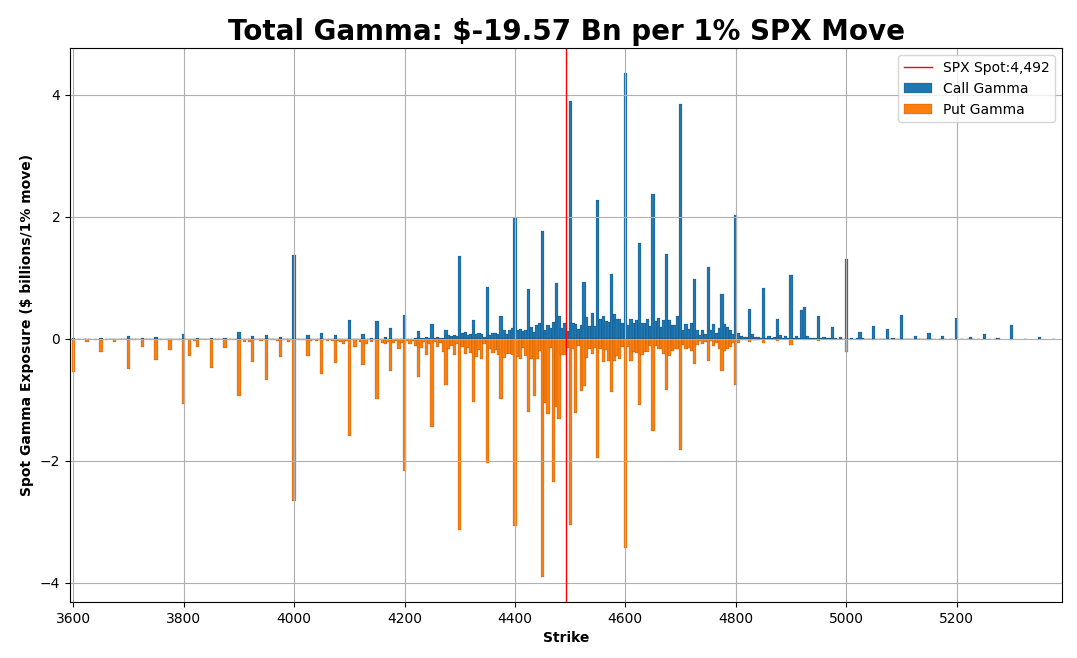

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level Perfiliev

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level Perfiliev

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level Perfiliev

Intro to Gamma Exposure Charts and how to create your own gamma levels

Terrestrial gamma radiation exposure rates and dose levels in farm 2

What is Gamma Exposure and Why Should Equity Investors Care

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level Perfiliev

Web What's Gamma Exposure?

You Can Create Your Own Trigger Levels Based On Options Positioning.

Web Gamma Index Charts And Quotes — Tradingview.

Gex Stands For Gamma Exposure.

Related Post: