Clo Rating Chart

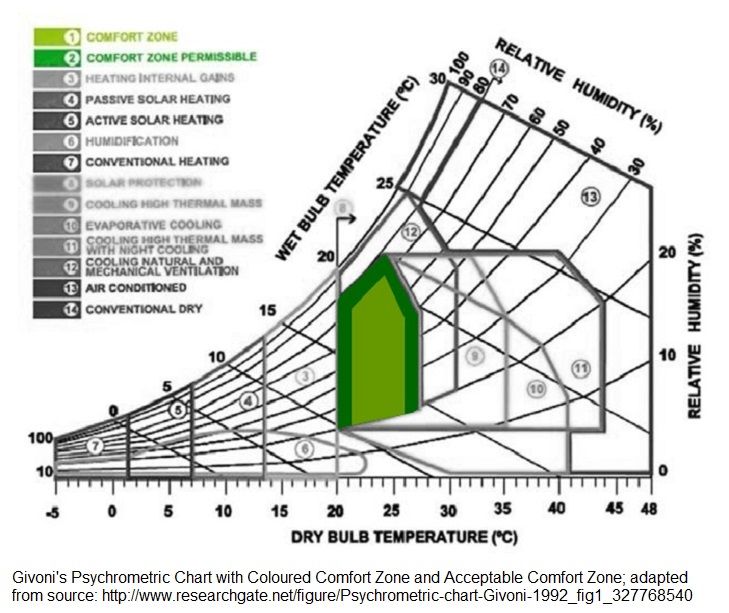

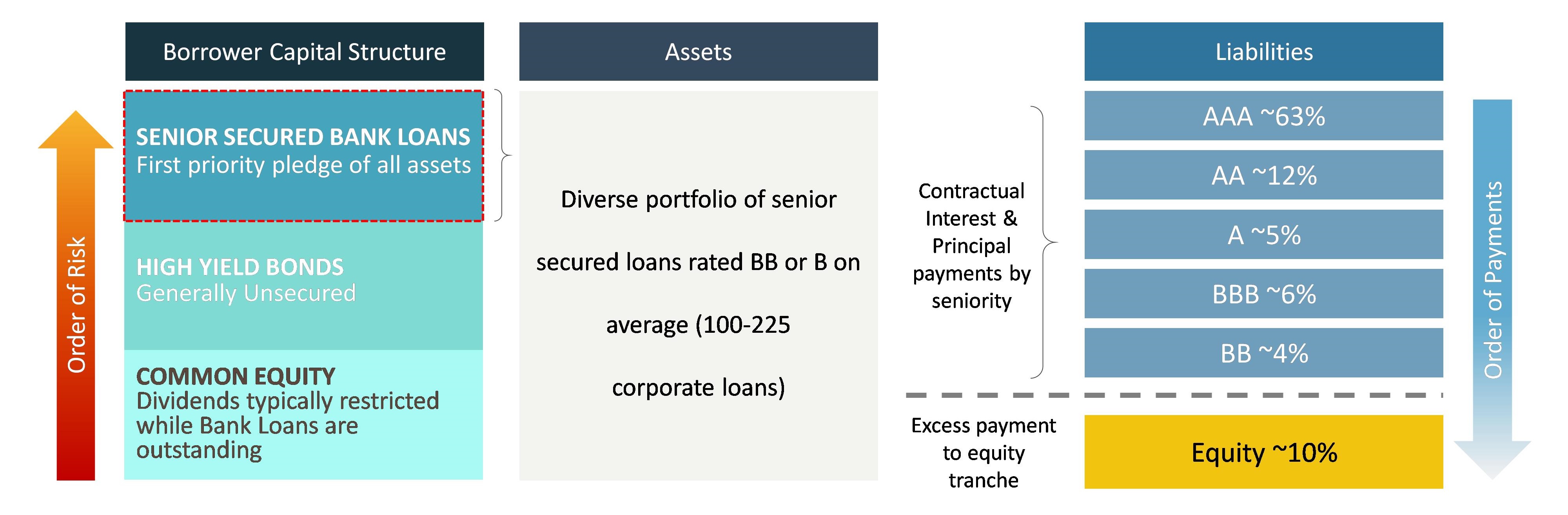

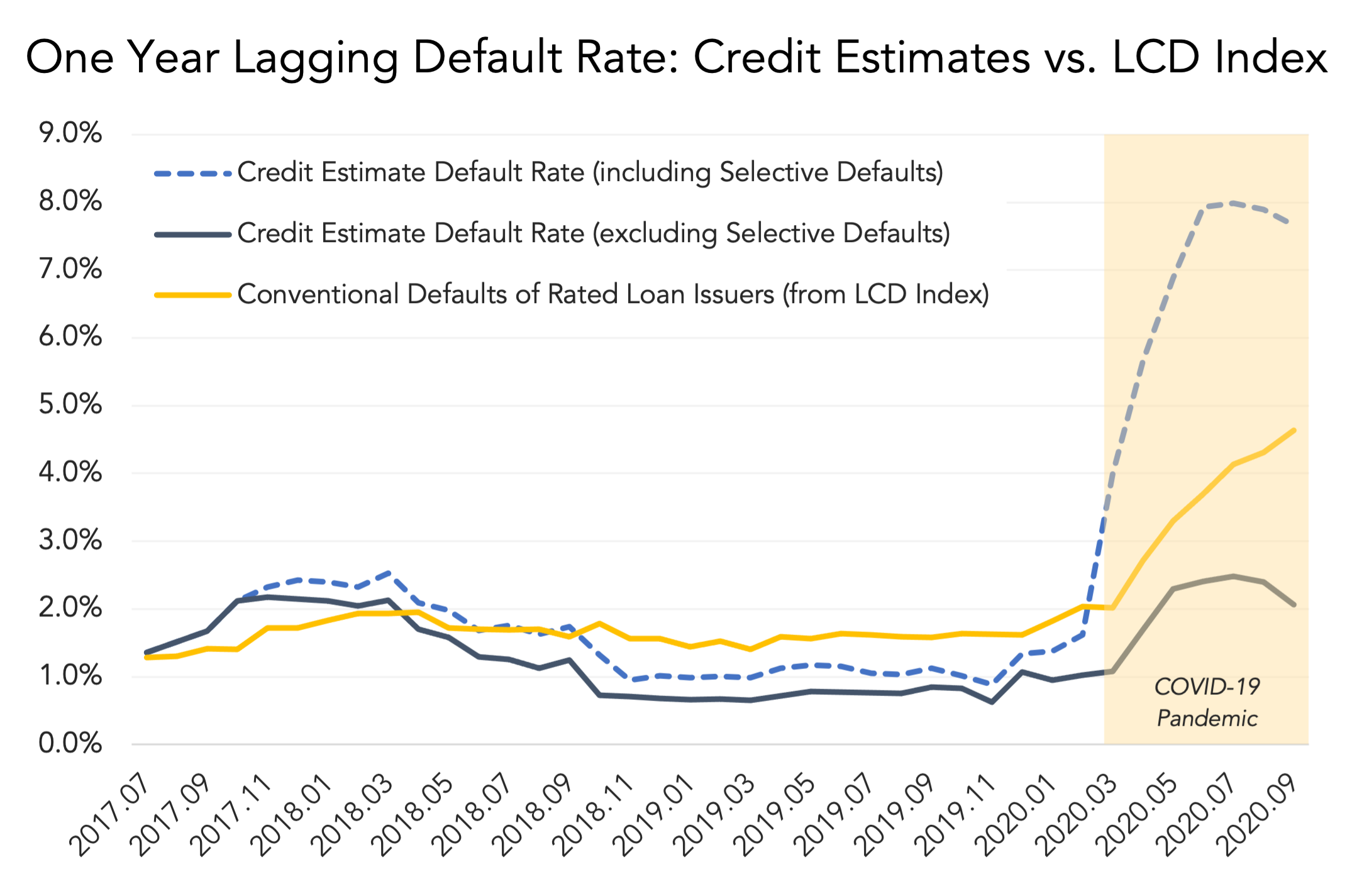

Clo Rating Chart - This should be read together with the counterparty risk methodology. Web as announced on july 23, 2020, any new transactions in u.s. Web i a (clo) calm < 1 < 2 < 0.5 > 0.5; Synthetic insulators provide more insulation per. This can relate each default scenario to the asset and liability side cashflow. Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). The estimated loss is then distributed to each tranche using ejr proprietary modeling. Our interactive tool provides clarity to examine, compare and benchmark individual emea s&p global ratings rated clos across a series of key performance indicators to help you. Pants 1/2 long legs made of wool: These changes have no rating impact. Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). The estimated loss is then distributed to each tranche using ejr proprietary modeling. Rating clos and cdos of large corporate credit. Only temperatures, relative humidities, and specific volumes which would allow people to continue wearing clothing are accepted as part of the. The important thing here is that unlike fill power, clo is not a characteristic that is unique to one ounce of the material. Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). Only temperatures, relative humidities, and specific volumes which would allow people to continue wearing clothing are accepted as part. Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). I cl, clo m 2 k/w; Clos and corporate cdos rating criteria. Synthetic insulators provide more insulation per. Clo asset classes will be rated and monitored by dbrs morningstar using the following dbrs morningstar methodologies (collectively, the dbrs morningstar clo methodologies): This report highlights typical clo indenture terms, explains the impact of variances in these terms and notes fitch’s credit perspective on whether such items are positive, neutral or negative. Except for assured/bluemountain sale, thrusting sound point to one of the top managers in active. Web what is a clo? Cash flow assumptions for corporate credit. For example, this value is. Web what is a clo? The companies that issue the loans in mm clos, like other highly leveraged companies, have felt the impact of rising interest rates and. Fitch ratings is proposing updated assumptions in its global criteria for rating collateralized loan obligation (clo) notes. Web as announced on july 23, 2020, any new transactions in u.s. Clo value is. Only temperatures, relative humidities, and specific volumes which would allow people to continue wearing clothing are accepted as part of the comfort zone. Fitch ratings has updated its global clo and corporate cdo rating criteria, replacing the existing version dated sept. Web as announced on july 23, 2020, any new transactions in u.s. Clo asset classes will be rated and. Fitch ratings has updated its global clo and corporate cdo rating criteria, replacing the existing version dated sept. Except for assured/bluemountain sale, thrusting sound point to one of the top managers in active. Web fitch ratings reviews collateralized loan obligation (clo) documentation as part of its rating analysis. Web our clo rating methodology captures shifting risk conditions in the loan. Web the clo is related to the comfort zone in the psychrometric chart because it is assumed people wear clothing while in buildings; Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). This can relate each default scenario to the asset and liability side cashflow. Our interactive tool provides clarity to. Web fitch ratings reviews collateralized loan obligation (clo) documentation as part of its rating analysis. Overall, there were five clo manager exits versus seven new entrants, representing a net gain of two managers. Clos and corporate cdos rating criteria. Web clo value is the insulation power of an insulation setting. Fitch ratings has updated its rating criteria for collateralised loan. Fitch ratings has updated its rating criteria for collateralised loan obligations (clos) and corporate collateralised debt obligations (cdos). Overall, there were five clo manager exits versus seven new entrants, representing a net gain of two managers. Rating clos and cdos of large corporate credit. Only temperatures, relative humidities, and specific volumes which would allow people to continue wearing clothing are. The estimated loss is then distributed to each tranche using ejr proprietary modeling. This should be read together with the counterparty risk methodology. Web s&p global ratings emea collateral managers dashboard provides you with a snapshot view of your clo critical credit risk factors all in one place. Web what is a clo? Fitch ratings is proposing updated assumptions in its global criteria for rating collateralized loan obligation (clo) notes. Web our clo rating methodology captures shifting risk conditions in the loan market through its use of recovery ratings ('1+' through '6'), and these are currently available for more than 95% of the assets found in u.s. Rating clos and cdos of large corporate credit. Only temperatures, relative humidities, and specific volumes which would allow people to continue wearing clothing are accepted as part of the comfort zone. Clo asset classes will be rated and monitored by dbrs morningstar using the following dbrs morningstar methodologies (collectively, the dbrs morningstar clo methodologies): Web fitch ratings reviews collateralized loan obligation (clo) documentation as part of its rating analysis. Web the clo is related to the comfort zone in the psychrometric chart because it is assumed people wear clothing while in buildings; Web i a (clo) calm < 1 < 2 < 0.5 > 0.5; 1 day −2.78% 1 week −0.68% 1 month −31.51% 6 months −73.94% year to date −74.02% 1 year −90.12% 5 years −93.93% all time −97.58% key stats. Pants 1/2 long legs made of wool: Clo 2.0 transactions totaling over $1.07 trillion (including refinancing and reset activity). No clos rated 'a' or higher were downgraded during the year.

FAQ

(PDF) CLO Rating Methodology Scope Ratings DOKUMEN.TIPS

PPT Structured Finance Synthetic ABS PowerPoint Presentation, free

Global Association of Risk Professionals GARP

The Clo and Thermal Comfort THE environmental ARCHINEER

![]()

Fitch Ratings WebBased CLO Tracker LSTA

CLO Rating Chart In Powerpoint And Google Slides Cpb

CLOs

The Lead Left CLOs Revisited Ratings, Risks, and Returns (Last of a

An Introduction to Collateralized Loan Obligations (2022)

Web This Methodology Supplements Our General Structured Finance Rating Methodology For The Rating Analysis Of Collateralised Loan Obligation (Clo) Transactions, And Supersedes It In Case Of Conflict, Inconsistency Or Ambiguity.

Web From 2010 Through 2023, S&P Global Ratings Rated 14,204 Classes From More Than 1,750 U.s.

Web As Announced On July 23, 2020, Any New Transactions In U.s.

Metaphorically, Like Fp * Fw Value In Down Jackets…And The Higher The Value Is, The Warmer The Insulation Is.

Related Post: