Ct Tax Chart

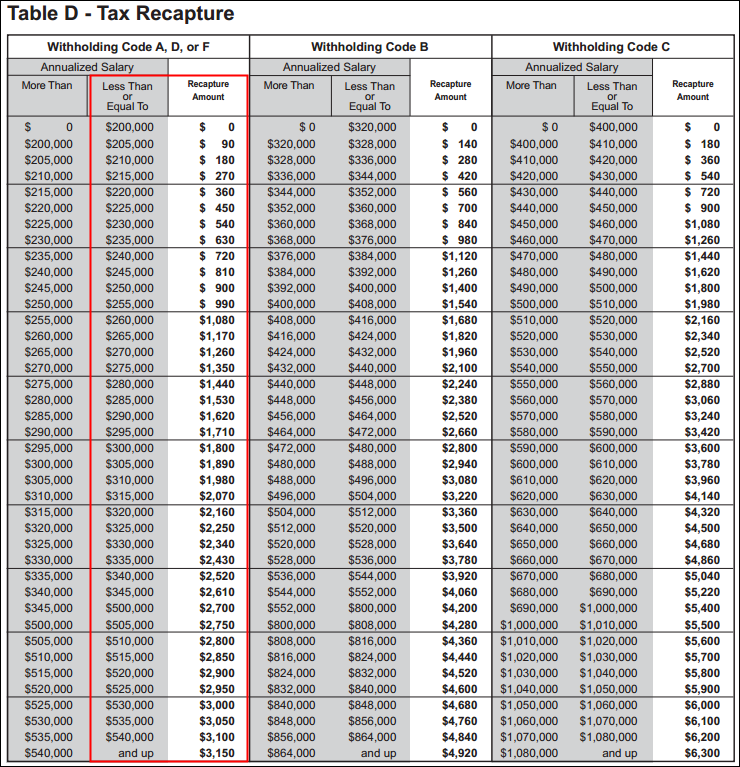

Ct Tax Chart - Web state of connecticut department of revenue services. 100% of the income tax. Detailed connecticut state income tax rates and brackets are. Web learn whether you’re getting paid what you deserve by comparing your salary to the average nurse salary in your location. Many in connecticut will see tax cuts in 2024. Web simply enter your home location, property value and loan amount to compare the best rates. Web complete all lines of the tax calculation schedule on page 1 to correctly calculate your 2021 connecticut income tax. This report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds. Web 1 hr ago. Web 50 states and washington, d.c. If you make $70,000 a year living in connecticut you will be taxed $10,235. Totals for tax years 2021 and 2022. Use the filing status shown on the front of your return. Social security benefit adjustment worksheet. Detailed connecticut state income tax rates and brackets are. Web simply enter your home location, property value and loan amount to compare the best rates. 90% of the income tax shown on your 2024 connecticut income tax return; Web the connecticut income tax has seven tax brackets, with a maximum marginal income tax of 6.990% as of 2024. Web we last updated connecticut tax tables in february 2024 from. 90% of the income tax shown on your 2024 connecticut income tax return; Web the connecticut department of revenue services released its 2021 connecticut circular ct employer's tax guide containing the 2021 income tax withholding calculation rules. Territories, with a population of at least 100,000 as of july 1,. Totals for tax years 2021 and 2022. If you make $70,000. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local. 100% of the income tax. Many in connecticut will see tax cuts in 2024. Use the filing status shown on the front of your return. Web state of connecticut department of revenue services. Web learn whether you’re getting paid what you deserve by comparing your salary to the average nurse salary in your location. Use the filing status shown on the front of your return. By john moritz, staff writer dec 31, 2023. Web your required annual payment for the 2024 taxable year is the lesser of: For a more advanced search, you. By john moritz, staff writer dec 31, 2023. Web we last updated connecticut tax tables in february 2024 from the connecticut department of revenue services. If you make $70,000 a year living in connecticut you will be taxed $10,235. This form is for income earned in tax year 2023, with. This table lists the 336 incorporated places in the united. Totals for tax years 2021 and 2022. If you make $70,000 a year living in connecticut you will be taxed $10,235. Web the connecticut department of revenue services released its 2021 connecticut circular ct employer's tax guide containing the 2021 income tax withholding calculation rules. Many in connecticut will see tax cuts in 2024. This table lists the 336 incorporated. This form is for income earned in tax year 2023, with. Web your required annual payment for the 2024 taxable year is the lesser of: Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local. Use the filing status shown on the front of. Web 2022 connecticut income tax tables all exemptions and credits are included if ct agi is. Web 1 hr ago. Social security benefit adjustment worksheet. 90% of the income tax shown on your 2024 connecticut income tax return; Web the connecticut income tax has seven tax brackets, with a maximum marginal income tax of 6.990% as of 2024. Biggest nursing pay gap in the upper. By john moritz, staff writer dec 31, 2023. This table lists the 336 incorporated places in the united states, excluding the u.s. Web simply enter your home location, property value and loan amount to compare the best rates. Web below is a table that presents the basis and rate of the ct pit. Biggest nursing pay gap in the upper. This report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds. Web complete all lines of the tax calculation schedule on page 1 to correctly calculate your 2021 connecticut income tax. Territories, with a population of at least 100,000 as of july 1,. For a more advanced search, you can filter your results by loan type for. Web 2024 connecticut sales tax table. Web learn whether you’re getting paid what you deserve by comparing your salary to the average nurse salary in your location. This table lists the 336 incorporated places in the united states, excluding the u.s. This form is for income earned in tax year 2023, with. 100% of the income tax. Use this calculator to determine your connecticut. Web your required annual payment for the 2024 taxable year is the lesser of: Web simply enter your home location, property value and loan amount to compare the best rates. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local. Use the filing status shown on the front of your return. Web 50 states and washington, d.c.

Ct Tax Rates 2024 Dorie Geralda

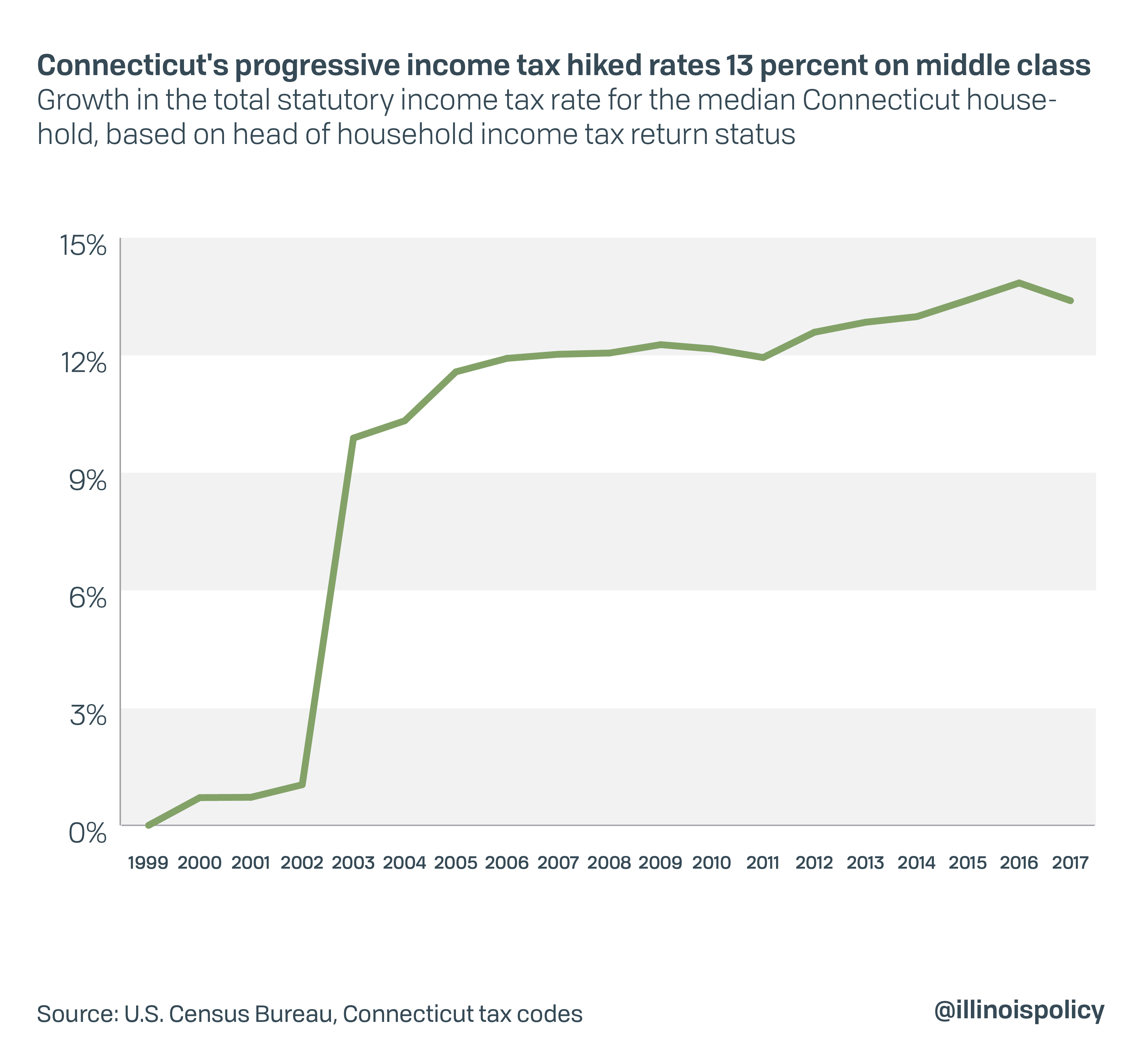

How Connecticut’s ‘tax on the rich’ ended in middleclass tax hikes

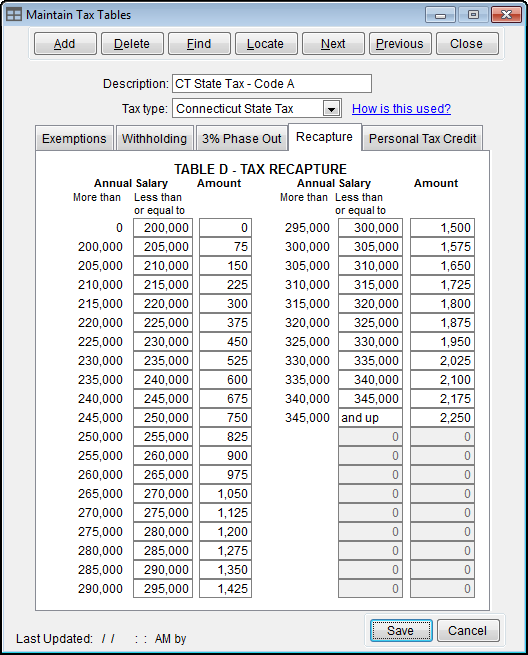

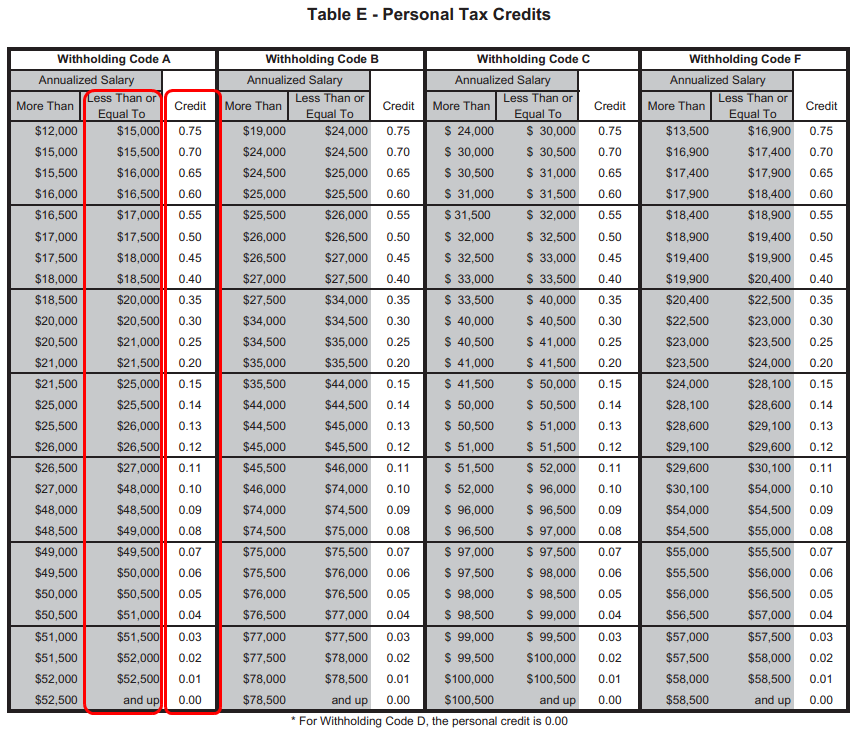

PowerChurch Software Church Management Software for Today's Growing

Connecticut’s Tax Where Did the Money Go? Yankee Institute

PowerChurch Software Church Management Software for Today's Growing

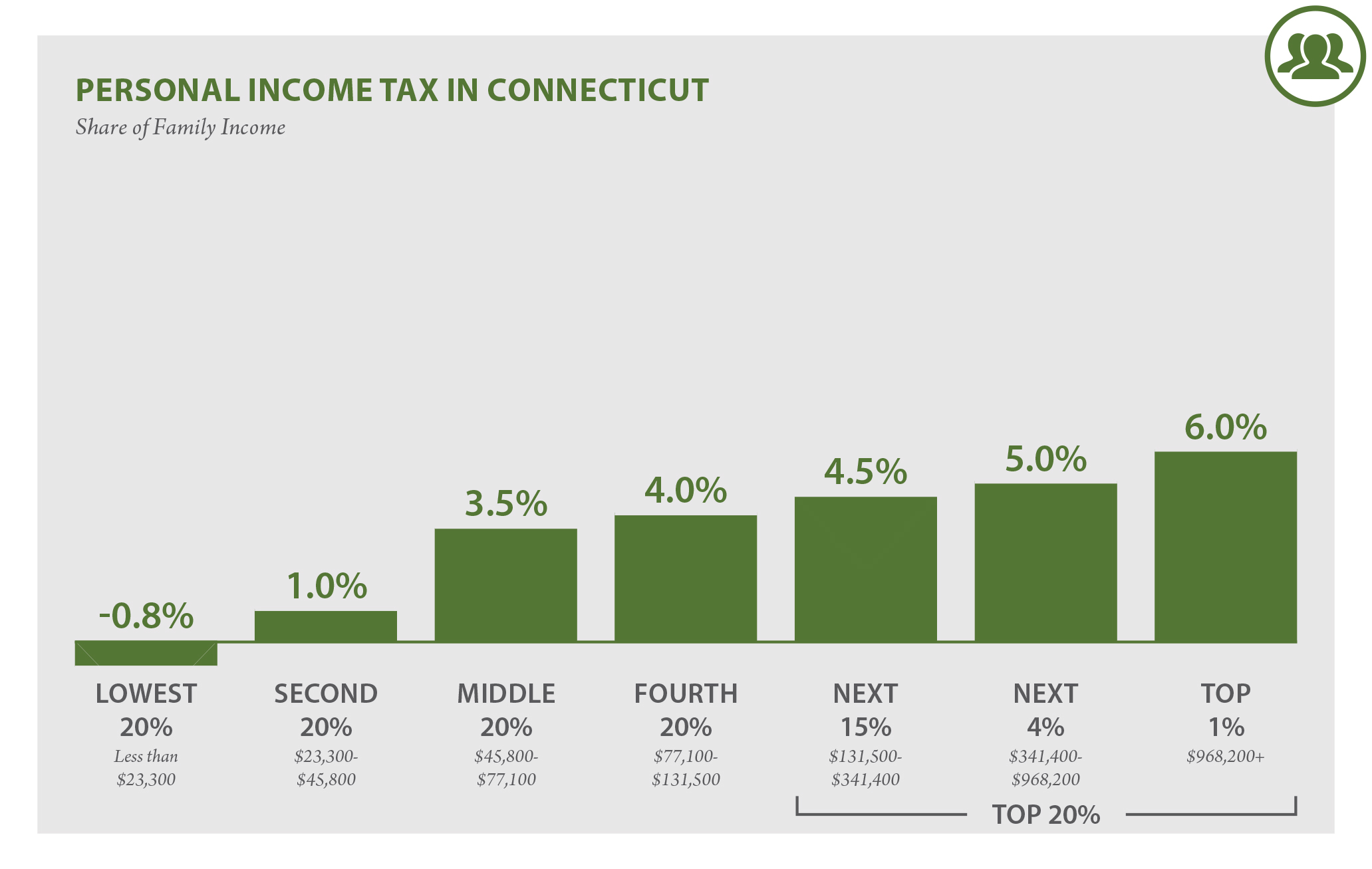

Connecticut Who Pays? 6th Edition ITEP

Connecticut has 2nd highest tax collection rate in the country Yankee

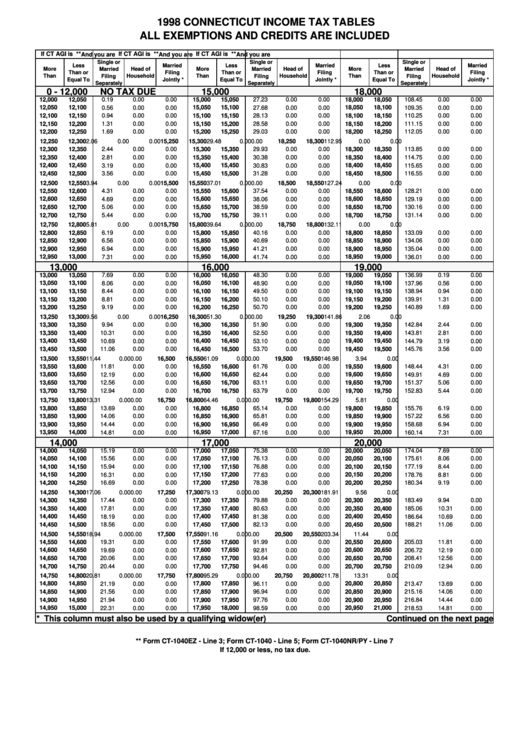

Connecticut Tax Tables All Exemptions And Credits Are Included

Connecticut State Tax Withholding Form 2022

11 charts that explain taxes in America Vox

Web We Last Updated Connecticut Tax Tables In February 2024 From The Connecticut Department Of Revenue Services.

Web 1 Hr Ago.

Web State Of Connecticut Department Of Revenue Services.

Web 2022 Connecticut Income Tax Tables All Exemptions And Credits Are Included If Ct Agi Is.

Related Post: