Existing Draw Draft Payment Meaning

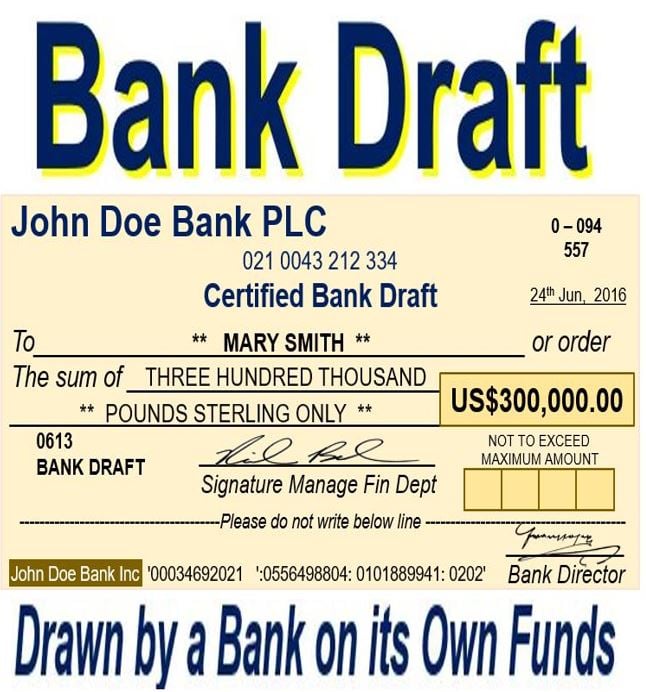

Existing Draw Draft Payment Meaning - This ensures that the funds are available and the check will not bounce. Web a bank draft is a check that is issued by a bank, and it is guaranteed by the bank that the funds will be available when the check is presented for payment. It’s used for large purchases or to provide security during a transaction. These instruments draw money from the account of the issuing corporation and. Bank drafts are often used for international transactions, as they are a. Bank drafts are often used for larger payments such as a down payment on a home. You can visit your local bank branch and get a bank draft issued on the spot by a teller, assuming you have the available funds already in. Once the payment has been deposited, the bank drafts can’t be cancelled or reversed. Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount of money from one account to another. Web a bank draft is a payment that is guaranteed by the issuing bank. Web in the banking industry, a draft refers to a negotiable instrument that serves as a form of payment. It is a common financial instrument used in banking transactions for facilitating payments between individuals, businesses, or financial institutions. Banks verify and withdraw funds. Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by. Web a demand draft is a method used by an individual to make a transfer payment from one bank account to another. Web draft withdrawals require you to set up the electronic payment with the business that issues the bill. Web a bank draft is a payment on behalf of the payer, which is guaranteed by the issuing bank. In. Web a bank draft is a payment that is guaranteed by the issuing bank. However, once you have set up the draft withdrawal, your bank will automatically deduct the funds from your bank account according to the payment schedule. Web in general, in 2022, getting a bank draft costs between $10 to $20. Web a bank draft, sometimes referred to. It is a common financial instrument used in banking transactions for facilitating payments between individuals, businesses, or financial institutions. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. Where can i go to get a bank draft? You can visit your local bank branch and get a bank. Once the payment has been deposited, the bank drafts can’t be cancelled or reversed. It’s used for large purchases or to provide security during a transaction. Web a bank draft is a payment that is guaranteed by the issuing bank. Demand drafts differ from regular normal checks in that they do not require. Discover how bank drafts differ from other. Web the bank draft meaning would be defined as “a convenient and secure instrument for making large payments without having to withdraw cash from one’s account.” a bank draft is a physical way of paying a. A bank draft, also called a bank check, is a method of payment that involves a document issued by a bank guaranteeing that the. You can visit your local bank branch and get a bank draft issued on the spot by a teller, assuming you have the available funds already in. Where can i go to get a bank draft? Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. to. It is a common financial instrument used in banking transactions for facilitating payments between individuals, businesses, or financial institutions. These instruments draw money from the account of the issuing corporation and. Learn how bank drafts work, their advantages, and how they compare to other payment options. Web a draft, in the context of banking, refers to a written order that. similar to a cashier’s check, a legitimate bank draft is safer than a personal check when accepting large payments. Once the payment has been deposited, the bank drafts can’t be cancelled or reversed. Discover how bank drafts differ from other payment methods. However, once you have set up the draft withdrawal, your bank will automatically deduct the funds. to get a banker’s draft, a bank customer must have funds (or cash) available. For most business types, autodraft ends up being far less expensive. It’s a secure way of making payments, ensuring that the funds are available and will be transferred to the recipient. Perhaps most important, your cash flow will improve. It’s used for large purchases. Web in general, in 2022, getting a bank draft costs between $10 to $20. Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount of money from one account to another. When you automatically draft payment, you get paid faster than when you use checks. In most instances, the bank will probably review the requester of the draft to establish whether he or she has enough funds for the check to clear. Discover how bank drafts differ from other payment methods. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. Web a bank draft is a guaranteed form of payment by the issuing financial institution. Web a bank draft is a check that is drawn on a bank’s funds and guaranteed by the bank that issues it. similar to a cashier’s check, a legitimate bank draft is safer than a personal check when accepting large payments. A bank draft, also called a bank check, is a method of payment that involves a document issued by a bank guaranteeing that the amount stated on the certificate will be paid to the recipient of the document. Perhaps most important, your cash flow will improve. Where can i go to get a bank draft? Securing a bank draft requires that a payer has already deposited funds equivalent to an indicated amount plus fees to the issuing bank. Web draft withdrawals require you to set up the electronic payment with the business that issues the bill. However, once you have set up the draft withdrawal, your bank will automatically deduct the funds from your bank account according to the payment schedule. It is used when the payee wants a highly secure form of payment.

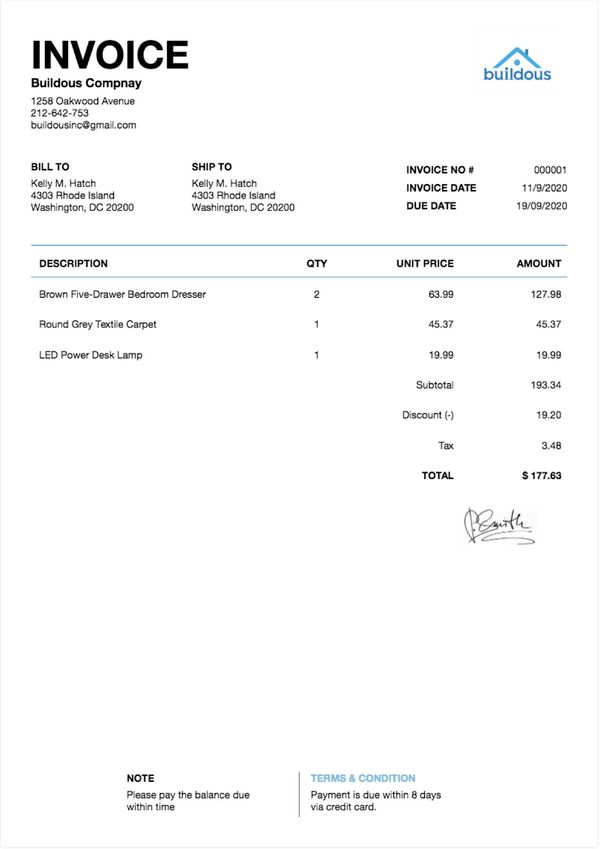

How to Make An Invoice & Get Paid Faster (10+ Invoice Templates)

Direct Draw Draft System Examples

Direct Draw Draft System Examples

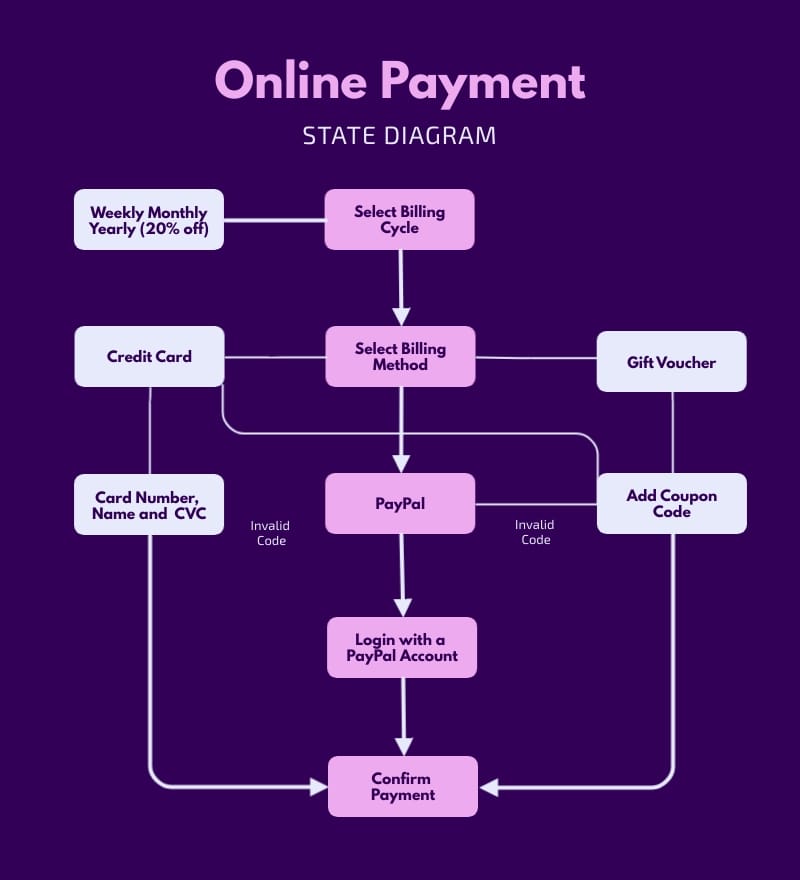

Online Payment State Diagram Template Visme

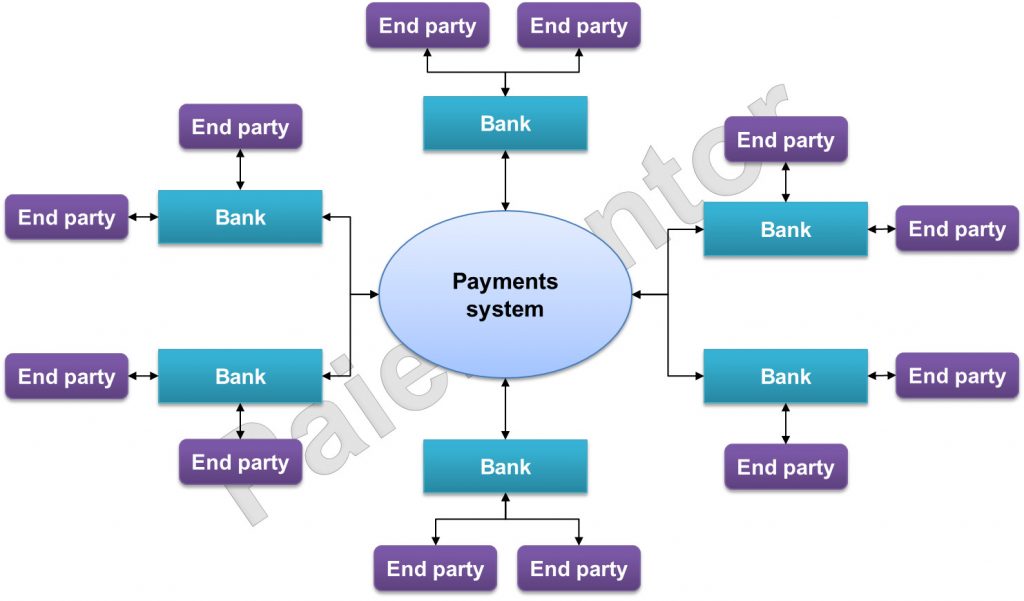

Payment systems models Paiementor

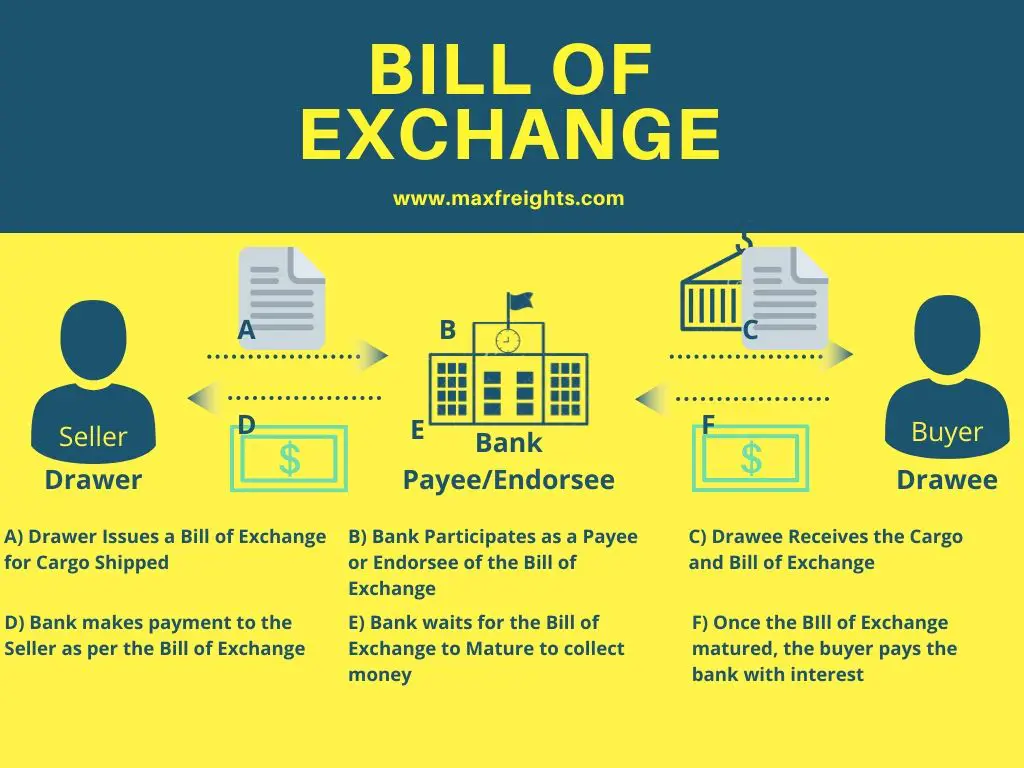

Explain the Difference Between a Drawer and a Drawee IsiahhasIbarra

Direct Draw Draft System Examples

Direct Draw Draft System Examples

What is the meaning of bank draft Isodisnatura

Free Simple Draft Agreement Template Google Docs, Word, Apple Pages

Web Essentially, A Bank Draft Is A Guaranteed Check Issued By The Bank.

Web The Bank Draft Meaning Would Be Defined As “A Convenient And Secure Instrument For Making Large Payments Without Having To Withdraw Cash From One’s Account.” A Bank Draft Is A Physical Way Of Paying A.

It’s A Secure Way Of Making Payments, Ensuring That The Funds Are Available And Will Be Transferred To The Recipient.

Bank Drafts Are Often Used For International Transactions, As They Are A.

Related Post: