Debt Snowball Tracker Printable

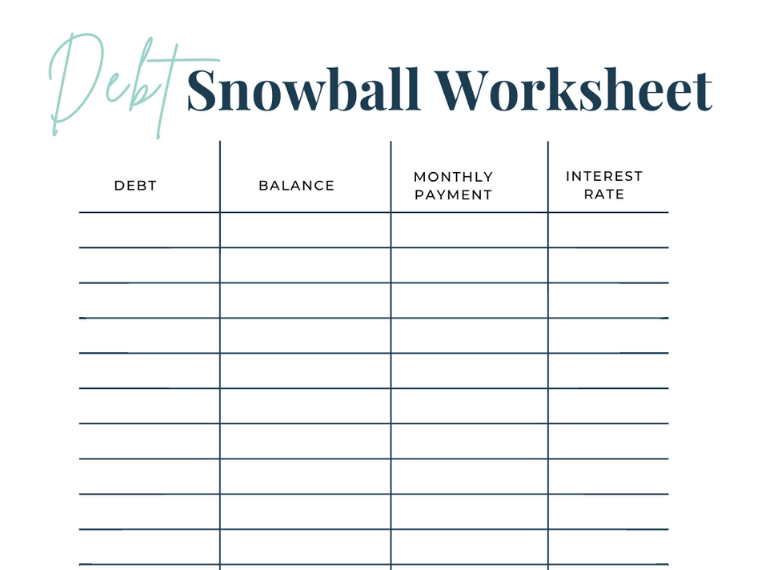

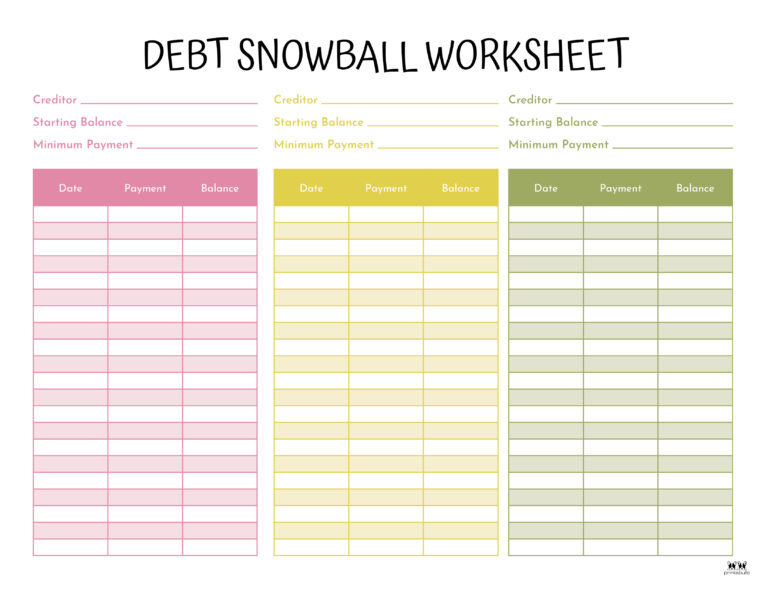

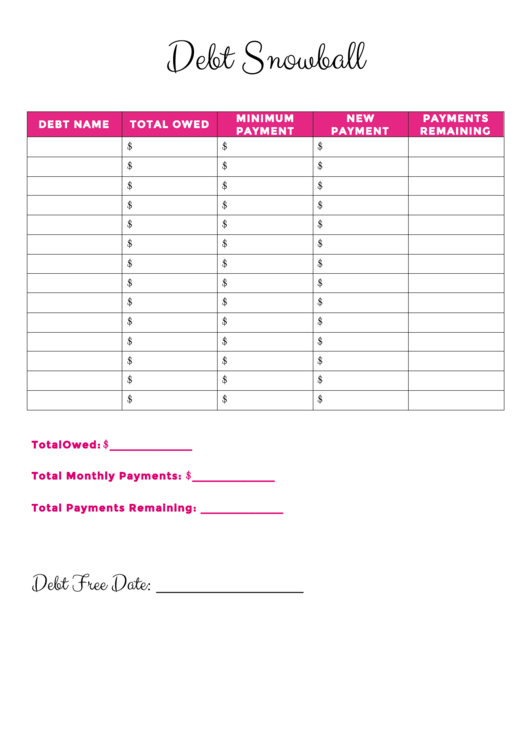

Debt Snowball Tracker Printable - The first page in the kit is the debt snowball payments page. In the first worksheet, you enter your creditor information and your total monthly payment. You will also include your monthly payment and the amounts you have paid on it each month. I have the perfect worksheet to help you with this step. For those who like it simple; Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Web this printable worksheet can be used to track individual debts you are trying to pay off. Preventing further debt accumulation is critical for financial health. Write each one of your debts down on this form in order from smallest to largest. $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: For those who like it simple; List the balance, interest rate, and minimum payment. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. On the left you write. Web debt snowball illustration & free printable debt payoff worksheet pdf. We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. If. 2 the benefits of using the debt snowball method. The first page in the kit is the debt snowball payments page. 4 how does the snowball method for paying off. Write down the amount you plan to pay on that debt each month. $1,000 ($50 minimum payment) 2nd debt: 2 the benefits of using the debt snowball method. The debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan #1”, “student loan #2” etc. You can list. Below, we’ve got lots of free printable debt trackers (and debt payoff planners. Web simply unscripted’s debt snowball tracker. This debt snowball tracker is a simple form to help you track your debt payoff progress. Instead of having one sheet for each debt, you will list all of your debts on a single sheet. If you’ve been trying to get. Free printable debt snowball worksheet. The first page in the kit is the debt snowball payments page. I have the perfect worksheet to help you with this step. Web a free debt tracker assists in managing your debt by providing an organized way to keep track of debt payments. Managing debt is a normal part of the modern financial journey. In the first worksheet, you enter your creditor information and your total monthly payment. For those who want to monitor their snowball from all angles; Instead of having one sheet for each debt, you will list all of your debts on a single sheet. Here you will list all of your debts from smallest to largest. Web debt one debt. $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. $2,000 ($65 minimum payment) 3rd debt: This process works, and you can see how effective it is on our printable guide. Web debt one debt two debt three debt four debt snowball tracker. Write down the amount you plan to pay on that debt each month. We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. Web now to see it in action, assume the following is your debt snowball strategy. You can either print it or fill it in online as a pdf, so. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. As you knock out your smallest debts first, watch your extra payments towards your larger debts balloon until your balances are totally. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. This process works, and you can see how. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. The smallest debt will be the one that will be getting the snowball payment. In the first worksheet, you enter your creditor information and your total monthly payment. This debtbuster worksheet works best if you put the smallest debt at the top of the list and the biggest debt at the. This process works, and you can see how effective it is on our printable guide. Do the same for the second smallest debt untill that one is paid off as well. 2.2 you can negotiate the interest rates; Web a free debt tracker assists in managing your debt by providing an organized way to keep track of debt payments. List the balance, interest rate, and minimum payment. Repeat until each debt is paid in full. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Web table of contents. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan #1”, “student loan #2” etc. Keep reading and at the end of the post. Here you will list all of your debts from smallest to largest. For those who want to monitor their snowball from all angles;![]()

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Debt Snowball Tracker Printable

Free Printable Debt Snowball Worksheet To Payoff Debt In 2024

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Free Printable Snowball Debt Spreadsheet Printable World Holiday

Debt Snowball Tracker Printable Etsy

Printable Debt Snowball Tracker

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Debt Snowball Tracker Printable

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-snowball-excel.jpg?gid=443)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

The Second Credit Card Is $9,000 At 9% Interest.

Instructions Are At The Bottom Of The Sheet, But I’ll List Them Here As Well:

Web Debt Snowball Illustration & Free Printable Debt Payoff Worksheet Pdf.

Check Out Repayment Methods Such As The Debt Snowball Or Avalanche Method.

Related Post: