Credit Spread Chart

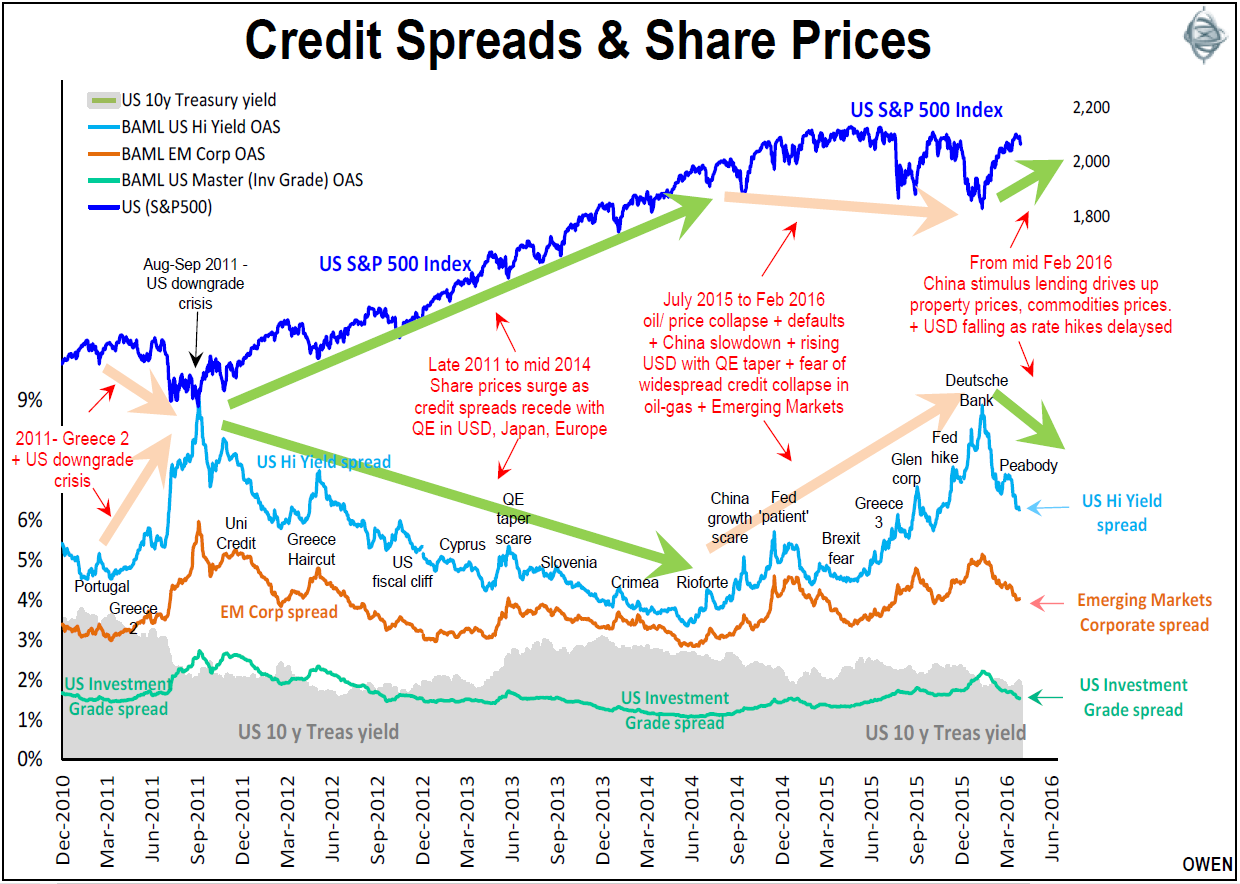

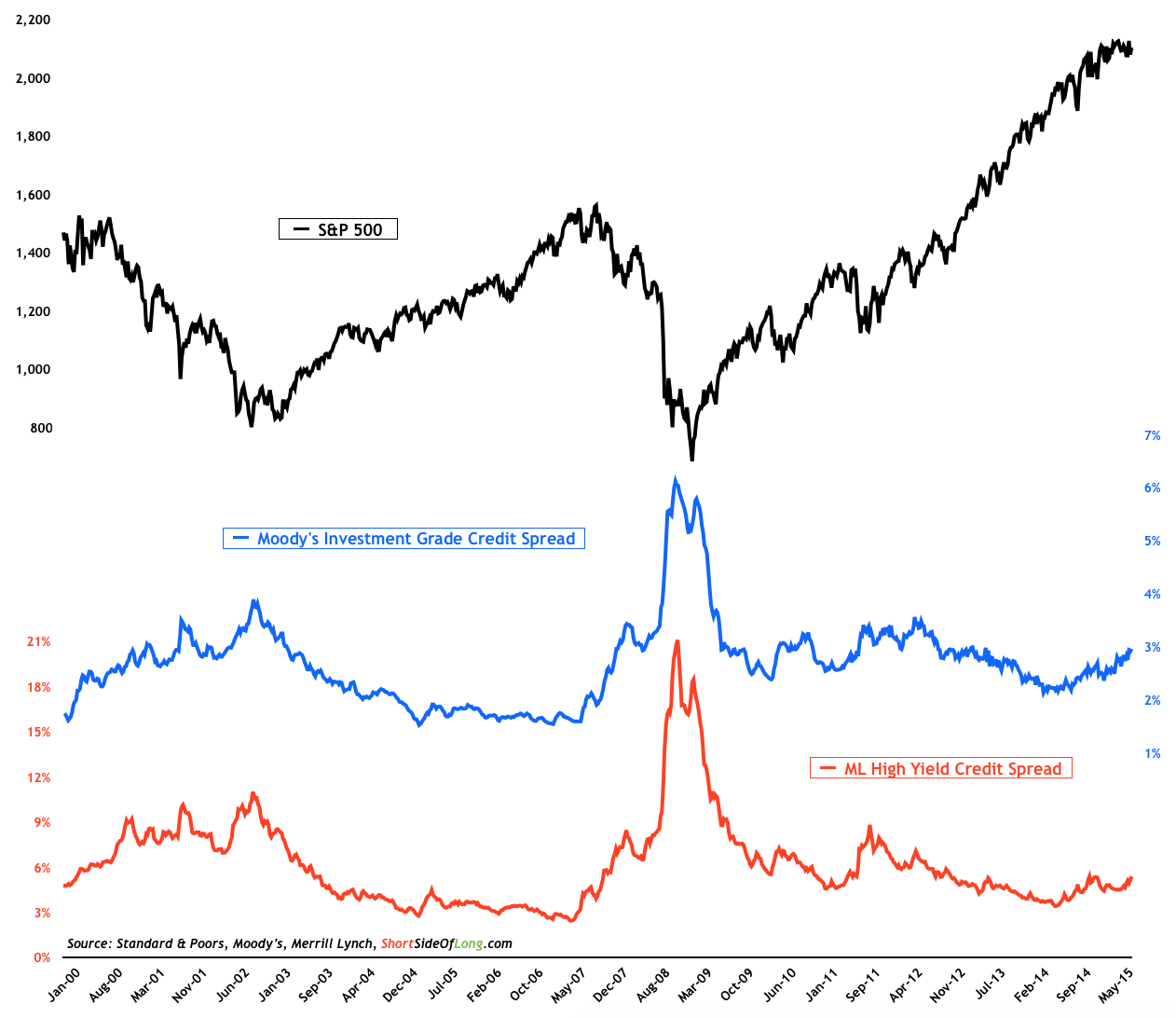

Credit Spread Chart - An oas index is constructed using each constituent bond's oas, weighted by. In other words, the spread is the difference in returns due to different credit qualities. Web this download contains the latest credit spread fed data for the credit spread regression process. Web net percentage of large domestic banks increasing spreads of interest rates over banks' cost of funds on credit card loans. This is lower than the long term average of 5.34%. International intermediate term corporates (averages) quarterly. Bull put credit spreads screener. Web in bond trading, a credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit quality. Download, graph, and track economic data. Die zahlungsfähigkeit ist dabei ein wichtiges kriterium, da es sich. International intermediate term corporates (averages) quarterly. Bank of america merrill lynch. Web net percentage of large domestic banks increasing spreads of interest rates over banks' cost of funds on credit card loans. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. Web rating changes, reviews and outlook changes. Finding profits using a bull put credit spread: This is lower than the long term average of 1.95%. Bull put credit spreads screener. Bank of america merrill lynch. Web this download contains the latest credit spread fed data for the credit spread regression process. Bank of america merrill lynch. Using a bull put strategy, you sell a put option, and buy the same number of lower striking put options. In other words, the spread is the difference in returns due to different credit qualities. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. Bull put credit spreads. Web this download contains the latest credit spread fed data for the credit spread regression process. In practice, the credit spread is expressed in terms of basis points (or “bps”), in which 1.0% equals 100 basis points. Web net percentage of large domestic banks increasing spreads of interest rates over banks' cost of funds on credit card loans. Bull put. Web in bond trading, a credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit quality. Die zahlungsfähigkeit ist dabei ein wichtiges kriterium, da es sich. Bank of america merrill lynch. Bank of america merrill lynch. In practice, the credit spread is expressed in terms of. Download, graph, and track economic data. Web as an example, the us ccc credit spread is calculated as follows: International intermediate term corporates (averages) quarterly. 396 economic data series with tag: Web in bond trading, a credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit. Bank of america merrill lynch. In other words, the spread is the difference in returns due to different credit qualities. Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note with a similar maturity date (the 'benchmark treasury'). Download, graph, and. This is lower than the long term average of 1.95%. International intermediate term corporates (averages) quarterly. Web this download contains the latest credit spread fed data for the credit spread regression process. Web credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. An oas index is constructed. Web in bond trading, a credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit quality. Bank of america merrill lynch. Interest rate spreads, 36 economic data series, fred: The best bull put strategy is one where you think the price of the underlying stock will. Frequency (freq) a = annual, sa = semiannual, q = quarterly, m = monthly, bw = biweekly, w = weekly, d = daily, na = not applicable. Web rating changes, reviews and outlook changes. Web these charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. This is lower than the long term average of 5.34%. An oas. Web these charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. The best bull put strategy is one where you think the price of the underlying stock will go up. Bank of america merrill lynch. Die zahlungsfähigkeit ist dabei ein wichtiges kriterium, da es sich. Bank of america merrill lynch. Download, graph, and track economic data. Web as an example, the us ccc credit spread is calculated as follows: Interest rate spreads, 36 economic data series, fred: An oas index is constructed using each constituent bond's oas, weighted by. Finding profits using a bull put credit spread: Web this download contains the latest credit spread fed data for the credit spread regression process. Bull put credit spreads screener. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. Us treasury and corporate snapshot. This is lower than the long term average of 1.95%. Web net percentage of large domestic banks increasing spreads of interest rates over banks' cost of funds on credit card loans.

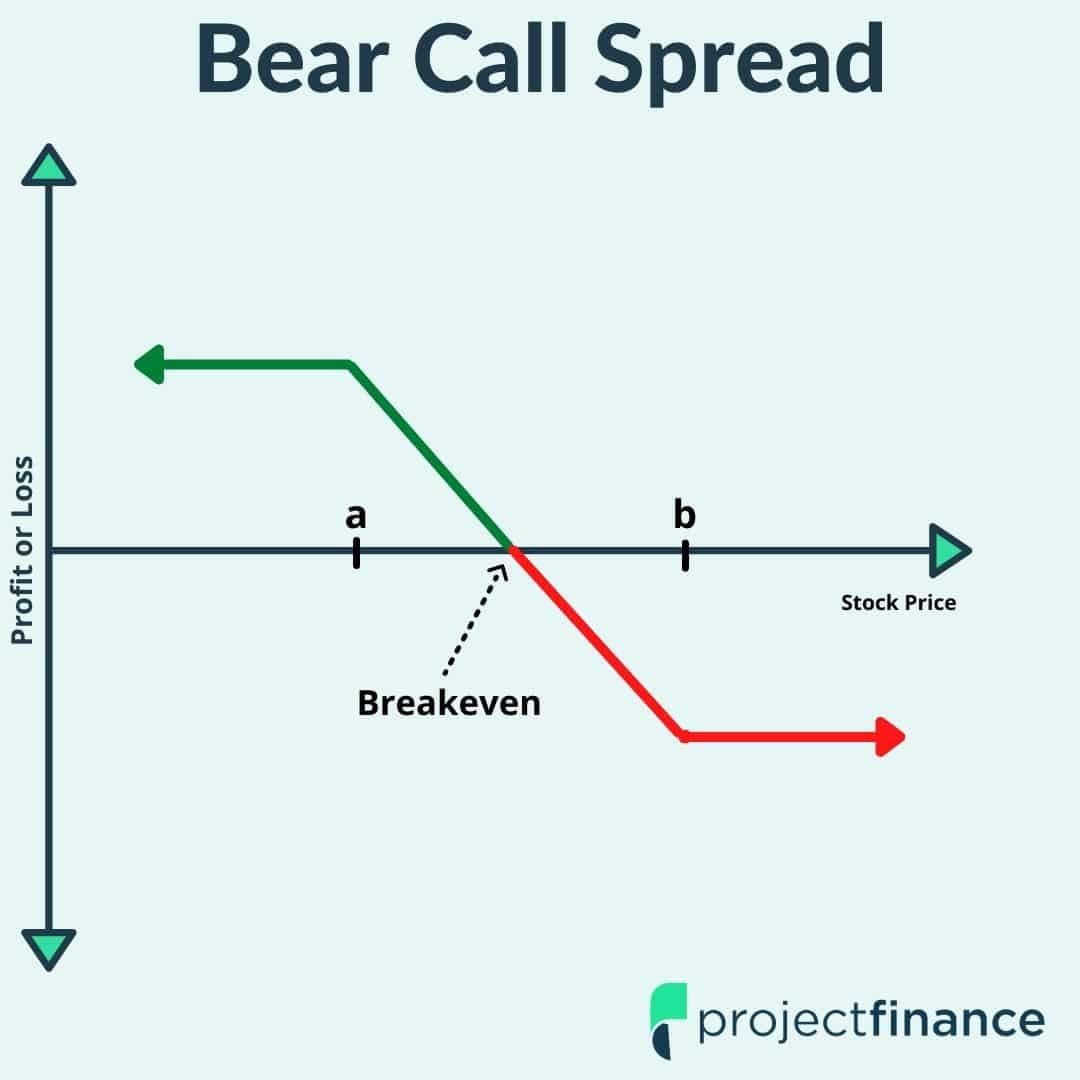

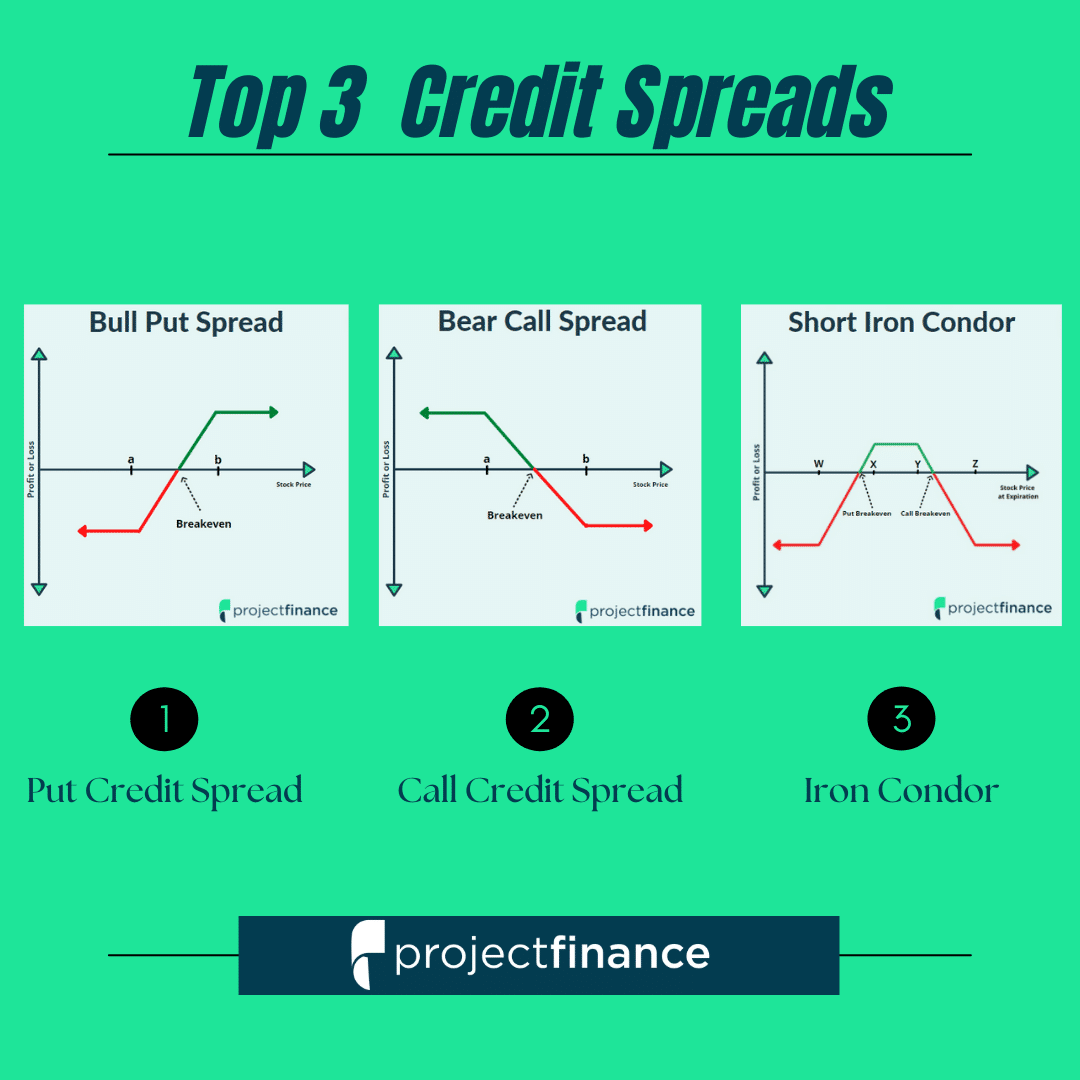

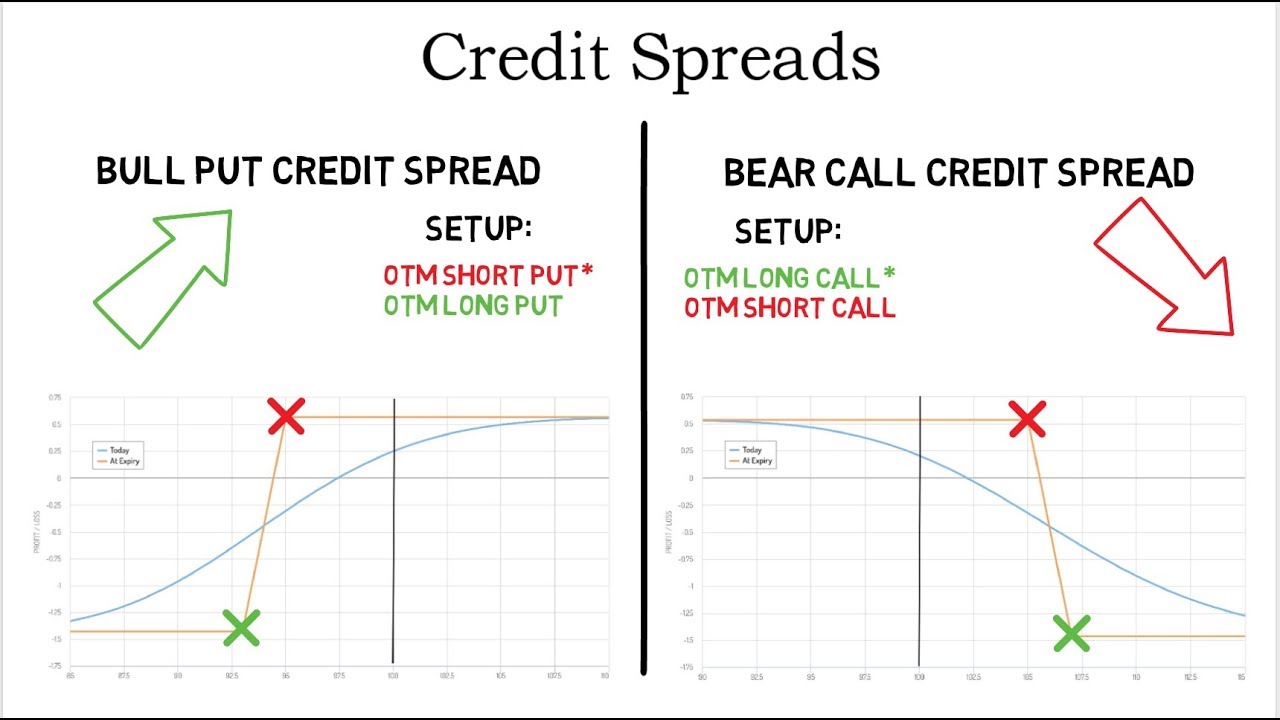

Credit Spread Options Strategies (Visuals and Examples) projectfinance

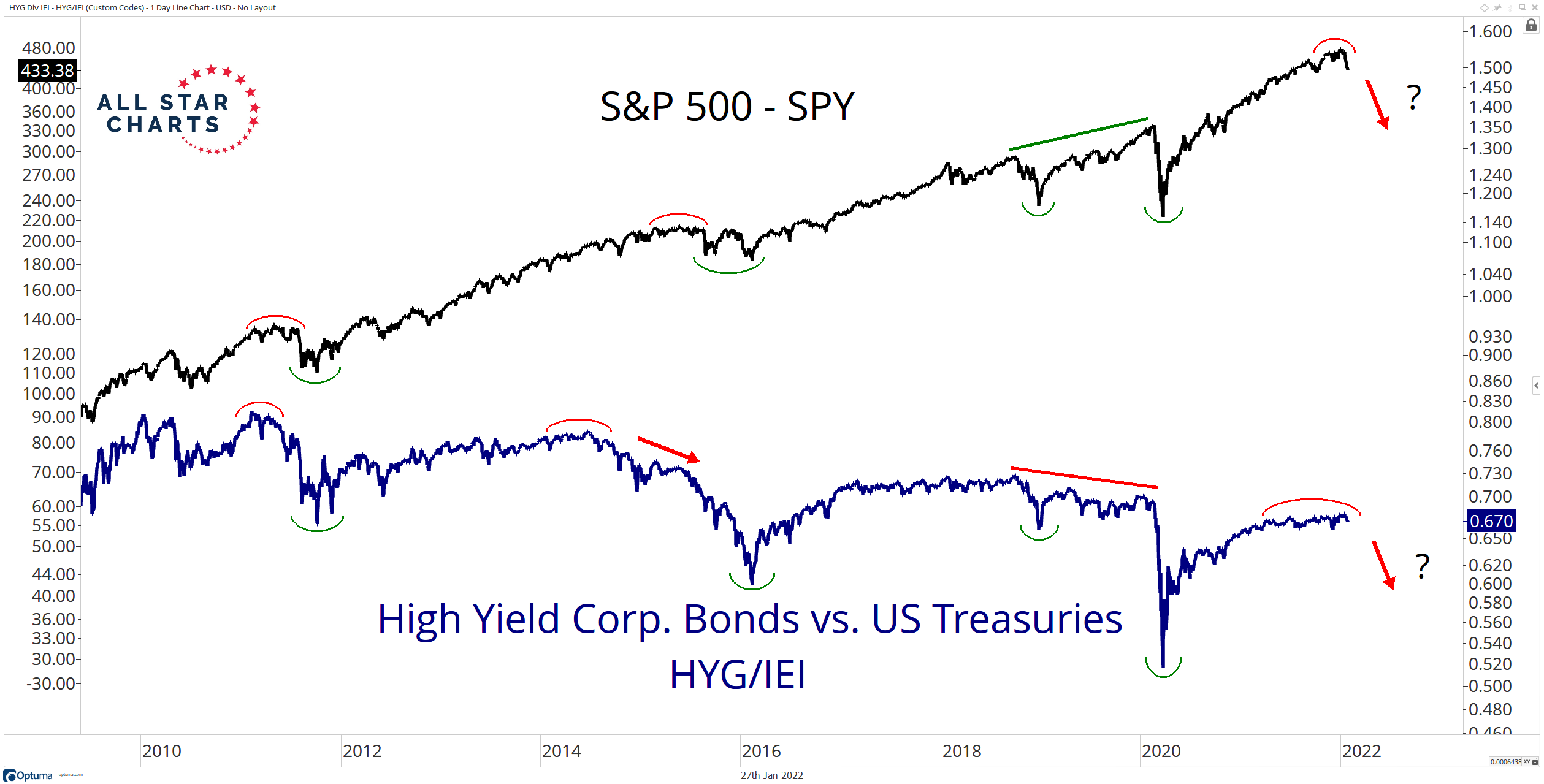

What credit spreads reveal about share markets

3 Best Credit Spread for Options Strategies projectfinance

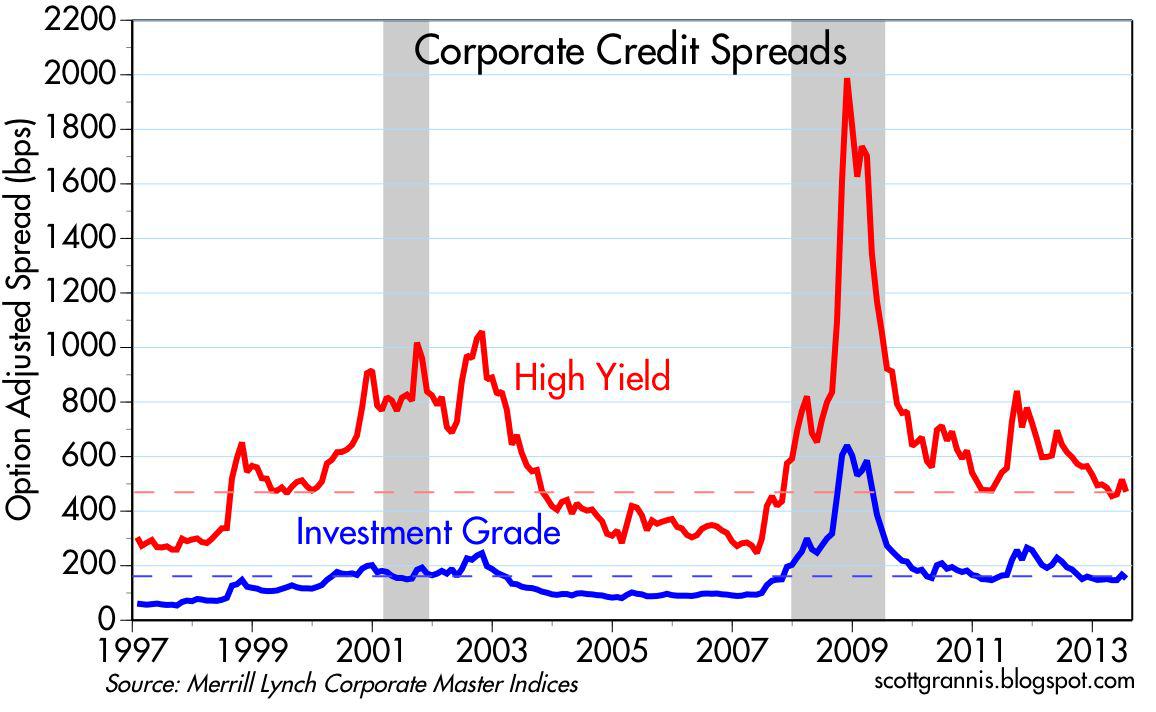

Credit Spreads Continue To Rise Seeking Alpha

Credit Spread Update Still Looking Good Seeking Alpha

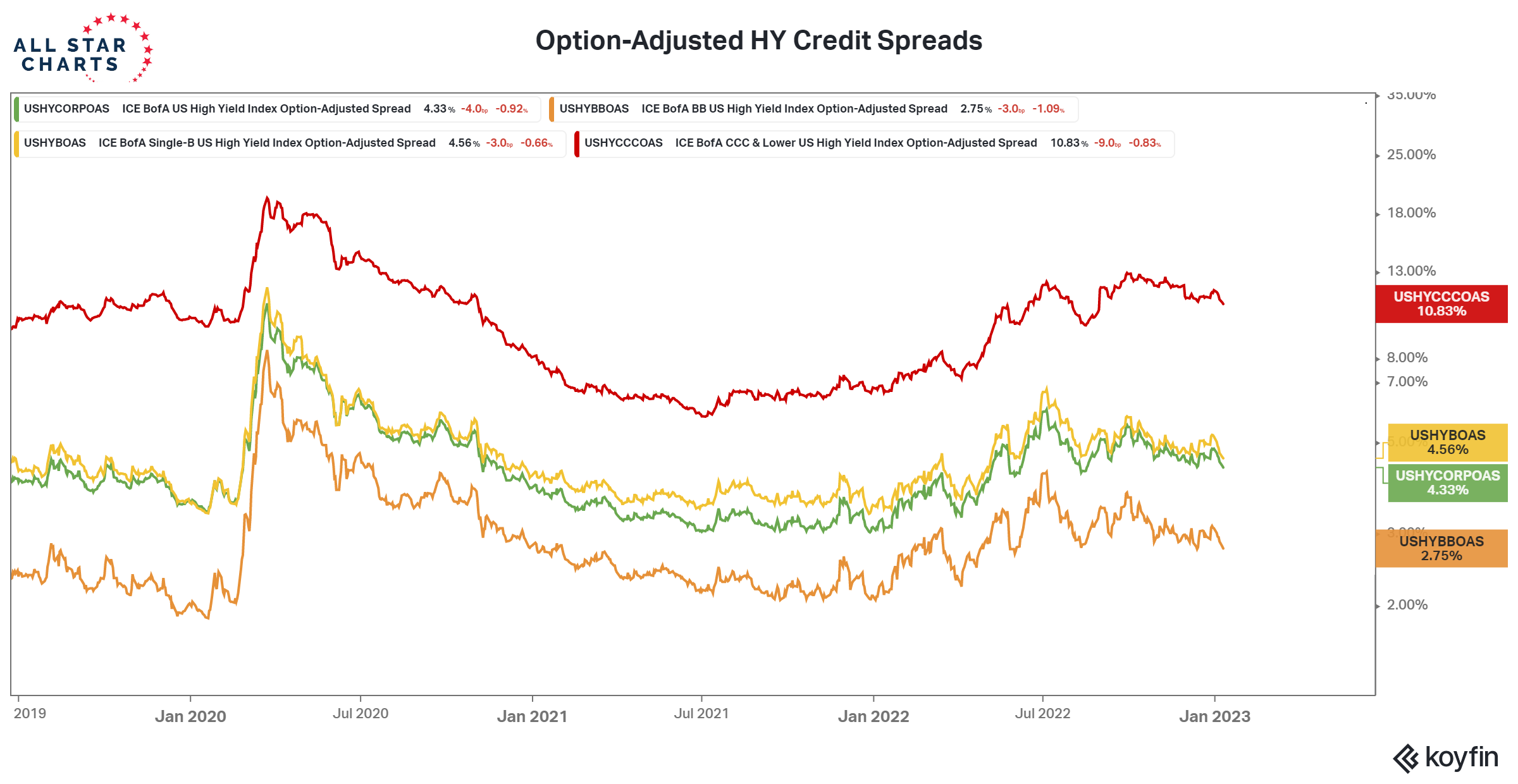

Breaking Down Credit Spreads All Star Charts

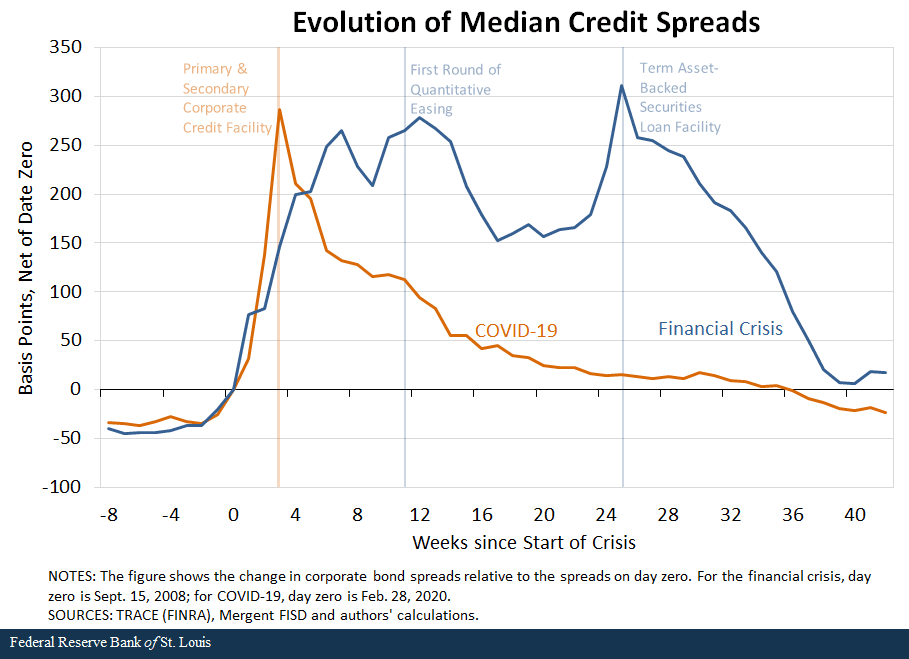

Credit Spreads, Financial Crisis and COVID19 St. Louis Fed

Options Series 1 Credit Spreads Knowmadic View

Credit Spreads Contract All Star Charts

LongTerm Credit Spread Chart September 12, 2016

Web Credit Spread Is The Difference Between The Yield (Return) Of Two Different Debt Instruments With The Same Maturity But Different Credit Ratings.

Using A Bull Put Strategy, You Sell A Put Option, And Buy The Same Number Of Lower Striking Put Options.

This Is Lower Than The Long Term Average Of 5.34%.

396 Economic Data Series With Tag:

Related Post: