Fake Breakout Chart

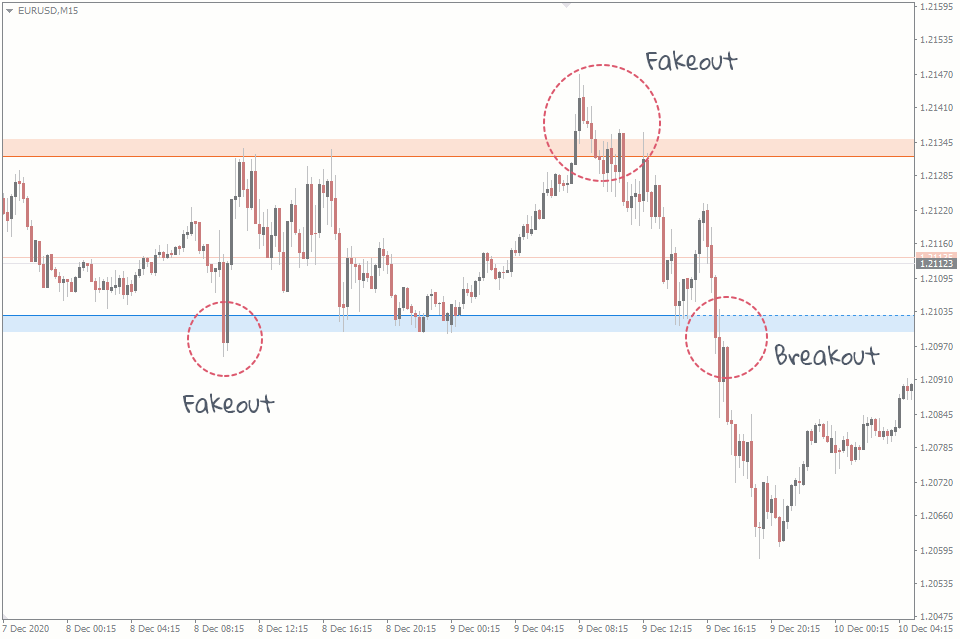

Fake Breakout Chart - Web a false break, or breakout, as the name implies, is any move (and subsequent close) above or below resistance or support respectively followed by a reversal that fails to respect the broken level as new support or resistance. Let’s take a look at an example. Web what are false breakouts (fakeouts) in crypto and stock markets? Web 🔍 understanding fake breakouts: In this report, we will look at what false breakouts are, how you can identify them, and how you can use them in the market. The head and shoulders chart pattern is actually one of the hardest patterns for new traders to spot. Web a fake breakout chart displays a clear breach of a price level that doesn’t result in a sustained move. How to identify false breakout (fakeout) trading patterns? India’s premiere diy documentarian anand patwardhan turns his lens homeward in “ the world is family ,” a personal chronicle of india’s freedom movement and its. A false breakout occurs when the price moves. How to identify false breakout (fakeout) trading patterns? Web however, the biggest risk of trading a breakout is when the price suddenly reverses, in what is known as a false breakout. Web what are false breakouts in forex? In the chart, as highlighted, a green candle indicates a reversal above a certain level, signifying a fake breakout. This is often. Web the chart below shows examples, which you can consider false breakouts. Using (false) breakouts to confirm trade ideas. Stock passes all of the below filters in nifty. Web a fake breakout chart displays a clear breach of a price level that doesn’t result in a sustained move. Here is a simple intraday trading setup based on a fake breakout. Stock passes any of the below filters in nifty 200 segment: Web what are false breakouts (fakeouts) in crypto and stock markets? The chart timeframe for this intraday strategy is 3 minutes. Web however, the biggest risk of trading a breakout is when the price suddenly reverses, in what is known as a false breakout. India’s premiere diy documentarian anand. Here is a simple intraday trading setup based on a fake breakout technique. The fakey pattern always starts with an inside bar pattern. False breakouts are key trading opportunities. This is often visualized by a candlestick with a long wick passing through a trendline or price level and a body. Web false breakouts are one of the most frustrating and. This is where the market seems to break a support or resistance level but quickly reverses direction, invalidating the breakout. In this report, we will look at what false breakouts are, how you can identify them, and how you can use them in the market. A false breakout occurs when the price moves through a certain level but doesn't continue. Web false breakout trading strategy & its steps. False breakouts around events or economic situations. Web what are false breakouts (fakeouts) in crypto and stock markets? A false breakout occurs when the price moves through a certain level but doesn't continue to accelerate in that direction. Web a fake breakout chart displays a clear breach of a price level that. Web breakout trades is one of the most popular ways of trading but how do you know if its a fake breakout and what do you do if it is? This is where the market seems to break a support or resistance level but quickly reverses direction, invalidating the breakout. Let’s take a look at an example. False breakouts are. In order to ‘filter out’ a false breakout, a trader might wait for a confirmation. Let’s take a look at an example. Stock passes any of the below filters in nifty 200 segment: A false breakout occurs when the price moves through a certain level but doesn't continue to accelerate in that direction. Scanner guide scan examples feedback. A breakout is a market movement that happens when the price for an asset breaks out of its normal price range, either the support level or resistance level. Using (false) breakouts to confirm trade ideas. Web the chart below shows examples, which you can consider false breakouts. In the chart, as highlighted, a green candle indicates a reversal above a. These situations, known as false breakouts, can lead to valuable trading signals when properly analyzed. Web a fake breakout chart displays a clear breach of a price level that doesn’t result in a sustained move. This is often visualized by a candlestick with a long wick passing through a trendline or price level and a body. Web two common patterns. Scanner guide scan examples feedback. However, with time and experience, this pattern can become an instrumental part of your trading arsenal. Using (false) breakouts to confirm trade ideas. The head and shoulders chart pattern is actually one of the hardest patterns for new traders to spot. In this report, we will look at what false breakouts are, how you can identify them, and how you can use them in the market. False breakouts around events or economic situations. The fakey pattern always starts with an inside bar pattern. This is where the market seems to break a support or resistance level but quickly reverses direction, invalidating the breakout. These situations, known as false breakouts, can lead to valuable trading signals when properly analyzed. Web a fake breakout chart displays a clear breach of a price level that doesn’t result in a sustained move. Web however, the biggest risk of trading a breakout is when the price suddenly reverses, in what is known as a false breakout. Screener false breakouts and breakdowns. A false breakout occurs when the price moves. A breakout is a market movement that happens when the price for an asset breaks out of its normal price range, either the support level or resistance level. In the chart, as highlighted, a green candle indicates a reversal above a certain level, signifying a fake breakout. Stop loss on fake breakouts.

False Breakout (Fakeout) How to Avoid and Even Trade It? FXSSI

False Breakout Strategy A Simple Yet Powerful Approach

False Breakouts and Fakeouts Can Be Profitable Setups Forex Training

False Breakout Strategy The best trading approach Pro Trading School

Fake Breakout Forex Reversal Strategy

False Breakout Strategy The best trading approach Pro Trading School

How to Trade Fakeouts in Forex

False Breakouts and Fakeouts Can Be Profitable Setups Forex Training

FAKE BREAKOUTS Trading charts, Stock trading strategies, Options

Fakeout breakout day trading strategy SidewaysMarkets Day Trading

Web False Breakout And Breakdown, Technical Analysis Scanner.

Stock Passes All Of The Below Filters In Nifty.

Let’s Take A Look At An Example.

Web 🔍 Understanding Fake Breakouts:

Related Post: