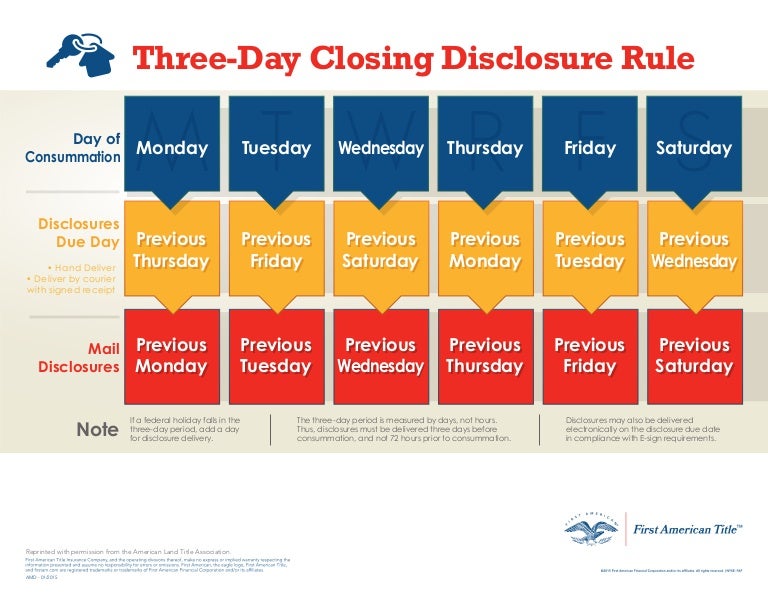

Closing Disclosure 3 Day Rule Chart

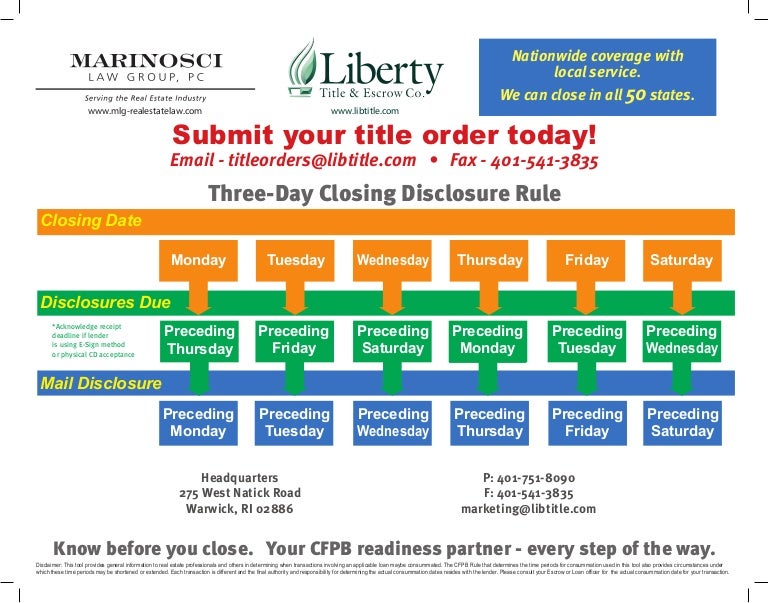

Closing Disclosure 3 Day Rule Chart - It must be provided to the borrower at least three business days before closing. Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date in compliance with e. (2) if the loan product information required to be disclosed under the trid rule has become inaccurate; With consumer confirmed receipt email: This will give you more time to understand your mortgage terms and costs, so that you know before you owe. Web the closing disclosure is presumed to have been received three (3) business days after it is dropped in the mail or sent via email, so the practical result is that most closing disclosures will need to be sent a. Or (3) if a prepayment. Web the closing disclosure form is a pivotal document in real estate transactions, containing key components crucial for both buyers and sellers. The customer must receive a final closing disclosure at least 3 business days prior to consummation. Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Your lender is required by law to give you the standardized closing disclosure at least 3 business days before closing. Informa on on this handout was obtained from american land title associa on, alta.org/cfpb. Web reference this chart to determine when you need to. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date in compliance with e. Friday would be day #1; With receipt confirmed by consumer after approval to use email method of delivery (if not, assume 3 days to open mail) delivery defined. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Web reference this chart to determine when you need to be sure that the closing disclosure is either electronically received by your borrower or delivered via us mail. In the last national election held on wednesday, may 8, 2019, the final results were announced. Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Web reference this chart to determine when you need to be sure that the closing disclosure is either electronically received by your borrower or delivered via us mail.. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date in compliance with e. The customer must receive a final closing disclosure at least 3 business days prior to consummation. The creditor (lender) must provide the “closing disclosure” (cd) to the borrower. The table below sets out the acknowledgment and earliest possible signing days. This document finalizes the loan terms and closing costs, allowing borrowers to review final details before concluding the mortgage process. Web south africa's ruling party, the african national congress (anc), is on course to lose its majority in parliament for the first time since it came to power. Web south africa's ruling party, the african national congress (anc), is on course to lose its majority in parliament for the first time since it came to power 30 years ago, partial results from. The precise definition of business day is used here. Web the iec normally begins releasing partial results within hours of polls closing. This enables the consumer. To ensure you have enough time to review all of the numbers before signing your final paperwork, lenders are required by law to provide you with a closing disclosure. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the following monday; It must be provided to the borrower at least. Web the iec normally begins releasing partial results within hours of polls closing. Web however, the creditor must ensure that a consumer receives the corrected closing disclosure at least three business days before consummation of the transaction if: Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Web reference this chart to determine. Disclosures may also be delivered This comprehensive breakdown includes a closing disclosure sample showcasing loan. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date in compliance with e. With consumer confirmed receipt email: Web south africa's ruling party, the african national. Web reference this chart to determine when you need to be sure that the closing disclosure is either electronically received by your borrower or delivered via us mail. The customer must receive a final closing disclosure at least 3 business days prior to consummation. Informa on on this handout was obtained from american land title associa on, alta.org/cfpb. Web pursuant to 12 c.f.r §1026.19(f)(2) of regulation z, the creditor must deliver the closing disclosure to the consumer at least three business days prior to the date of consummation of the transaction. Or (3) if a prepayment. Web the closing disclosure form is a pivotal document in real estate transactions, containing key components crucial for both buyers and sellers. With receipt confirmed by consumer after approval to use email method of delivery (if not, assume 3 days to open mail) delivery defined the 3 day closing disclosure rule Contact oct today for more informaon on trid and f or all your tle needs7. In the last national election held on wednesday, may 8, 2019, the final results were announced three days later on. Web receipt 3 days after placed in mail overnight delivery: This will give you more time to understand your mortgage terms and costs, so that you know before you owe. Generally, if changes occur between the time the closing disclosure form is given and the closing, the consumer must be provided a new form. Thus, disclosures must be delivered three days before consummation, and not 72 hours prior to consummation. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date in compliance with e. The table below sets out the acknowledgment and earliest possible signing days. (1) the change results in the apr becoming inaccurate;

Resources Integrity Land Title

ThreeDay Closing Disclosure Rule Infographic

3day closing disclosure rule chart Calendar, How to make notes

Three day closing disclosure rule TRID October 2015 from Liberty Titl…

NEW LOAN ESTIMATE AND CLOSING DISCLOSURE FORMS Village Settlements, Inc.

The 3 Day Closing Disclosure Rule Twin City Title

Sellers Apex Title & Closing Services, LLC.

3 day closing disclosure rule.

Closing Disclosure 3 Day Rule Calendar Graphics Calendar examples

The Fund The 3Day Closing Disclosure Rule

This Document Finalizes The Loan Terms And Closing Costs, Allowing Borrowers To Review Final Details Before Concluding The Mortgage Process.

Web Use The Chart Below To Help You Determine When The Closing Disclosure Should Be Sent To Ensure The Buyer Receives It Three Days Prior To Consummation Of The Transaction.

Your Lender Is Required By Law To Give You The Standardized Closing Disclosure At Least 3 Business Days Before Closing.

Web Because The Closing Disclosure Must Be Provided To The Consumer No Later Than Three Business Days Before Consummation (See Section 10.2 Below), This Means The Consumer Must Receive A Revised Loan Estimate No Later Than Four Business Days Prior To Consummation.

Related Post: