Drawings Accounting Definition

Drawings Accounting Definition - Web in standard accounting, drawings refer to withdrawals of funds or assets by a business owner or partners for personal use. Business owners typically use drawing accounts when they are a part of a sole proprietorship or partnership. It is also called a withdrawal account. Web the meaning of drawing in accounts is the record kept by a business owner or accountant that shows how much money has been withdrawn by business owners. The money taken from the business must be recorded on the general ledger and appear on the balance sheet. Large companies and corporations will not deal the issue of drawings very often, simply because owners can be quite detached from day to day running of the. The drawings or draws by the owner (l. Web owner's drawing account definition — accountingtools. Drawing accounts are frequently used by companies that undergo taxation under the assumption of being partnerships or sole proprietorships. It’s important to document these drawings in order to maintain accurate records of the business’s finances and determine its taxable income. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal use are termed as drawings. Web definition of drawings in accounting. Web drawings are money or assets that are withdrawn from a company by its owners for personal use and must be recorded as a reduction of assets and owner's. Web drawing, in accounting, refers to the action of taking funds from an account or company holdings for individual use. It reduces the total capital invested by the proprietor(s). Web in accounting, drawings refer to the withdrawal of funds or assets from a business by its owners or partners for personal use. At the end of the accounting period, if. Drawings can be in the form of cash, business assets, or checks. Web a drawing account, in the context of business finance, is a ledger that carefully tracks money and other assets withdrawn from a business. Web what are drawings in accounting? Web the amount of money or assets (money’s worth) drawn from a business by an owner for personal. Web a drawing account is a financial account that essentially records owners’ drawings, i.e., the assets, mainly including money, that are withdrawn from a business by its owner (s) for their personal use. Web the amount of money or assets (money’s worth) drawn from a business by an owner for personal use is called drawings. Web drawings account is a. It is important to track the drawings in a business as it reduces the capital or the owner’s equity in a business. Web drawings accounting is used when an owner of a business wants to withdraw cash for private use. Web the meaning of drawing in accounts is the record kept by a business owner or accountant that shows how. Web an artist is someone who requires an artist’s studio. They do not affect the business expenses on the profit and loss account (income statement). It reduces the total capital invested by the proprietor(s). Drawing accounts are generally associated with unincorporated business organizations, such as sole proprietorships and partnerships. This is a contra equity account that is paired with and. Drawing can also include items that are removed from a business for personal use. The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. A drawing account is a record in accounting kept to monitor cash and other such assets taken out of a company by their owners. The drawing account is. Business owners typically use drawing accounts when they are a part of a sole proprietorship or partnership. It is also called a withdrawal account. Web in standard accounting, drawings refer to withdrawals of funds or assets by a business owner or partners for personal use. Web as we noted in our earlier articles, drawings are transactions withdrawing equity an owner. These withdrawals are typically made by sole traders or partners in a partnership. Web drawing, in accounting, refers to the action of taking funds from an account or company holdings for individual use. Drawings in accounting refer to the withdrawal from a business by its owner in the form of cash or any other asset aimed to spend for personal. It reduces the total capital invested by the proprietor(s). They are, in effect, drawing funds from the business (hence the name). Web a drawing account is a financial account that essentially records owners’ drawings, i.e., the assets, mainly including money, that are withdrawn from a business by its owner (s) for their personal use. Web what is a drawing account?. Web a drawing account is a ledger that tracks money and other assets withdrawn from a business, usually a sole proprietorship or a partnership, by its owner. In this situation the bookkeeping entries are recorded on the drawings account in the ledger. Business owners typically use drawing accounts when they are a part of a sole proprietorship or partnership. It’s important to document these drawings in order to maintain accurate records of the business’s finances and determine its taxable income. The money taken from the business must be recorded on the general ledger and appear on the balance sheet. The drawings or draws by the owner (l. These withdrawals are typically made by sole traders or partners in a partnership. They are, in effect, drawing funds from the business (hence the name). It is important to note that while drawings are commonly associated with sole proprietorships and partnerships, they are not applicable to corporations, as the ownership structure is different. Drawings are the withdrawals of a sole proprietorship’s business assets by the owner for the owner’s personal use. Web what are drawings in accounting? Web definition of drawings in accounting. Web a drawing account is a financial account that essentially records owners’ drawings, i.e., the assets, mainly including money, that are withdrawn from a business by its owner (s) for their personal use. This is a contra equity account that is paired with and offsets the owner's capital account. Web a drawing account, sometimes referred to as a “draw account” or “owner’s draw,” is a critical accounting record used to track money and other assets withdrawn from a business by its owners. Drawings in accounting are when money is taken out of the business for personal use.

Drawing Definition In Accounting Fox Phoenix rpgs

Update more than 151 drawing definition in accounting vietkidsiq.edu.vn

Top 143+ define drawings in accounting best seven.edu.vn

:max_bytes(150000):strip_icc()/DrawingAccount-ebf43543399c4f2aaaa3bdec5e94f1ee.jpg)

Drawing Account What It Is and How It Works

What are Drawings in Accounting?

Drawings in Accounting Definition, Process & Importance

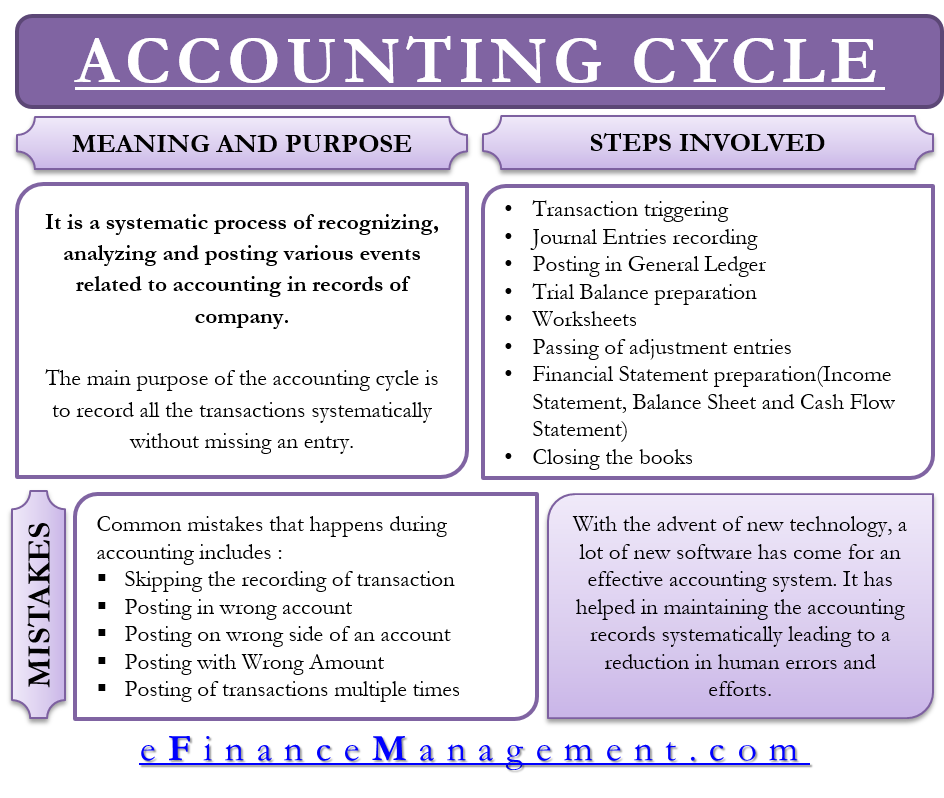

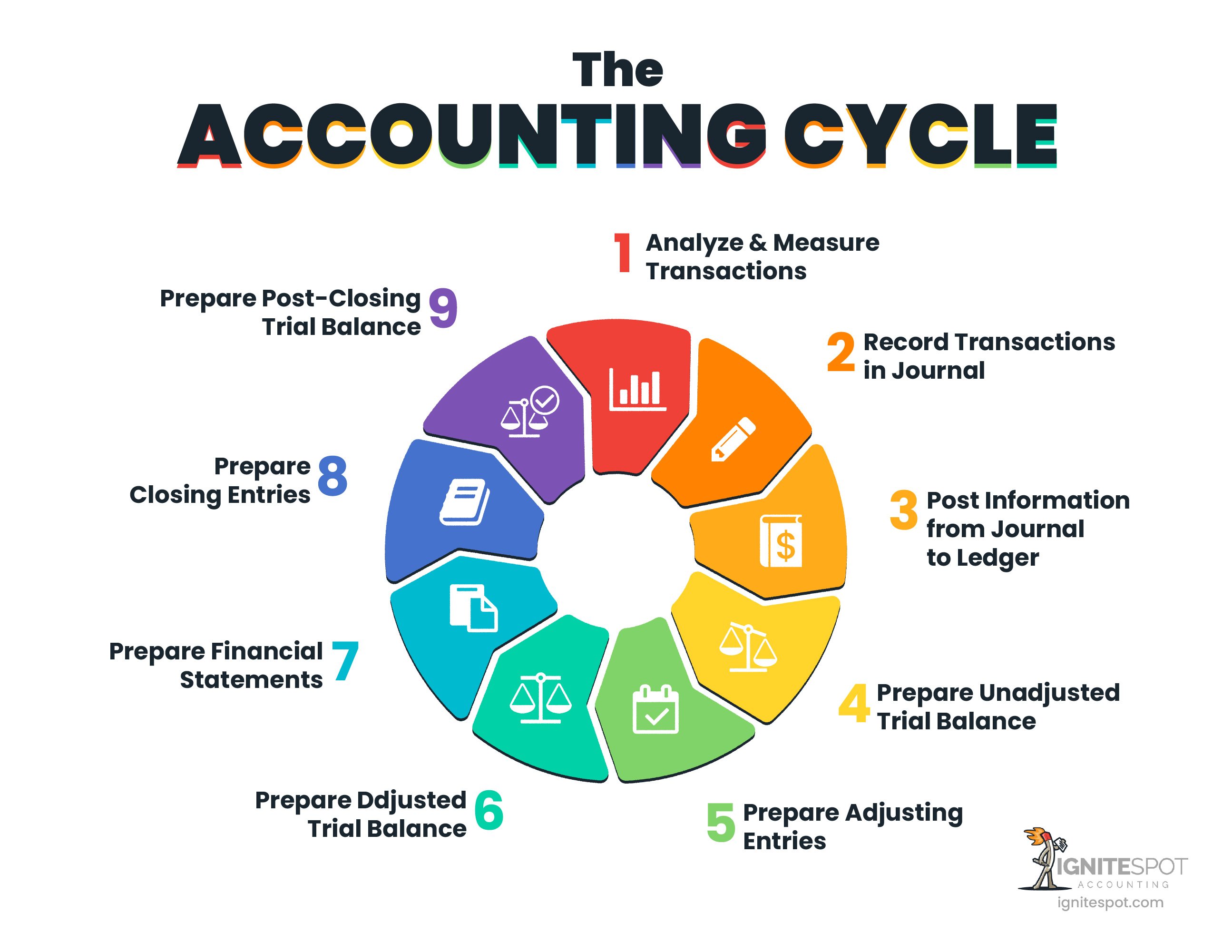

Basic Accounting The Accounting Cycle Explained

What is Drawing in Accounting? Accounting for Beginners by Student

What is Drawing Account in Journal Entry Definition, Features and Example

What Are Drawings In Accounting? SelfEmployed Drawings

Web A Drawing Account, In The Context Of Business Finance, Is A Ledger That Carefully Tracks Money And Other Assets Withdrawn From A Business.

Web What Is A Drawing Account?

Drawing Accounts Are Generally Associated With Unincorporated Business Organizations, Such As Sole Proprietorships And Partnerships.

Drawings In Accounting Refer To The Withdrawal From A Business By Its Owner In The Form Of Cash Or Any Other Asset Aimed To Spend For Personal Use Rather Than Business Use.

Related Post: