Expanding Chart Pattern

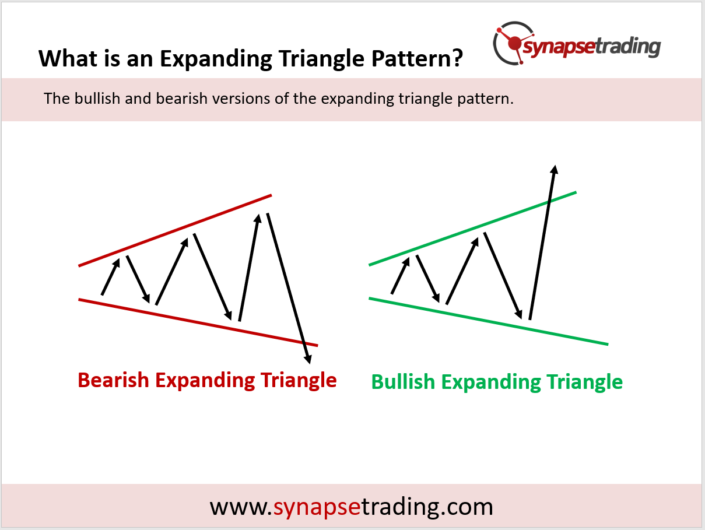

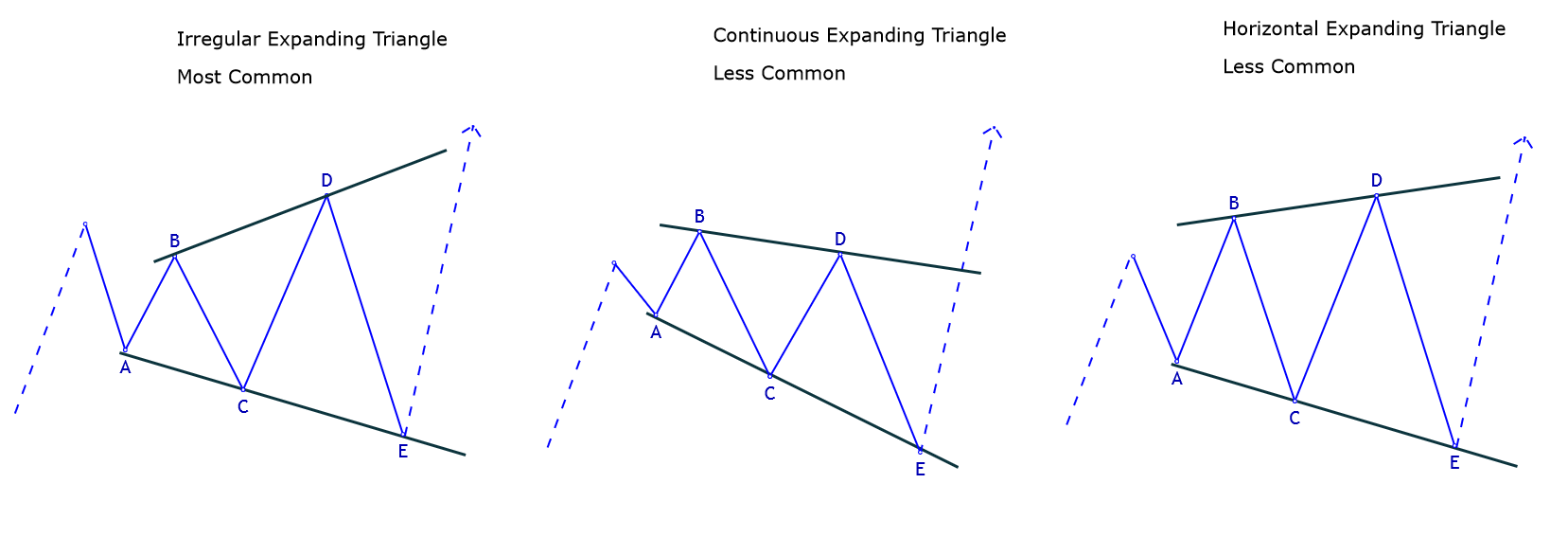

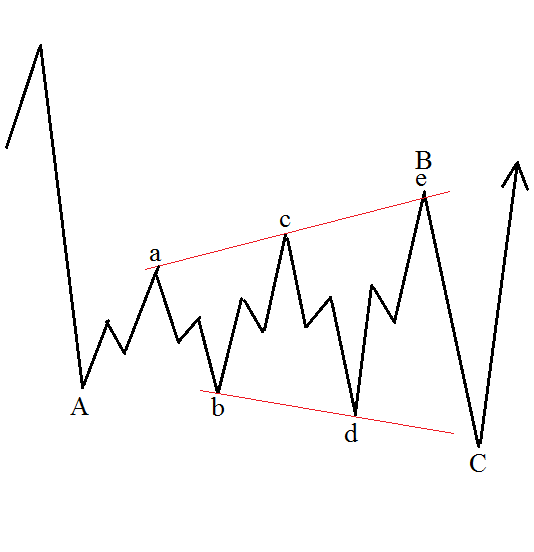

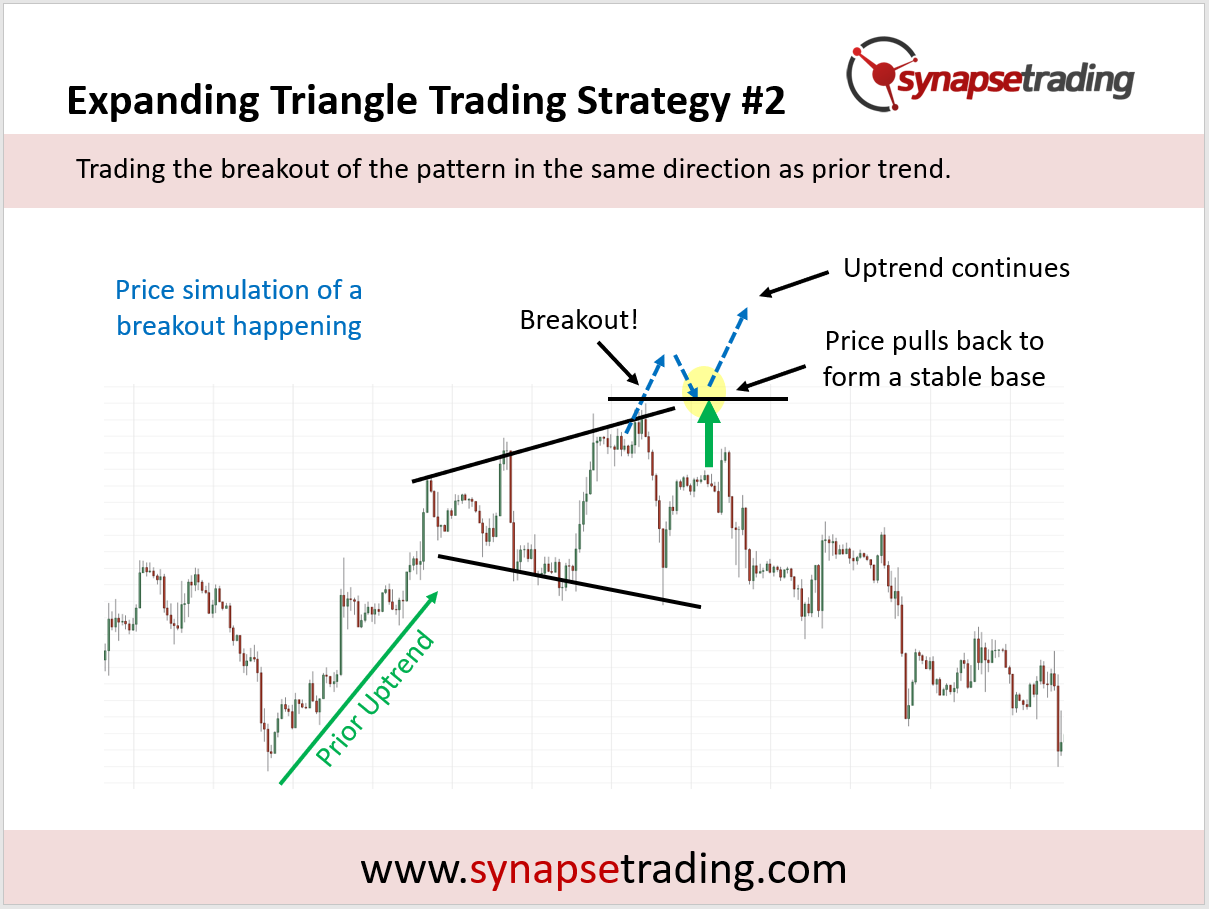

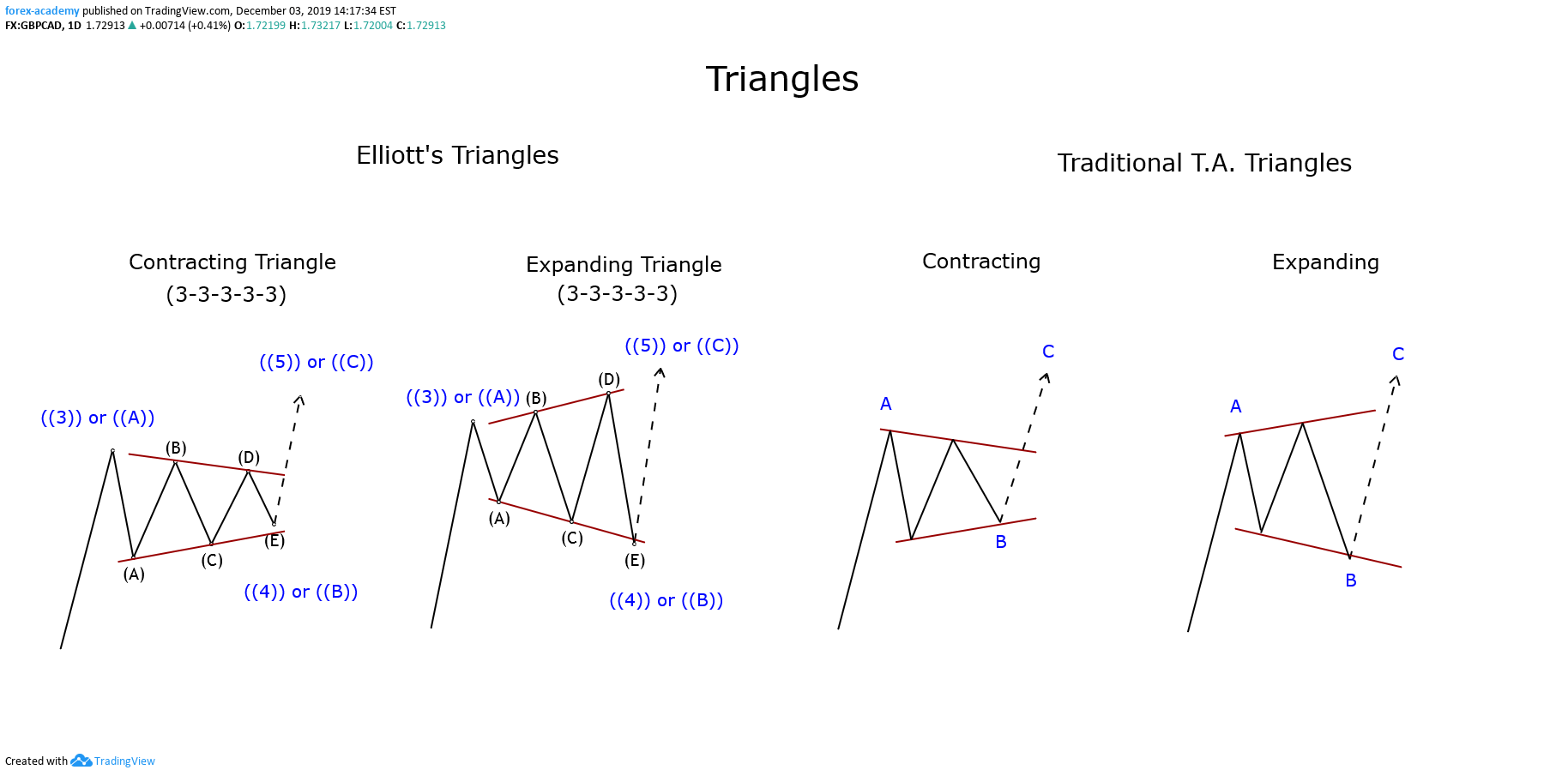

Expanding Chart Pattern - The pattern forms when price action makes a series of higher highs and lower lows, creating a widening trend line shape resembling a megaphone. It is formed when the prices forge higher highs and lower lows consecutively. Web the expanding triangle pattern is a unique chart formation commonly found in technical analysis. These wedges tend to break downwards. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. The expanding triangle is a very tricky pattern, because price is making new lows and new highs in each wave. This guide will provide an overview of the different triangle chart pattern trading strategies. Web expanding triangle chart pattern. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Cvx) remains a leading player in the oil and gas industry. Diverging upper and lower trendlines as. Web the expanding triangle pattern is a unique chart formation commonly found in technical analysis. Ambulances rushed to some complexes. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. We cover the characteristics, entry and exit points, and risk management strategies for this chart pattern. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Web what is an ascending broadening wedge? The pattern forms when price action makes a series of higher highs and lower lows, creating a widening trend line shape resembling a megaphone. We cover. Broadening formations indicate increasing price volatility. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. Web detecting a triangular pattern in a chart is pretty straightforward: An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. Web a pattern is identified by a line connecting. An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). These wedges tend to break downwards. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to. Web a broadening triangle is a relatively rare triangle pattern which occurs when there is. Broadening formations indicate increasing price volatility. On a real chart the expanding triangle looks like the one below: These wedges tend to break downwards. The lows are climbing faster than the highs. It is represented by two lines, one ascending and one descending, that diverge from each other. Web a broadening formation is a technical chart pattern depicting a widening channel of high and low levels of support and resistance. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Ambulances rushed to some complexes. Web detecting a triangular pattern in a chart is pretty straightforward: The expanding triangle is a very. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. The expanding triangle is another broadening formation with diverging trend lines that may take longer to form than other triangles. Web learn how to trade the expanding triangle pattern. We will explain how to identify the pattern, its characteristics, and how traders. Web learn how to trade the expanding triangle pattern. It is represented by two lines, one ascending and one descending, that diverge from each other. Cvx) remains a leading player in the oil and gas industry. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web a broadening. It consists of two trendlines—one ascending and the other descending—forming a triangle as they widen. It is represented by two lines, one ascending and one descending, that diverge from each other. The lows are climbing faster than the highs. Cvx) remains a leading player in the oil and gas industry. Web the expanding triangle pattern is a unique chart formation. Web there are basically 3 types of triangles and they all point to price being in consolidation: The expanding triangle is another broadening formation with diverging trend lines that may take longer to form than other triangles. Web instead of contracting, it is expanding, which means that wave “a” is the smallest and wave “e” the biggest. It consists of. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. This pattern exhibits a broadening formation, indicating increasing price volatility as the trading range expands over time. These wedges tend to break downwards. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Nifty intraday 15 mins chart. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. Web an expanding triangle can be either a reversal or a continuation pattern and is made of at least five swings (sometimes seven, and rarely nine), each one greater than the prior one. Triangles are similar to wedges and pennants and can be either a continuation pattern,. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. This pattern is formed when the price of an asset creates higher highs and lower lows, creating a triangle shape that expands over time. Broadening formations indicate increasing price volatility. Web what is an ascending broadening wedge? Ambulances rushed to some complexes. Web there are basically 3 types of triangles and they all point to price being in consolidation:

Expanding Triangle Forex Trading Technical Analysis Stock

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Your detailed guide to the Elliott Wave expanding triangle pattern

Your detailed guide to the Elliott Wave expanding triangle pattern

Bear Expanding Triangle — ToTheTick™

Bull Expanding Triangle — ToTheTick™

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Ascending & Descending Triangle Pattern Strategy Guide

Expanding Triangle Chart Pattern

We Cover The Characteristics, Entry And Exit Points, And Risk Management Strategies For This Chart Pattern.

It Is Formed By Two Diverging Bullish Lines.

Web The Expanding Triangle Pattern Is A Popular Technical Analysis Tool Used By Traders From Decades To Identify Potential Trend Reversals In The Financial Markets.

Web The Rising Wedge Is A Chart Pattern Used In Technical Analysis To Predict A Likely Bearish Reversal.

Related Post: