Dollar Cost Averaging Chart

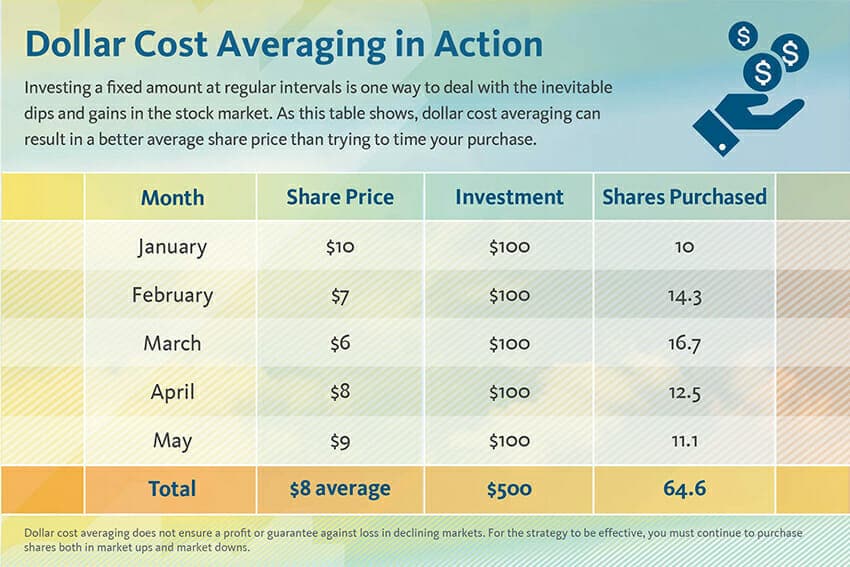

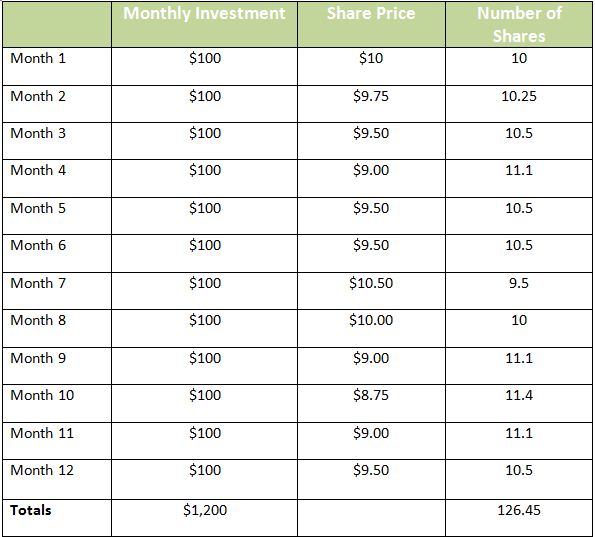

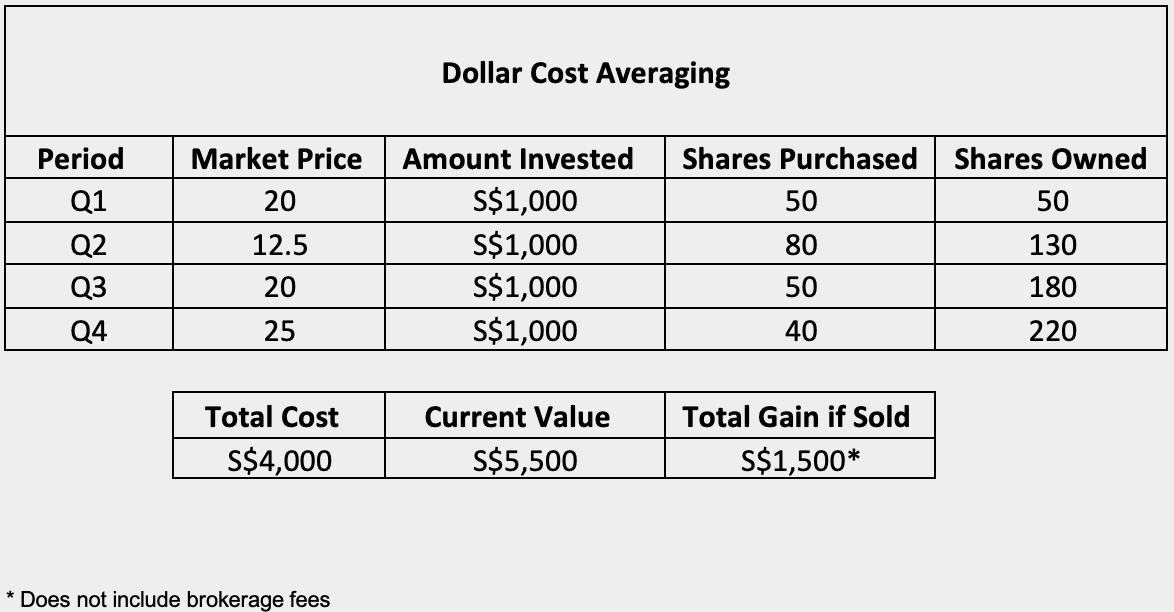

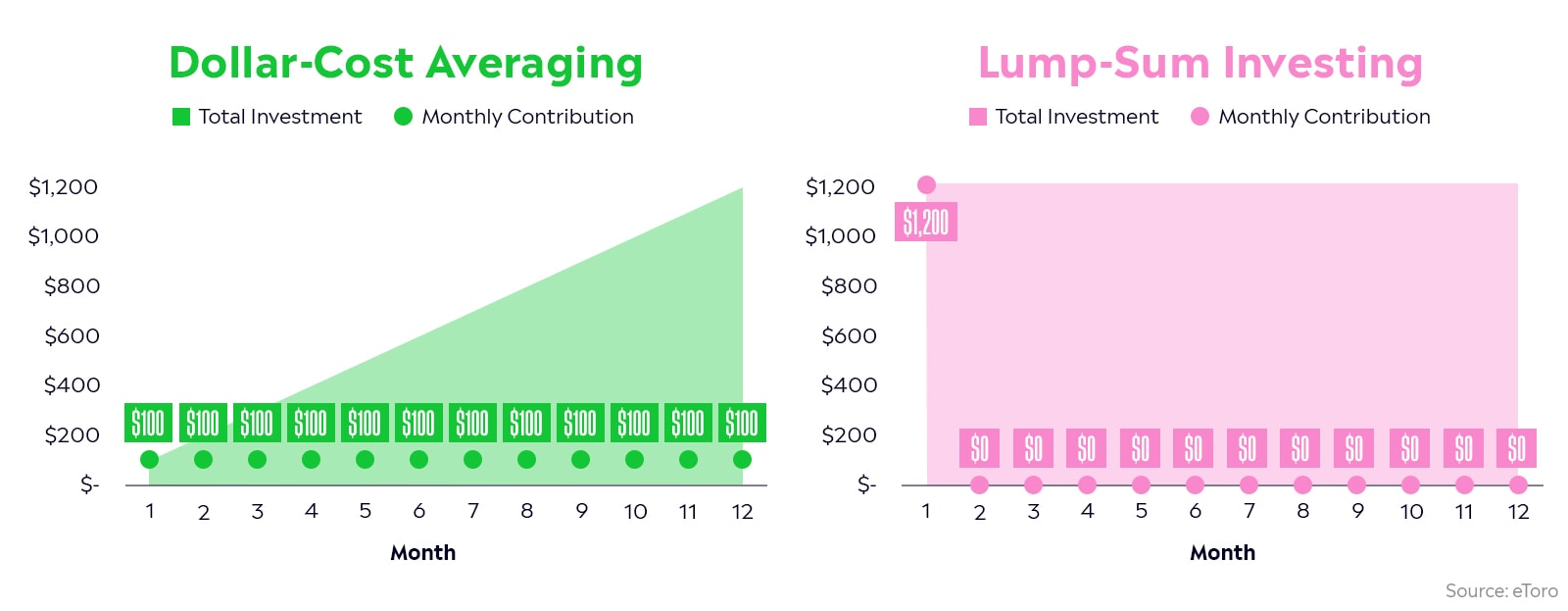

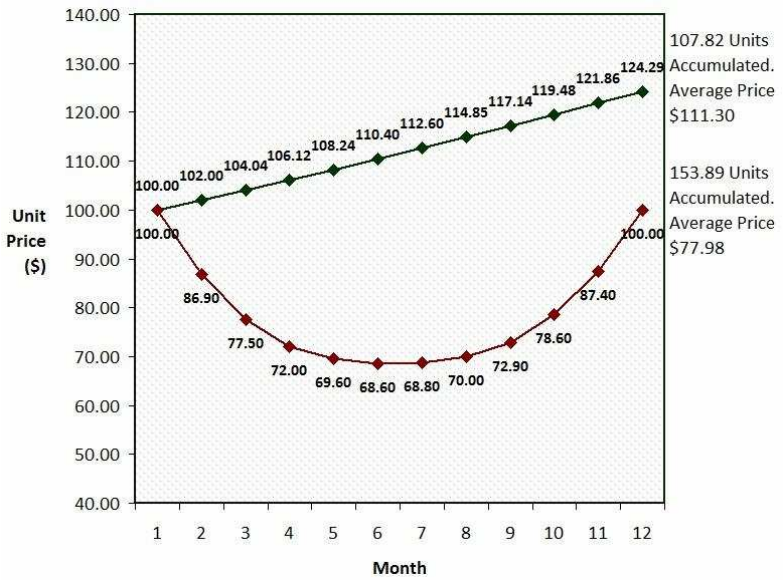

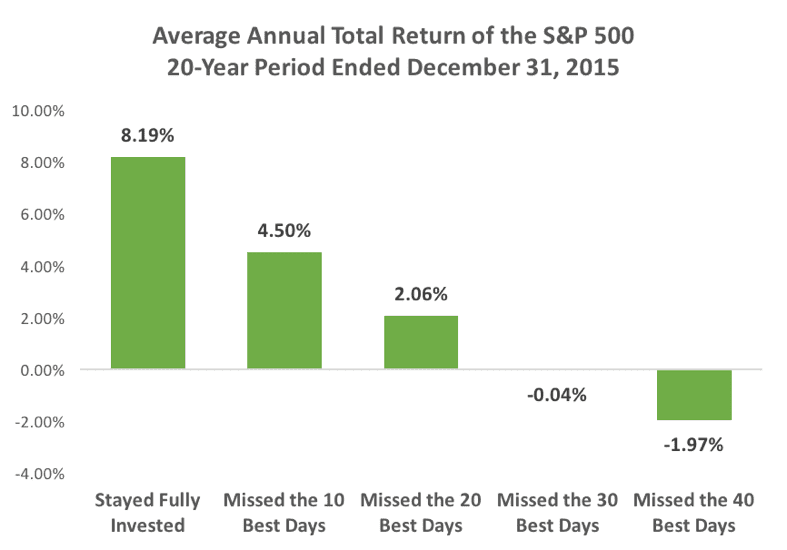

Dollar Cost Averaging Chart - This article delves deep into the mechanics, benefits, and practical applications of dollar cost averaging. Web dollar cost averaging is an investment strategy that involves regularly investing a fixed amount at predetermined intervals, regardless of market conditions. Web dollar cost average calculator for stocks, etfs & crypto. Web dca provides just that. No matter what the financial markets are. The term was first coined by benjamin graham in his book the intelligent investor. It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs. You'll invest a fixed dollar amount at regular intervals over a long period. What is dollar cost averaging? You can set up a specific. Web however, if you assume this trend continues, $500 monthly investments would cross the $1 million mark in around 25 years by averaging 14% total returns. Instantly analyze dollar cost averaging (dca) for stocks, etfs & crypto over any investment schedule using recent financial data. No matter what the financial markets are. Use the dollar cost averaging (dca) calculator from. This is done until the end value. Web however, if you assume this trend continues, $500 monthly investments would cross the $1 million mark in around 25 years by averaging 14% total returns. What is dollar cost averaging? This article delves deep into the mechanics, benefits, and practical applications of dollar cost averaging. The term was first coined by benjamin. Let's say you invest $100 every month. This is done until the end value. If you have a 401 (k). No matter what the financial markets are. Use the dollar cost averaging (dca) calculator from merrill edge to learn more about dollar cost averaging and find a dca strategy that works for you. Use the dollar cost averaging (dca) calculator from merrill edge to learn more about dollar cost averaging and find a dca strategy that works for you. It is also called unit cost averaging, incremental averaging, or cost average effect. If you have a 401 (k). Web dollar cost average calculator for stocks, etfs & crypto. Web dollar cost averaging is. No matter what the financial markets are. Web dca provides just that. Web dollar cost average calculator for stocks, etfs & crypto. Instantly analyze dollar cost averaging (dca) for stocks, etfs & crypto over any investment schedule using recent financial data. You'll invest a fixed dollar amount at regular intervals over a long period. This is done until the end value. Want to know if this strategy's right for you? You'll invest a fixed dollar amount at regular intervals over a long period. If you have a 401 (k). This article delves deep into the mechanics, benefits, and practical applications of dollar cost averaging. If you have a 401 (k). The term was first coined by benjamin graham in his book the intelligent investor. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. Use the dollar cost averaging (dca) calculator from merrill edge to learn more about dollar. Instantly analyze dollar cost averaging (dca) for stocks, etfs & crypto over any investment schedule using recent financial data. Web dollar cost averaging is an investment strategy that involves regularly investing a fixed amount at predetermined intervals, regardless of market conditions. This strategy aims to reduce the impact of market volatility by buying more shares when prices are low and. If you go with the more conservative 12%. Web dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. Dca aims to mitigate the impact of market volatility and potentially lower the average cost per share. What is dollar cost averaging? If you have a 401 (k). Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. It's helpful to understand the math. If you make regular contributions to an investment or retirement account,. This helps to average out the cost of the acquired asset over time. This article delves deep into. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. Use the dollar cost averaging (dca) calculator from merrill edge to learn more about dollar cost averaging and find a dca strategy that works for you. The amount of money invested using this approach is usually smaller than a lump sum would be, but the contributions will build up steadily over time. If you go with the more conservative 12%. No matter what the financial markets are. Web dca provides just that. Let's say you invest $100 every month. Web dollar cost averaging (or dca investing) is the process of purchasing investments on a regular schedule instead of putting a large sum of money into the market all at once. The term was first coined by benjamin graham in his book the intelligent investor. It is also called unit cost averaging, incremental averaging, or cost average effect. Instantly analyze dollar cost averaging (dca) for stocks, etfs & crypto over any investment schedule using recent financial data. Web dollar cost averaging ( dca) is an investment strategy that aims to apply value investing principles to regular investment. Web if the current price is $12.50 per share, the original position is worth $625 (50 shares times $12.50), which only requires an investment of $375 to reach $1,000. Instead of purchasing shares at a single price point, with. If you make regular contributions to an investment or retirement account,. It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs.What Exactly is Dollar Cost Averaging? Ms. Independcent

How Dollar Cost Averaging Transforms Your Investment Strategy

Dollar Cost Average Chart

Exploring Finance The Ultimate Dollar Cost Averaging Strategy

A Beginners Guide to DollarCost Averaging (DCA) with Examples

Dollar Cost Averaging A Passive Stock Investment Strategy YouTube

How to Use Dollar Cost Averaging to Build LongTerm Wealth Standard

Dollarcost averaging A simpleyeteffective investment strategy eToro

Dollar Cost Averaging Roy Walker Wealth Management

Dollar Cost Averaging Bravias Financial

It's Helpful To Understand The Math.

Web Dollar Cost Average Calculator For Stocks, Etfs & Crypto.

Web Dollar Cost Averaging Is The Practice Of Investing A Fixed Dollar Amount On A Regular Basis, Regardless Of The Share Price.

This Helps To Average Out The Cost Of The Acquired Asset Over Time.

Related Post: