Free Printable Tax Deduction Worksheet

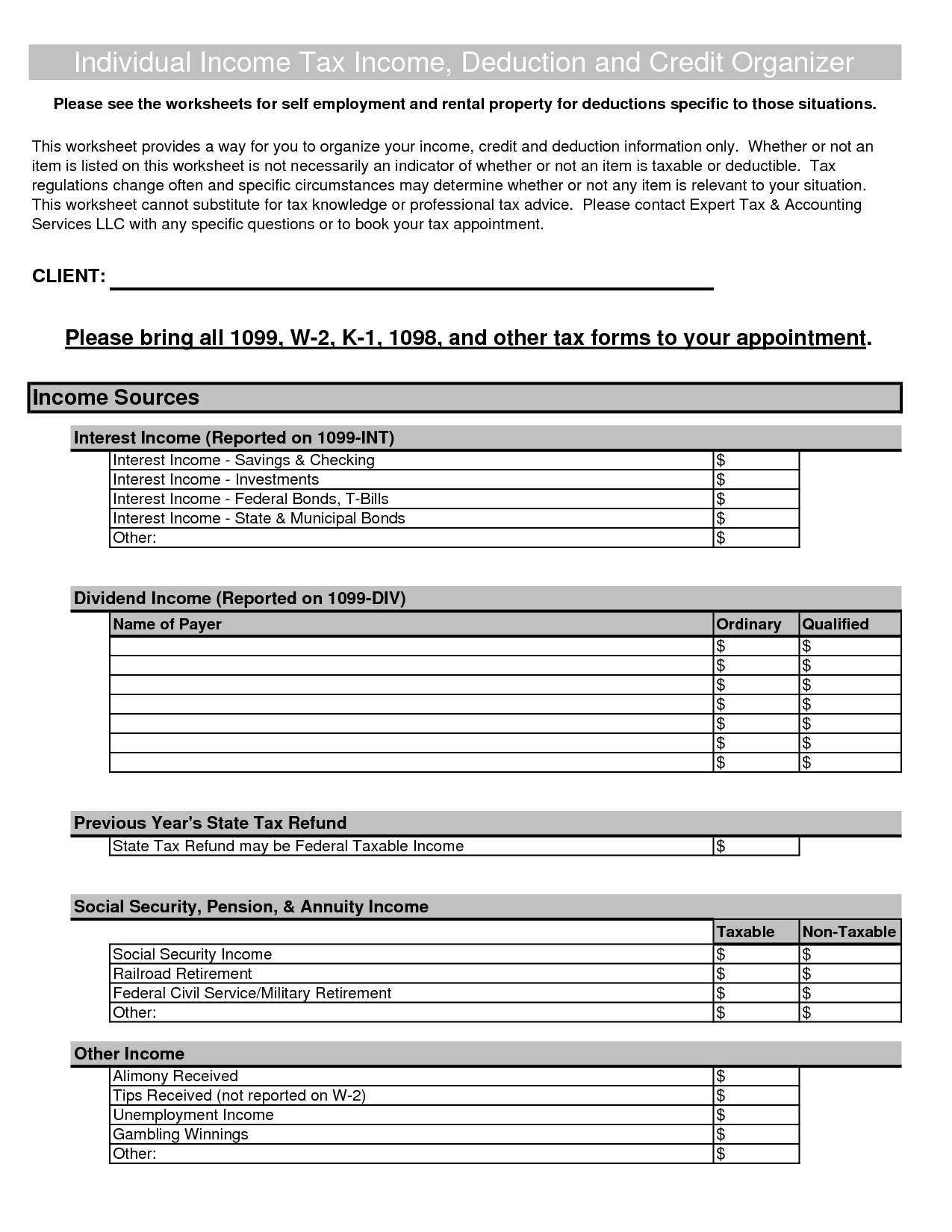

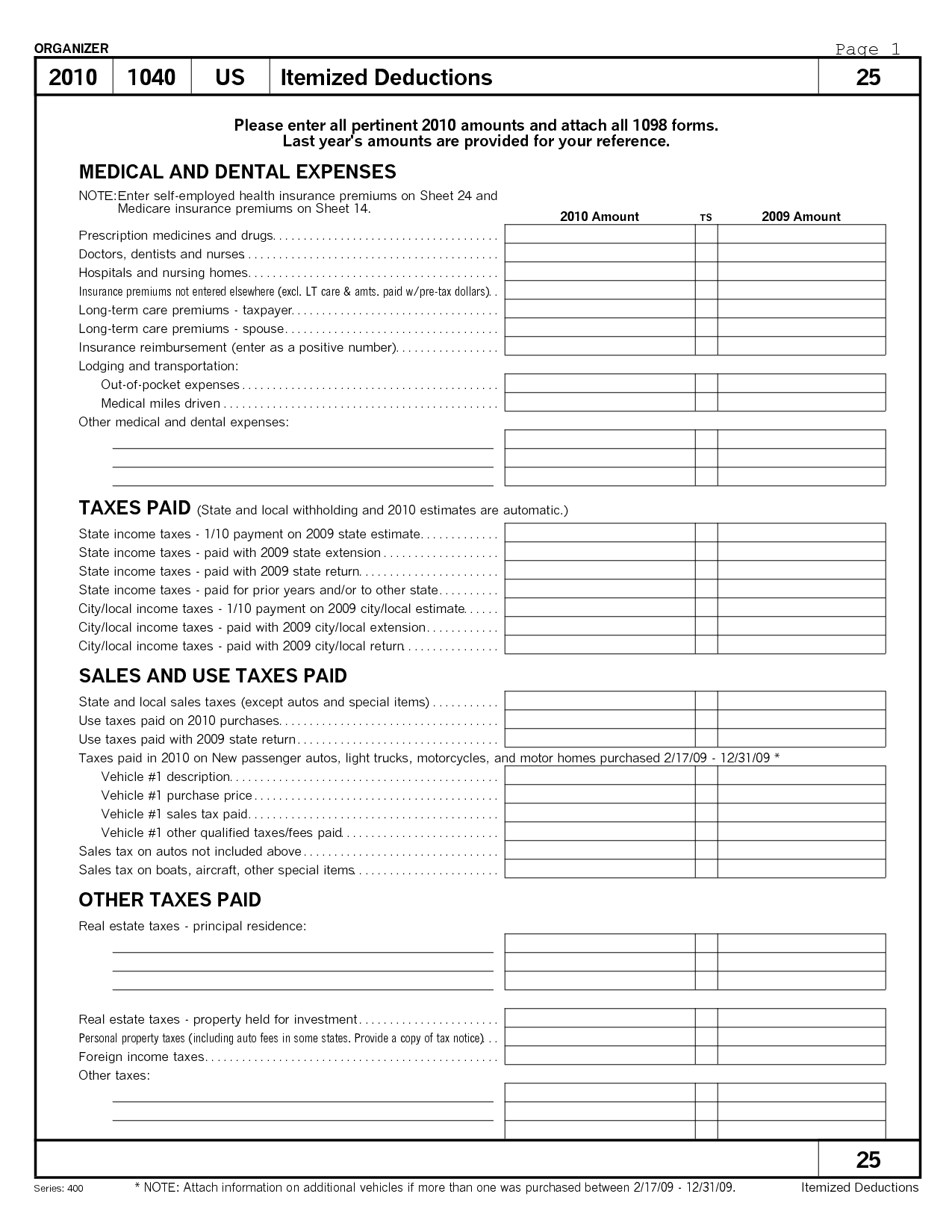

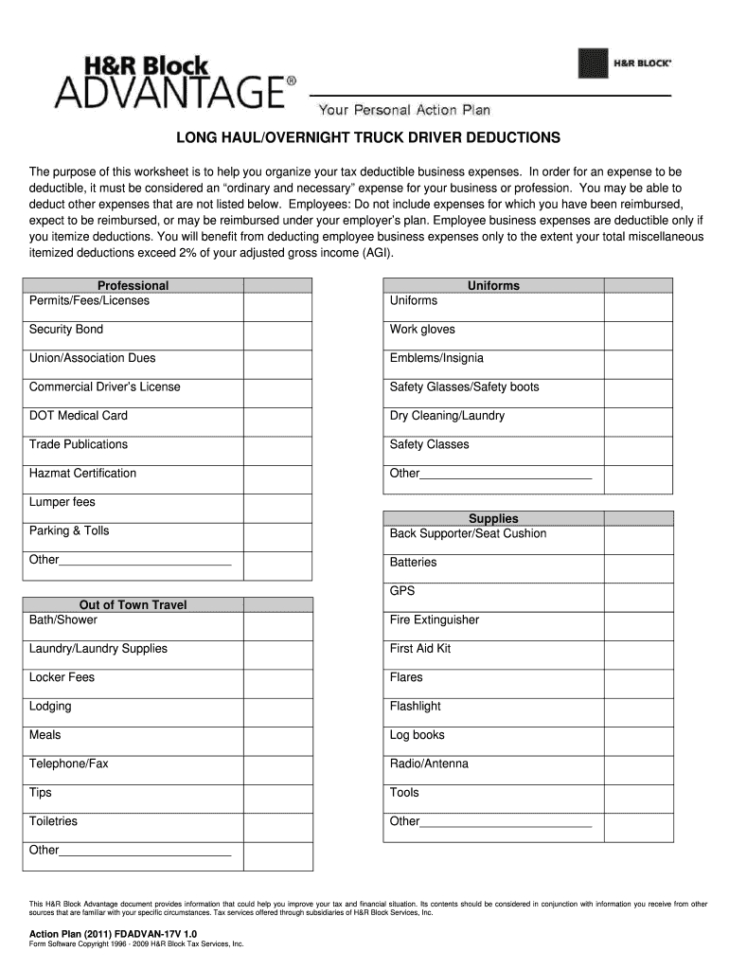

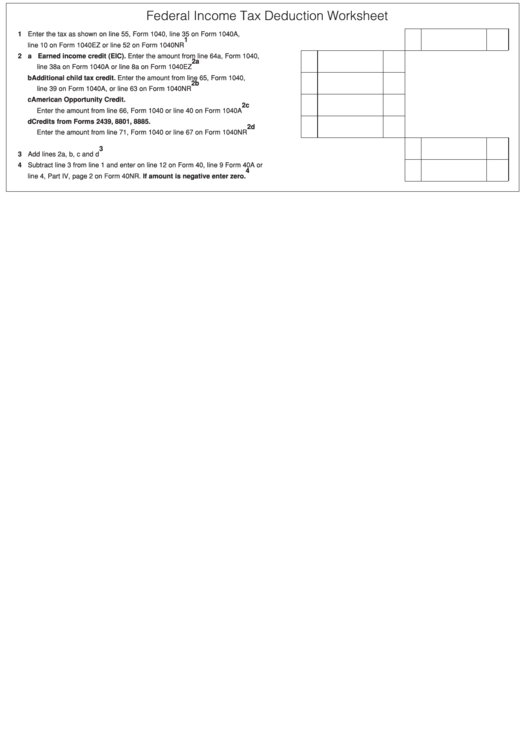

Free Printable Tax Deduction Worksheet - 107 13 how to figure your tax. In most cases, your federal income tax will be less if you take the larger of your itemized. Web free home office deduction worksheet (excel) for taxes. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Long haul trucker/overnight driver tax. Single (65+) $14,700 married (one 65+) $27,300 hoh (65+). Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. You as a dependent your spouse as a dependent. 97 12 other itemized deductions. Was born before january 2, 1959 is. Web form 1040 pdf. Were born before january 2, 1959. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Web itemized deductions worksheet you will need: In most cases, your federal income tax will be less if you take the larger of your itemized. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if. You as a dependent your spouse as a dependent. The purpose of this worksheet is to help you organize your tax deductible business expenses. Web download free pdf worksheets to organize your income tax data by topic, occupation, or year. Web tax regulations change often and specific circumstances may determine whether or not any item is relevant to your situation.. The home office deduction is one of the most significant tax benefits of running a small business out of your home. This worksheet cannot substitute for tax knowledge or professional tax advice. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Simply follow the. 107 13 how to figure your tax. Single (65+) $14,700 married (one 65+) $27,300 hoh (65+). Instructions for form 1040 pdf. Trucker's income and expense worksheet. Web the attached worksheets cover income, deductions, and credits, and will help in the preparation of your tax return by focusing attention on your special needs. You as a dependent your spouse as a dependent. Figuring your taxes, and refundable and nonrefundable credits. 107 14 child tax credit and credit for other dependents. Single (65+) $14,700 married (one 65+) $27,300 hoh (65+). Find worksheets for wages, interest, rental, expat, home, and more. Simply follow the instructions on this sheet and start lowering your social security. Figuring your taxes, and refundable and nonrefundable credits. Web free home office deduction worksheet (excel) for taxes. You may include other applicable. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web our free downloadable real estate agent tax deductions worksheet! Use schedule a (form 1040) to figure your itemized deductions. 2023 instructions for schedule aitemized deductions. Were born before january 2, 1959. Single $12,950 married $25,900 hoh $19,400. The home office deduction is one of the most significant tax benefits of running a small business out of your home. Web form 1040 pdf. Long haul trucker/overnight driver tax. Track and calculate your home office expenses with this free template. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Web itemized deductions worksheet you will need: When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the. In most cases, your federal income tax will be less if you take the larger of your itemized. Was born before january 2, 1959 is. Find worksheets for wages, interest, rental, expat, home,. Was born before january 2, 1959 is. Web department of the treasury internal revenue service. Figuring your taxes, and refundable and nonrefundable credits. My client took the standard deduction in 2020 but still made some charitable deductions that i'm hoping to carry through to 1040 line 10b. Web itemized deductions worksheet you will need: Track and calculate your home office expenses with this free template. Trucker's income and expense worksheet. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Long haul trucker/otr driver deductible expenses worksheet. You as a dependent your spouse as a dependent. This worksheet cannot substitute for tax knowledge or professional tax advice. The home office deduction is one of the most significant tax benefits of running a small business out of your home. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the. Long haul trucker/overnight driver tax. Tax table from instructions for form 1040 pdf. Single $13,850 married (filing joint) $27,700 single (65+) $15,700 married (one 65+) $29,200 married (both 65+).

18 Itemized Deductions Worksheet Printable /

8 Best Images of Monthly Bill Worksheet 2015 Itemized Tax Deduction

Printable Tax Deduction Worksheet —

Federal Tax Deduction Worksheet Form printable pdf download

Printable Real Estate Agent Tax Deductions Worksheets Printable

Itemized Deductions Form 1040 Schedule A Free Download Worksheet

Printable Itemized Deductions Worksheet

EXCEL of Tax Deduction Form.xlsx WPS Free Templates

Itemized Deductions Worksheet 2018 Printable Worksheets and

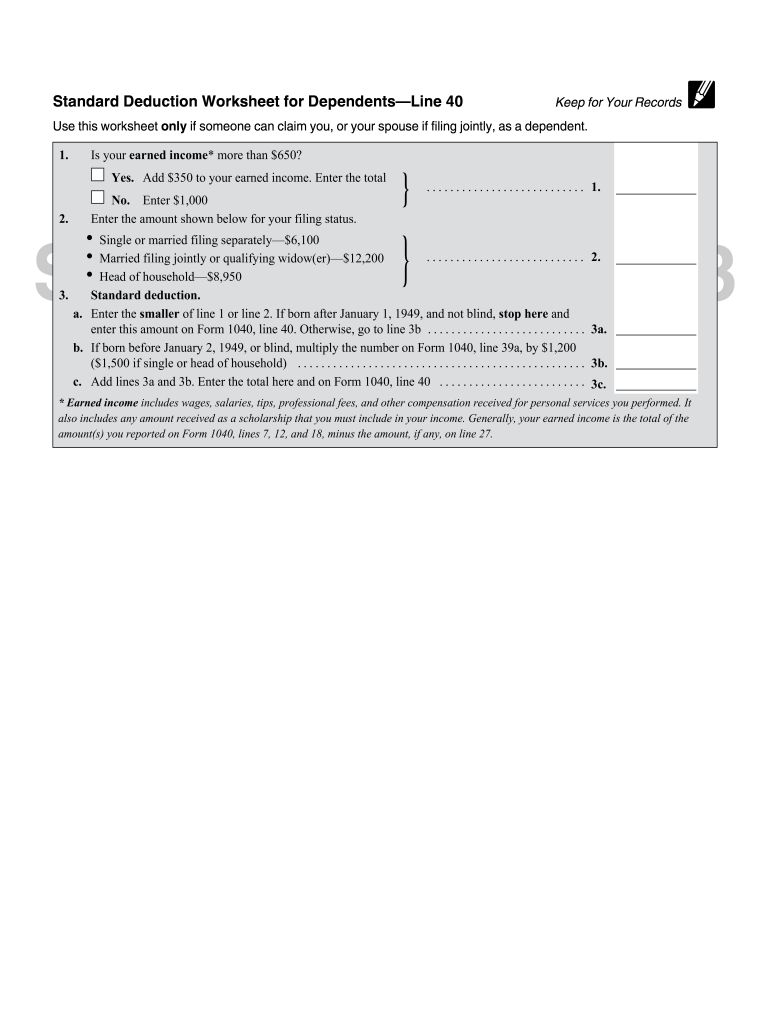

Standard Deduction Line Fill Online, Printable, Fillable, Blank

Tax Information Documents (Receipts, Statements, Invoices, Vouchers) For Your Own Records.

You May Include Other Applicable.

Please Enter Your 2023 Information In The Designated Areas On The Worksheets.

Otherwise, Reporting Total Figures On This Form Indicates Your Acknowledgement That Such Figures Are Accurate And That You.

Related Post: