Divergence Chart Patterns

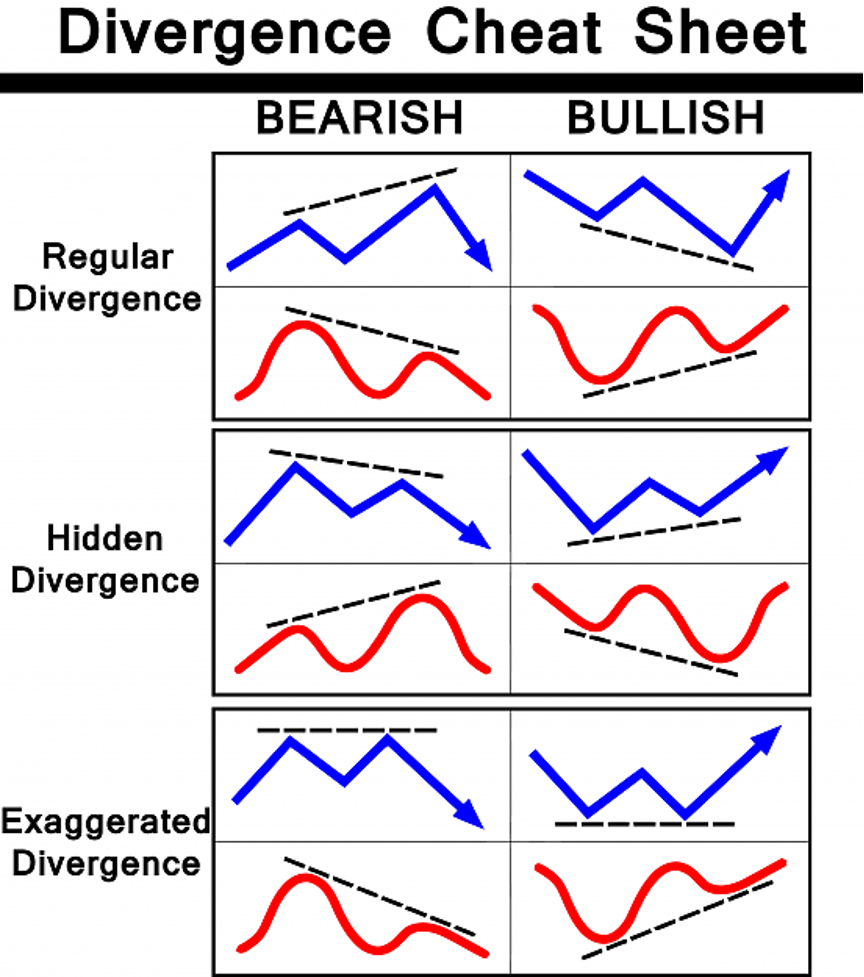

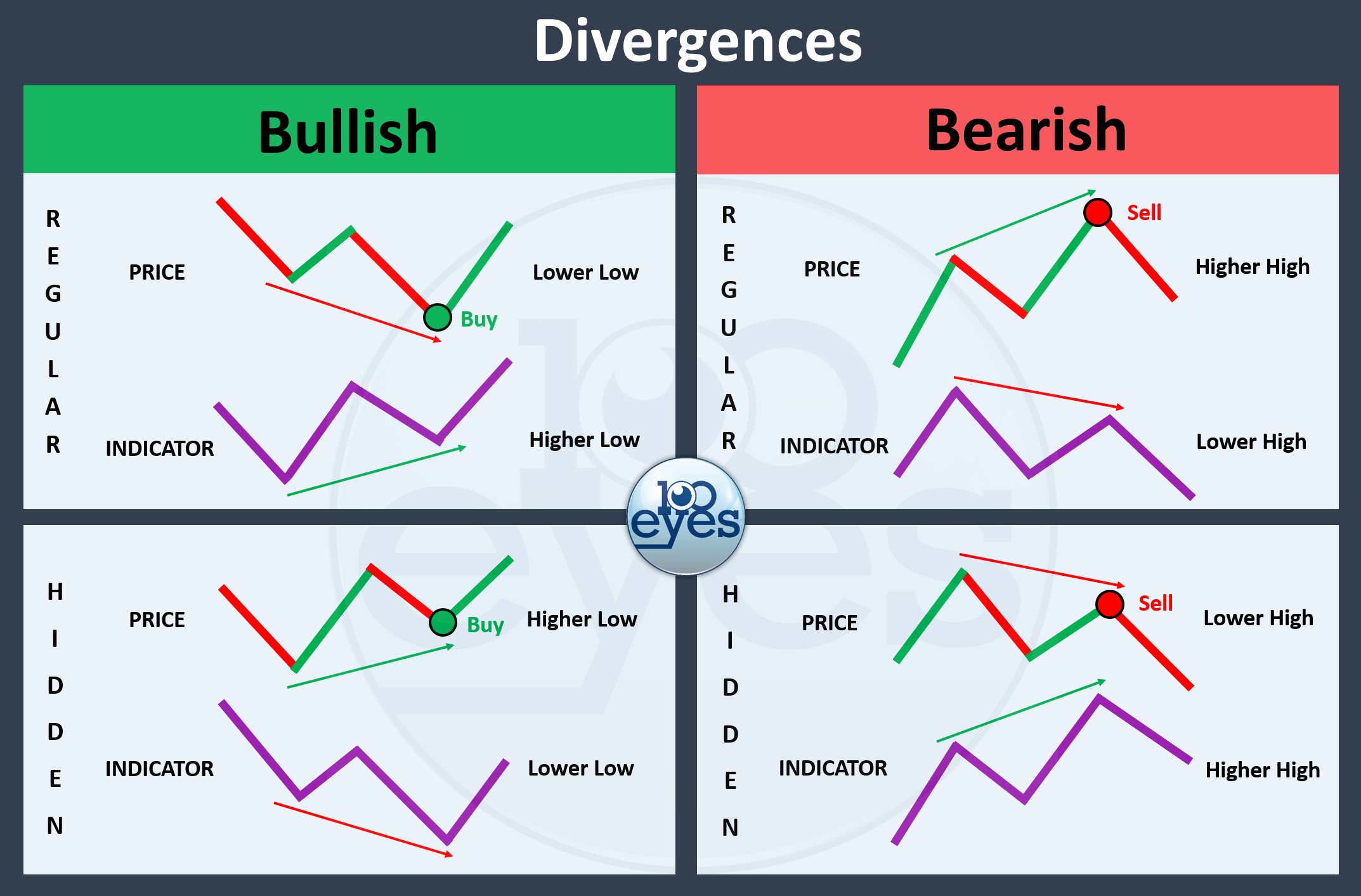

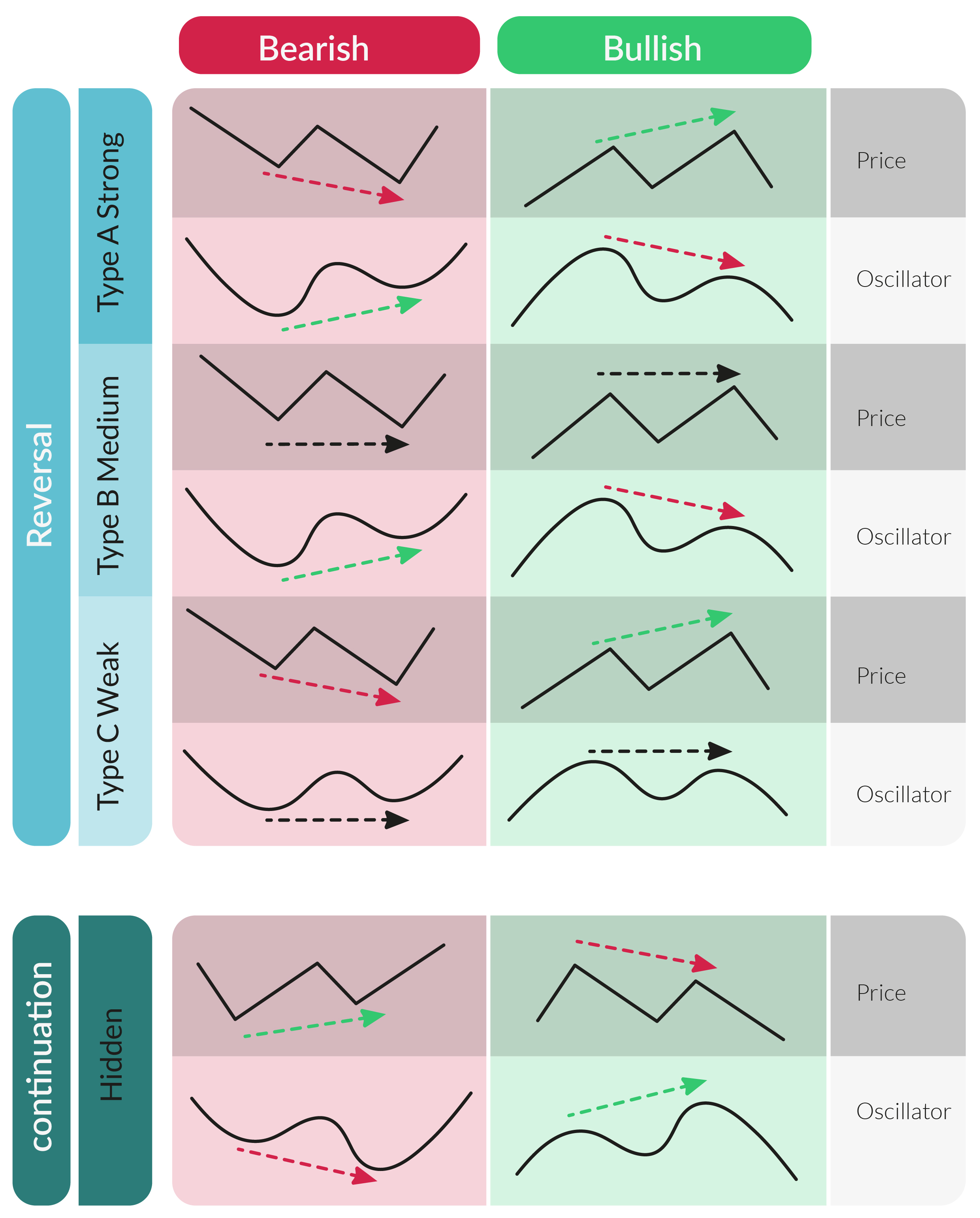

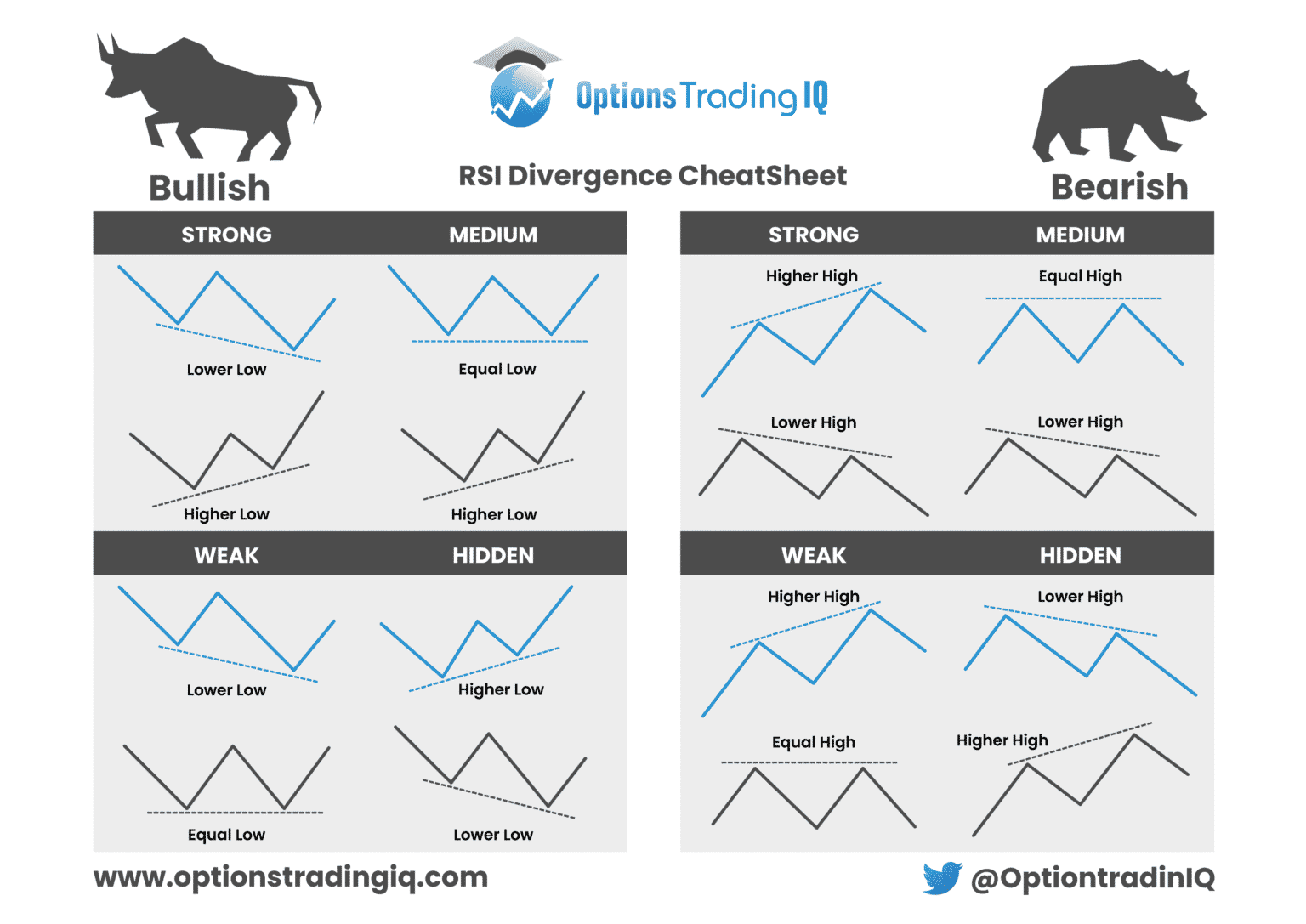

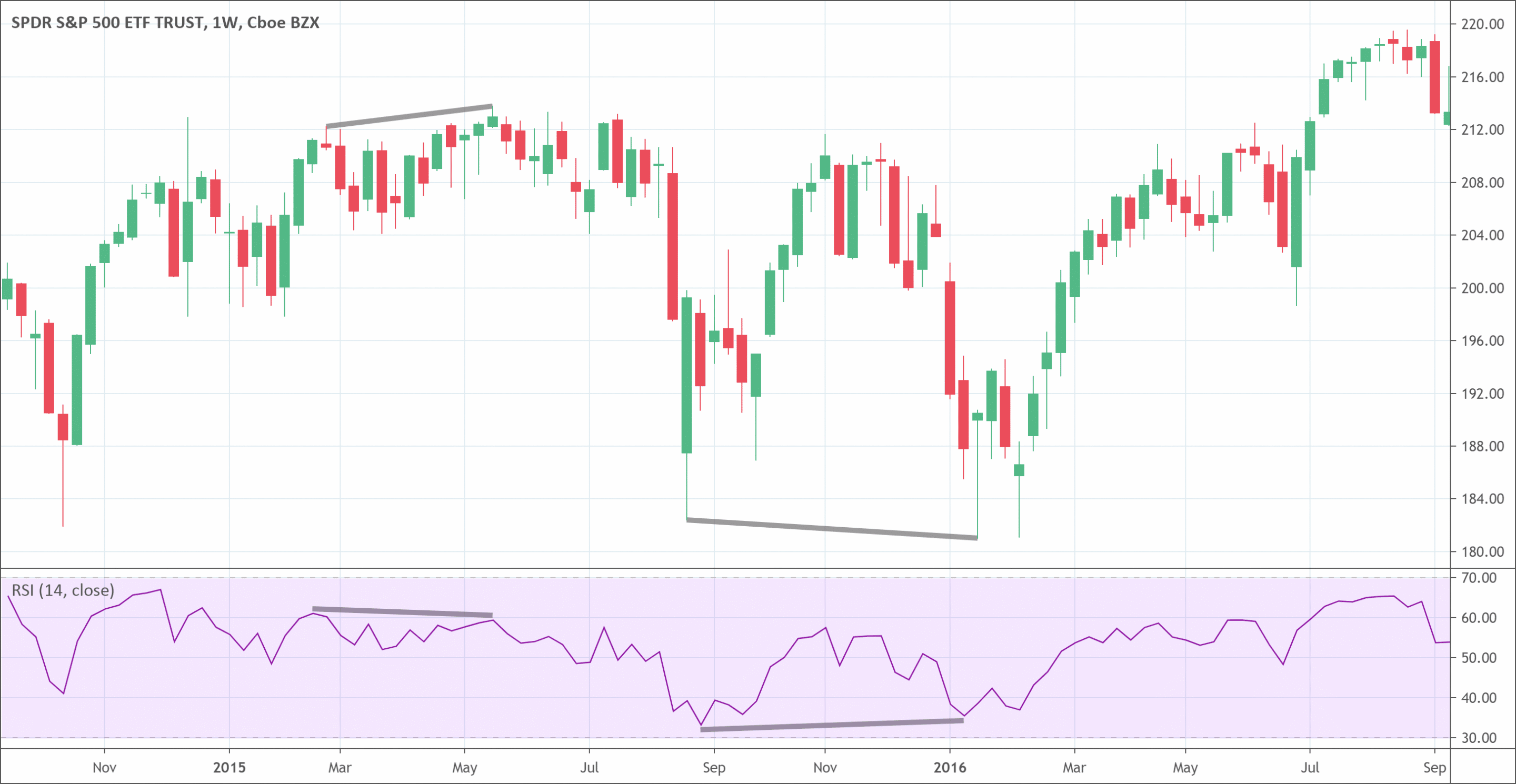

Divergence Chart Patterns - Divergence is a warning sign that the price trend is weakening, and in some case may result in. There are other configurations that. This pattern provides valuable insights into potential price reversals or changes in trends. They occur when the price action of an asset and a corresponding trading indicator, such as the relative strength index (rsi) or moving average convergence divergence (macd), move in the opposite. For instance, if price forms a higher high while the rsi forms a lower high, it indicates bearish divergence. We make the best profits when we understand trend momentum and use it for the right strategy at the right time. Web this chart in figure 6 shows that trends don't reverse quickly or even often. Cvx) remains a leading player in the oil and gas industry. With each of these two categories, you have a bullish or a bearish. Web divergences are used by technical traders to read momentum, such as when the market's momentum is about to change direction or the speed at which an investor is approaching a possible momentum. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Each type of divergence will contain either a bullish bias or a bearish bias. Both patterns start at the dow/gold ratio peak (1966 and 1999, respectively). Divergence is a warning sign that the price trend is weakening, and in some case may result in.. Web divergence in trading refers to scenarios where the price of an asset and its momentum as measured by an indicator such as rsi or macd do not confirm each other’s direction. Divergence trading is an effective method, and allow traders to combine price action and indicator analysis into a trading strategy; There are other configurations that. There are four. Web the charts for these safe havens are really bullish and warn of a major us dollar meltdown. I've marked out two patterns showing how the recent breakout puts gold in the acceleration phase of the bull market. Web in technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals.. This pattern provides valuable insights into potential price reversals or changes in trends. You can get your free divergence cheat sheet pdf below. There are two types of divergences: Web divergences are used by technical traders to read momentum, such as when the market's momentum is about to change direction or the speed at which an investor is approaching a. Divergence occurs when an asset’s price and an indicator, like the relative strength index (rsi), move in opposite directions. Web divergence is a very useful tool to help traders spot trend reversals or continuation patterns. Aha, that’s the tricky part! Each type of divergence will contain either a bullish bias or a bearish bias. Make it your computer wallpaper! Web the charts for these safe havens are really bullish and warn of a major us dollar meltdown. Here, a news source viewed as more trustworthy by a group — overall, among democrats, by those ages 65 and over, etc. At the same time, price must make a higher high on the second peak, where the rsi is. They occur. You can get your free divergence cheat sheet pdf below. Web this chart in figure 6 shows that trends don't reverse quickly or even often. Make it your computer wallpaper! Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes movements. A bullish divergence pattern refers to a situation when the. You can get your free divergence cheat sheet pdf below. Below is a gold chart i shared previously: Cvx) remains a leading player in the oil and gas industry. Make it your computer wallpaper! They occur when the price action of an asset and a corresponding trading indicator, such as the relative strength index (rsi) or moving average convergence divergence. Web the charts for these safe havens are really bullish and warn of a major us dollar meltdown. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Also, you can. Divergence is a warning sign that the price trend is weakening, and in some case may result in. Web this quick reference guide highlights the various trading divergence patterns that may appear on a chart. Web here’s what the divergence cheatsheet looks like: Web divergences are used by technical traders to read momentum, such as when the market's momentum is. 1) regular or classic divergence. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Web we can graph this to show the differences. Being able to spot these types of patterns is a massive advantage as they will help you to identify new trading opportunities and. Web oscillator indicator for divergence patterns is weis wave volume, macd, the rsi, cci, or stochastic obv. There are 4 types of divergence, which are broadly classified into two categories: — is higher on each chart. Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes movements. Web divergence is when the price of an asset and a technical indicator move in opposite directions. Developed in 1978 by j. This pattern provides valuable insights into potential price reversals or changes in trends. Web divergence in trading refers to scenarios where the price of an asset and its momentum as measured by an indicator such as rsi or macd do not confirm each other’s direction. Rsi divergence occurs when the relative strength index indicator starts reversing before price does. Also, you can use other suitable chart patterns to confirm the trade, especially harmonic chart patterns that are extremely accurate in predicting price movements. Web divergence is a very useful tool to help traders spot trend reversals or continuation patterns. There are two main types of divergences seen in.The Ultimate Divergence Cheat Sheet A Comprehensive Guide for Traders

How To Trade an RSI Divergence Complete Guide Living From Trading

MACD Divergence Forex Trading Strategy The Ultimate Guide To Business

Divergence Trading 100eyes Scanner

![RSI Divergence Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/rsi-divergence-cheat-sheet-2048x1448.png)

RSI Divergence Cheat Sheet [FREE Download] HowToTrade

The New Divergence Indicator and Strategy 3rd Dimension

RSI Divergence Cheat Sheet Options Trading IQ

Trading strategy with Divergence chart patterns Trading charts, Forex

Types of Divergence for POLONIEXETHBTC by Yrat — TradingView

Divergence Everything Traders Should Know PatternsWizard

Web A Divergence Setup Is A Leading Forex Pattern, Giving Us An Early Entry Into Emerging Price Moves.

Web This Chart In Figure 6 Shows That Trends Don't Reverse Quickly Or Even Often.

We Make The Best Profits When We Understand Trend Momentum And Use It For The Right Strategy At The Right Time.

A Bearish Divergence Consists Of An Overbought Rsi Reading, Followed By Lower High On Rsi.

Related Post: