Dp1 Dp2 Dp3 Comparison Chart

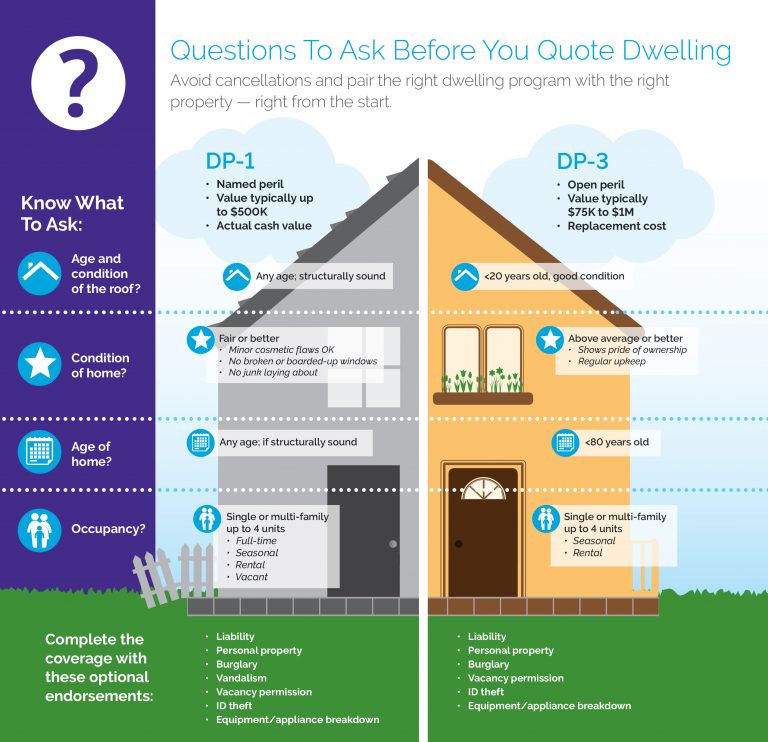

Dp1 Dp2 Dp3 Comparison Chart - See a chart that shows the perils covered, reimbursement type, and best use cases for each policy. See the differences in occupancy, deductibles, loss of use, personal property, and additional coverages for each policy. Each form offers more protection than the last. You’ll notice the biggest difference in dp3 vs. Web what are the differences between dp1, dp2, and dp3 policies? The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. There will also be three io units to interface components, as opposed to a double set of sensors typically used in a dp 2 configuration. Dp1 systems are the most basic, with the ability to keep their position in automatic mode. But, what are the differences between those two policies? Let's start by taking a look at the differences between dp1 vs dp3. It’s an open perils policy, which means it covers far more types of loss than dp1. The levels build on each other, with each succeeding level having the abilities of the previous level. Which policy is right for me? Dp1, dp2, and dp3 policies are. In some dp2 and dp3 policies for certain roof ages, roofs may be covered for. Compare the perils covered, the type of insurance (named or open), and the cost of each policy. In addition, both the dp2 and dp3 provide replacement cost value (rcv) where the insurer doesn’t deduct the property’s depreciation from your claim (note: Web two common policy options you’ve probably come across are dwelling policy 1 (dp1) and dwelling policy 3 (dp3).. There will also be three io units to interface components, as opposed to a double set of sensors typically used in a dp 2 configuration. Rather than listing a few covered perils, the dp3 covers all perils except those listed in. See the differences in occupancy, deductibles, loss of use, personal property, and additional coverages for each policy. Which policy. Each form offers more protection than the last. Web learn the key differences between dp1, dp2, and dp3 dwelling policies for rental properties. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. Web dp1, dp2 , dp3: Web a spreadsheet that compares the coverage options and perils for different types of homeowners insurance policies,. The triple redundant dp controller is still used and a minimum of three operator stations is required. It’s an open perils policy, which means it covers far more types of loss than dp1. It’s the most comprehensive and expensive of the three options. Each form offers more protection than the last. We’re here to answer your questions. Web learn the key differences between dp1, dp2, and dp3 dwelling policies for rental properties. But, what are the differences between those two policies? They’re usually more expensive than a dp1 or dp2 policy, but they cover you against more. Web dp1, dp2 , dp3: A dp2 policy usually covers the home for damage from: Dp1, dp2, and dp3 policies are. Named perils vs open perils policies; Web the three most common rental insurance policies are the dp1, dp2, and dp3. We’re here to answer your questions. You’ll notice the biggest difference in dp3 vs. Rather than listing a few covered perils, the dp3 covers all perils except those listed in. Web here’s a simple breakdown of dp3 vs ho3: It’s an open perils policy, which means it covers far more types of loss than dp1. Obie offers quotes for all three and can help you secure the right coverage with fast delivery and additional. Ho3 is that some coverages are added by default and others are optional. Dp1 systems are the most basic, with the ability to keep their position in automatic mode. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. Web a dp 3 system has an extended hardware configuration compared to a. The triple redundant dp controller is still used and a minimum of three operator stations is required. Each form offers more protection than the last. A dp3 is the most expensive policy. They’re usually more expensive than a dp1 or dp2 policy, but they cover you against more. It’s an open perils policy, which means it covers far more types. Named perils vs open perils policies; Web a spreadsheet that compares the coverage options and perils for different types of homeowners insurance policies, such as dp1, dp2, dp3, ho2, ho3, etc. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. A dp3 is the most expensive policy. We’re here to answer your questions. Web what are the differences between dp1, dp2, and dp3 policies? Dp1 systems are the most basic, with the ability to keep their position in automatic mode. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. Differences in cost among the three forms of dwelling property insurance; Web dp1 is also a more affordable option than dp2 and dp3. Compare the perils covered, the type of insurance (named or open), and the cost of each policy. Obie offers quotes for all three and can help you secure the right coverage with fast delivery and additional endorsements. Web dp1, dp2 , dp3: It’s the most comprehensive and expensive of the three options. Web two common policy options you’ve probably come across are dwelling policy 1 (dp1) and dwelling policy 3 (dp3). The three forms, dp1, dp2, and dp3, vary in the amount of cover they offer, the way they settle payments, and other endorsements to provide stability and security to landlords.

DP1 and DP3 comparison chart American Modern Insurance Agents

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Michelle Ferrigno, Insurance Agent Coverages Explained 'Landlord

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Dp1 Dp2 Dp3 Insurance Comparison Chart Best Picture Of Chart

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

.png)

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Each Form Offers More Protection Than The Last.

It Is More Affordable Than A Dp3 Policy And Covers More Perils Than The Dp1 Policy.

But, What Are The Differences Between Those Two Policies?

In Addition, Both The Dp2 And Dp3 Provide Replacement Cost Value (Rcv) Where The Insurer Doesn’t Deduct The Property’s Depreciation From Your Claim (Note:

Related Post: