Chart Of Accounts Rental Property

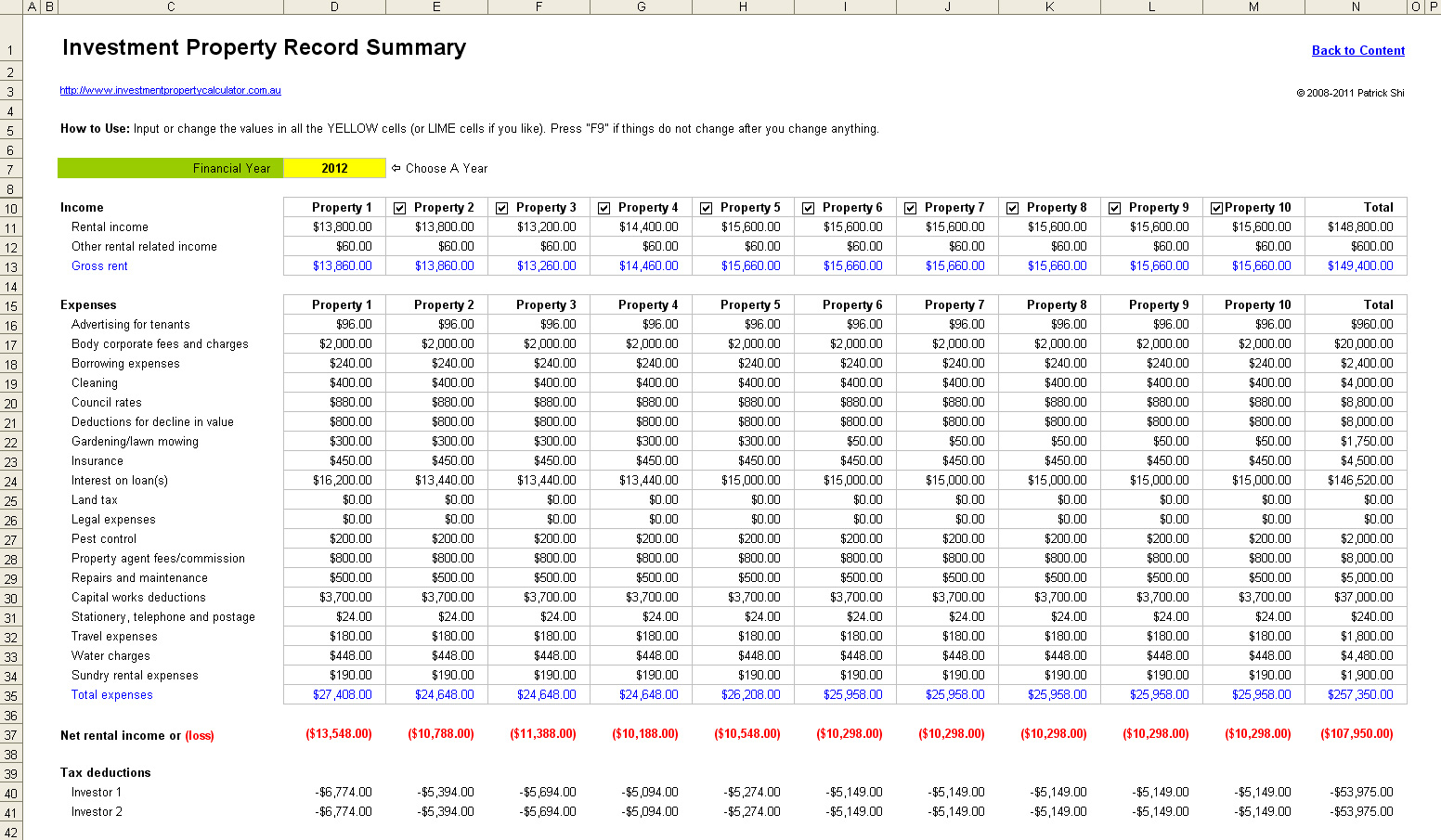

Chart Of Accounts Rental Property - Creating a process for invoicing tenants for rent and posting receipts. Identify the specific financial transactions and categories relevant to your rental property business, such as rental income, maintenance expenses, and property taxes. Web basic principles of rental property accounting. Web steps to create a comprehensive chart of accounts for rental properties. Web use a rental property chart of accounts to accurately track transactions, streamline reporting and tax filing, and make better decisions. Web with quickbooks desktop, you don’t only set up a company file, you can as well perform tasks such as run your property management business, track and receive rent from tenants, paying property owners and management companies, record fees and overhead charges for property maintenance. Once you understand the basic principles, it will be much easier to accurately keep track of your income and expenses: Looking to create your first chart of accounts? Accurately tracking payments made to vendors and charging to the right account. Web if you’re managing a rental property, a good place to start for a suggested chart of accounts is irs schedule e (form 1040). Create a bank account for each individual rental property, along with a debit card or. Web in the online version, you can set up your company and customize the chart of accounts to align with your rental property management. The guide below will give you everything you need to craft a complete chart of accounts, whether you're a landlord, investor,. Web rental property accounting is a formal, organized system real estate investors use to keep track of income and expenses. Web basic principles of rental property accounting. How you set this up is your decision as the owner. Web in this article, we’ll review how to set up a chart of accounts for your rental property using quickbooks, in addition. Web setting up a chart of accounts. Web set up a chart of accounts referencing schedule e (form 1040) and the stessa real estate balance sheet. However, it also has a few weaknesses for use by landlords. Harnessing vencru for chart of accounts optimization Web a typical airbnb chart of accounts includes categories like assets, liabilities, equity, income, and expenses. Web the chart of accounts includes all the different types of accounts (assets, liabilities, equity, revenues, and expenses) used within your business. Web in this article, we’ll review how to set up a chart of accounts for your rental property using quickbooks, in addition to covering an alternative tool that you might find more useful for this exercise. Web a. Identify the specific financial transactions and categories relevant to your rental property business, such as rental income, maintenance expenses, and property taxes. Web in this guide, we’ll explore the basics of the chart of accounts for rental properties, including: Since you likely file that already, you’ll be familiar enough with it to understand how your current accounts break down into. Web a typical airbnb chart of accounts includes categories like assets, liabilities, equity, income, and expenses. Web with quickbooks desktop, you don’t only set up a company file, you can as well perform tasks such as run your property management business, track and receive rent from tenants, paying property owners and management companies, record fees and overhead charges for property. Web use a rental property chart of accounts to accurately track transactions, streamline reporting and tax filing, and make better decisions. If your portfolio has mostly commercial real estate assets, check out our new blog: Create a bank account for each individual rental property, along with a debit card or. Web in this article, we’ll review how to set up. Web properly setting up the chart of accounts for your rental property business will save you time and help you get the most out of your accounting system. Web if you’re managing a rental property, a good place to start for a suggested chart of accounts is irs schedule e (form 1040). Accurately tracking payments made to vendors and charging. The guide below will give you everything you need to craft a complete chart of accounts, whether you're a landlord, investor, or property manager. If your portfolio has mostly commercial real estate assets, check out our new blog: This structure helps you track your financial performance and make informed decisions about your airbnb business. Let’s begin with a macro view. Web in this article, we’ll review how to set up a chart of accounts for your rental property using quickbooks, in addition to covering an alternative tool that you might find more useful for this exercise. Once you understand the basic principles, it will be much easier to accurately keep track of your income and expenses: Next, input all relevant. What is a rental property chart of accounts? The guide below will give you everything you need to craft a complete chart of accounts, whether you're a landlord, investor, or property manager. A rental property chart of accounts serves as the foundation for keeping track of every financial transaction and record relating to the rental property. Web if you’re managing a rental property, a good place to start for a suggested chart of accounts is irs schedule e (form 1040). Accurately tracking payments made to vendors and charging to the right account. Since you likely file that already, you’ll be familiar enough with it to understand how your current accounts break down into those major categories. Set up automated rent invoices. Keep track of rental income received for each property and an entire rental property portfolio. Web with quickbooks desktop, you don’t only set up a company file, you can as well perform tasks such as run your property management business, track and receive rent from tenants, paying property owners and management companies, record fees and overhead charges for property maintenance. Web check out this demo where i show you how to establish your coa for rental property management! Access data anywhere via cloud accounting. Harnessing vencru for chart of accounts optimization Creating a process for invoicing tenants for rent and posting receipts. Web many landlords and real estate investors use xero to track their rental property accounts because it offers the comprehensive accounting they need. Web a typical airbnb chart of accounts includes categories like assets, liabilities, equity, income, and expenses. This structure helps you track your financial performance and make informed decisions about your airbnb business.

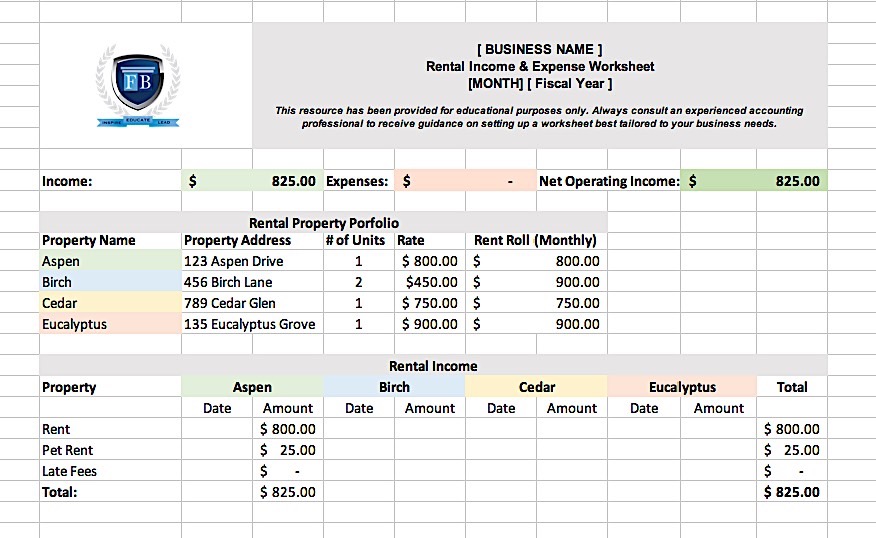

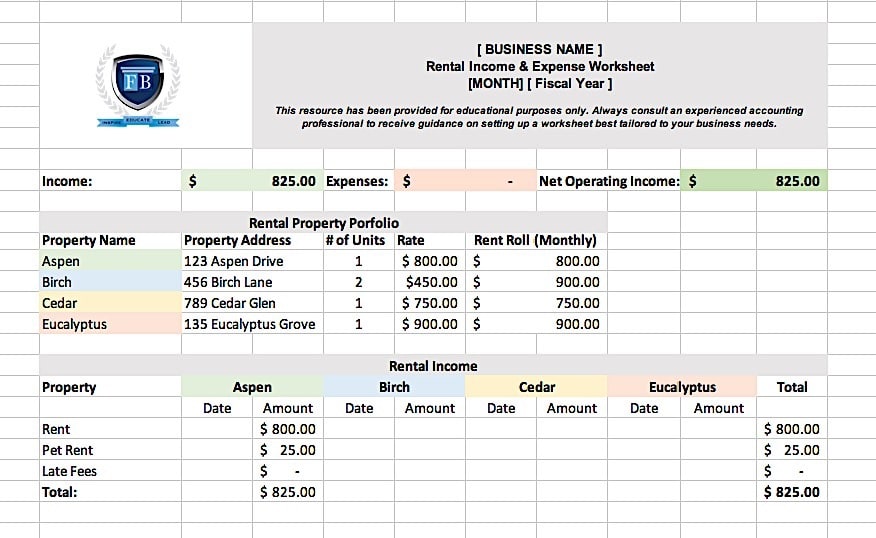

EXCEL TEMPLATES Rental Property Chart Of Accounts Template

sample chart of accounts Residential Design

How to Set Up a Chart of Accounts For a Real Estate Company

Rental Property Accounting & Bookkeeping Tips FortuneBuilders

Chart of Accounts Examples (Property Management, Medical)

Chart Of Accounts Templates Free Download

Rental Property Accounting & Bookkeeping Tips FortuneBuilders

Chart Of Accounts For Property Management

Accounting For Rental Property Spreadsheet —

Rental Property Chart Of Accounts Quickbooks

Web Basic Principles Of Rental Property Accounting.

Web The Chart Of Accounts Includes All The Different Types Of Accounts (Assets, Liabilities, Equity, Revenues, And Expenses) Used Within Your Business.

A Good Rental Property Accounting Template Helps Real Estate Investors To:

Components Of Chart Of Accounts For Rental Properties;

Related Post: