Free Printable W9

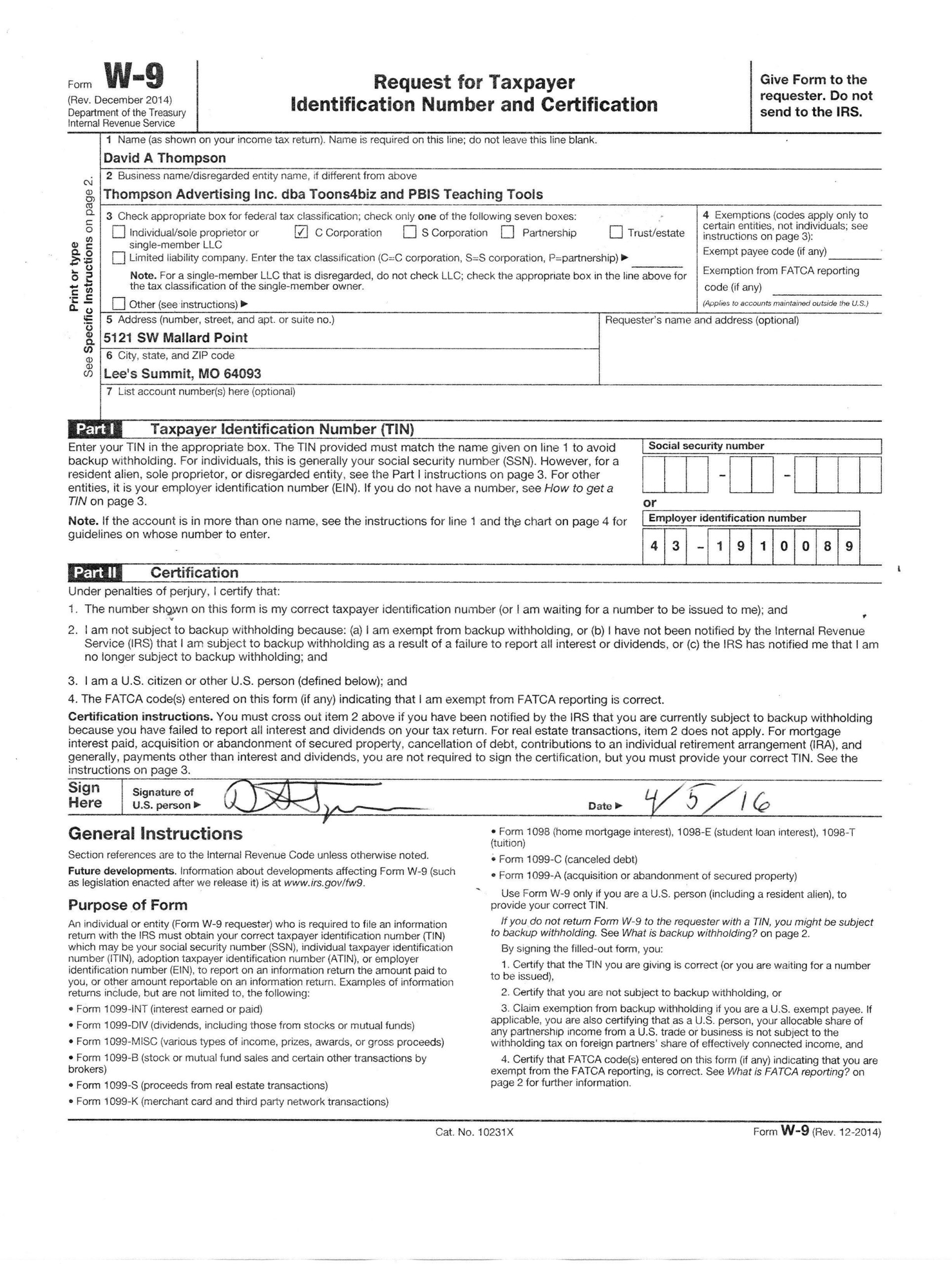

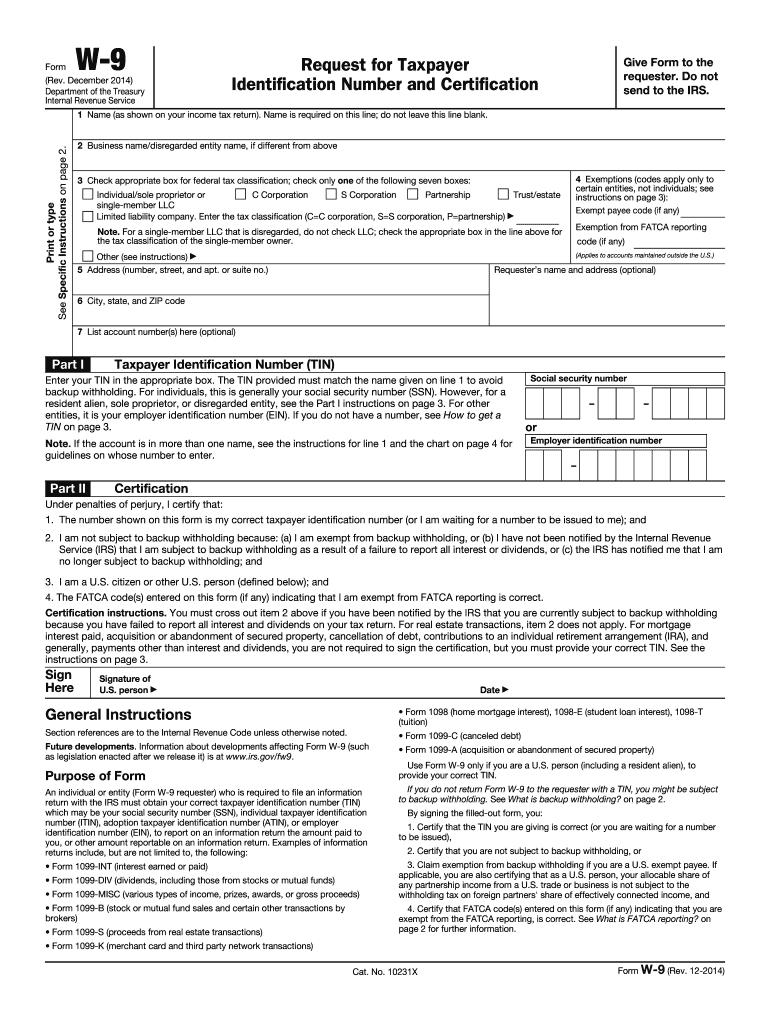

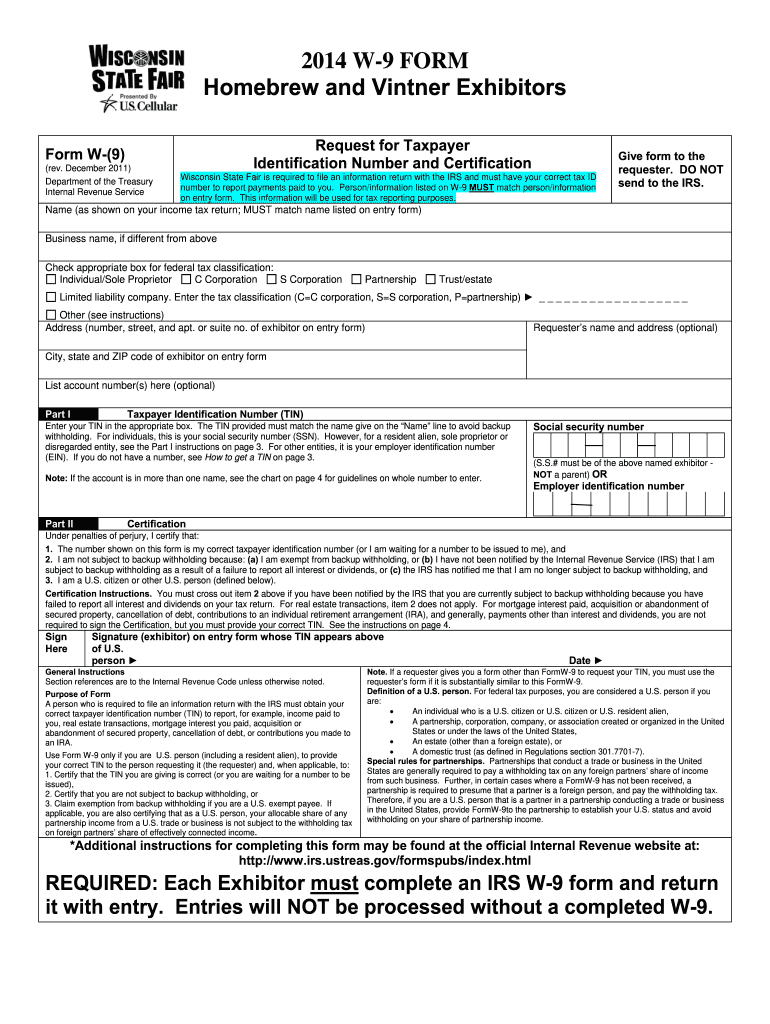

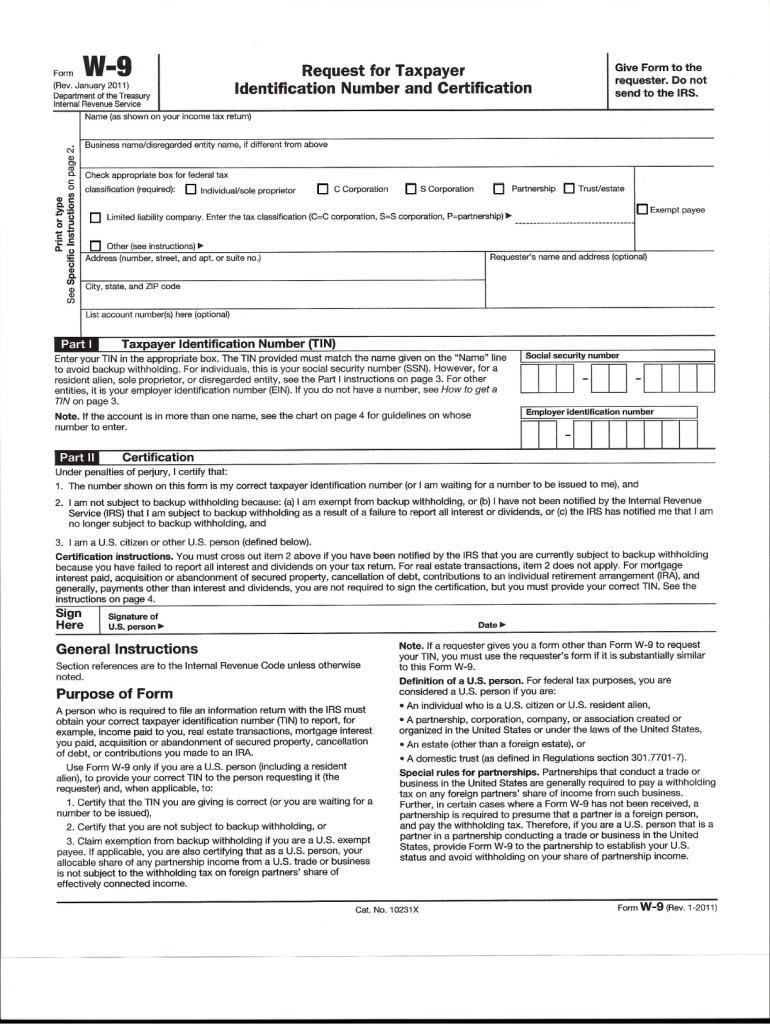

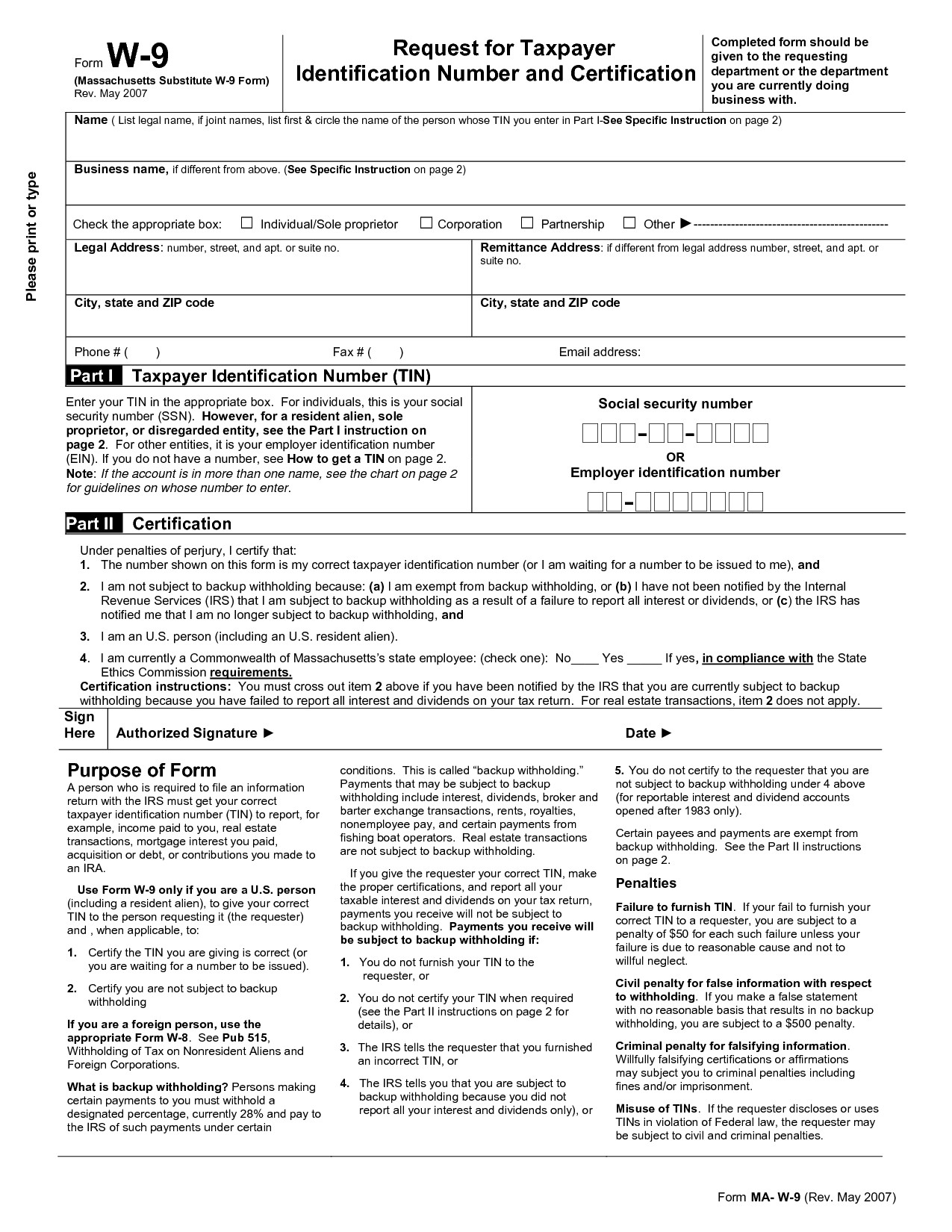

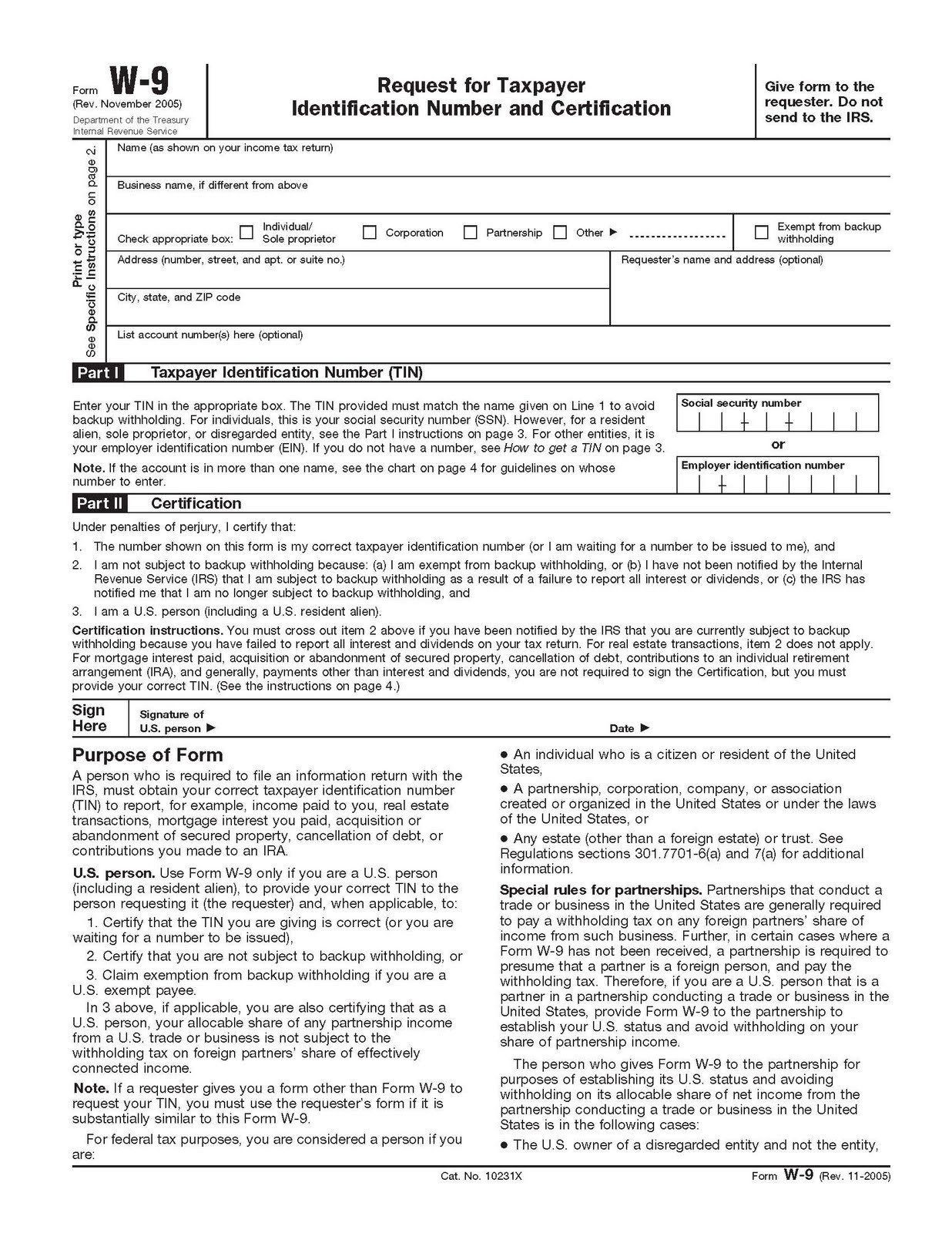

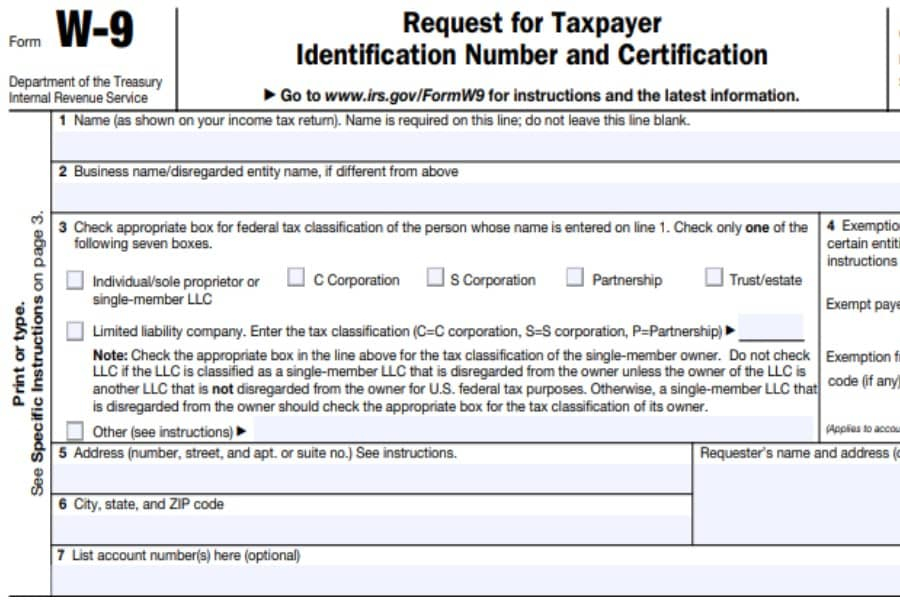

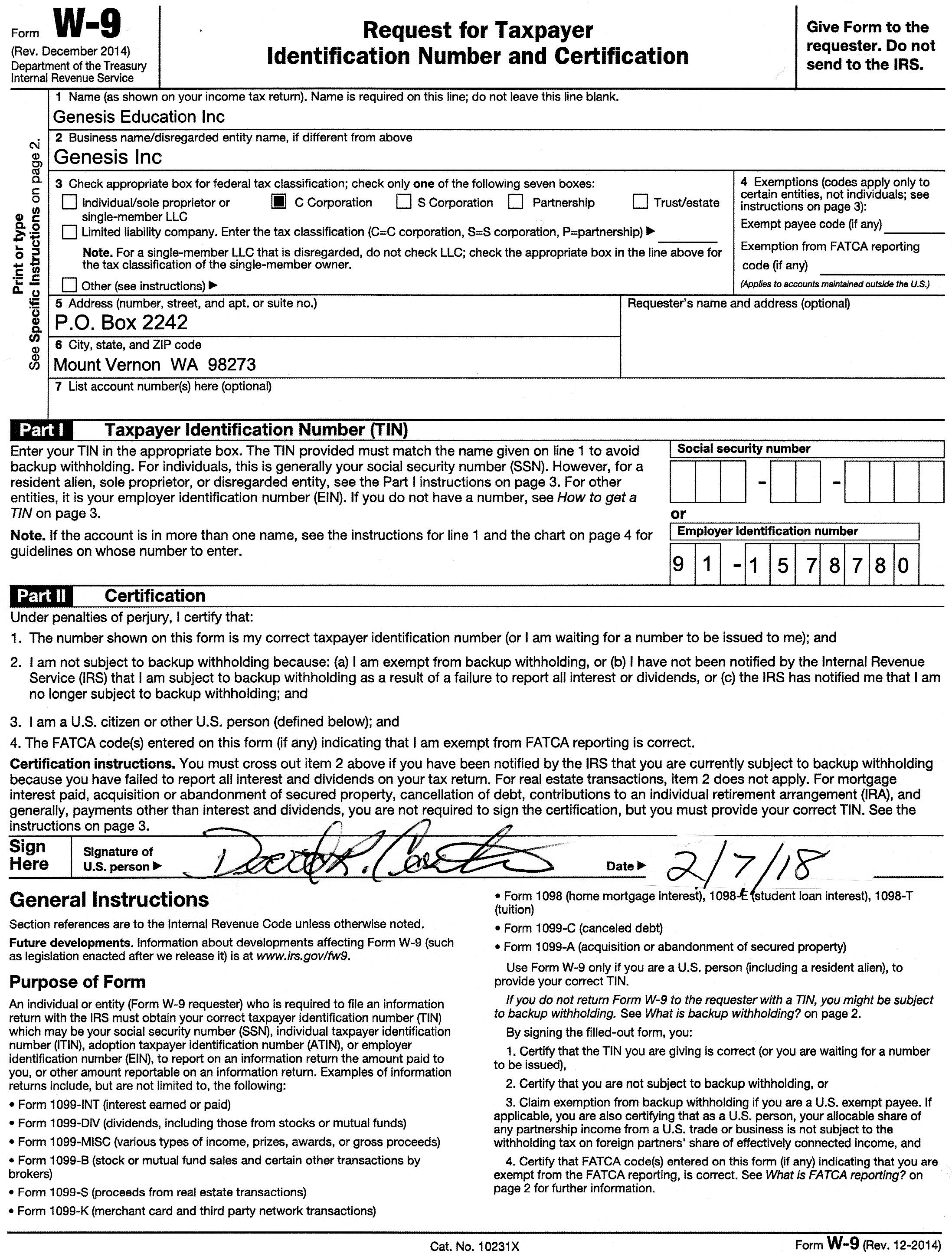

Free Printable W9 - Independent contractors who were paid at least $600 during the year need to fill out a. The form helps businesses obtain important information from payees to prepare information returns for the irs. Learn how to fill out the form, what information to enter, and what to do if you are. Web print blank w9 form calendar template printable, the adobe acrobat library contains free. Edit on any devicecompliant and securepaperless solutionsfree mobile app Who needs to fill it out: It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social. Web enter your ssn, ein or individual taxpayer identification as appropriate. Blank w 9 form 2021 printable irs calendar template printable, for tax year 2023, this tax filing application operates until october 15, 2024. You must also certify your federal tax classification, backup withholding status, and u.s. Web print blank w9 form calendar template printable, the adobe acrobat library contains free. You must also certify your federal tax classification, backup withholding status, and u.s. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. It requests the name, address, and taxpayer identification information of a taxpayer. The 2024 version replaces the version. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. The form helps businesses obtain important information from payees to prepare information returns for the irs. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. This. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Web enter your ssn, ein or individual taxpayer identification as appropriate. Who needs to fill it out: The form helps businesses obtain important information from payees to prepare information returns for the irs. Web print blank w9 form calendar template printable, the adobe acrobat. This form is for income earned in tax year 2023, with tax returns due in april 2024. Web print blank w9 form calendar template printable, the adobe acrobat library contains free. Web enter your ssn, ein or individual taxpayer identification as appropriate. Status and avoid section 1446 withholding on your share of partnership income. The 2024 version replaces the version. This form is for income earned in tax year 2023, with tax returns due in april 2024. The form helps businesses obtain important information from payees to prepare information returns for the irs. Edit on any devicecompliant and securepaperless solutionsfree mobile app Learn how to fill out the form, what information to enter, and what to do if you are.. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Web a us business owner, independent contractor or a freelancer who works as a vendor for a company. Web enter your ssn, ein or individual taxpayer identification as appropriate. Web download a free pdf of irs form w9, a document used to obtain the. Web a us business owner, independent contractor or a freelancer who works as a vendor for a company. The form helps businesses obtain important information from payees to prepare information returns for the irs. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. Blank w 9 form 2021. Edit on any devicecompliant and securepaperless solutionsfree mobile app It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. Web download a free pdf of irs form w9, a document used. Web enter your ssn, ein or individual taxpayer identification as appropriate. Web print blank w9 form calendar template printable, the adobe acrobat library contains free. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social. You. Edit on any devicecompliant and securepaperless solutionsfree mobile app Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. The form helps businesses obtain important information from payees to prepare information returns for the irs. Independent contractors who were paid at least $600 during the year need to fill. This form is for income earned in tax year 2023, with tax returns due in april 2024. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. Web download a free pdf of irs form w9, a document used to obtain the tax identification number of an individual or business entity. Blank w 9 form 2021 printable irs calendar template printable, for tax year 2023, this tax filing application operates until october 15, 2024. Edit on any devicecompliant and securepaperless solutionsfree mobile app Web enter your ssn, ein or individual taxpayer identification as appropriate. You must also certify your federal tax classification, backup withholding status, and u.s. Web print blank w9 form calendar template printable, the adobe acrobat library contains free. It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social. Learn how to fill out the form, what information to enter, and what to do if you are. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. The 2024 version replaces the version. Web a us business owner, independent contractor or a freelancer who works as a vendor for a company.

W9 Forms 2021 Printable Pdf Example Calendar Printable

Printable Blank W9 Form Calendar Template Printable

2021 W9 TaxFree Printable Form Calendar Template Printable

2021 Blank W9 Calendar Template Printable

W 9 Printable Form Example Calendar Printable

W9 Form Free Printable, Fillable Download Blank Online

Free Printable Blank W9 Form 2021 Calendar Template Printable

2022 W9 Form Printable W9 Form 2022 (Updated Version)

W9 Tax Form 2021 Printable

Printable W9 Form for W9 Tax Form 2016

The Form Helps Businesses Obtain Important Information From Payees To Prepare Information Returns For The Irs.

Status And Avoid Section 1446 Withholding On Your Share Of Partnership Income.

Independent Contractors Who Were Paid At Least $600 During The Year Need To Fill Out A.

Who Needs To Fill It Out:

Related Post: