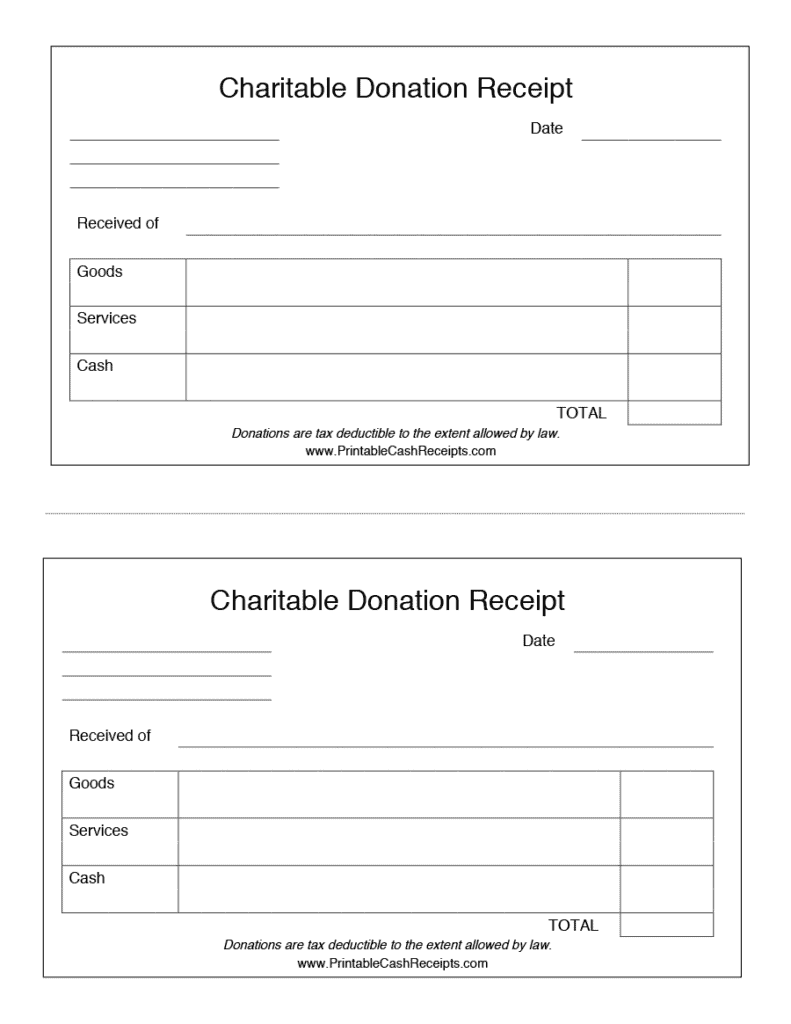

Free Printable Donation Receipt Template

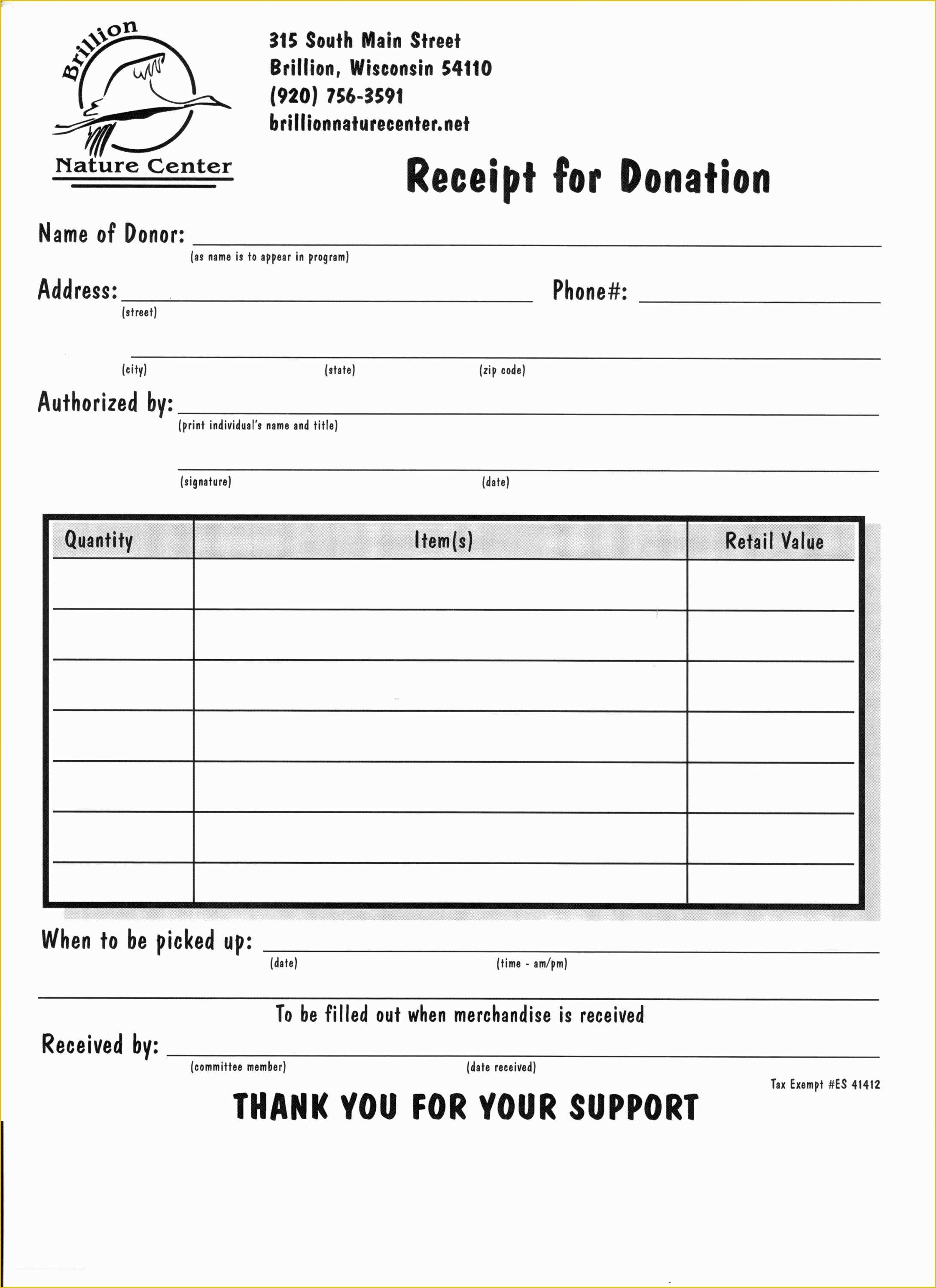

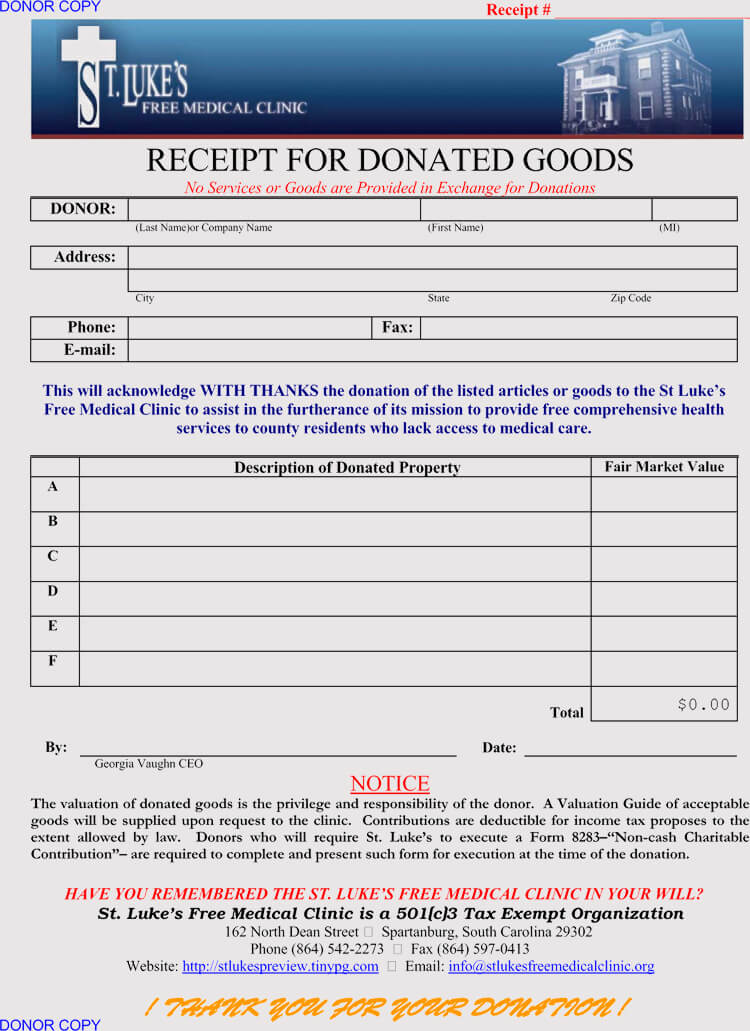

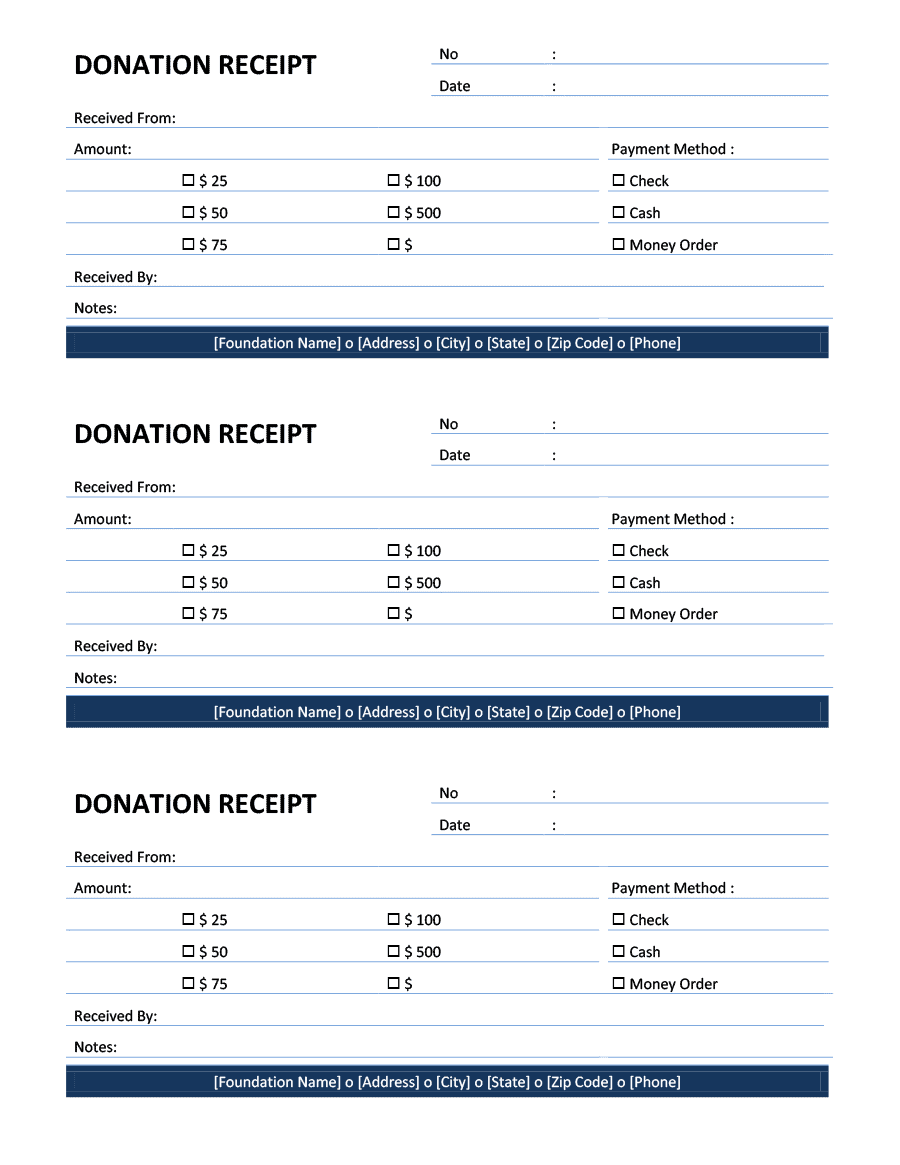

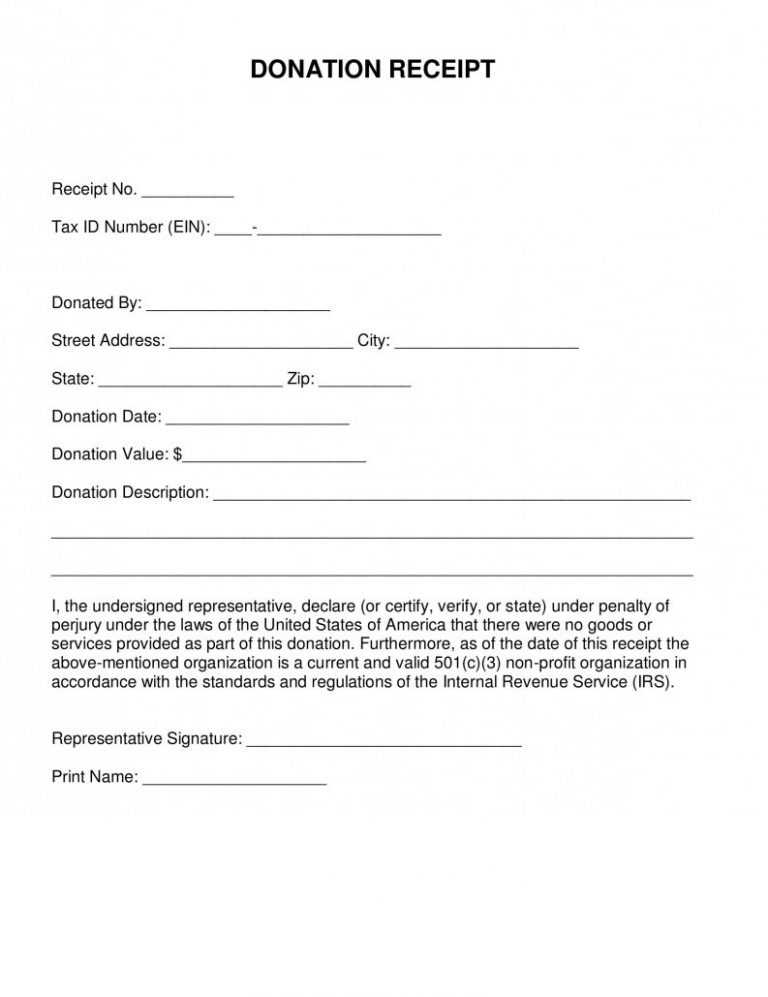

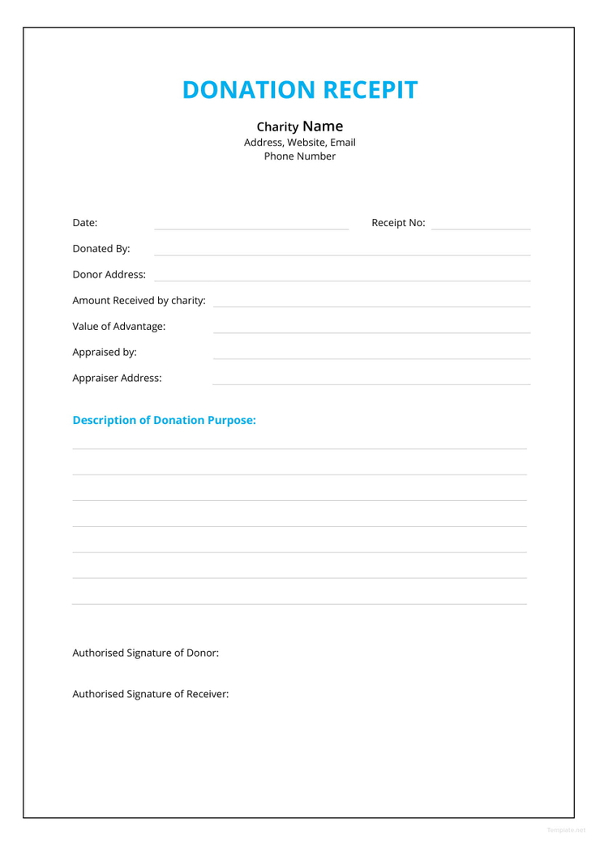

Free Printable Donation Receipt Template - Consider which way you’ll want to create the receipt based on your. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Check out our advantage calculator to easily. These free printable templates in pdf and word format simplify the. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Here are some free 501 (c) (3) donation receipt templates for you to download and use; Web in the charitable donation process, proper documentation is essential to ensure transparency, accountability, and compliance. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. Consider making the receipt look more like a letter, so it’s more personal than a typical receipt (use our receipt maker to do this easily). 34 first street, gig harbor, wa, 98332. Consider making the receipt look more like a letter, so it’s more personal than a typical receipt (use our receipt maker to do this easily). Charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. 34 first street, gig harbor, wa, 98332. These receipts are also used for tax purposes by. Web using a (501) (c) (3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. These receipts are also used for tax purposes by the organization. Web. Web using a (501) (c) (3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Check out our advantage calculator to easily. Consider making the receipt look more like a letter, so it’s more personal than a typical receipt (use our receipt maker to do this easily). It’s utilized by an individual that. Web using a (501) (c) (3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to. Microsoft word (.docx) cash donation receipt template. Web in the charitable donation process, proper documentation is essential to ensure transparency, accountability, and compliance. These free printable templates in pdf and word format simplify the. These receipts are also used for tax purposes by the organization. Consider making the receipt look more like a letter, so it’s more personal than a. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to. Here are some free 501 (c) (3) donation receipt templates for you to download and use; It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. Consider which. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. Consider making the receipt look more like a letter, so it’s more personal than a typical receipt (use our receipt maker to do this easily). The cost of the gift the donor receives must be. Check out our advantage calculator to easily. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Consider which way you’ll want to create the receipt based on your. Web in the charitable donation process, proper documentation is essential to ensure transparency, accountability, and. Consider making the receipt look more like a letter, so it’s more personal than a typical receipt (use our receipt maker to do this easily). Consider which way you’ll want to create the receipt based on your. Here are some free 501 (c) (3) donation receipt templates for you to download and use; Check out our advantage calculator to easily. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. These free printable templates in pdf and word format simplify the. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. Web using a (501) (c) (3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Microsoft word (.docx) cash donation receipt template. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. 34 first street, gig harbor, wa, 98332. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more.

Free Printable Donation Receipt Template

14+ Printable Donation Receipt Sample Templates Sample Templates

46 Free Donation Receipt Templates (501c3, NonProfit)

Free InKind (Personal Property) Donation Receipt Template PDF Word

FREE 5+ Donation Receipt Forms in PDF MS Word

6+ Free Donation Receipt Templates

Free Sample Printable Donation Receipt Template Form

Donation Receipt Templates 15 Free Printable Templates My Word

6+ Free Donation Receipt Templates Word Excel Formats

45+ Printable Receipt Templates Free & Premium Templates

Charitable Donation Receipt Templates Provide A Practical And Efficient Way To Generate Accurate Receipts That Acknowledge And Record Donations.

Web In The Charitable Donation Process, Proper Documentation Is Essential To Ensure Transparency, Accountability, And Compliance.

These Receipts Are Also Used For Tax Purposes By The Organization.

Related Post: